Report Overview

Global Electric Vehicle Market Highlights

Electric Vehicle Market Size:

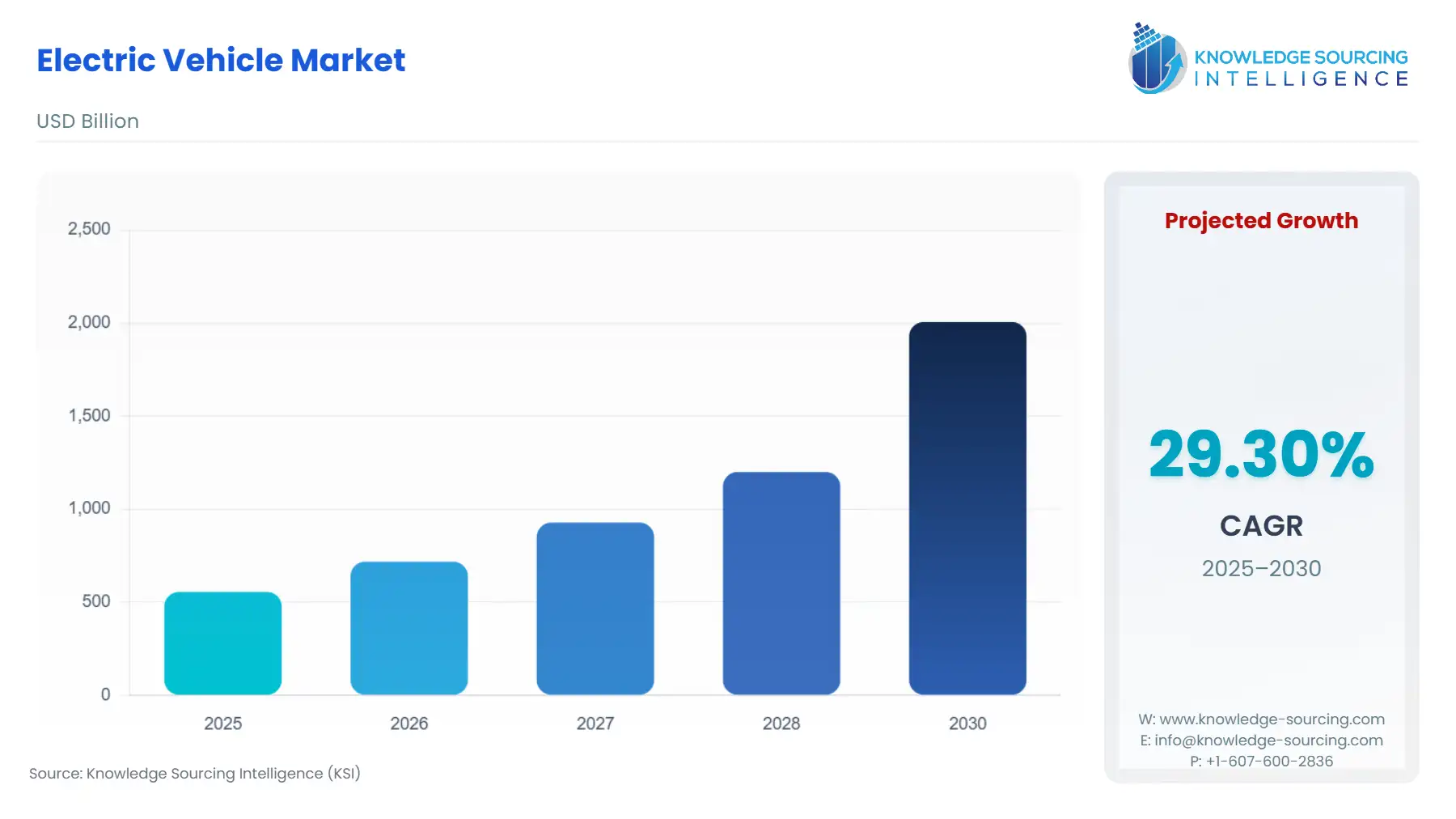

The global electric vehicle market will grow from USD 555.169 billion in 2025 to USD 2,006.346 billion in 2030 at a CAGR of 29.30%.

Electric Vehicle Market Introduction:

The global electric vehicle (EV) market is pivotal in advancing sustainable transportation, driven by innovations in battery technologies like LFP batteries and NMC batteries, which dominate due to their balance of cost and performance. Emerging Solid-State Batteries (SSB) promise higher battery energy density and enhanced safety, while Sodium-Ion Batteries and Lithium-Sulfur Batteries offer sustainable alternatives, reducing reliance on critical minerals for EVs like lithium and cobalt. Fast charging battery advancements and EV battery recycling enhance efficiency and sustainability, with second-life EV batteries extending utility in energy storage. In March 2025, HiNa launched an advanced sodium-ion battery with improved energy density, targeting cost-effective EVs. The market is propelled by technological breakthroughs and environmental goals.

