Report Overview

Global Power Electronics Market Highlights

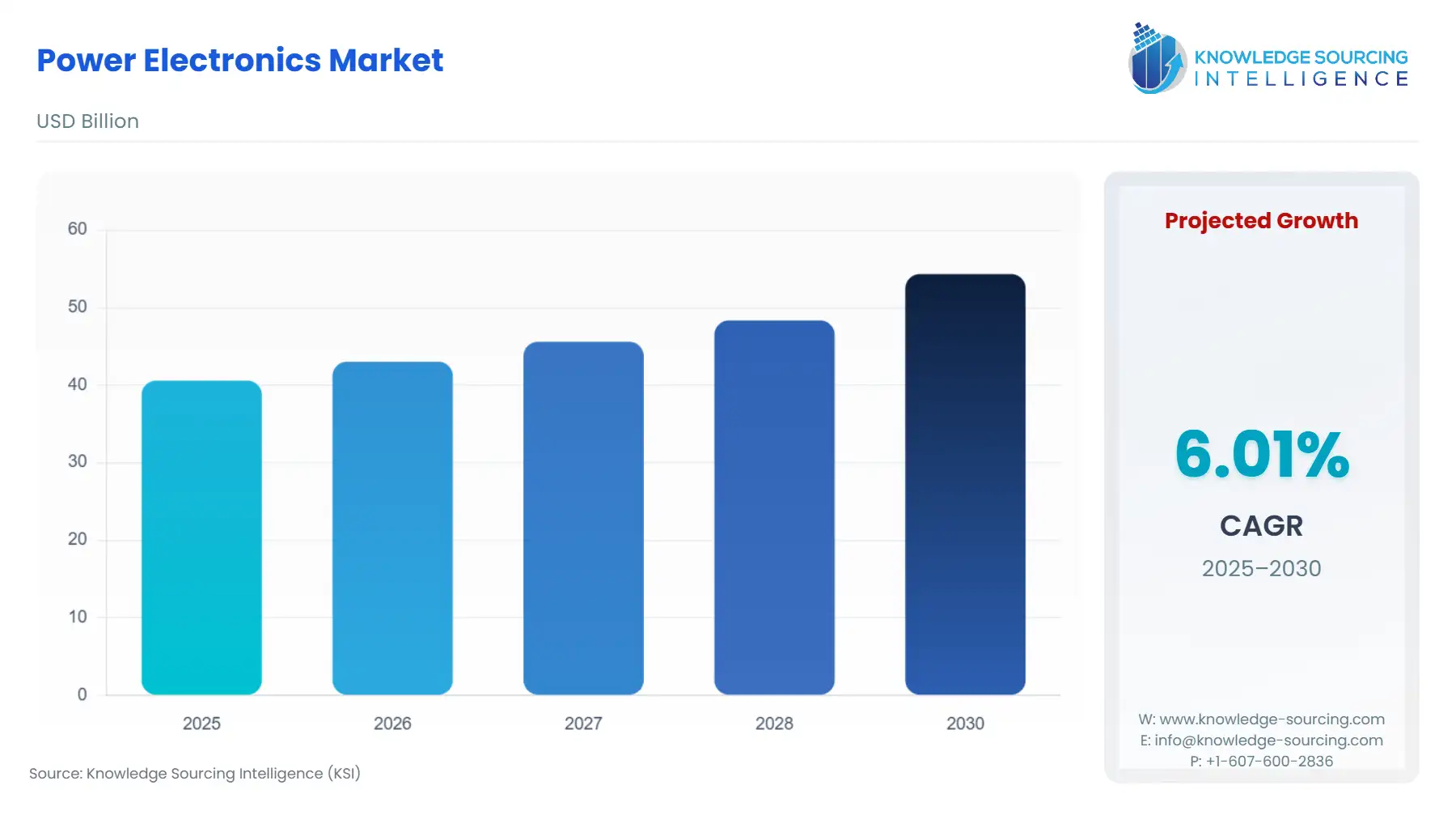

Power Electronics Market Size:

The global power electronics market is forecasted to expand at a 6.01% CAGR, reaching USD 54.337 billion by 2030 from USD 40.592 billion in 2025.

