Report Overview

Global Ophthalmic Drugs Market Highlights

Ophthalmic Drugs Market Size:

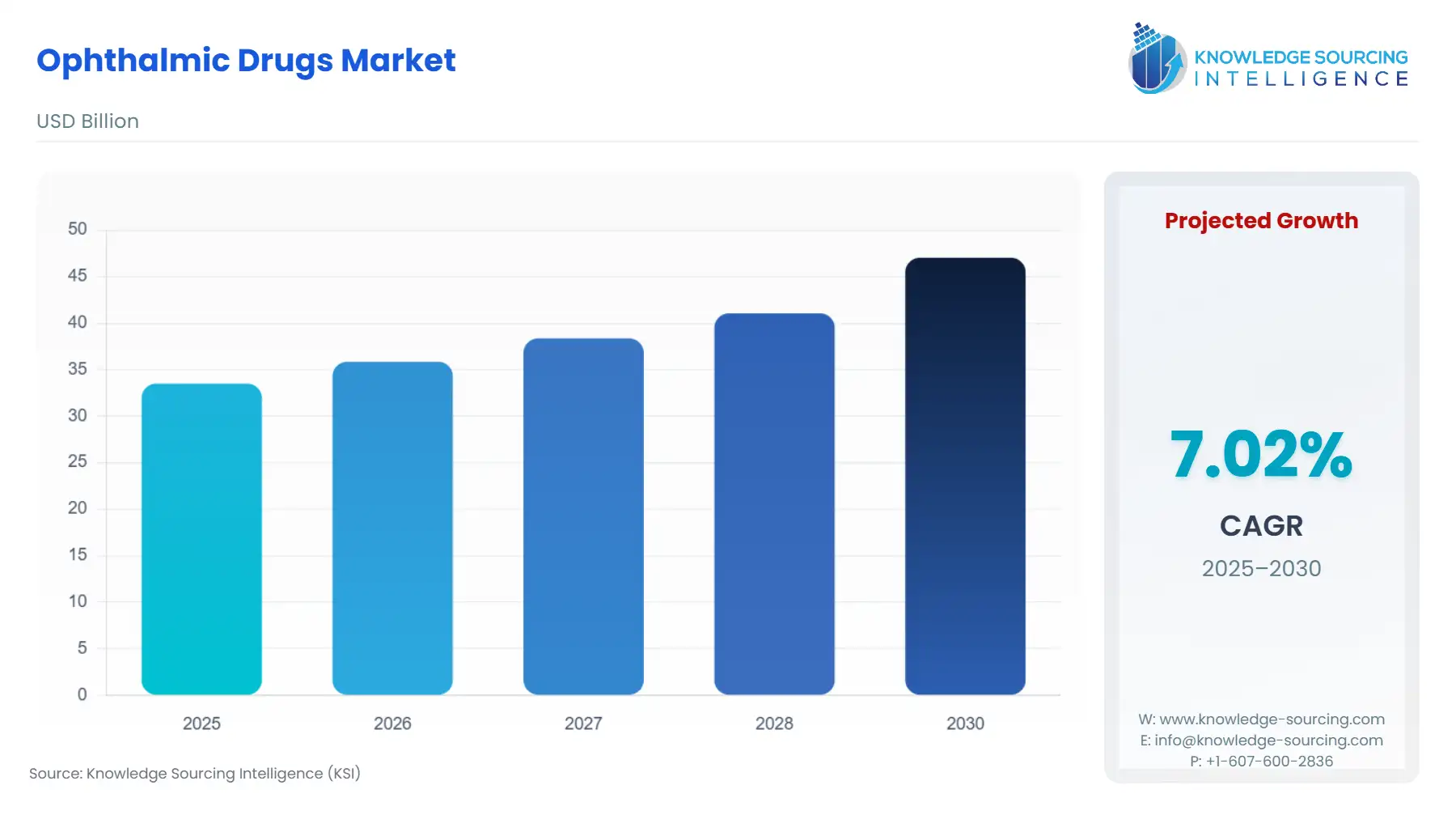

The Global Ophthalmic Drugs Market is expected to grow from USD 33.495 billion in 2025 to USD 47.031 billion in 2030, at a CAGR of 7.02%.

The Global Ophthalmic Drugs Market is characterized by rapid expansion, driven by the rising prevalence of vision disorders, technological innovations, and increasing focus on preventive eye care. The market has been divided into broad therapeutic categories, such as the treatment of glaucoma, dry eye disease, retinal disorders, inflammation, and infections.

