Report Overview

Sleep Apnea Devices Market Highlights

Sleep Apnea Devices Market Size:

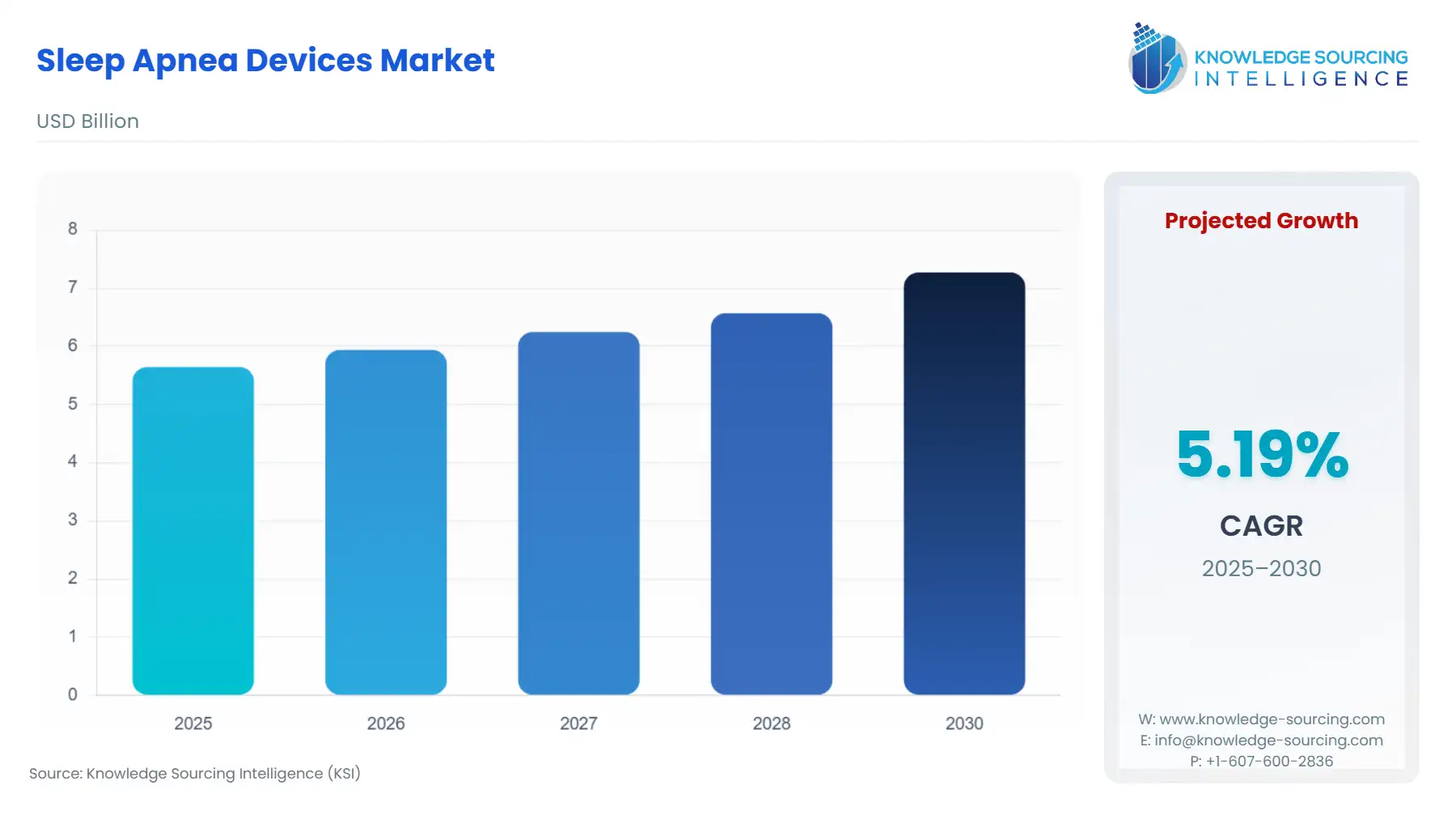

The sleep apnea devices market will grow at a CAGR of 5.18% to be valued at US$7.271 billion in 2030 from US$5.647 billion in 2025.

