Report Overview

Portable Glucose Monitor Market Highlights

Portable Glucose Monitor Market Size:

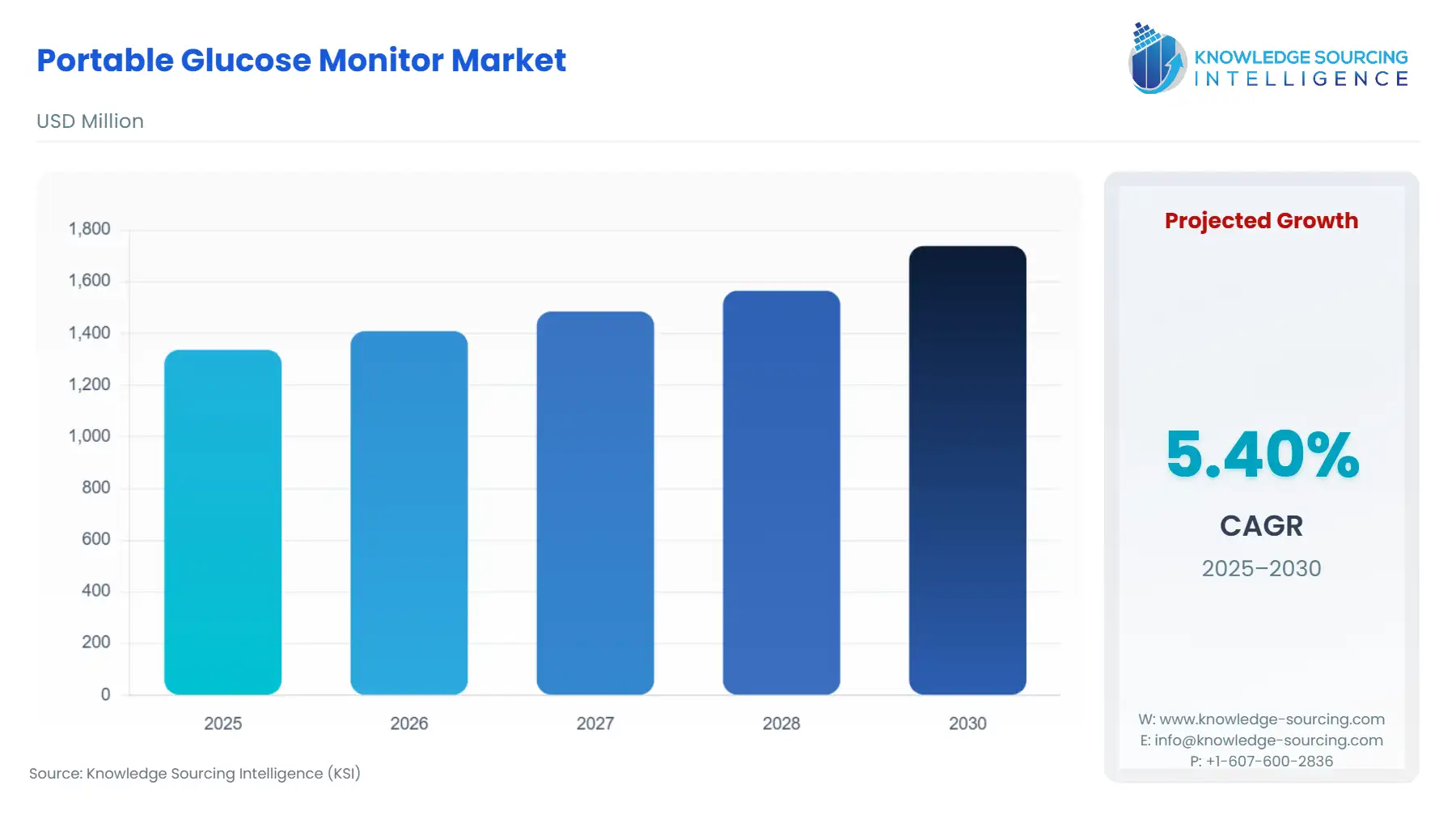

The global portable glucose monitor market will grow at a CAGR of 5.40% to be valued at US$1.739 billion in 2030 from US$1.337 billion in 2025.