These trends are supported by demographic changes like the increasing global aging population and the growing prevalence of diabetes, which in turn increases the prevalence of diseases such as diabetic retinopathy and macular degeneration. As a result, pharmaceutical and biotechnology companies are investing heavily in ophthalmic research to develop advanced formulations, including sustained-release systems, biologics, and gene therapies that provide better efficacy and fewer side effects.

Out of the 2.2 billion, at least 1 billion people suffer from a vision impairment that could be prevented or is not addressed. The majority of the people are over the age of 50 years. Moreover, there is a rise in the prevalence of eye diseases such as Wet AMD, which is a chronic disease that is caused by the excess of VEGF. This protein is responsible for promoting the growth of abnormal blood vessels under the macula (an area of the retina that aids in sharp and clear vision). So, when the fluid leaks out of these blood vessels and hinders vision, there is a requirement for drugs that inhibit the VEGF and suppress the growth of abnormal blood vessels. In addition, the rise in diseases such as glaucoma in the rising geriatric population is also a factor that is leading to increased demand for ophthalmic products and augmenting market growth.

Ophthalmic Drugs Market Overview:

The global ophthalmic drugs market is observing considerable growth, primarily attributed to the increasing rates of eye diseases, including glaucoma, age-related macular degeneration (AMD), diabetic retinopathy, and dry eye disease. In 2050, the number of people with POAG or Primary Open-Angle Glaucoma in the United States is projected to be around 7.32 million, out of which most patients will be aged 70 to 79 years (32%), women (50%), and Hispanics (50%). Among men, the biggest demographic group is Hispanic.

These factors, along with increased awareness about eye health, an increasing elderly population, and improvement in drug delivery technologies such as sustained-release implants, nanotechnology-based formulations, and gene therapy, are collectively contributing to the market's growth. Drug companies are investing heavily in R&D in ophthalmics to develop revolutionary therapies that will both enhance the effectiveness of the treatment and make it easier for patients to follow the prescribed regimen.

Furthermore, the increasing prevalence of lifestyle diseases like diabetes has resulted in a larger number of diabetic eye diseases, which is significantly increasing the ophthalmology market expansion. The same trend is observed with the use of biologics and biosimilars, which provide a targeted mechanism of action for chronic and severe ocular conditions. Additionally, the implementation of government programs and healthcare initiatives encouraging regular eye checkups and early diagnosis is facilitating drug adoption worldwide. Diabetes statistics demonstrate the rising prevalence of diabetes in people, families, and nations worldwide. According to the most recent International Diabetes Federation (IDF) Diabetes Atlas (2025), 11.1%, or 1 in 9, of adults aged 20 to 79 have diabetes, and more than 40% are not aware that they have the disease. According to projections, 1 in 8 adults, or 853 million people, will have diabetes by 2050, a 46% increase.

The global ophthalmic drugs market’s growth is supported by several government programs and public health initiatives, aiming for the prevention, diagnosis, and treatment of eye diseases. For instance, the World Health Organization (WHO), through its Vision 2020, The Right to Sight program, was developed in collaboration with the International Agency for the Prevention of Blindness (IAPB), which rallied global endeavours to eradicate blindness that can be avoided.

The top companies in the global ophthalmic drugs market scenario are a list of companies such as Sun Pharmaceutical Industries, Bausch + Lomb Incorporated, Pfizer Inc., Novartis AG, F. Hoffmann-La Roche Ltd., AbbVie Inc., Santen Pharmaceutical Co., Ltd., Bayer AG, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Otsuka Pharmaceutical Co., Ltd., and NicOx S.A.

These companies are committed to delivering cutting-edge solutions for eye diseases by maintaining a robust R&D, forming collaborative partnerships, and maintaining a global presence.

Ophthalmic Drugs Market Drivers:

The presence of stringent packaging restrictions, which the market players must strictly adhere to avoid the imposition of penalties

There are stringent measures regarding the packaging of ophthalmic products in terms of coloured caps and drug labelling. The yellow and blue-capped ophthalmic drugs are labelled as B blockers, and the red-capped ophthalmic drugs are labelled as mydriatics and cycloplegics. There are also green-capped ophthalmic drugs that are to be labelled as miotics, orange-capped are labelled as carbonic anhydrase inhibitors, brown-capped are to be labelled as anti-infective agents, and the grey and pink-capped products are to be labelled as non-steroidal anti-inflammatory drugs and steroids, respectively.

