Report Overview

Nanosensors Market - Strategic Highlights

Nanosensors Market Size:

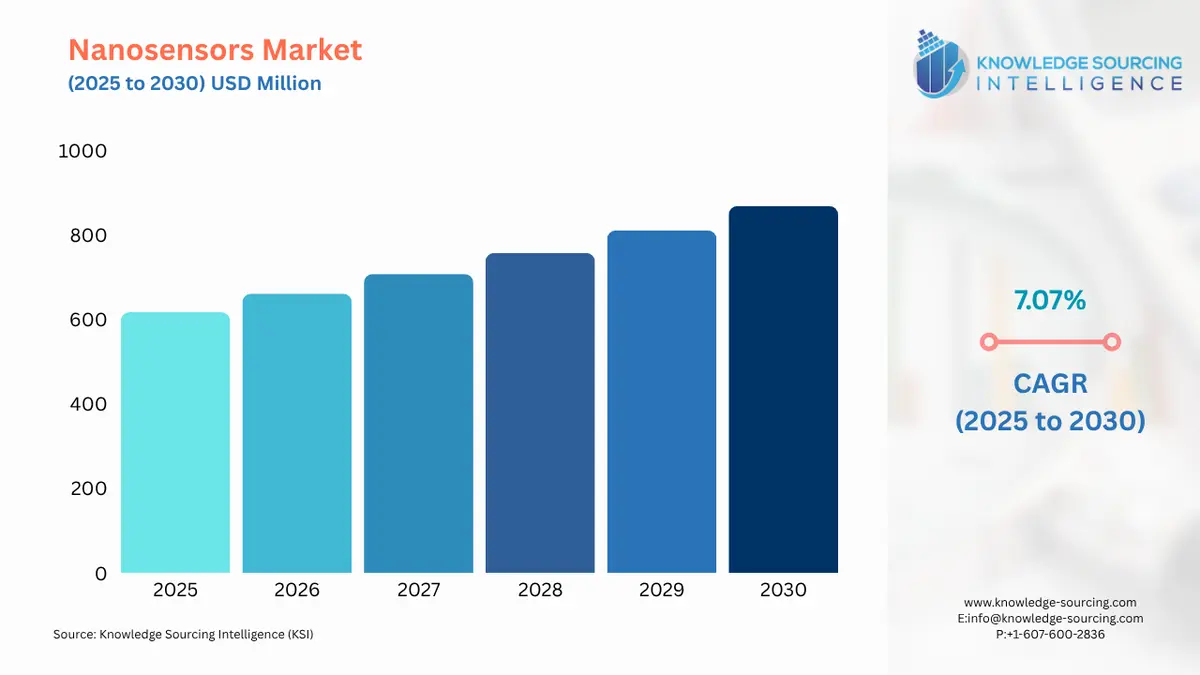

Nanosensors market is valued at US$617.227 million in 2025 is projected to grow at a CAGR of 7.07% to reach US$868.678 million in 2030.

Nanosensors Market Introduction

The nanosensors market is a rapidly evolving sector within nanotechnology, driven by the unique capabilities of nanoscale devices to detect and measure physical, chemical, and biological phenomena with unprecedented sensitivity and precision. Nanosensors, typically ranging from 1 to 100 nanometers in size, leverage nanomaterials such as carbon nanotubes, graphene, quantum dots, and metal nanoparticles to monitor molecular or atomic changes in real time. Their applications span healthcare, environmental monitoring, aerospace, defense, agriculture, and industrial automation, making them pivotal in addressing global challenges like disease detection, environmental sustainability, and security. As industries increasingly prioritize miniaturization, precision, and connectivity, nanosensors are poised to transform diagnostics, manufacturing, and IoT ecosystems.

Nanosensors are engineered to detect specific analytes—such as chemical compounds, biological markers, or physical parameters—with high specificity and sensitivity, owing to the unique properties of nanomaterials, including high surface-to-volume ratios and tunable electrical or optical characteristics. In healthcare, nanosensors enable early disease detection through biomarker identification, revolutionizing diagnostics for conditions like cancer and diabetes. For instance, in May 2024, researchers at MIT developed a nanosensor platform using carbon nanotubes to detect tumor-specific biomarkers in blood, enhancing cancer diagnostics with real-time monitoring capabilities. In environmental monitoring, nanosensors detect pollutants and toxins at trace levels, supporting regulatory compliance and sustainability efforts. A 2024 project by the University of Cambridge introduced graphene-based nanosensors for real-time water quality monitoring, detecting heavy metals with high accuracy.

