Report Overview

Global Reservoir Analysis Market Highlights

Global Reservoir Analysis Market

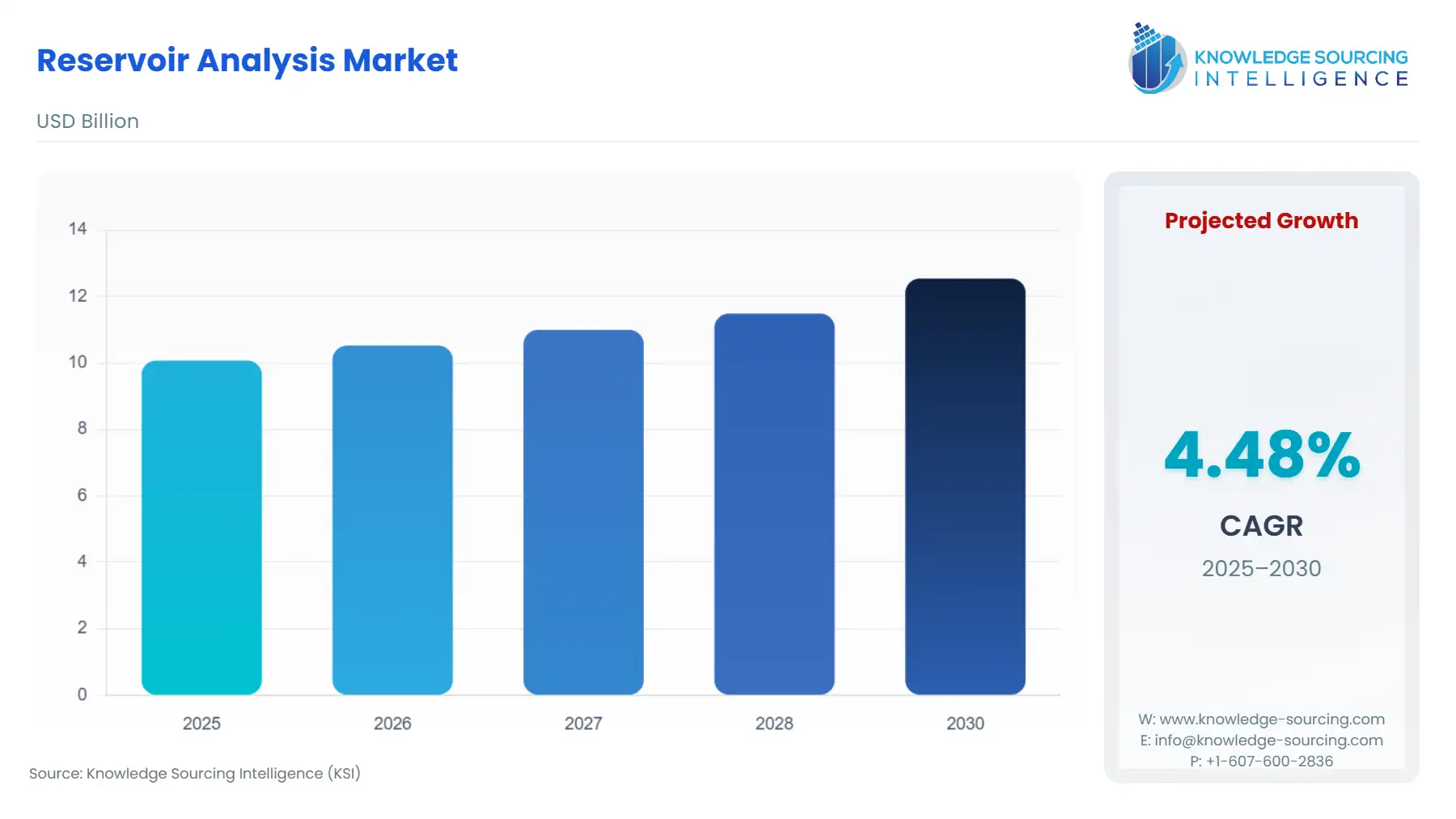

The Reservoir Analysis Market size will increase from USD 10.075 billion in 2025 to USD 12.543 billion by 2030, fueled by a 4.48% compound annual growth rate (CAGR).

