Report Overview

Global Non-Optical Actuators Market Highlights

Non-Optical Actuators Market Size:

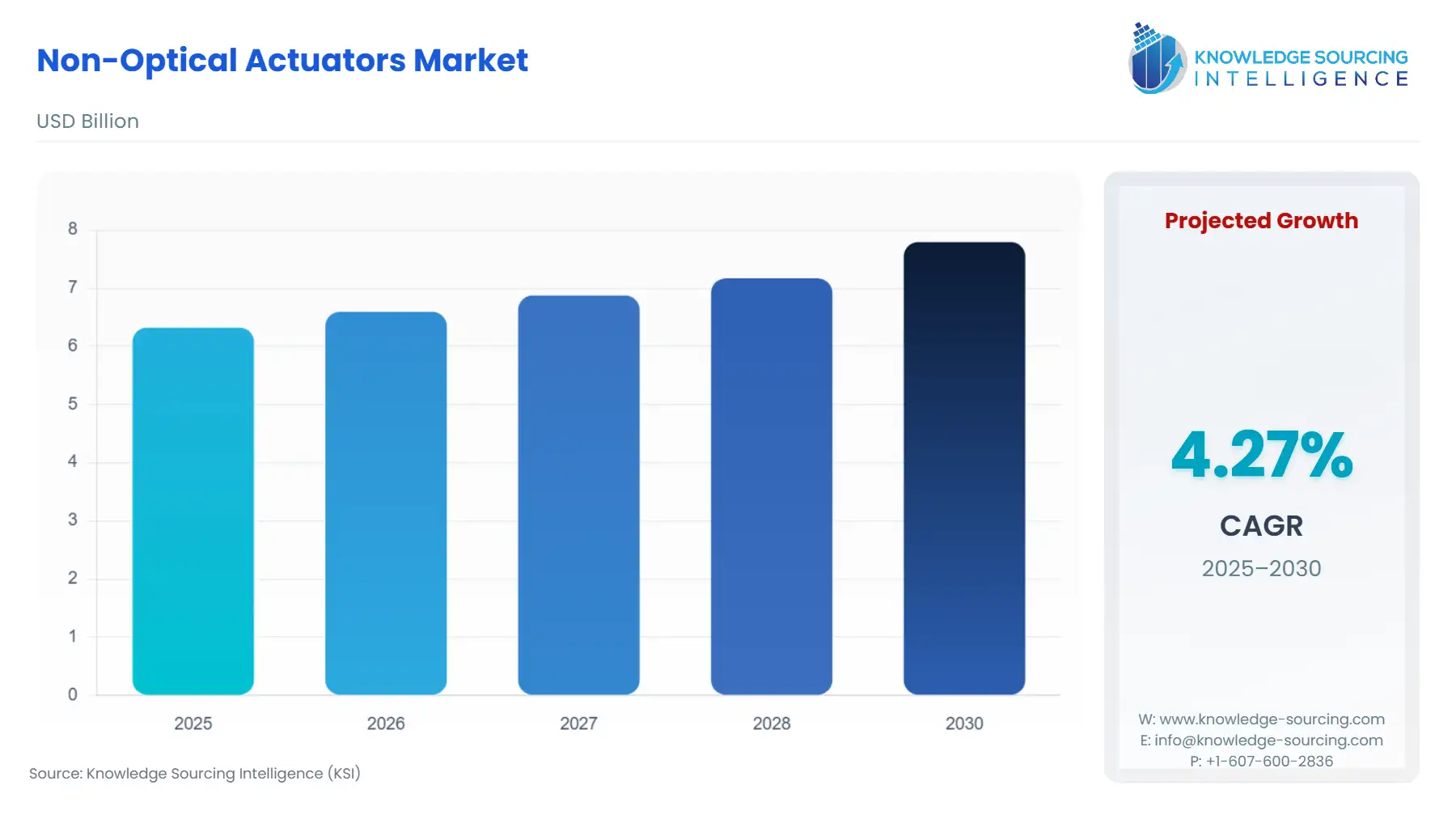

The Global Non-Optical Actuators Market is expected to grow from US$6.325 billion in 2025 to US$7.795 billion in 2030, at a CAGR of 4.27%.

