Report Overview

Global Sodium Carbonate (Soda Highlights

Sodium Carbonate Market Size:

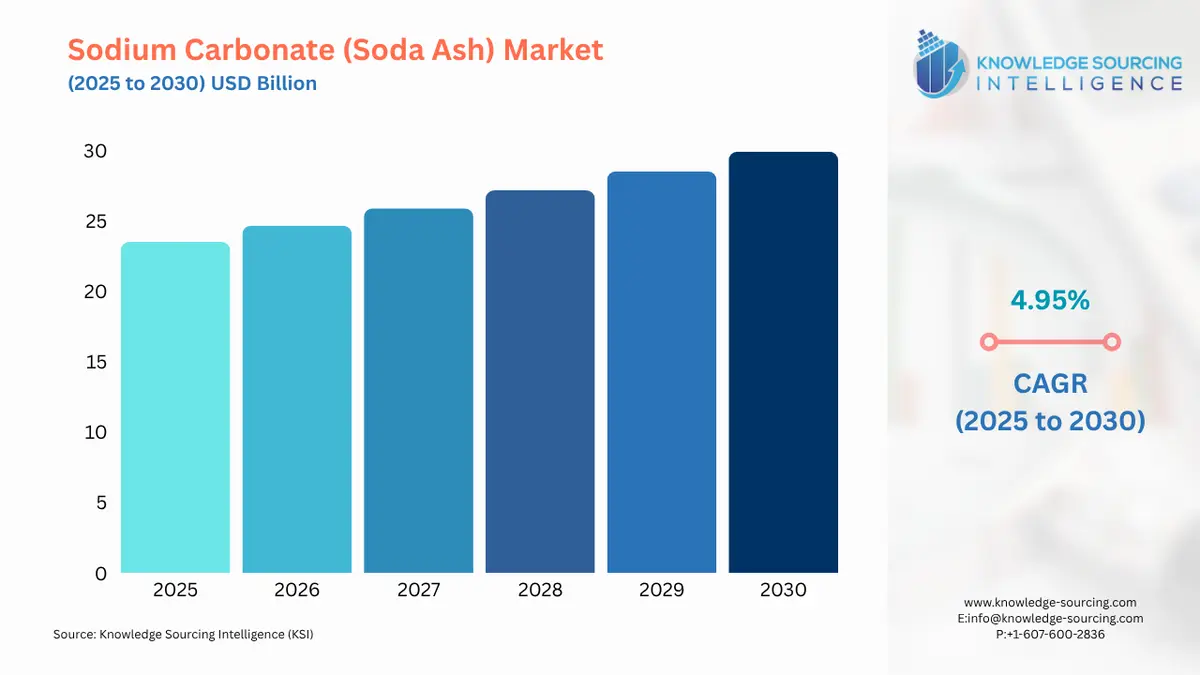

The global sodium carbonate (soda ash) market is estimated to attain a market size of US$29.932 billion by 2030, growing at a 4.95% CAGR from a valuation of US$23.508 billion in 2025.

Sodium Carbonate Market Trends:

Soda Ash, also known as sodium carbonate (Na?CO?), serves as a crucial raw material in the production of glass, soaps, detergents, and various other industrial applications. It is a white, odourless powder or granular substance. Soda Ash is either derived naturally or produced synthetically. As per the annual publication of mineral commodity by the USGS of the United States Government, in the USA, the total value of domestic soda ash (sodium carbonate) produced in 2024 was an estimated $2.5 billion and the quantity produced was an estimated 12 million tons, 10% more than that in 2023. The domestic consumption has increased from 5,590 in 2020 to an estimated 7,400 million tons in 2024, while production increased from 9,990 from 2020 to 12,000 million tons in 2024. The data highlights the growing production and consumption of soda ash, driving the market.