Global Reservoir Analysis Market Key Highlights

The Global Reservoir Analysis Market serves as a critical enabler for the upstream oil and gas sector, providing the necessary subsurface intelligence to optimize hydrocarbon recovery, reduce exploratory risk, and guide capital allocation decisions. Reservoir analysis transcends basic data interpretation, utilizing integrated workflows—from data acquisition and geological modeling to advanced reservoir simulation—to characterize the fluid, rock, and pressure dynamics of subsurface formations. This advanced analytical function is indispensable in the context of declining production from mature conventional fields, compelling energy companies to pursue complex and technically challenging resources, such as ultra-low permeability unconventional reservoirs and deepwater offshore prospects. The inherent complexity and high cost associated with these frontier areas directly establish the imperative for highly accurate and predictive reservoir analysis, thereby cementing its central role in modern petroleum development strategies and driving continuous technological evolution across the market landscape.

Global Reservoir Analysis Market Analysis

- Growth Drivers

The pervasive pursuit of Unconventional Resources drives a direct and substantial demand increase for reservoir analysis services. Conventional reservoirs are depleting, forcing operators into difficult tight gas and shale formations where permeability is ultra-low. Commercial viability in these fields is contingent upon sophisticated analysis of natural fractures, rock mechanics, and fluid flow through complex pore systems, which directly necessitates advanced Reservoir Simulation and Geo Modelling services to design effective hydraulic fracturing programs. Similarly, the industry-wide focus on Enhanced Oil Recovery (EOR) techniques, aiming to boost production from mature fields, requires rigorous, high-definition characterization and monitoring to optimize chemical, gas, or thermal injection strategies. This requirement generates demand for specialized Data Acquisition and Monitoring services, including permanent downhole gauges and time-lapse (4D) seismic data, to track fluid movement in real time and validate simulation models.

- Challenges and Opportunities

A major market challenge is the significant capital expenditure and complexity associated with integrating disparate data streams, from seismic and log data to fluid samples, into a unified, coherent reservoir model. This complexity can create a bottleneck, particularly for smaller independent operators, thereby constraining the adoption rate of cutting-edge, high-cost solutions. Conversely, this constraint presents a substantial Opportunity in the domain of Digitalization and Automation. The integration of Machine Learning (ML) and cloud-native solutions, such as Halliburton's DecisionSpace® 365, offers a path to lower the cost and accelerate the speed of data processing and interpretation. This shift from high-touch, proprietary software to scalable, subscription-based digital platforms directly increases demand for more powerful, automated analytical tools, enabling a greater volume of assets to benefit from advanced analysis.

- Supply Chain Analysis

The supply chain for the Global Reservoir Analysis Market is structured as a complex, multi-tiered service ecosystem, centered on intangible assets—proprietary software, analytical methodologies, and human capital. The primary production hubs reside in major technology and research centers across North America (Houston, Texas) and Europe (Paris, Oslo, London), where leading providers like Schlumberger, Halliburton, and CGG develop and refine their foundational software platforms. Logistical complexities stem not from physical transport but from the secure, real-time transmission and processing of massive volumes of seismic, well-log, and pressure-volume-temperature (PVT) data from remote, often offshore, operating locations to these central analytical centers. The supply chain exhibits a critical dependency on a specialized talent pool of geoscientists and computer scientists, creating a severe labor dependency. This human capital dependency represents the market's greatest vulnerability, directly impacting the capacity of firms to deliver complex services globally.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Bureau of Ocean Energy Management (BOEM) / Bureau of Safety and Environmental Enforcement (BSEE) |

Regulations governing well integrity and mandatory reserve reporting for offshore and federal lands enforce rigorous data acquisition and reservoir characterization standards. This compels E&P companies to purchase high-accuracy monitoring and simulation services to comply with regulatory requirements for well placement, pressure maintenance, and ultimate recovery projections. |

|

European Union |

EU Methane Strategy and Emissions Trading System (ETS) |

Directives aiming to reduce methane emissions from the energy sector necessitate advanced reservoir monitoring and modeling. Operators must use sophisticated Data Acquisition services (e.g., fiber optic sensing, permanent downhole gauges) to detect and quantify fugitive emissions from reservoirs and wells, thereby driving demand for services focused on environmental compliance and risk mitigation. |

|

International |

Society of Petroleum Engineers (SPE) / Securities and Exchange Commission (SEC) Reserve Reporting Standards |

The requirement for publicly traded companies to report oil and gas reserves based on verifiable analytical data drives consistent, mandatory demand for auditable Reservoir Simulation and Geo Modelling services to prove and categorize reserves (Proved, Probable, Possible). Compliance mandates the utilization of standardized, transparent methodologies offered by market leaders. |