Portable Glucose Monitor Market Introduction:

The Portable Glucose Monitor Market is a pivotal segment of the diabetes management industry, providing compact, user-friendly devices that enable individuals with type 1 diabetes and type 2 diabetes to monitor blood glucose levels effectively. These portable devices, including self-monitoring blood glucose (SMBG) meters and continuous glucose monitoring (CGM) systems, empower patients and healthcare providers to track glucose fluctuations in real-time, facilitating informed treatment decisions and reducing diabetic complications such as hypoglycemia and hyperglycemia.

The market serves hospitals, clinics, home care settings, and retail channels, with North America leading due to advanced healthcare infrastructure and the Asia-Pacific emerging as a growth hub driven by rising diabetes prevalence. Healthcare digitalization and remote diabetes care are transforming the market, integrating CGMs with smartphone apps and telehealth platforms to enhance patient adherence.

The Portable Glucose Monitor Market encompasses SMBG devices, which require fingerstick blood samples for point-in-time glucose readings, and CGM systems, which use subcutaneous sensors to provide continuous, real-time glucose data. These devices cater to type 1 diabetes patients requiring strict glucose control and type 2 diabetes patients managing lifestyle-related glucose fluctuations. The diabetes prevalence globally, driven by aging populations, obesity, and sedentary lifestyles, fuels demand, with the World Health Organization reporting CVDs and diabetes as leading global health burdens. Portable glucose monitors leverage healthcare digitalization, integrating with mobile apps and wearable technology to support remote diabetes care, as seen in Dexcom’s 2024 ONE+ CGM launch. The market is propelled by technological advancements and patient-centric innovations, enhancing accessibility and management efficiency for diabetes care.

Frequency of Blood Glucose Monitoring with Portable Glucose Monitors:

The frequency of checking blood glucose levels with a portable glucose monitor depends on the diabetes type, treatment regimen, and individual health needs. For type 1 diabetes patients, who rely on insulin therapy, SMBG is recommended 4–10 times daily, typically before meals, exercise, or bedtime, to adjust insulin doses and prevent hypoglycemia. CGM systems, providing real-time data every 5 minutes, are ideal for type 1 diabetes patients with hypoglycemia unawareness, reducing the need for fingersticks. For type 2 diabetes patients, SMBG frequency varies: insulin-dependent patients may test 2–4 times daily, while those on oral medications or lifestyle management may test 1–2 times daily or less, focusing on postprandial glucose. CGMs enhance patient adherence by offering continuous monitoring, particularly for type 2 diabetes patients with poor glycemic control. Healthcare providers should tailor monitoring schedules based on patient needs, ensuring effective diabetes management.

The Portable Glucose Monitor Market is driven by several factors. First, the escalating diabetes prevalence, particularly type 2 diabetes, increases demand for portable monitors, as noted by the WHO. Second, healthcare digitalization integrates CGMs with smartphone apps and telehealth, enhancing remote diabetes care, as seen in Abbott’s Lingo CGM for wellness users. Third, patient adherence improves with user-friendly devices, like ACON Laboratories’ On Call® MultiPro, offering real-time monitoring in point-of-care settings. Finally, government initiatives, such as Germany’s CGM reimbursement policies, boost adoption in Europe.

The market faces restraints such as high costs of CGM systems, limiting accessibility in low-income regions. Regulatory complexities, including FDA and EMA approvals, delay market entry, as seen with Senseonics’ Eversense CGM. Calibration requirements for some CGMs reduce patient adherence, particularly for type 2 diabetes patients. Additionally, data privacy concerns in healthcare digitalization challenge remote diabetes care adoption.