In aerospace and defense, nanosensors are used for chemical and biological threat detection, as well as structural health monitoring. In September 2024, Lockheed Martin Corporation integrated nanosensors into its NextGen Air Transportation System, enhancing air safety through real-time environmental monitoring. The agriculture sector leverages nanosensors for precision farming, monitoring soil conditions and pest activity to optimize crop yields. In June 2024, NT Sensors, a Spanish startup, launched nanotube-based nanosensors to quantify ion concentrations in agricultural solutions, improving crop performance. Additionally, the integration of nanosensors with IoT and wearable devices is expanding their role in consumer electronics and industrial automation, enabling real-time data analytics for smart systems.

Nanosensors Market Overview

Nanosensors are used to convey information about nanoparticles to the macroscopic world and have a wide array of applications in sectors such as defense, energy and power, and healthcare, among others. Leading companies have made massive investments in research and development to capture market share by supplying high-quality products at economical prices. Increasing investment in research and development and rising demand for these sensors by various industries will drive the demand for nanosensors. North America holds a significant market share owing to the presence of well-established multinationals and the growing use of advanced medical devices. The Asia Pacific region will grow at a remarkable rate due to impressive economic growth and the need for state-of-the-art technology by companies across industry verticals over the forecast period.

The nanosensors market is poised for significant expansion, primarily fueled by increasing military and defense applications. These advanced sensors offer diverse capabilities in critical areas such as chemical detection, forensic analysis, and decontamination processes. Leading nations including the United States, China, and India are anticipated to drive substantial market growth, with India's government demonstrating particular commitment through its Innovations for Defense Excellence (iDEX) initiative. Under the 'Make In India' program, approximately INR 450 crores have been earmarked to support MSMEs and startups developing innovative defense technologies. The market landscape is being transformed by a growing ecosystem of startups worldwide creating cutting-edge nanosensing solutions. Notable examples include Spain's NT Sensors, which produces nanotube-based sensors for real-time agricultural monitoring, Italy's Nasys developing customizable gas detection nanotechnology, and Israel's Tracense specializing in ultra-sensitive threat detection at nanoscale levels. These technological advancements across various sectors—from agriculture to environmental monitoring and security—are collectively shaping the nanosensors market's trajectory and are expected to be key growth drivers in the coming years.

Some of the major players covered in this report include Analog Devices, Inc., Honeywell International Inc., Omron Corporation, STMicroelectronics N.V., Robert Bosch GmbH, Nanowear Inc., Agilent Technologies, Inc., and Sensirion AG, among others.

Nanosensors Market Drivers

Advancements in Healthcare and Precision Medicine

The demand for early disease detection and personalized healthcare is a primary driver for the nanosensors market, as these devices enable highly sensitive detection of biomarkers at the molecular level. Nanosensors facilitate non-invasive diagnostics and continuous monitoring, revolutionizing the management of chronic diseases like cancer and diabetes. Their ability to detect minute concentrations of analytes supports precision medicine, tailoring treatments to individual patient needs. In July 2024, LiveMetric received FDA clearance for its LiveOne wearable nanosensor, which monitors blood pressure at 10-second intervals using a radial artery nanosensor, enhancing accessible cardiovascular care. Additionally, in May 2024, MIT researchers developed a carbon nanotube-based nanosensor platform for detecting tumor-specific biomarkers in blood, advancing real-time cancer diagnostics. These developments underscore nanosensors’ critical role in improving diagnostic accuracy and patient outcomes, driving their adoption in healthcare.

Rising Need for Environmental Monitoring and Sustainability

Stringent environmental regulations and growing sustainability concerns are fueling demand for nanosensors in monitoring pollutants, toxins, and resource conditions. Nanosensors’ high sensitivity enables detection of trace-level contaminants in air, water, and soil, supporting compliance with environmental standards and sustainable development goals. In 2024, the University of Cambridge introduced graphene-based nanosensors for real-time water quality monitoring, capable of detecting heavy metals with high accuracy, aiding regulatory efforts in water management. Furthermore, the European Union’s Horizon Europe program allocated €10 million in 2024 for nanosensor-based environmental monitoring projects, focusing on air and water pollution detection to support the EU’s Green Deal objectives. This emphasis on environmental protection drives nanosensor adoption across industries, from municipal water systems to industrial emissions monitoring.