The launch of better-equipped and new and enhanced varieties of ophthalmic drugs to cater to the increased cases of serious diseases and rare diseases by existing and new players in different markets is expected to propel the growth of this market in the forecast period.

Rising prevalence of eye disorders

The growing number of eye diseases is one of the main reasons for the global ophthalmic drugs market’s expansion. The increasing number of cases of diseases such as cataract, glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), etc., is fostering continuous demand for effective treatments. Such increasing common diseases are the result of a change in demographic, environmental and lifestyle factors, which have led to certain changes in the health pattern of the world population.

One of the largest contributing populations is the global burden of diabetes. With the increasing diabetic population, the incidence of diabetic retinopathy is also rising, which is a major cause of preventable blindness. The latest International Diabetes Federation (IDF) Diabetes Atlas (2025) reports that 11.1% – or 1 in 9 – of the adult population (20-79 years) is living with diabetes, with over 4 in 10 unaware that they have the condition. A major part of this population will be at risk of developing disease leading to diabetic complications of the eyes, thus causing a larger demand for anti-VEGF drugs, corticosteroids and the various other types of targeted ophthalmic therapies.

Further, lifestyle changes and an increased dependence on digital technology have led to an escalation of the problem. The prolonged exposure to screens through smartphones, desktops and televisions is leading to an increase in the incidence of these diseases, such as digital eye strain, dry eye syndrome and a persistent rise in myopia, etc. This phenomenon is particularly noticeable in the younger population throughout urban areas, where there is a predominance of activities near work in daily routines. The World Health Organisation has also identified myopia as one of the increasing phenomena that is seen globally now. The increasing incidence of the same affects the requirement of prescription eye drops, lubricants and varied types of anti-inflammatory formulations to relieve and cure the various symptoms to prevent advancement of the disease.

The elderly population is expanding rapidly, with approximately 60,977,581 people aged 65 and above in the United States and 103,691,375 people in India in 2024. This demographic shift is directly influencing the ophthalmic drugs market, as age is a major risk factor for conditions such as cataracts, glaucoma, and age-related macular degeneration. The growing geriatric base is increasing demand for both prescription and over-the-counter ophthalmic medications, including anti-inflammatory, anti-glaucoma, and anti-VEGF drugs. As a result, pharmaceutical companies are focusing more on managing age-related eye diseases and long-term vision care solutions to meet this expanding healthcare need.

Ophthalmic Drugs Market Segment Analysis:

By Indication: Glaucoma

The global ophthalmic drugs market is segmented by indication into dry eye, glaucoma, infection/inflammation/allergies, retinal problems, and others. Glaucoma is one of the main reasons people purchase ophthalmic medications, as it requires lifelong consumption of drugs for its management. According to the National Glaucoma Research data, more than 80 million people had glaucoma in 2022, and the number is expected to reach 111 million by 2040, the main reason being the growing elderly population.

In the U.S., the number of people suffering from glaucoma is projected to increase from 4.2 million in 2022 to 6.3 million in 2050. World Health Organization (WHO) reports that the global burden of diabetes was at 200 million cases in 1990, rising to 830 million by 2022, thus increasing the risk of glaucoma due to the impaired optic nerve health through the vascular complications. Furthermore, according to IDF, the number of adults in the age group of 20 to 79 years living with diabetes will go up from 589 million in 2024 to 853 million by 2050.

Moreover, high blood pressure has the same effect on the progression of the disease, leading to the use of IOP-lowering eye drops such as beta-blockers and alpha agonists. The public health sector, through awareness programs like World Glaucoma Week, has significantly boosted the screening and early treatment of glaucoma, resulting in an increase in patients requiring long-term therapy. This increase in the number of patients has led to a corresponding increase in the treatment of glaucoma cases, and the latter has directly improved compliance with eye-drop regimens.

The new drug innovations include preservative-free eye drops, fixed-dose combinations, and novel classes of drugs that have collaborated in bringing about a change in efficacy, thereby lessening side effects, and enhancing patient compliance is also fuelling the segment.