The Global Power Electronics Market is undergoing a rapid, technology-led transformation, moving beyond its traditional role as a commodity component supplier to become a strategic enabler of global electrification and energy transition imperatives. Power electronics, devices, modules, and ICs that efficiently control the flow and conversion of electrical energy are fundamental to modern infrastructure, including electric vehicle powertrains, high-speed data centers, and grid-scale renewable energy systems. This market is defined by a dichotomy: the massive, established volume of Silicon-based devices supporting consumer and industrial applications, and the aggressive, high-growth trajectory of Silicon Carbide and Gallium Nitride, which are reshaping the high-power, high-frequency segments. The market's current state is characterized by intense R&D investment aimed at achieving higher power density and minimizing energy loss, directly supporting global regulatory trends focused on climate mitigation and energy efficiency.

Global Power Electronics Market Analysis

- Growth Drivers

The electrification of transportation serves as a paramount growth catalyst. The mandated transition to Electric Vehicles (EVs) across major economies creates immense, non-negotiable demand for high-voltage power modules, specifically Silicon Carbide (SiC) inverters, as these devices are required to manage battery power conversion with the necessary efficiency, high switching speed, and thermal stability to extend driving range. Concurrently, the global surge in renewable energy integration (solar, wind) directly propels demand for high-power, reliable, grid-tied inverters and converters. These systems require advanced power semiconductors to efficiently synchronize intermittent energy sources with the existing power grid and manage battery energy storage, creating a dedicated, high-volume demand stream for power modules.

- Challenges and Opportunities

The primary challenge constraining market growth is the high initial cost and limited production capacity of Wide-Bandgap (WBG) materials, specifically SiC and GaN substrates. This cost disparity with traditional Silicon (Si) devices tempers adoption in cost-sensitive medium-power applications, placing upward pressure on end-product prices. However, this challenge simultaneously creates a massive opportunity in supply chain vertical integration, where manufacturers who successfully secure or develop internal substrate supply will gain a competitive advantage and accelerate market penetration. A further opportunity lies in the burgeoning 5G and high-frequency RF markets, where the superior switching speeds of GaN devices are uniquely positioned to meet the high power-added efficiency requirements of 5G base stations, driving demand in the Communication and Technology segment.

- Raw Material and Pricing Analysis

The Power Electronics Market is a physical product market defined by the semiconductor wafer, making raw material and pricing analysis crucial. The market's foundation rests on Silicon (Si) wafers, which are highly commoditized with stable, predictable pricing, driving the cost-effectiveness of traditional power discrete devices. In contrast, the high-growth SiC and GaN segments face higher raw material costs. The SiC wafer supply chain is characterized by complex, energy-intensive growth processes and is currently dominated by 6-inch wafers, which contribute to higher final device pricing. GaN device costs are also elevated due to the expensive fabrication processes, such as Hydride Vapor Phase Epitaxy (HVPE) and the need for specific precursors. As manufacturing yields and wafer sizes increase (moving toward 8-inch SiC and 200mm GaN-on-Si), cost is projected to decrease, which will spur a corresponding increase in demand across all end-user segments.

- Supply Chain Analysis

The global power electronics supply chain is characterized by regional concentration and a high degree of vertical integration, particularly among leaders in the WBG space. Key production hubs are centered in Asia-Pacific (especially China, Japan, and Taiwan) and Europe (Germany, Italy, and France). The logistical complexity stems from the specialized nature of wafer fabrication, particularly for SiC and GaN, which requires highly precise, proprietary production equipment and specialized cleanroom environments. The most critical dependency is the raw wafer supply (SiC and GaN substrates). Current market dynamics show major device manufacturers, such as Infineon and onsemi, actively pursuing internal or long-term external sourcing agreements for SiC wafers to mitigate supply bottlenecks, demonstrating the dependency of the final product market on primary raw material capacity.