In-Depth Segment Analysis

- By Technology: Reservoir Simulation

Reservoir simulation constitutes a core analytical segment, driven by the critical need to model and predict the dynamic behavior of hydrocarbons under various production and development scenarios. The need for this technology is directly proportional to the complexity of the asset. Specifically, the global shift toward Unconventional Reservoirs has been the single greatest demand accelerator for advanced simulation. Traditional simulators often fail to accurately model the non-Darcy flow and multi-phase fluid dynamics within tight shales and fractured basement rock. Consequently, operators require next-generation, high-resolution simulators capable of incorporating complex hydraulic fracture networks and microseismic data. For instance, in deepwater operations, simulations are mandatory to model the impact of fluid withdrawal on seafloor stability and to optimize the placement of multiple subsea wells, a non-negotiable step before multi-billion-dollar field development sanction. This direct link between increasing geological complexity and the mandatory use of specialized simulation software establishes it as an indispensable investment for risk mitigation and capital efficiency in high-value projects.

- By Application: Offshore

The Offshore segment generates a high-intensity demand for premium reservoir analysis services due to the immense capital outlay, logistical difficulty, and stringent safety standards inherent to marine operations. The requirement is particularly acute in Deepwater and Ultra-deepwater projects, where the cost of a single dry well can exceed hundreds of millions of dollars. In this environment, pre-drill seismic interpretation, well placement, and ultimate recovery projection must achieve the highest possible degree of certainty. This necessitates the use of high-definition, multi-component seismic surveys, coupled with advanced geo-mechanical modeling, which translates into an immediate demand for sophisticated Geo Modelling and Data Acquisition services. Furthermore, once fields are on stream, the difficulty and expense of intervention from a drilling rig mandate the deployment of permanent monitoring systems—such as fiber optic Distributed Temperature Sensing (DTS) and Distributed Acoustic Sensing (DAS)—all of which are high-value analytical service purchases designed to maximize production efficiency without costly well workovers.

Geographical Analysis

- US Market Analysis (North America)

The US market for reservoir analysis is dominated by the relentless activity in unconventional shale plays, primarily the Permian Basin and Marcellus Shale. The local growth factor is the high cycle time—the rapid pace of drilling, completing, and producing wells—which necessitates quick, repeatable, and automated analytical workflows. US operators demand software-centric solutions that can efficiently process vast volumes of data from a large number of wells, driving the adoption of cloud-native and AI-driven reservoir characterization platforms. The continuous innovation in hydraulic fracturing techniques, requiring new predictive models for proppant effectiveness and cluster efficiency, sustains robust demand for advanced, iterative Reservoir Simulation.

- Brazil Market Analysis (South America)

Brazil's market is intrinsically linked to the development of its vast, technically challenging Pre-Salt Offshore fields. The local factor driving demand is the unique geology of these deepwater carbonate reservoirs, which are characterized by high pressure and temperature and low-permeability rock separated by complex salt layers. National operator Petrobras and its partners require ultra-high-resolution seismic processing (often demanding CGG’s specialized services) and sophisticated geo-mechanical models to accurately predict drilling hazards and optimize well trajectory through the Pre-Salt layers. This focus on technically advanced, high-cost, deepwater assets ensures consistent demand for premium, integrated reservoir analysis solutions.

- United Kingdom Market Analysis (Europe)

The UK market is largely defined by the late-life management of assets in the mature North Sea Basin. The primary local factor is the imperative to maximize recovery from aging infrastructure under increasingly complex fiscal and decommissioning pressures. This drives demand toward Data Acquisition, Monitoring, and Reservoir Sampling services geared toward maximizing the lifespan of existing wells. Operators require analysis to identify overlooked, bypassed hydrocarbons, utilize infill drilling opportunities, and plan complex plug and abandonment operations. The transition to lower-carbon energy also sees a nascent, growing demand for reservoir analysis expertise applied to carbon capture and storage (CCS) projects, particularly for geological storage and monitoring.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is characterized by massive, geologically stable conventional fields but is increasingly focused on developing complex carbonate and tight gas reservoirs to meet domestic energy requirement. The local factor influencing demand is the national oil company's long-term strategy of sustainable, maximized production. This requires consistent, high-quality Geo Modelling and Reservoir Simulation to optimize field-wide pressure maintenance and water-flooding programs across extremely large-scale assets. Furthermore, the commitment to digitalization means continuous investment in integrated operations centers, driving demand for real-time monitoring and data visualization tools from major international service companies.