Recent advancements, such as Dexcom’s ONE+ and Ambrosia’s A-CGM, highlight the market’s commitment to remote diabetes care and user-friendly innovation, positioning portable glucose monitors as essential for modern diabetes management.

Portable Glucose Monitor Market Overview:

A glucose monitor is a small, portable machine that is used to measure the amount of glucose present in the blood. People with diabetes often use a blood glucose meter to help them manage their condition. The changing lifestyle patterns have led to an increase in the number of diabetic patients worldwide which will fuel the growth of this market over the forecast period. In addition, due to the unhealthy eating habits of people, the number of people suffering from obesity has been surging globally. The increasing incidence of obesity will further spike the number of diabetic patients, subsequently increasing the demand for portable glucose monitors in the market. Also, the portable glucose monitors make it easier to keep a check on blood glucose levels, which is vital for proper diagnosis and treatment of diabetes. The monitor is a near-patient device that allows the immediate detection of glucose levels in the body of a patient and facilitates rapid treatment solutions if the need arises. Furthermore, the continuous innovations are increasing the portability, efficiency, and reliability of these monitors, which is anticipated to increase their demand over the projected period.

The ongoing increase in the number of diabetic patients worldwide is expected to significantly drive the growth of the portable glucose monitor market in the coming years. These devices are essential for monitoring blood glucose levels in diabetic individuals. According to the International Diabetes Federation, 1 in 5 people aged over 65 has diabetes, and more than 1.1 million children and adolescents globally live with type 1 diabetes. The growing diabetic population is anticipated to boost the demand and adoption of portable glucose monitors, supporting long-term market expansion.

Some of the major players covered in this report include Abbott Diabetes Care, Roche Diagnostics, LifeScan IP Holdings, LLC, Dexcom Inc., Medtronic Plc., Ascensia Diabetes Care Holdings AG, Arkray Inc., and Bionime Corporation, among others.

Portable Glucose Monitor Market Trends:

The Portable Glucose Monitor Market is evolving rapidly, driven by technological innovations in wearable biosensors that enhance diabetes management. CGM sensors, such as those in Freestyle Libre 3 and Dexcom G7, provide real-time glucose readings, reducing fingerstick reliance. The Freestyle Libre 3, with minute-by-minute updates and a 14–15 day wear time, offers a compact design and smartphone integration, phasing out older sensors by 2025. Dexcom G7, with a 30-minute warm-up and 15-day sensor life, excels in accuracy (MARD ~8.2%) and insulin pump connectivity, supporting type 1 and type 2 diabetes patients. Medtronic Simplera, FDA-approved in 2024, integrates with smart insulin pens and offers 7-day wear, with strengths in hypoglycemia detection despite initial warm-up inaccuracies. CGM transmitters enable wireless data sharing to smartphones or smartwatches, enhancing patient convenience. Emerging non-invasive biosensors, like Afon’s Glucowear, signal future trends in painless monitoring. These Portable Glucose Monitor market trends reflect advancements in wearable biosensors, improving glycemic control and patient adherence.

Portable Glucose Monitor Market Drivers vs. Challenges:

Drivers:

Escalating Diabetes Prevalence

The Portable Glucose Monitor Market is propelled by the rising diabetes prevalence, particularly type 2 diabetes, driven by aging populations, obesity, and sedentary lifestyles. Type 1 diabetes patients also rely heavily on continuous glucose monitoring (CGM) for insulin therapy adjustments. The World Health Organization highlights cardiovascular diseases and diabetes as leading global health burdens, increasing demand for portable glucose monitors to manage glycemic control and prevent complications like hypoglycemia. Devices like Dexcom G7, with real-time glucose tracking, cater to this need, enhancing patient outcomes. CGM sensors and self-monitoring blood glucose (SMBG) devices support home care, driving market growth as healthcare systems prioritize early diagnosis and chronic disease management in North America, Asia-Pacific, and Europe.Advancements in Healthcare Digitalization