Power Electronics Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

RoHS (Restriction of Hazardous Substances) Directive & WEEE (Waste Electrical and Electronic Equipment) Directive |

These directives mandate the reduction of hazardous materials in electronic products and require producers to manage end-of-life recycling. This directly increases demand for power devices (and their packaging) designed with compliant, easily recyclable materials, driving eco-design principles. |

|

United States |

DOE/EPA Energy Star Program and Federal Energy Management Program (FEMP) Standards |

Government-backed efficiency standards for industrial motors, lighting, and power supplies compel manufacturers to integrate higher-efficiency power electronics. This directly accelerates demand for WBG devices (GaN and SiC) as they offer demonstrably lower power losses than Si, enabling compliance and achieving higher energy ratings. |

|

China |

Made in China 2025 (Semiconductor Self-Sufficiency Policies) |

Policies promoting domestic semiconductor production, particularly in strategic areas like SiC and IGBTs, increase demand for local materials and manufacturing capacity. This alters global supply chain dynamics by creating a self-sustaining regional market and increasing competition for imported, high-end power devices. |

Power Electronics Market Segment Analysis

- By End-User Industry: Automotive

The Automotive segment's demand profile has fundamentally shifted from a cost-optimization focus to a performance and efficiency imperative driven by electrification. Power electronics are no longer peripheral but are central to the core functionality of Electric Vehicles (EVs), Hybrid Electric Vehicles (HEVs), and charging infrastructure. Demand for SiC power modules is accelerating sharply because their superior performance characteristics, higher breakdown voltage, faster switching, and excellent thermal conductivity, directly translate into tangible consumer benefits: longer driving range and faster charging times. Specifically, the industry’s ongoing migration toward 800V battery platforms creates a mandatory demand for SiC devices, as conventional Silicon IGBTs cannot handle the required voltage and power density efficiently. This technological transition ensures sustained, high-value demand for WBG power modules, prioritizing performance over historical cost constraints.

- By Device Type: Power Module

The Power Module segment is experiencing rapid growth, driven by the need for simplified, robust, and highly integrated power management solutions, primarily in high-power applications. A power module integrates multiple power discrete components (like MOSFETs, IGBTs, and diodes) into a single, compact, thermally managed package. The demand for these integrated modules is rising in the Energy and Power sector for utility-scale solar inverters and wind power converters, as well as in the Automotive segment for main inverters. This integration simplifies system design, reduces parasitic inductance, and significantly improves overall system reliability and power density compared to using discrete components. The shift from using individual components to pre-assembled, rugged modules reduces design complexity for the end-user, accelerating time-to-market for complex applications like fast EV chargers and large industrial motor drives.

Power Electronics Market Geographical Analysis

- North America (United States) Market Analysis

The US market for power electronics is characterized by high demand driven by military and aerospace investment, which necessitates ultra-reliable, high-performance power devices for avionics, radar, and defense systems. Concurrently, the aggressive build-out of Hyperscale Data Centers for AI computing creates substantial demand for high-efficiency GaN and SiC devices in power supplies to meet stringent power density and energy consumption targets. Local factors, including federal incentives for solar and EV manufacturing, directly influence demand by favoring components that meet high-efficiency thresholds, making WBG devices a strategic purchase.

- South America (Brazil) Market Analysis

The Brazilian market's demand is primarily influenced by the Energy and Power sector, specifically the expansion of its hydropower and emerging solar capacity. This drives steady demand for medium-to-high power discrete and modules to support power transmission, distribution infrastructure, and utility-scale inverters. Demand in the Automotive sector, while growing, remains focused on traditional Silicon devices and power ICs for basic vehicle electronics, with WBG adoption currently concentrated in specialized industrial applications rather than mass-market EV manufacturing.

- Europe (Germany) Market Analysis

Germany serves as a key European market, with demand dominated by the Automotive industry's stringent electrification goals and a massive Industrial automation sector. Regulatory pressure for energy efficiency and emission reduction is exceptionally high, which mandates the use of advanced power modules in industrial motor drives, high-speed trains, and renewable energy storage. This strong regulatory environment directly accelerates the adoption of premium SiC and IGBT modules, prioritizing efficiency and power density over lower initial cost, thereby setting a high bar for component demand across the continent.