Global Sodium Carbonate (Soda Ash) Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The global sodium carbonate (soda ash) market is segmented by:

- Type: The global sodium carbonate (soda ash) market is segmented by type into heavy soda ash and light soda ash. The heavy soda ash market will be growing at a significant rate due to the growth in the construction and automotive industries, as its dense form makes it ideal for the manufacturing of glass and containers. Heavy soda ash plays a vital role in the manufacture of glass, saving on energy expenses through the reduction in the melting point of silica. Increased demand for flat glass from the construction and automotive industries, especially in economies such as China and India, is leading to increased consumption.

As urbanization and infrastructure development increase, so does the demand for glass, hence directly boosting the demand for heavy soda ash. The global urban population witnessed a major growth over the past few years. The World Bank, in its global report, stated that as of 2023, the global urban population was recorded at 57%. The agency further stated that in 2021, the total urban population was recorded at 4.46 billion, which grew to 4.54 billion in 2022. In 2023, the total urban population across the globe was recorded at 4.61 billion.

- Application: The Global Sodium Carbonate (Soda Ash) Market is segmented by application into Glass, Soaps and Detergents, Chemicals, Mining, Paper and Pulp, and Others. The glass segment dominates the market due to the high demand for sodium carbonate for glass to meet the demands of the construction industry and the demand for consumer goods. The soda ash industry, mainly in the application segment of glass, is governed by the rising construction and automobile industries, as glass is a key material within them. The construction industry itself has seen escalating demand for flat glass for use in windows, facades, and inner components with increasing global urbanization and infrastructure progress. Adding to this, according to the U.S. Department of Commerce, the total construction spending in the United States in July 2024 was US$2,162.7 billion, which was 6.7% higher than that of July 2023, when the spending was US$2,027.4 billion.

The motor vehicle industry likewise makes a sizable contribution through the use of tempered as well as laminated glass during vehicle production. These trends raise the demand for soda ash, an essential raw material used in glass manufacturing, making its market growth trend more intensified. In addition to this, in 2023, world automobile production had reached around 94 million units. The size of the world automotive components industry was USD 2 trillion, with the share of exports amounting to around USD 700 billion. India has become the fourth-largest producer in the world after China, the USA, and Japan, with an annual production of nearly 6 million vehicles.

- Region: The global sodium carbonate (soda ash) market, by geography, is segmented into regions including North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Asia-Pacific is the fastest-growing regional market for soda ash, driven by increasing demand for soda ash for glass manufacturing to meet the demands of rising urbanization, the rising construction industry, the rising automotive industry, and demand from consumers for detergents and chemicals. The Asia-Pacific region will be the high-growth potential region for the market, especially in countries like India and China.

Top Trends Shaping the Global Sodium Carbonate (Soda Ash) Market:

1. Focus on Sustainable Production

- Producers are increasingly using environment-friendly production technologies to minimize their ecological footprint. Technology innovations such as Solvay's improved Solvay Process have recorded impressive reductions in CO? emissions, energy, and raw material use, in sync with worldwide carbon neutrality targets.

2. Increased Demand for High-Purity Grades

- Pharmaceuticals, electronics, and food & beverage industries are leading the demand for high-purity sodium carbonate. This is encouraging manufacturers to invest in cutting-edge purification technologies to ensure high-quality standards.

________________________________________

Global Sodium Carbonate (Soda Ash) Market Growth Drivers vs. Challenges:

Drivers:

- Significant Shift Towards Sustainable Production: The sodium carbonate (soda ash) market is witnessing significant shifts toward sustainable production and carbon capture technologies, driven by stringent environmental regulations and the global push for decarbonization.

For instance, Solvay's energy transition plans are enabling the phasing out of coal and reducing carbon emissions by 30% by 2030. Its introduction of the e.Solvay process represents a landmark innovation that cuts CO? emissions by 50% compared to the traditional ammonia-soda process. It has started a plant in Dombasle, France, for a pilot scale and has a Europe-wide adoption target by 2050.