The Sleep Apnea Devices Market is a vital segment of the medical device industry, encompassing global sleep disorder devices designed to diagnose and treat obstructive sleep apnea (OSA), central sleep apnea (CSA), and complex sleep apnea syndrome. These respiratory care devices, including Continuous Positive Airway Pressure (CPAP) machines, Bi-level Positive Airway Pressure (BiPAP) devices, oral appliances, and diagnostic tools, play a critical role in managing sleep-disordered breathing, which affects millions globally and is linked to comorbidities like cardiovascular disease, hypertension, and diabetes. The market also includes the sleep diagnostics market, which focuses on polysomnography (PSG), home sleep apnea tests (HSATs), and sleep monitoring solutions like wearable sensors. Driven by rising OSA prevalence, technological advancements, and growing awareness, the sleep apnea market trends 2025 indicate robust growth, particularly in home care settings. However, challenges like high costs and patient compliance issues persist.

Sleep apnea is characterized by repeated breathing interruptions during sleep, with OSA being the most common form, caused by airway obstruction, and CSA resulting from impaired brain signaling. Global sleep disorder devices address these conditions through therapeutic and diagnostic solutions. Therapeutic devices, such as CPAP machines, deliver pressurized air to keep airways open, while diagnostic devices like PSG systems and pulse oximeters enable accurate diagnosis in sleep labs or home settings. Sleep monitoring solutions, including wearables like the Apple Watch’s 2024 FDA-approved sleep apnea detection feature, enhance at-home monitoring by tracking breathing disturbances. The market serves hospitals, sleep clinics, and home care settings, with North America leading due to advanced healthcare infrastructure and high OSA prevalence. Sleep apnea market trends for 2025 emphasize portable devices, AI integration, and patient-centric care, reflecting a shift toward accessible and personalized solutions.

The Sleep Apnea Devices Market is propelled by several key drivers. First, the rising prevalence of OSA, driven by increasing obesity rates, an aging population, and comorbidities like hypertension, fuels demand for respiratory care devices. The World Health Organization notes that obesity, a major OSA risk factor, affects millions globally, amplifying the need for CPAP and BiPAP devices. Second, technological advancements in the sleep diagnostics market enhance diagnosis and treatment. For example, ResMed’s AirSense 11 CPAP, launched in November 2024 in Singapore, integrates digital health features for remote monitoring. Third, growing awareness and government initiatives, such as the UK’s NHS incorporating sleep apnea screening into primary care, drive early diagnosis and adoption of sleep monitoring solutions. Finally, the shift toward home care settings boosts demand for portable CPAP devices and wearable diagnostics, improving patient compliance and accessibility.

Despite its growth, the Sleep Apnea Devices Market faces notable restraints. The high cost of CPAP machines and accessories, detailed below, limits adoption, particularly in developing regions with limited insurance coverage. Patient non-compliance, due to discomfort from CPAP masks or noise, hinders treatment efficacy, with studies reporting 30-60% adherence rates. Regulatory challenges, such as stringent FDA requirements for AI-based diagnostics, delay market entry for innovative sleep monitoring solutions. Limited awareness in low-income regions further restricts market penetration, despite rising OSA prevalence, necessitating cost-effective and user-friendly global sleep disorder devices.

Cost of CPAP Machine and Accessories

The cost of CPAP machines and accessories varies based on brand, features, and region. In the US, a standard CPAP machine costs $600-$800 without insurance, while advanced models like ResMed’s AirSense 11 range from $900-$1,200. Accessories, including masks ($100-$200), humidifiers ($50-$150), heated hoses ($30-$80), and filters ($10-$50), add $200-$500 to the initial setup. In Europe, prices are comparable, with CPAP units costing €500-€1,000, though NHS or insurance often offsets costs. In developing regions, costs are prohibitive without subsidies, limiting adoption. Portable CPAP devices, considered premium, may exceed $1,500, further impacting affordability.