Ophthalmic Drugs Market Geographical Outlook:

North America: the USA

The U.S. population aged 65 and over reached 61.2 million in 2024, representing a 3.1% increase from the previous year. The reasons for this are vital. The elderly have increased susceptibility to age-related eye illnesses like macular degeneration, glaucoma, and diabetic retinopathy; furthermore, there is a greater demand for ophthalmic medications such as anti-VEGF medicines and corticosteroids. Substantial growth in the market for ophthalmic medicines is predicted.

Reimbursement policies can dictate the nature of the market. For instance, Medicare Part B pays for certain ophthalmic drugs. Part B (Medical Insurance) covers certain doctors’ services, outpatient care, medical supplies, and preventive services. It may cover cataract surgery that implants conventional intraocular lenses, depending on the patient’s location.

The presence of eye and vision conditions among children represents an important market segment for pediatric ophthalmic drugs. With 6.8% of children diagnosed with an eye disorder and nearly 3% experiencing blindness or vision impairment, demand for pediatric formulations, corrective medications, and therapeutic eye drops is growing. Early diagnosis and treatment are critical to prevent progression of vision problems, which drives prescriptions and over-the-counter product use through retail and hospital pharmacies. This demographic also emphasizes the need for specialized pediatric ophthalmic products, creating opportunities for pharmaceutical companies to expand product portfolios and develop age-appropriate drug delivery systems for children.

In conclusion, the aging population, rising disease incidence, and reimbursement opportunities are driving the ophthalmic drugs market in the United States. Continuous profits in ophthalmic research and development are essential to meet the public health needs of an ageing population.

Ophthalmic Drugs Market Key Players:

OTC drugs are being made easily available by market players, which is going to contribute to the market share of OTCs over the forecast period

Some of the major market players are involved in providing ophthalmic drugs that can be purchased over the counter. Bausch & Lomb and Sentiss provide a range of products, such as drops and ointments for eye problems, that can provide temporary relief for occasional and frequent users alike.

Solution and suspension are expected to hold a significant share and show considerable growth over the forecast period.

Solution and suspension ophthalmic products are most commonly used in eye care, as they do not hamper vision, can be instilled easily, and are less likely to cause complications.

Ophthalmic Drugs Market Key Developments:

September 2025: Amneal reported the approval by the U.S. FDA of its bimatoprost ophthalmic solution 0.01% (ANDA, generic equivalent of LUMIGAN 0.01%). The product is suggested among patients to lower the risk of open-angle glaucoma/ocular hypertension by Amneal, who stresses its significance as an ophthalmic product addition to its consumer-affordable medicines portfolio.

June 2025: Perfuse Therapeutics announced the Phase-2 results for its PER-001 (which is an intravitreal, constant-release endothelin receptor antagonist). As per the results near the end of the two trials for glaucoma and diabetic retinopathy, the drug given once intravitreally had drug release for ~half a year, was safe and well tolerated. It increased ocular blood flow, optic nerve structure (OCT RNFL), and visual function (visual field/contrast sensitivity). Perfuse Therapeutics is planning to hold pivotal studies starting in the second half of 2025.

January 2025: University of Toronto BME announced a new drug-delivery scheme that employs colloidal drug aggregates (CDAs), and these are encapsulated in a hydrogel, which, when applied in animal trials with a timolol prodrug, has resulted in continuous therapy for glaucoma lasting seven weeks, approximately 200 times longer than standard drops, after a single subconjunctival injection.

2025: Astellas Pharma Inc. and Pfizer Inc. announced positive results from the pivotal Phase 3 EV-303 clinical trial (also known as KEYNOTE-905) for PADCEV™ (enfortumab vedotin), a Nectin-4-directed antibody-drug conjugate, in combination with KEYTRUDA™ (pembrolizumab), a PD-1 inhibitor.

Ophthalmic Drugs Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 33.495 billion |

| Total Market Size in 2030 | USD 47.031 billion |

| Forecast Unit | Billion |

| Growth Rate | 7.02% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Indication, Product type, Drug Form, Drug Class |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Ophthalmic Drugs Market Segmentation:

By Indication

Dry Eye

Glaucoma

Infection/Inflammation/Allergies

Retinal Problems

Others

By Product type

OTC Drug

Prescription Drug

By Drug Form

Liquid

Semi-solid

Solid

By Drug Class

Anti-Inflammatory

Anesthetic

Anti-Allergy

Others

By Delivery Method

Topical (Eye Drops, Ointments)

Intraocular

Intravitreal

Subconjunctival

Systemic

Oral

Intravenous

By Distribution Channel

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Taiwan

Thailand

Others