Electric Vehicle Market Trends:

In recent years, the EV market has undergone significant growth and change, fueled by various factors such as increased environmental awareness, advancements in battery technology, and national drives toward emission reduction. Major auto manufacturers are investing heavily in developing and producing electric vehicles to meet the increasing demand of consumers. The reason why they are rolling out a variety of models confirms that, compared to traditional internal combustion engine vehicles, EVs are greener and more eco-friendly, thereby helping to mitigate global warming impacts and improve air quality.

The global electric vehicle market is advancing with a rising EV adoption rate, driven by the decarbonization of transport and sustainable mobility initiatives. Smart charging and a robust EV charging ecosystem mitigate range anxiety, enhancing consumer confidence. Digital cockpit EVs and over-the-air (OTA) updates for EVs improve user experience and vehicle functionality. EV policy incentives, including subsidies, accelerate market growth, while innovations in battery technology boost EV affordability. These trends, supported by infrastructure expansion and regulatory support, position the EV market for significant growth, addressing environmental concerns and consumer demands for efficient, connected, and accessible transportation solutions.

In addition, as more charging points are availed coupled with improved battery technology for extended range, there is greater interest by users to use EVs more frequently because they have become cost-effective for them over other fuel-based alternatives and convenient compared to other means of public transport. As a result, future predictions indicate that there will be a dramatic increase within a few decades from now when it comes to the total number of economies around different parts.”

Electric Vehicle Market Growth Drivers:

- The rising cost of diesel and gasoline pushes consumers towards buying electric vehicles.

One major factor driving the market for electric vehicles is the increasing cost of gasoline. In an effort to reduce their growing fuel expenses, consumers are looking for alternative forms of transportation as the price of gasoline rises. The price of regular motor gasoline rose by 49% between January and June of 2022, while the cost of diesel fuel increased by a slightly greater 55%. Even though fuel prices dropped in June and July of 2022, they are still more than twice as high as they were at the beginning of 2020. EVs are considered an attractive option since they tend to be cheaper and more reliable than gasoline.

Additionally, when compared to petrol-run vehicles, electric vehicles are more because of their low emission of CO2 and limited combustion particles related to fog. Therefore, when oil prices go up, people are pushed to turn to electric automobiles for more affordable and environmentally friendly transportation, fueling the EV market's expansion.

- Rising government initiatives

The PLI Scheme for the National Programme on Advanced Chemistry Cell (ACC) Battery Storage was launched to enhance India’s manufacturing facilities for ACC production.

Launched seven years back, with a two-year incubation period, it will draw INR 18,100 Crores or $2.1 Billion at INR 85/ Dollar.” Following the gestation period, five-year incentives will be provided based on the sale of domestically manufactured batteries. Currently, three companies have been chosen, collectively possessing a manufacturing capacity of 30 GWh.

The EVI Zero Emission Government Fleet Declaration was unveiled during the Global Clean Energy Action Forum, held in Pittsburgh in September 2022. Governments pledging their support have agreed to significantly decrease carbon and air pollutant emissions originating from cars and, at the same time, facilitate a green transportation sector. They intend to fast-track the incorporation and uptake of zero-emission automobiles in every class of their vehicles. The main aim here is for all light-duty zero-emission vehicle procurement to be made by the whole of the civilian government fleets/captured, while at this, they express a desire/aim to be able to realize this within a short time for medium- and heavy-duty vehicles by 2035.

- Strict government regulations on vehicle emissions are expected to boost market growth

There are various stringent automobile emission legislations worldwide aimed at reducing greenhouse gas concentrations in the air. For instance, the European Union set a regulation in 2022 that mandated a 15% reduction in CO2 emissions from light and medium commercial vehicles by 2025.' The Indian Petroleum Ministry requires all automakers to begin producing BS-VI vehicles after April 1, 2020. Reducing the nation's air pollution was the goal of the decision. The strict actions taken by several regulatory agencies to reduce air pollution are anticipated to accelerate the growth of this industry in the upcoming years.

- Increased solar installations are expected to spur the market expansion.

The solar panel recycling market is strongly impacted by the growing installation of solar panels in several noteworthy ways. As more solar systems are installed, the quantity of end-of-life photovoltaic (PV) panels nearing the end of their use rises. As more panels become retired, there is an increasing need for effective and environmentally friendly recycling methods to handle their disposal and recover valuable materials.