The Global Non-Optical Actuators Market, which encompasses devices converting electrical, pneumatic, or hydraulic energy into mechanical motion without relying on light-based sensing, functions as a foundational enabler of automation across diverse industrial and consumer applications. These devices, including electric motors, solenoids, hydraulic cylinders, and piezoelectric elements, are critical components in systems requiring precise, repeatable, and high-force or high-speed actuation. The current market dynamic is characterized by a systemic shift away from traditional fluid-power (hydraulic and pneumatic) systems toward highly integrated, digitally controlled electric and solid-state actuators. This transition is not incidental; it is a direct consequence of the industrial imperative for energy efficiency, simplified maintenance, and seamless connectivity within IoT and cyber-physical systems, fundamentally changing the performance criteria against which actuators are evaluated and procured.

The increasing adoption of automation systems in the automotive industry is boosting the market of non-optical actuators in the automotive industry. Automation and AI (Artificial Intelligence) systems are widely employed in the production and manufacturing industries. The more efficiency and less time consumption offered by automation systems increase the popularity of automation systems in different sectors. The ability of actuators to convert electrical signals into physical movements and specific physical parameters is increasing the applications of actuators in the automation field. Actuators are specific semiconductor devices that can be efficiently employed in a wide range of electronic devices and applications. The increasing penetration of electronics into various sectors and fields also gives potential for the market growth of non-optical actuators in the global market. The wide adoption and application of automation in the automotive industry are fuelling the market value of non-optical actuators in the automotive field. The increasing research and developments in electronics are also raising the demand for non-optical actuators in the global market.

Global Non-Optical Actuators Market Analysis:

Growth Drivers The pervasive integration of advanced driver assistance systems (ADAS) and the accelerating adoption of electric vehicles (EVs) directly propel actuator demand. ADAS features, which are increasingly mandatory under regulations like the EU's GSR II, require a high-speed control loop necessitating precision electronic actuators for automated braking, steering, and suspension adjustments. Simultaneously, the global Industry 4.0 mandate for smart factories and industrial automation increases demand for high-performance electric actuators that can be digitally controlled, monitored via IoT protocols, and integrated into robotic systems to ensure manufacturing efficiency and minimal human intervention. This dual pressure from the automotive and manufacturing sectors guarantees continued volumetric expansion.

Challenges and Opportunities A primary constraint on market expansion is the inherent complexity and higher material cost of precision electronic and piezoelectric actuators compared to traditional fluid-power counterparts. This high Bill of Materials (BOM) cost can restrict their adoption in highly price-sensitive industrial automation and consumer electronics segments. The main opportunity lies in leveraging advancements in semiconductor technology, particularly Gallium Nitride (GaN) and Silicon Carbide (SiC), to produce power management and motor control Integrated Circuits (ICs). These advanced ICs enable smaller, lighter, and significantly more energy-dense electric actuators, which directly lower system-level costs and enhance performance, thereby unlocking demand in space-constrained and battery-powered applications, such as complex robotics and aerospace mechanisms. Raw Material and Pricing Analysis The non-optical actuators market, being an electromechanical hardware segment, is inherently sensitive to raw material cost volatility. Key inputs include rare-earth magnets (such as Neodymium) essential for high-torque electric motors, copper for coil windings, and specialized silicon wafers and composite materials for sensor and driver electronics.

The price of copper and rare earths is subject to global commodity market fluctuations and geopolitical supply chain stability, directly impacting the manufacturing cost of electric and electromagnetic actuators. Furthermore, the semiconductor content per actuator, driven by integrated control and communication ICs, dictates a pricing dependency on the global semiconductor foundry capacity, which creates a critical component dependency and influences final actuator system pricing. Supply Chain Analysis The supply chain is vertically integrated and globally distributed, yet critically dependent on a limited number of high-tech manufacturing hubs in Asia-Pacific. Semiconductor companies (e.g., Texas Instruments, Infineon) based in the US and Europe design the core control and driver ICs, which are then fabricated and packaged, primarily in Taiwan and China. The final assembly of the actuators, which combines motors, mechanical components, and these advanced ICs, is concentrated in the automotive and industrial manufacturing ecosystems of China, Japan, and Germany. This structure exposes the market to acute risks, notably the reliance on Asian fabrication for microcontrollers and power semiconductors, which has historically created bottlenecks that directly limit the production volume of high-specification actuators.

Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

| European Union | General Safety Regulation II (GSR II) / Machinery Regulation 2023/1230 | GSR II mandates advanced safety features (e.g., automated emergency braking) for all new vehicles starting July 2024, creating guaranteed, high-volume demand for high-reliability, precision automotive actuators. The Machinery Regulation mandates cybersecurity for connected machinery, driving demand for smart actuators with integrated, secure control ICs. |

| United States | Corporate Average Fuel Economy (CAFE) Standards / National Highway Traffic Safety Administration (NHTSA) | CAFE standards impose penalties for failing to meet fuel economy targets, directly increasing demand for lighter, more efficient electric actuators in thermal management and engine control systems to reduce vehicle weight and parasitic loss. NHTSA regulations reinforce safety requirements for braking and steering, cementing actuator adoption in critical systems. |

| China | Made in China 2025 / New Energy Vehicle (NEV) Mandates | The "Made in China 2025" industrial policy encourages domestic substitution and technological upgrading in high-end machinery, stimulating localized demand for advanced industrial and robotic actuators. NEV mandates create explosive domestic demand for battery and thermal management electric actuators. |

Non-Optical Actuators Market Segment Analysis

- By Type: Linear Movement Linear movement actuators, which convert energy into straight-line motion, are defined by their widespread application in precision manufacturing and specialized automotive subsystems. The need for exact positional control and high force density within automated production lines, robotics, and industrial machinery propels this demand. In the Manufacturing sector, the shift from pneumatic cylinders to electric linear actuators is accelerating because the latter offers variable speed control, positional feedback (crucial for quality control), and energy-on-demand operation, contrasting sharply with the continuous energy consumption of pneumatic systems. Specifically, the expansion of warehouse and logistics automation drives the need for electric linear systems in conveyor sorting, pick-and-place robotics, and automated guided vehicles (AGVs), where high duty cycles and millimetre-level precision are non-negotiable operational requirements. The ability to integrate these actuators into a deterministic fieldbus network (e.g., EtherCAT) is a key demand differentiator for systems integrators.

- By End-User: Automotive The automotive sector dictates the market trajectory for non-optical actuators, leveraging them across powertrain, chassis, safety, and comfort systems. The primary growth catalysts are the simultaneous trends of vehicle electrification and the mandatory adoption of ADAS features. The transition to battery electric vehicles (BEVs) fundamentally replaces many hydraulic and pneumatic systems with electric actuators, creating new high-volume applications in thermal management (cooling loops, battery heaters), active suspension systems, and electronic braking. Furthermore, regulations such as the European GSR II mandate the inclusion of features like Intelligent Speed Assistance (ISA) and Lane Keeping Assist (LKA). These safety features rely entirely on high-speed, high-redundancy, precision linear and rotary electric actuators to physically manipulate the steering column and brake calipers, locking in multi-year, high-volume demand for semiconductor and electromechanical suppliers capable of meeting Automotive Safety Integrity Level (ASIL) standards.

Non-Optical Actuators Market Geographical Analysis:

- US Market Analysis: The US market is characterized by a strong, cyclical demand from the advanced Automotive and Aerospace & Defense sectors. The domestic push for electric vehicle manufacturing, coupled with significant investment in autonomous driving technology, drives high-specification demand for precision electric actuators. Furthermore, the US manufacturing sector's increasing adoption of sophisticated, large-scale industrial robotics creates sustained demand for high-payload linear and rotary actuators. Local regulatory incentives and procurement policies favour technologies that can demonstrate higher levels of integration, cybersecurity compliance, and compliance with domestic content rules for federally funded projects. Brazil Market Analysis The Brazilian market is primarily driven by the Manufacturing and Oil & Gas industries, heavily boosted by the need for heavy-duty actuators for process control and infrastructure. The market exhibits a preference for robust and cost-effective hydraulic and pneumatic solutions in heavy industrial applications, though the adoption of electric actuators is accelerating in the high-growth automotive manufacturing sector.