- China Market Analysis (Asia-Pacific)

China's reservoir analysis market is experiencing rapid expansion, fueled by a national energy security mandate to boost domestic production, particularly from unconventional gas and tight oil reserves. The local growth factor is a government-backed push for technological self-reliance combined with a large, underexplored resource base. This necessitates massive investments in both the hardware (logging tools, coring equipment) for Data Acquisition and the software required for complex, high-volume analysis of newly developed shale plays in regions like the Sichuan Basin. International service providers are crucial partners, supplying the advanced analytical platforms and expertise required to rapidly mature these frontier resources.

Competitive Environment and Analysis

The Global Reservoir Analysis Market is dominated by an oligopoly of diversified, integrated oilfield service giants, where competition centers on the breadth of the service portfolio, technological integration across the asset lifecycle, and proprietary software ecosystems. The major players—Schlumberger, Halliburton, and Baker Hughes—leverage their global operational footprint and deep research and development budgets to set industry standards and capture the highest-value contracts for complex, integrated reservoir studies. Mid-tier and niche players like CGG, Core Laboratories, and Trican Well Service compete by offering specialized expertise, such as high-end seismic imaging, core analysis, or proprietary chemical tracers, often forming strategic alliances to complement the larger players' integrated offerings.

- Schlumberger Limited

Schlumberger is positioned as the market's technological leader, offering a comprehensive, integrated subsurface-to-surface workflow. Its strategic advantage lies in its DELFI cognitive E&P environment, a cloud-based platform that hosts its suite of advanced reservoir analysis applications. This platform facilitates collaborative workflows and leverages AI/ML for seismic interpretation, geological modeling, and reservoir simulation, directly driving demand for data integration and predictive analytics. Key reservoir analysis products include the Petrel E&P software platform and the INTERSECT high-resolution reservoir simulator, which are fundamental tools used globally for dynamic reservoir modeling and production forecasting, particularly in complex, high-pressure, high-temperature (HPHT) environments.

- Halliburton Company

Halliburton’s competitive strategy is anchored in its comprehensive well construction and production enhancement capabilities, tightly integrated with its Landmark software division. The company's core offering in reservoir analysis is the DecisionSpace® 365 platform. This system is a cloud-based suite of applications designed to integrate real-time drilling and production data directly into reservoir models, enabling rapid, data-driven decision-making. Halliburton is highly specialized in unconventional asset analysis, providing sophisticated modeling for hydraulic fracture geometry and production optimization, particularly in the North American shale sector, where its stimulation and fracturing service portfolio complements its analytical software.

- Baker Hughes Company

Baker Hughes focuses on delivering reservoir analysis through a balanced portfolio of subsea and surface technology, positioning itself as an industrial technology firm for energy. Its strategic positioning emphasizes the integration of its Reservoir Technical Services (RTS) with its leading-edge measurement-while-drilling (MWD) and wireline logging tools. Key services include advanced petrophysical analysis and fluid sampling, which acquire critical data for reservoir characterization. The company places a significant emphasis on efficiency, utilizing its software and services to optimize field performance, particularly in mature and deepwater basins where its subsea production systems are prevalent.

Recent Market Developments

- September 2025: Halliburton announced the launch of the SmartWell® Turing® electro-hydraulic control system, designed for improved reservoir management. This new product provides enhanced reliability and faster response times for downhole flow control in complex wells, directly increasing the efficacy of the company's reservoir simulation and production monitoring services by enabling finer-tuned real-time flow adjustments.

- September 2025: SLB signed an agreement to acquire RESMAN Energy Technology, a specialist in wireless reservoir surveillance. RESMAN's advanced chemical tracers track fluid movement with high precision, optimizing production and recovery. The acquisition, expected to close in early 2026, aims to integrate tracer technology with SLB's digital workflows for enhanced, data-driven reservoir monitoring across traditional and energy transition applications like CO2 storage.

Global Reservoir Analysis Market Segmentation

By Reservoir Type

- Conventional

- Unconventional

By Service

- Geo Modelling

- Reservoir Simulation

- Data Acquisition

- Monitoring

- Reservoir Sampling

- Others

By Application

- Onshore

- Offshore

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others