The sleep apnea market trends for 2025 highlight significant advancements. In June 2025, Sleep Cycle launched a clinical study for an AI-aided smartphone-based sleep apnea screening tool, targeting home diagnostics. In April 2025, ResMed introduced NightOwl, a fingertip home sleep apnea test device that collects 10 nights of data, enhancing diagnostic accessibility. In August 2024, Inspire Medical Systems received FDA approval for its Inspire V neurostimulator, a novel implantable device for OSA treatment, offering an alternative to CPAP. In 2024, Mount Sinai researchers secured funding for AI-powered models to predict OSA outcomes, advancing sleep diagnostics market capabilities. These developments underscore the market’s focus on innovation, home-based care, and patient compliance, positioning it for sustained growth.

The Sleep Apnea Devices Market is a dynamic sector driven by the rising prevalence of OSA, advancements in respiratory care devices, and growing adoption of sleep monitoring solutions. Key drivers include increasing obesity rates, technological innovations, and healthcare policies, while restraints like high costs and non-compliance pose challenges. The cost of CPAP machines and accessories, ranging from $600-$1,500 with additional expenses, underscores affordability issues. Recent developments, such as AI-integrated diagnostics, portable CPAPs, and implantable devices, reflect sleep apnea market trends 2025, emphasizing home care and personalized treatment. As global sleep disorder devices evolve, the market is poised to address unmet needs, improving patient outcomes and quality of life in sleep diagnostics and therapy.

Sleep Apnea Devices Market Overview

Sleep apnea is a sleep disorder characterized by breathing difficulties during sleep, causing patients to feel fatigued despite a full night's rest. This condition involves repeated interruptions in breathing, leading to snoring or other sleep disturbances. Persistent sleep disruptions can significantly impact patients' mental and physical health. The disorder is more prevalent in men and becomes more severe with age and obesity. Sleep apnea devices are specialized respiratory tools designed to help patients sleep effectively.

The primary driver of market growth is the increasingly demanding and complex modern lifestyle. The rising prevalence of chronic diseases has intensified the severity of sleep apnea, elevating mortality risks. Additionally, the aging population contributes significantly to the market. The widespread use of smartphones and laptops, particularly among youth staying up late, has further exacerbated the condition.

The increasing prevalence of chronic diseases has heightened the severity of sleep apnea, driving greater demand for sleep apnea devices.

Some of the major players covered in this report include ResMed Inc., Philips Respironics (Koninklijke Philips N.V.), Fisher & Paykel Healthcare Corporation Limited, SomnoMed Limited, Inspire Medical Systems, Inc., Compumedics Limited, Itamar Medical Ltd., Natus Medical Incorporated, BMC Medical Co., Ltd., and Drive DeVilbiss Healthcare, among others.

Sleep Apnea Devices Market Trends

The Sleep Apnea Devices Market is advancing rapidly, driven by technological innovations enhancing the diagnosis and treatment of obstructive sleep apnea (OSA). AI in sleep medicine is transforming care, with algorithms analyzing sleep data to predict apnea events and personalize therapy. Sleep Cycle’s 2025 clinical study on AI-aided smartphone-based screening exemplifies this, improving diagnostic accuracy. Wearable sleep apnea devices, like Happy Health’s FDA-cleared Happy Ring, offer 97% accurate home sleep testing, enhancing accessibility. Smart CPAP machines, such as ResMed’s AirSense 11, launched in November 2024, integrate cloud connectivity for real-time adjustments, boosting CPAP adherence solutions. Telehealth for sleep apnea and remote patient monitoring are revolutionizing care, with Philips’ 2024 AI-enhanced CPAP machines enabling connected care platforms for remote therapy management. These trends, supported by patient-centric innovations, are driving adoption in home care settings, improving compliance and outcomes.