Healthcare digitalization significantly drives the Portable Glucose Monitor Market by integrating CGM sensors and wearable biosensors with smartphone apps and telehealth platforms, enhancing remote diabetes care. CGM transmitters, like those in Freestyle Libre 3, enable wireless data sharing, allowing real-time monitoring and physician access to glucose trends, as seen in Abbott’s Lingo CGM for wellness users. This connectivity improves patient adherence by simplifying data tracking and treatment adjustments for type 1 and type 2 diabetes. Digital health platforms, supported by cloud-based analytics, facilitate personalized care, driving market expansion in developed and emerging markets like India and China. Healthcare digitalization fosters innovation, making portable glucose monitors essential for modern diabetes management.Growing Focus on Patient Adherence

The emphasis on patient adherence drives the portable glucose monitor market’s growth, as user-friendly devices like CGM sensors and wearable biosensors encourage consistent glucose monitoring. Type 1 diabetes patients benefit from continuous monitoring to prevent hypoglycemic events, while type 2 diabetes patients use SMBG or CGMs for lifestyle management. Devices like Medtronic Simplera, with intuitive interfaces and smart insulin pen integration, enhance compliance. Non-invasive monitors, such as Afon’s Glucowear, reduce discomfort, further improving adherence. Patient-centric designs and remote diabetes care capabilities, supported by healthcare digitalization, drive market growth by addressing patient needs and improving glycemic control across global healthcare settings.

Restraints:

High Device Costs

High device costs pose a significant restraint for the Portable Glucose Monitor Market, particularly for CGM systems, limiting accessibility in low-income regions. CGM sensors and transmitters, like those in Dexcom G7, require expensive components and frequent replacements, increasing financial burdens for type 1 and type 2 diabetes patients. SMBG devices, while more affordable, still involve recurring costs for test strips and lancets, deterring adoption in developing countries. Limited reimbursement in some regions further restricts market penetration, despite healthcare digitalization efforts. This restraint necessitates cost-effective innovations, such as non-invasive biosensors, to enhance affordability and equitable access for diabetes management.Regulatory Complexities

Regulatory complexities significantly restrain the Portable Glucose Monitor Market, as CGM sensors and wearable biosensors require rigorous validation to meet safety and accuracy standards set by agencies like the FDA and EMA. For example, Medtronic Simplera faced extensive clinical trials for FDA approval in 2024, delaying market entry. Regional variations in regulatory frameworks, such as China’s NMPA requirements, complicate global commercialization of non-invasive monitors like Glucowear. These restraints increase development costs and time-to-market, hindering patient adherence and remote diabetes care adoption, particularly in emerging markets where regulatory harmonization is needed to support market growth.

Portable Glucose Monitor Market Segmentation Analysis:

Continuous Glucose Monitoring Devices (CGMs) will hold a large market share

Continuous Glucose Monitoring Devices (CGMs) dominate the product type segment of the Portable Glucose Monitor Market due to their real-time, continuous glucose tracking capabilities, offering superior convenience and accuracy over Blood Glucose Monitoring Devices (BGMs). CGMs use subcutaneous sensors to monitor glucose levels every few minutes, reducing fingerstick reliance and improving patient adherence for type 1 diabetes and type 2 diabetes management. Devices like Dexcom G7, with 15-day sensor life and smartphone integration, enhance remote diabetes care. CGMs support insulin pump connectivity, as seen in Medtronic Simplera, which integrates with smart insulin pens for automated dosing. Their healthcare digitalization capabilities drive market growth by addressing diabetes prevalence and enabling personalized care in home and clinical settings.The demand for Glucometer Devices is rising rapidly