Market penetration is significantly influenced by import tariffs and currency volatility, which often increase the cost of imported high-specification electronic actuators, thereby favoring local assembly or simpler component use. German Market Analysis Germany stands as a global hub for the Manufacturing and Industrial Automation segments, dictated by the stringent quality and performance requirements of the Mittelstand and global engineering firms. The necessity is intensely focused on high-precision, highly durable electric actuators, often with integrated sensor feedback and compliance with complex safety standards (SIL/PL). The national focus on Industry 4.0 and machine safety ensures high-volume sales of premium, digitally connected electric actuators capable of advanced diagnostics and predictive maintenance functions. UAE Market Analysis The UAE market’s need for non-optical actuators is concentrated heavily within the Oil & Gas and Infrastructure sectors. Actuators are critical in controlling high-pressure valves and dampers across petrochemical processing plants and large-scale utility projects. The local demand is characterized by the requirement for actuators certified for operation in harsh, high-temperature, and corrosive environments, necessitating explosion-proof (Ex-rated) and high-IP-rated pneumatic and hydraulic systems, though electric actuators are gaining ground in smart building and non-critical utility control. China Market Analysis The Chinese market is characterized by a massive scale of demand across Consumer Electronics, Automotive, and Manufacturing. The national mandates for New Energy Vehicles (NEVs) have catalyzed an explosive need for electric actuators in vehicle subsystems. Furthermore, the rapid expansion of domestic smartphone and electronic device production creates substantial high-volume demand for micro-actuators (e.g., piezoelectric, electromagnetic) for haptics, camera stabilization (OIS), and autofocus mechanisms, making it the highest volume market for certain component types globally. The market is competitive, with a growing domestic supplier base challenging established multinational entities.

Non-Optical Actuators Market Competitive Environment and Analysis:

The Global Non-Optical Actuators market is dominated by large semiconductor manufacturers supplying the core electronic components and diversified industrial conglomerates supplying the final electromechanical assemblies. The competitive pressure focuses on miniaturization, integration of motor control, driver ICs, and communications interfaces onto a single chip, and achieving ASIL certification for safety-critical applications. Semiconductor giants leverage their process technology and volume capabilities to offer highly optimized solutions. Infineon Technologies AG is a foundational supplier to the market, strategically positioning itself as a leader in power semiconductors and microcontrollers, which are the fundamental building blocks of electric actuators. The company focuses heavily on the Automotive and Industrial Power segments. Its core actuator-enabling products include the MOTIX family of motor control integrated circuits (ICs) and system-on-chips (SoCs), which are specifically designed for the control of brushed DC, brushless DC (BLDC), and stepper motors. Infineon leverages its expertise in Silicon Carbide (SiC) and Gallium Nitride (GaN) to deliver high-efficiency power stages and gate drivers, directly supporting the trend toward smaller, more powerful, and energy-efficient electric actuators for high-voltage EV and industrial applications. Texas Instruments Incorporated (TI) provides a vast portfolio of analog and embedded processing products critical to actuator functionality. TI’s strategy is to deliver complete signal-chain solutions, encompassing microcontrollers, analog-to-digital converters (ADCs), and motor drivers, which simplifies the design process for actuator manufacturers.

The company's C2000™ real-time microcontrollers are pivotal for high-precision, low-latency motor control in industrial and automotive safety applications. TI’s focus on the Automotive, Industrial, and Communications sectors ensures its components are at the heart of systems requiring high-reliability and low-power control, such as EV onboard chargers and industrial servo drives. ST Microelectronics (STM) is strategically positioned across the Automotive, Industrial, and Consumer Electronics markets, leveraging its expertise in microcontrollers, sensors, and power management ICs. STM is a major supplier of ICs for high-volume applications like smartphone haptics and camera actuators, capitalizing on its expertise in MEMS (Microelectromechanical Systems). For industrial applications, the company offers a broad range of motor control solutions, often utilizing its STM32 microcontrollers and high-voltage power drivers, enabling high-performance and cost-effective digital actuation systems for robotics and industrial machinery.

Non-Optical Actuators Market Developments:

- November 2025: STMicroelectronics launched a dual-range motion sensor supporting data-hungry industrial transformation. The device integrates sensing and processing, enhancing accuracy and enabling predictive maintenance within complex motor and actuator-driven systems. October 2025: Infineon released its next-generation EasyPACK C package, featuring Silicon Carbide (SiC) power modules. This product enables over 30% higher power density and extended lifetime for industrial applications like fast EV charging and UPS, which require robust actuation controls. June 2024: Texas Instruments partnered with Delta Electronics to advance EV onboard charging and power solutions. This collaboration leverages TI’s C2000™ MCUs to develop lighter, more efficient chargers, directly increasing demand for associated high-performance control and power ICs.

Non-Optical Actuators Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6.325 billion |

| Total Market Size in 2031 | USD 7.795 billion |

| Growth Rate | 4.27% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User Industries, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Non-Optical Actuators Market Segmentation:

- By Type

- Linear Movement

- Rotary Movement

- By End-User Industries

- Communication

- Automotive

- Manufacturing

- Consumer Electronics

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America