Report Overview

Global Seed Market Report, Highlights

Seed Market Size:

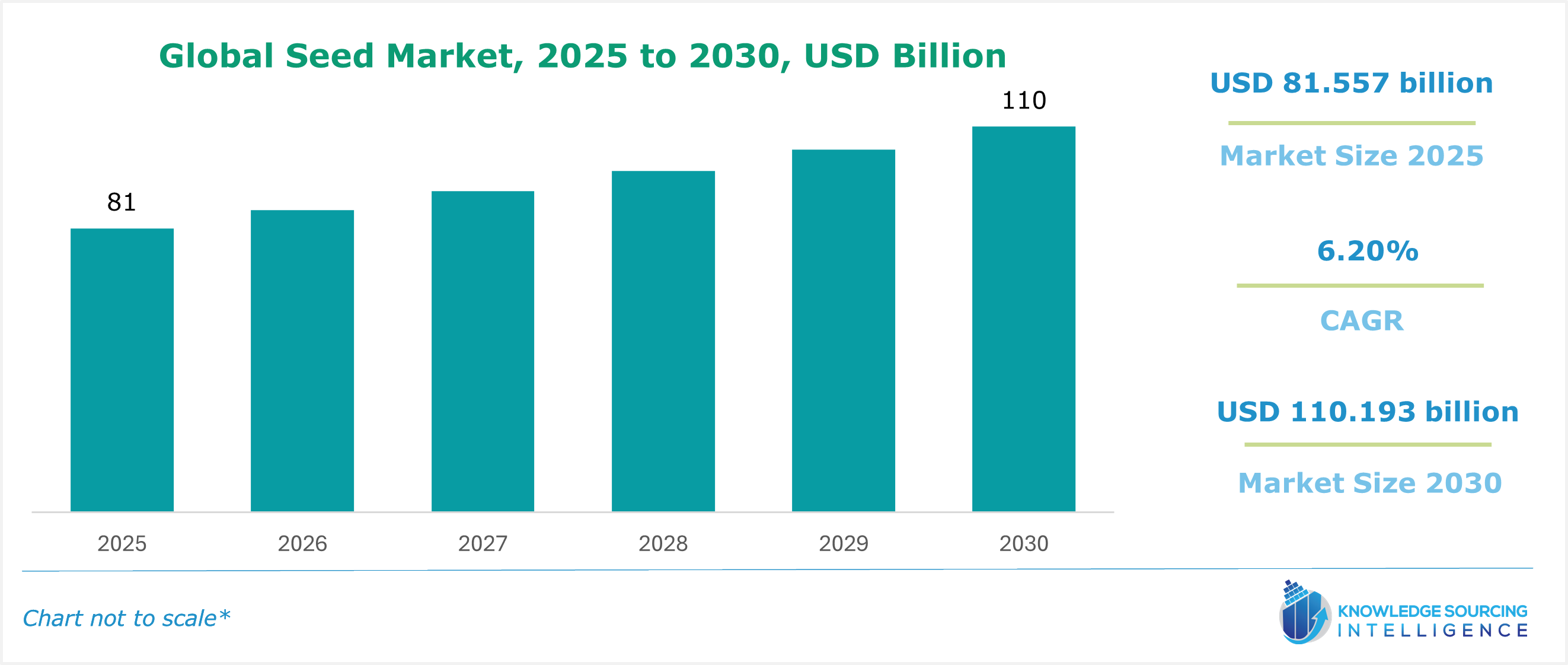

The global seed market is expected to grow at a CAGR of 6.20%, reaching a market size of US$110.193 billion in 2030 from US$81.557 billion in 2025.

Seeds store the nutrients of a plant during the embryonic stage and with the growing global population, the food demand is on the constant rise thereby bolstering the need for more food production. Genetically engineered or conventional seeds differ on the basis of water intake and other ex-factors required for them to turn into plants, but with the growing environmental concern, their demand is anticipated to positive growth.

Several companies have launched disease-resistant seeds, for example, on February 2023, BASF introduced new tomato seed varieties that are resistant to ToBRFV. Their Nunhems® portfolio currently includes a selection of tomato seed varieties that exhibit resistance to ToBRFV. Likewise, In March 2024, Syngenta Vegetable Seeds opened a new Seed Health Lab in Hyderabad, India, showcasing the company's ongoing commitment to enhancing quality control capabilities. This lab is India's first specialized seed health lab. It will cater to growers not only in India but also across the Asia Pacific region and beyond.

Global Seed Market Growth Drivers:

- Growing horticulture practices is expected to improve the market growth

Horticulture defines the growing of genetically engineered crops inclusive of fruits, vegetables, and ornamental plants which has provided a framework for the adoption of new technological options for developing hybrid crop varieties. Hence major economies are aiming to optimize the growing potential of hybrid crop production, therefore investments in vertical farming and indoor farming programs are being implemented to bolster horticulture production.

For instance, according to the Department of Agriculture and Farmers Welfare’s second advanced estimate for 2023-2024, India’s horticulture production reached 352.23 million tons with fruits, aromatic & medicinal plants, honey flowers, spices and plantation crops showing positive expansion. Likewise, the European region undertaking various schemes to bolster the production of major horticulture crops such as potatoes which is also creating a surge in the market expansion.