Integration with IoT and Miniaturization Trends

The proliferation of the Internet of Things (IoT) and the demand for compact, energy-efficient devices are accelerating nanosensor adoption in smart systems. Nanosensors’ small size, low power consumption, and high sensitivity make them ideal for integration into IoT devices, enabling real-time data analytics for applications like smart cities, industrial automation, and wearables. In October 2024, Analog Devices Inc. partnered with Pinpoint Science to develop nanosensor diagnostics for portable IoT devices, enhancing capabilities in healthcare and environmental monitoring through connected platforms. Additionally, a 2024 initiative by the Indian Nanoelectronics Users Programme (INUP-i2i) at IIT Bombay expanded nanofabrication facilities, fostering nanosensor development for IoT applications in agriculture and healthcare. These advancements highlight nanosensors’ role in enabling connected, data-driven ecosystems, driving market growth.

Nanosensors Market Restraints

High Development and Manufacturing Costs

The complex fabrication processes and specialized materials required for nanosensors, such as carbon nanotubes, graphene, and quantum dots, result in high development and production costs, limiting scalability and affordability. These costs stem from the need for advanced techniques like chemical vapor deposition and precise nanomaterial synthesis, which require significant investment in R&D and manufacturing infrastructure. A recent study emphasized that the high cost of producing reliable, high-performance nanosensors restricts their adoption in price-sensitive markets, particularly in developing regions. This financial barrier hinders widespread commercialization, especially for applications requiring large-scale deployment.

Regulatory and Standardization Challenges

The absence of standardized protocols and varying regulatory frameworks for nanosensor applications, particularly in healthcare and food safety, poses significant challenges to market growth. The novel nature of nanomaterials raises concerns about toxicity, environmental impact, and long-term safety, necessitating rigorous testing and approval processes. A 2024 analysis highlighted that inconsistent global regulations for nanosensor-based medical devices and environmental sensors create barriers to market entry, delaying commercialization. These regulatory complexities limit the speed of innovation and adoption, particularly in highly regulated sectors like healthcare and agriculture.

Nanosensors Market Segmentation Analysis

The Electrochemical Nanosensors are rising rapidly

Electrochemical Nanosensors dominate the nanosensors market due to their high sensitivity, specificity, and versatility, making them ideal for a wide range of applications, particularly in healthcare, environmental monitoring, and industrial process control. These sensors operate by detecting changes in electrical properties caused by chemical reactions at the nanoscale, often using materials like graphene, carbon nanotubes, or metal nanoparticles. Their ability to provide real-time, accurate detection of ions and molecules, such as glucose or pollutants, underpins their widespread adoption. In healthcare, electrochemical nanosensors are integral to devices like glucose monitors for diabetes management, offering rapid and precise diagnostics. For instance, in July 2024, LiveMetric’s LiveOne wearable nanosensor, which uses electrochemical principles to monitor blood pressure every 10 seconds, received FDA clearance, highlighting their role in non-invasive health monitoring. In environmental applications, these sensors detect trace-level contaminants, such as heavy metals in water. A 2024 study by the University of Cambridge demonstrated electrochemical nanosensors using graphene to monitor water quality in real time, supporting environmental sustainability efforts. Their compatibility with portable, low-power devices and IoT systems further enhances their market dominance, as they enable seamless integration into wearable and smart technologies. The segment’s leadership is driven by ongoing innovations in nanomaterial synthesis and sensor miniaturization, addressing the demand for compact, high-performance diagnostic tools.