- Middle East & Africa (Saudi Arabia) Market Analysis

Demand in Saudi Arabia is strongly linked to large-scale infrastructure projects and ambitious renewable energy targets (e.g., solar farms). These mega-projects require high-power-rated power modules and systems for utility-scale energy conversion, transmission, and the construction of new industrial facilities. The local factors are largely budget-driven, but the extreme operating temperatures in the region necessitate power electronics with superior thermal stability, increasing demand for robust, high-temperature SiC devices in critical energy installations.

- Asia-Pacific (China) Market Analysis

China is the world's largest consumer and producer of power electronics, with demand fueled by a massive Consumer Electronics base, rapid EV manufacturing growth (domestic and export), and enormous investment in industrial infrastructure. Government policy, particularly the focus on domestic supply chain localization and aggressive EV sales targets, creates unprecedented demand for all device types, from basic power discrete devices in consumer goods to highly advanced SiC power modules in its domestic EV and high-speed rail sectors, leading to a vertically integrated and high-volume competitive environment.

Power Electronics Market Competitive Environment and Analysis

The competitive landscape is characterized by a few global semiconductor giants with extensive R&D resources and significant market share, particularly in the premium automotive and industrial segments. The major players are engaged in a race to control the supply chain for WBG materials, shifting the competitive focus from silicon device volume to SiC and GaN substrate security and manufacturing yields.

- Company Profile: Infineon Technologies AG

Infineon Technologies AG is a global leader in power systems, maintaining a dominant position across all three key materials: Silicon, SiC, and GaN. The company’s strategic positioning centers on providing end-to-end power solutions through its portfolio of power switches (CoolMOS™ MOSFETs, IGBTs, and the CoolSiC™ MOSFET family), drivers, and microcontrollers (XMC). A key strategy is mastering the entire WBG supply chain, including significant investments in SiC manufacturing capacity and the strategic acquisition of GaN Systems. This focus on vertical integration ensures control over raw material costs and supply security, which is critical for meeting the high-volume demands of its largest segments, Automotive and Industrial Power Control.

- Company Profile: STMicroelectronics N.V.

STMicroelectronics (STM) is strategically positioned as a major supplier of power discretes, modules, and application-specific Power ICs, with a strong focus on the Automotive and Industrial markets. The company’s competitive edge is its extensive portfolio of WBG devices, marketed under the STPOWER brand, which includes a comprehensive range of SiC MOSFETs and GaN power transistors. STM has prioritized partnerships with major automakers and tier-one suppliers to secure long-term, high-volume contracts for SiC devices used in EV inverters and on-board chargers. Their commitment to the WBG shift is evidenced by capacity expansion, ensuring they remain a critical, high-volume source for the rapidly accelerating electrification segments.

- Company Profile: onsemi (ON Semiconductor)

onsemi focuses on driving intelligent power and sensing technologies for a sustainable future, positioning itself as a leader in power management solutions, particularly in the Automotive and Industrial segments. The company's key strategic offering is the EliteSiC power portfolio, which is essential for high-performance applications like EV traction inverters and charging systems. onsemi's strategy is heavily weighted toward vertical integration of the SiC manufacturing process, from crystal growth to the final packaging, which provides superior control over quality, yield, and cost. This focus is aimed at capturing market share in the high-growth EV and AI Data Center power supply markets.

Power Electronics Market Developments

- January 2025: onsemi Completes Acquisition of SiC JFET Technology

Onsemi completed the acquisition of the Silicon Carbide Junction Field-Effect Transistor (SiC JFET) technology business from Qorvo US, Inc, for $115 million in cash. This strategic acquisition complements OnSemi's existing EliteSiC power portfolio and is specifically aimed at addressing the demand for high energy efficiency and power density required in the AC-DC stage of power supply units for AI data centers.

Global Power Electronics Market Segmentation

- BY MATERIAL

- Gallium Nitride (GaN)

- Silicon (Si)

- Silicon Carbide (SiC)

- Others

- BY DEVICE TYPE

- Power Discrete

- Power Module

- Power IC

- BY END-USER INDUSTRY

- Communication and Technology

- Consumer Electronics

- Energy and Power

- Automotive

- Aerospace and Defense

- Others

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America