Sleep Apnea Devices Market Drivers

Rising Obesity Rates and Comorbidities

The Sleep Apnea Devices Market is significantly driven by rising obesity rates, a primary risk factor for obstructive sleep apnea (OSA). Obesity, affecting millions globally, increases airway obstruction risks, necessitating respiratory care devices like CPAP machines. Conditions like hypertension, diabetes, and cardiovascular disease, often linked to obesity, exacerbate OSA prevalence, driving demand for sleep monitoring solutions. The American Academy of Sleep Medicine notes that OSA affects a significant portion of adults, with obesity as a key contributor, amplifying the need for therapeutic devices. Innovations like ResMed’s AirSense 11, launched in 2024, cater to this demand with patient-centric features, enhancing compliance in home care settings. This trend underscores the market’s growth as healthcare systems address obesity-related sleep disorders.

Geriatric Population Growth

The expanding geriatric population is a major driver of the Sleep Apnea Devices Market, as aging increases susceptibility to sleep-disordered breathing. Older adults, particularly those over 65, are more prone to OSA due to age-related airway muscle deterioration, boosting demand for global sleep disorder devices. The WHO projects a significant rise in the global elderly population, amplifying the need for sleep diagnostics market solutions like polysomnography and home sleep apnea tests. Devices like Inspire Medical’s Inspire V neurostimulator, FDA-approved in August 2024, offer alternatives to CPAP for elderly patients, improving compliance. Geriatric population growth drives market expansion by necessitating accessible respiratory care devices tailored to age-related health challenges in sleep clinics and home settings.

Increased awareness of sleep apnea

The rising awareness of sleep apnea significantly drives the Sleep Apnea Devices Market, as public and healthcare professional education highlights the risks of untreated OSA, including cardiovascular complications and cognitive impairment. Initiatives like the UK’s NHS sleep apnea screening programs promote early diagnosis, boosting adoption of sleep monitoring solutions. The American Sleep Apnea Association’s campaigns further emphasize OSA’s health impacts, encouraging the use of CPAP and oral appliances. Innovations like Happy Health’s FDA-cleared Happy Ring for home sleep testing enhance diagnostic accessibility, aligning with awareness efforts. Increased sleep apnea awareness drives demand for respiratory care devices, particularly in North America and Europe, where healthcare policies support early intervention and patient-centric care.

Sleep Apnea Devices Market Restraints

High Costs of Sleep Apnea Devices

The high costs of sleep apnea devices are a significant restraint for the Sleep Apnea Devices Market, limiting accessibility in low- and middle-income regions. CPAP machines cost $600-$1,500, with accessories like masks ($100-$200) and humidifiers ($50-$150) adding to expenses, often unaffordable without insurance coverage. Smart CPAP machines and wearable sleep apnea devices, while innovative, are premium-priced, restricting adoption in developing countries. Limited reimbursement policies in regions like Sub-Saharan Africa exacerbate affordability issues, reducing the uptake of CPAP adherence solutions. This financial barrier hinders market growth, despite rising OSA prevalence, necessitating cost-effective global sleep disorder devices and subsidized programs to enhance accessibility and improve patient outcomes.

Patient Non-Compliance and Device Discomfort

Patient non-compliance due to discomfort from sleep apnea devices is a major restraint for the Sleep Apnea Devices Market, impacting treatment efficacy. CPAP masks often cause claustrophobia, skin irritation, or noise disturbances, leading to poor adherence, with studies reporting significant non-compliance rates. Despite advancements in smart CPAP machines, discomfort persists, particularly for patients new to therapy. Telehealth for sleep apnea and remote patient monitoring aim to improve compliance, but challenges like device complexity deter consistent use. In home care settings, lack of patient education further exacerbates non-compliance, limiting the effectiveness of respiratory care devices. Addressing this requires user-friendly designs and enhanced CPAP adherence solutions to ensure sustained market growth.