Glucometer Devices lead the component segment of the Portable Glucose Monitor Market, serving as the primary tool for self-monitoring blood glucose (SMBG) in diabetes management. These portable devices measure blood glucose levels from fingerstick samples, offering quick, reliable readings for type 1 and type 2 diabetes patients. Glucometer Devices, like ACON Laboratories’ On Call® MultiPro, provide point-of-care testing with user-friendly interfaces, supporting patient adherence in home care settings. Integration with mobile apps enhances data tracking, aligning with healthcare digitalization trends. Glucometer Devices remain cost-effective compared to CGM sensors, driving their widespread adoption in developing regions like Asia-Pacific, where diabetes prevalence is rising. Their reliability and accessibility fuel market expansion for diabetes care.Home Care Settings is expected to be largest end-user of the market

Home Care Settings dominate the end-user segment of the Portable Glucose Monitor Market, driven by the growing preference for self-management among type 1 diabetes and type 2 diabetes patients. Home Care Settings leverage CGM sensors and Glucometer Devices to enable patients to monitor glucose levels independently, enhancing patient adherence and reducing hospital visits. Devices like Freestyle Libre 3, with wireless data sharing, support remote diabetes care through smartphone integration, as seen in Abbott’s Lingo CGM. The FDA’s 2024 approval of the first over-the-counter CGM further boosts home use, improving accessibility. Home Care Settings drive market growth by addressing diabetes prevalence and supporting healthcare digitalization in North America, Europe, and Asia-Pacific.

Portable Glucose Monitor Market Key Developments:

July 2025: The Blood Vitals Glucose Monitor is a new digital system designed for accurate, real-time glucose tracking. It's a compact and portable device that uses next-generation biosensors, which provides readings in as little as five seconds. It's a no-coding device, which makes it simple to use. The monitor can store up to 500 test results and integrates seamlessly with a companion mobile app for iOS and Android, allowing for easy data tracking and analysis.

Abbott's 2024 Freestyle Libre 3 Plus Sensor is an innovation on its existing Libre 2 system, offering a longer wear time of up to 15 days. It's designed to work with the current FreeStyle Libre 2 reader and app, providing real-time glucose readings every minute. The device also offers optional alarms to alert users of high or low glucose levels. Its main benefit is the extended wear, making diabetes management more convenient by reducing the frequency of sensor changes.

In March 2024, Dexcom launched the Stelo Glucose Biosensor System, which is the first over-the-counter (OTC) continuous glucose monitor (CGM) available without a prescription. It's designed for people with type 2 diabetes who do not use insulin and for individuals who want to track how diet and exercise affect their glucose levels. The 15-day disposable sensor provides real-time glucose data directly to a smartphone app, but it does not have medical alerts for hypoglycemia.

In January 2024, Abbott introduced the Freestyle Libre 2 Plus sensor, which is an enhanced version of the Freestyle Libre 2 system. It offers continuous glucose monitoring by sending real-time readings every minute to a user's smartphone, eliminating the need for frequent scans. The sensor provides alerts for high and low glucose levels and has been associated with a reduction in cardiovascular disease-related hospitalizations.

List of Top Portable Glucose Monitor Companies:

Abbott Laboratories

Dexcom, Inc.

Medtronic Plc

F. Hoffmann-La Roche Ltd

Ascensia Diabetes Care Holdings AG

Portable Glucose Monitor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.337 billion |

| Total Market Size in 2030 | USD 1.739 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.40% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Component, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Portable Glucose Monitor Market Segmentations:

Portable Glucose Monitor Market Segmentation by Product Type

Blood Glucose Monitoring Devices (BGMs)

Continuous Glucose Monitoring Devices (CGMs)

Portable Glucose Monitor Market Segmentation by Component

Glucometer Devices

Test Strips

Lancets

Portable Glucose Monitor Market Segmentation by End-User

Hospitals

Diagnostic Laboratories

Home Care Settings

Clinics

Portable Glucose Monitor Market Segmentation by regions:

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others