The Healthcare industry is increasingly using nanosensors, propelling its market growth

The Healthcare industry is the leading end-user segment for nanosensors, driven by the critical need for rapid, sensitive, and accurate diagnostic systems. Nanosensors enable early disease detection, real-time monitoring, and personalized medicine by detecting biomarkers, pathogens, and physiological changes at the molecular level. In cancer diagnostics, nanosensors identify tumor-specific biomarkers, improving early detection rates and treatment outcomes. For example, in May 2024, MIT researchers developed a carbon nanotube-based nanosensor platform for detecting cancer biomarkers in blood, offering a non-invasive method for real-time monitoring. In chronic disease management, nanosensors are used in wearable devices for continuous monitoring, such as glucose sensors for diabetes or cardiovascular monitors. In February 2024, the University of Twente and Wageningen University in the Netherlands developed a nanosensor capable of detecting cancer biomarkers across a wide concentration range, enhancing diagnostic precision. The healthcare sector’s dominance is further supported by significant R&D investments and regulatory approvals, which prioritize patient-friendly diagnostics and point-of-care solutions. The integration of nanosensors with telemedicine and IoT platforms is also expanding their role in remote patient monitoring, solidifying their position as the largest end-user segment.

North America is anticipated to lead the market expansion

North America, particularly the United States, is the dominant region in the nanosensors market, driven by robust R&D infrastructure, significant investments in nanotechnology, and early adoption across industries like healthcare, defense, and environmental monitoring. The U.S. hosts leading technology companies and research institutions, fostering innovation in nanosensor development. Government support, such as funding from the National Nanotechnology Initiative, accelerates advancements in sensor technologies. In September 2024, Lockheed Martin Corporation integrated nanosensors into its NextGen Air Transportation System, enhancing air safety through real-time environmental monitoring. The healthcare sector in the U.S. benefits from FDA approvals for nanosensor-based devices, such as LiveMetric’s LiveOne in 2024, which supports cardiovascular monitoring. Additionally, stringent environmental regulations in the U.S. drive demand for nanosensors in pollution monitoring, with applications in air and water quality assessment. A 2024 initiative by the U.S. Environmental Protection Agency highlighted nanosensors’ role in detecting contaminants, supporting compliance with environmental standards. The region’s technological leadership, combined with a strong ecosystem of startups, universities, and industry players, ensures North America’s position as the largest market for nanosensors, with the U.S. leading due to its advanced infrastructure and investment in cutting-edge applications.

Nanosensors Market Key Developments

September 2024: Lockheed Martin Corporation Integrates Nanosensors into Aerospace Systems

Lockheed Martin Corporation incorporated nanosensors into its NextGen Air Transportation System to improve air safety through real-time environmental monitoring. These chemical nanosensors detect atmospheric changes, enhancing aerospace safety and performance, and reinforcing their role in defense applications.April 2024: Researchers at IIT Jodhpur developed a nanosensor designed to reduce mortality rates by enabling early disease detection through biomarker monitoring. This electrochemical nanosensor targets healthcare applications, offering rapid diagnostics to address delayed detection, particularly in critical conditions, and supports India’s growing role in nanosensor innovation.

January 2024: MIT researchers launched a carbon nanotube-based electrochemical nanosensor platform for detecting tumor-specific biomarkers in blood, enabling non-invasive, real-time cancer diagnostics. This breakthrough strengthens nanosensors’ role in precision medicine, offering high sensitivity for early disease detection.

Nanosensors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 617.227 million |

| Total Market Size in 2030 | USD 868.678 million |

| Forecast Unit | Million |

| Growth Rate | 7.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Application, End-User Industry, Geography |

| Geographical Segmentation | Americas, Europe Middle East and Africa, Asia Pacific |

| Companies |

|

Nanosensors Market Segmentations:

Nanosensors Market Segmentation by Type

The nanosensors market is analyzed by type into the following:

Optical Nanosensors

Electrochemical Nanosensors

Mechanical Nanosensors

Thermal Nanosensors

Chemical Nanosensors

Nanosensors Market Segmentation by Application

The nanosensors market is analyzed by application into the following:

Environmental Monitoring

Healthcare Diagnostics

Food Safety

Industrial Process Monitoring

Security & Defense

Nanosensors Market Segmentation by end-user industry

The nanosensors market is analyzed by end-user industry into the following:

Healthcare

Automotive

Aerospace & Defense

Consumer Electronics

Energy & Utilities

Others

Nanosensors Market Segmentation by regions:

The study also analysed the Nanosensors market into the following regions, with country level forecasts and analysis as below:

Americas (US)

Europe, Middle East, and Africa (Germany, Netherlands, and Others)

Asia Pacific (China, Japan, Taiwan, South Korea, and Others)