Sleep Apnea Devices Market Segmentation Analysis

Positive Airway Pressure (PAP) Devices in the therapeutic device segment are rising notably

Positive Airway Pressure (PAP) Devices dominate the Sleep Apnea Devices Market due to their proven efficacy in treating OSA by delivering pressurized air to keep airways open during sleep. This category includes CPAP, Bi-level Positive Airway Pressure (BiPAP), and Auto-titrating Positive Airway Pressure (APAP) devices, widely used for OSA and central sleep apnea (CSA). Smart CPAP machines, like ResMed’s AirSense 11, launched in November 2024, integrate cloud connectivity and AI-driven analytics to optimize therapy and enhance CPAP adherence solutions. These devices are critical in home care settings, offering patient-centric solutions with features like heated humidifiers and quiet operation. Their dominance is driven by widespread insurance coverage in North America and Europe, coupled with advancements in portable PAP devices, making them the cornerstone of respiratory care devices for sleep apnea management.

The Home Care Settings segment is expected to grow exponentially

Home Care Settings lead the end-user segment of the Sleep Apnea Devices Market, reflecting a shift toward accessible, patient-driven care for OSA. The rise in home sleep apnea testing (HSAT) and wearable sleep apnea devices, such as Happy Health’s FDA-cleared Happy Ring, enables accurate diagnosis and monitoring outside traditional sleep clinics. PAP devices and oral appliances are increasingly used at home, supported by telehealth for sleep apnea and remote patient monitoring platforms, which improve compliance. For instance, Philips’ 2024 AI-enhanced CPAP systems facilitate connected care platforms for real-time therapy adjustments. The emphasis on home care settings is driven by patient preference for convenience and cost-effective solutions, particularly in regions with robust healthcare infrastructure, positioning this segment as a key market driver.

North America is leading the market expansion

North America, particularly the United States, dominates the Sleep Apnea Devices Market due to high OSA prevalence, advanced healthcare systems, and supportive reimbursement policies. The American Academy of Sleep Medicine highlights OSA as a growing concern, driven by obesity rates and an aging population, necessitating respiratory care devices. Innovations like Inspire Medical Systems’ Inspire V neurostimulator, FDA-approved in August 2024, offer CPAP alternatives, boosting market adoption. North America benefits from widespread insurance coverage for PAP devices and sleep diagnostics, with insurers like Aetna and Cigna covering CPAP and HSAT. The region’s leadership in sleep monitoring solutions, such as Apple Watch’s 2024 sleep apnea detection feature, further drives growth, solidifying North America as the market’s epicenter.

Sleep Apnea Devices Market Key Developments

Aug 2025: ProSomnus announced FDA registration of its HWO2 buccal-mucosal wellness oximeter, a non-CPAP device that allows patients to monitor blood oxygen saturation and pulse rate during sleep via smartphone.

Aug 2025: Nyxoah’s Genio system (bilateral hypoglossal nerve stimulation) received FDA approval for treating moderate-to-severe obstructive sleep apnea (OSA) in patients with AHI 15–65.

Apr 2025: ResMed launched its NightOwl™ FDA-cleared home sleep apnea test (HSAT) in the U.S., using a fingertip sensor to enable up to 10 nights of sleep data collection.

Sleep Apnea Devices Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 7.271 billion |

| Total Market Size in 2030 | USD 7.271 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, End-User, Distribution Channel, Regions |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Sleep Apnea Devices Market Segmentations:

Sleep Apnea Devices Market Segmentation by product type:

Therapeutic Devices

Positive Airway Pressure (PAP) Devices

Oral Appliances

Adaptive Servo-Ventilators

Facial Interfaces/Masks

Diagnostic Devices

Polysomnography (PSG) Devices

Home Sleep Apnea Testing (HSAT) Devices

Oximeters

Actigraphy Devices

Sleep Apnea Devices Market Segmentation by end-user:

Hospitals & Sleep Clinics

Home Care Settings

Ambulatory Surgical Centers

Others (Diagnostic Centers, Telemedicine Providers, etc.)

Sleep Apnea Devices Market Segmentation by distribution channel:

Direct Sales

Retail Stores

Online Stores

Pharmacies

Sleep Apnea Devices Market Segmentation by regions:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, and Others)

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)