Global Seed Market Restraints:

- Technical complexities in seed engineering can hamper the overall market expansion.

Genetically engineered seeds though provide high-performance features in comparison to conventional varieties, however, the time and efforts taken to in altering the seed genetics so that it meets the area-specific production requirement of the crop is very time-consuming as the engineered seed goes through rigorous testing to analyze its functioning.

Owing to their high research & development expenditure seed engineering can be a costly process in small & underdeveloped economies that mainly rely on import and external trade.

Global Seed Market Segment Analysis:

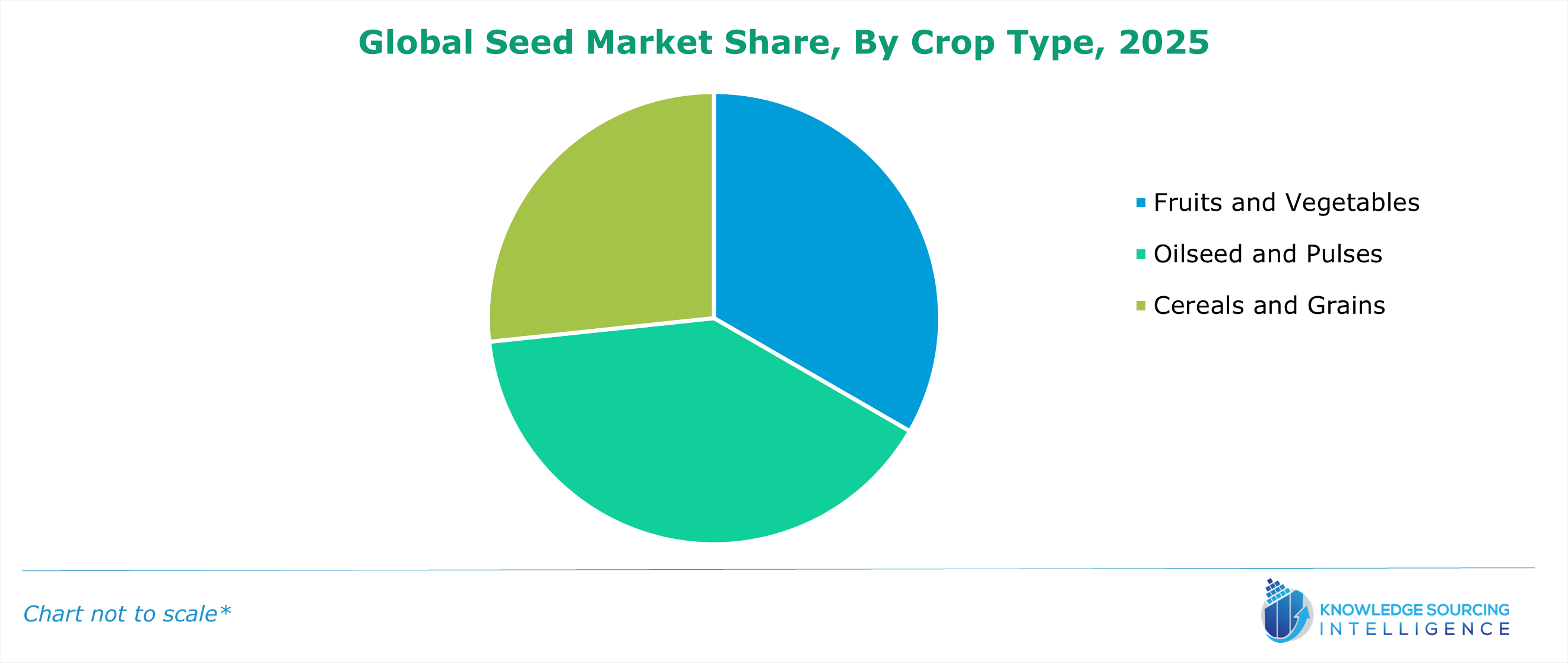

- The fruits and vegetable segment based on crop type will account for a considerable market share.

Based on crop type, fruits and vegetable is estimated to hold a significant share of the market fueled by the growing for vegetables with high nutrition content which is driving the urge to exercise genetic engineering to improve the overall crop production and nutritional content. Major economies inclusive of the United States, the European Union, and China among others are investing in expanding their diverse range of major fruits & vegetable production which has provided a major scope for hybrid varieties usage.

According to the USDA’s “Fresh Deciduous Fruit” report, by July 2024, China’s apple, pear, and table grapes production increased to 48 MMT, 20.2 MMT, and 14.2 MMT. The country’s horticulture practices are witnessing positive growth and with the ongoing government to support for farmer’s productivity, the demand for hybrid varieties is anticipated to show positive growth in the coming years in the country.