Additionally, the growing solar industry encourages infrastructure development and innovation in global electric vehicle technology. Recycling facilities and procedures have been established to efficiently and effectively manage the increasing number of panels.

- A rise in regulatory mandates is anticipated to drive the market.

Regulations that set standards and guidance for the proper end-of-life management of photovoltaic (PV) panels have a substantial influence on the market for global electric vehicles. Extended producer responsibility (EPR) regulations, which force producers to arrange and fund product collection and recycling, are frequently a part of these mandates.

To satisfy recycling targets, which also aim to keep a specific proportion of end-of-life PV panels out of landfills, investments in recycling infrastructure and procedures are encouraged. Grants, tax credits, and other forms of financial assistance may be offered as incentives to promote recycling initiatives and ease compliance. Regulations may also set criteria and certification requirements for recycling procedures, guaranteeing the sustainability of recycled materials in the environment and their quality.

Electric Vehicle Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

The electric vehicle (EV) market is experiencing robust global growth, with Asia-Pacific leading due to exponential expansion driven by rapid population growth, urbanization, and government initiatives. The region, including China, India, Japan, and South Korea, dominates the EV market due to favorable policies, technological advancements, and increasing consumer demand for sustainable transportation.

China holds a commanding position, accounting for nearly 60% of global EV registrations in 2022, with electric car sales reaching a 29% share of total domestic car sales, up from 16% in 2021 (International Energy Agency, 2023). The country achieved a 20% sales share for new energy vehicles (NEVs) by 2025, well ahead of schedule, driven by government subsidies, tax exemptions, and charging infrastructure development. China’s focus on air quality and ecological sustainability further accelerates EV adoption, reducing reliance on fossil fuels.

India is a fast-growing market, with its EV industry projected to grow at a CAGR of 49% from 2022 to 2030, targeting 10 million annual sales by 2030 (Economic Survey, 2023). The automotive sector, contributing 7.1% to India’s GDP, is bolstered by government policies like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, offering subsidies and infrastructure support. The EV market is expected to generate approximately 50 million jobs, both direct and indirect, by 2030, highlighting its economic impact.

Asia-Pacific’s growth is further supported by major automakers like BYD, Tata Motors, and Hyundai, alongside advancements in battery technology, such as lithium-ion batteries and solid-state batteries, improving range and affordability. Environmental concerns over air pollution drive consumer preference for clean mobility, boosting demand for electric cars, e-scooters, and electric commercial vehicles.

Globally, North America and Europe are significant markets, with the United States and Germany leveraging technological innovation and regulatory support for zero-emission vehicles. Europe’s stringent emission standards and green incentives promote EV adoption, while North America benefits from Tesla’s leadership and charging networks. The Middle East and Africa and South America are emerging markets, driven by urbanization and infrastructure investments.

Challenges like high initial costs and charging infrastructure gaps persist, but cost reductions and public-private partnerships are addressing these barriers. The EV market thrives on sustainability, policy support, battery innovation, and regional growth, with Asia-Pacific leading the charge in transforming global mobility.

Electric Vehicle Market Key Developments:

- In January 2024, Tata Passenger Electric Mobility Ltd (TPEM), a subsidiary of Tata Motors and a leader in India's electric vehicle movement, introduced its inaugural pure EV model – the Punch.ev. As the first product developed on its newly unveiled, advanced Pure EV architecture known as acti.ev, the Punch.ev sets itself apart with state-of-the-art technology, environmental consciousness, and affordability. Offering three distinct variants – Smart, Adventure, and Empowered – the Punch.ev is a versatile and multifaceted electric vehicle with an attractive SUV design. With prices starting at an introductory rate of INR 10.99 Lakh, the Punch.ev will be accessible at all authorized Tata Motors showrooms for EV sales and Tata.ev stores nationwide.

- In February 2023, Renault and Nissan unveiled a new long-term strategy for India: ramping up production and research and development (R&D) endeavors, launching electric vehicles, and shifting towards carbon-neutral manufacturing. The investment, totaling $600 million (?5,300 crore), backed the production of six new models manufactured in India, including two electric vehicles.

List of Top Electric Vehicle Companies:

- Tesla

- Lucid Motors

- Nissan

- Volvo

- Zoox, Inc.

Electric Vehicle Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Electric Vehicle Market Size in 2025 |

USD 555.169 billion |

|

Electric Vehicle Market Size in 2030 |

USD 2006.346 billion |

| Growth Rate | CAGR of 29.30% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

|

List of Major Companies in Electric Vehicle Market |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Electric Vehicle Market Segmentation:

- By Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

- By End-User

- Public

- Private

- Commercial

- By Charging Point

- AC charging

- DC charging

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Isreal

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America