Global Seed Market Geographical Outlook:

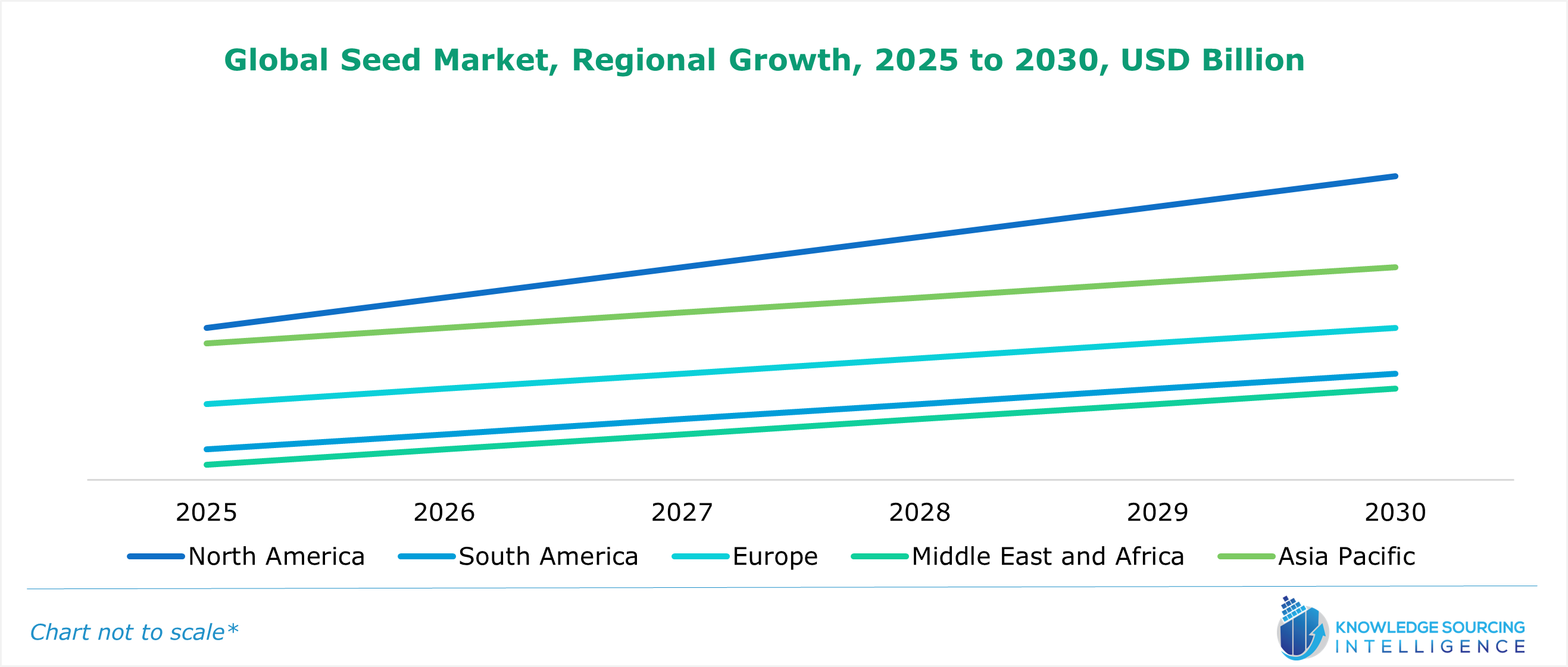

- North America is expected to account for a significant share of the market during the forecast period.

Geographically, the global seed market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, North America will be holding a considerable share of the market which is attributable to the bolstering of crop production in major regional economies namely the United States and Canada. For instance, according to the United States Department of Agriculture (USDA), wheat production in 2021-22 was 44.8 million metric tons, which increased to 44.9 million metric tons in 2022-23. Likewise, in 2021, corn production in the United States was 15.0 billion bushels, which increased to 15.3 billion bushels in 2023.

Moreover, the growing emphasis on seed production in the United States has led to various research collaborations which are also shaping the regional market. Major companies are extending their product to improve their market presence in North America, for instance, in August 2023, Syngenta launched a new state-of-the-art 32,000 square feet laboratory space for research and development known as Syngenta Seeds R&D Innovation Center, in Illinois, United States

Global Seed Market Recent Development:

- In August 2024: The Indian Prime Minister launched nearly 109 crop seeds in Pusa which were genetically engineered to meet the diverse production requirements of area-specific crops. The new varieties form a part of the government's efforts to bolster the production of crops that are insecticide-resistant and require less-water usage.

- In July 2024: Bayer formed a strategic collaboration with Solyntra for the distribution and commercialization of the latter’s hybrid potato seeds in the Indian and Kenyan markets. The collaboration marks Bayer's entry on the global potato market with the aim of producing new potato varieties that meet the different geographical requirements.

Global Seed Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Seed Market Size in 2025 | US$81.557 billion |

| Seed Market Size in 2030 | US$110.193 billion |

| Growth Rate | CAGR of 6.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Seed Market |

|

| Customization Scope | Free report customization with purchase |

Global Seed Market Segmentation:

- By Origin

- Genetically Modified

- Conventional

- By Trait

- Herbicide-Tolerant

- Insecticide-Resistance

- Stacked Trait

- By Crop Type

- Fruits and Vegetables

- Oilseed and Pulses

- Cereals and Grains

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Others

- North America