In December 2023, Solvay and ENOWA planned to construct the first carbon-neutral soda ash plant in NEOM before 2030. This collaboration aimed to establish a new global standard, emphasising competitiveness, circularity, and carbon neutrality. Positioned strategically along the Red Sea coast to facilitate market access across the Middle East, Africa, and Southeast Asia.

- Rising Demand from Glass Manufacturing: The rising demand from glass manufacturing is a primary driver of the soda ash market, as soda ash has a critical role as a fluxing agent in glass production. Soda ash helps in lowering the melting point of silica, thus helping in the reduction of energy costs and enabling the production of various types of glass, such as flat glass for windows and construction, container glass, and specialized glasses. Thus, the critical role played by soda ash in the glass manufacturing by reducing its energy cost is the primary driver of the market.

The crucial role of soda ash in glass manufacturing can be understood by the fact that it holds almost half of the share in the end-user of soda ash. As per the data by the U.S. Geological Survey, Mineral Commodity Summaries, January 2025, based on 2024 quarterly reports, the estimated distribution of soda ash by end use was glass, 45%; chemicals, 29%, miscellaneous uses, 9%; distributors, 7%; soap and detergents, 5%; flue gas desulfurization, 3%; pulp and paper 1%; and water treatment, 1%. It highlights the major share of glass manufacturing as the end-user of soda ash. Thus, the growth in glass manufacturing will be the key driver for the soda ash market.

Sodium Carbonate (Soda Ash) Market Restraints:

- Environmental Concerns over Production Emissions: One of the major challenges the soda ash market is facing is the growing environmental concerns over the production of soda ash. Soda ash, natural or synthetic, production generates considerable greenhouse gas (GHG) emissions and has other environmental impacts.

As there is an increasing sustainability trend and a growing focus on the reduction of greenhouse gas emissions, the soda ash market is witnessing key challenges. For example, natural soda ash has a carbon footprint of 0.52kg CO?e/kg. As per the European Environment Agency, on average, 200–300 kg CO2 is vented into the atmosphere per tonne of soda ash produced. As there is an increasing decarbonization goal, soda ash producers face pressure to reduce emissions, increasing operational complexity and costs.

There are increasing environmental regulations, posing a key challenge to manufacturers and users as they comply with the regulations. For instance, in the USA, Soda Ash manufacturing facilities must report CO2 process emissions from each soda ash manufacturing line.

________________________________________

Global Sodium Carbonate (Soda Ash) Market Regional Analysis:

- Asia Pacific: China has emerged as the global leader in the sodium carbonate (soda ash) market, significantly driving its growth through robust production and consumption, underpinned by rapid industrialization and urbanization.

The fast-growing glass and construction industries are key drivers of growth, with soda ash being a vital raw material for flat glass employed in buildings, car windshields, and solar panels. The growing detergent and chemical industries, which are fueled by increasing disposable incomes and consumer goods manufacturing, also depend significantly on soda ash for water softening and pH control. The expansion of water treatment plants and the pulp and paper sector further supports consumption, while new applications in lithium carbonate manufacturing for batteries further improve market opportunities.

________________________________________

Global Sodium Carbonate (Soda Ash) Market Key Developments:

- Sustainability Initiative: In 2025, Solvay made a bold move to replace coal at its soda ash and bicarbonate sites with a new energy transition project in Torrelavega, Spain, to reduce CO2 emissions by nearly half by 2027 and make the site long-term competitive.

List of Top Sodium Carbonate Companies:

- Qemetica SA

- Solvay S.A.

- BASF SE

- Occidental Petroleum Corporation

- Tronox Holdings plc

________________________________________

Sodium Carbonate Market Scope:

| Report Metric | Details |

| Sodium Carbonate Market Size in 2025 | US$23.508 billion |

| Sodium Carbonate Market Size in 2030 | US$29.932 billion |

| Growth Rate | CAGR of 4.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Sodium Carbonate Market |

|

| Customization Scope | Free report customization with purchase |

Global Sodium Carbonate (Soda Ash) Market Segmentation:

By Type

- Heavy soda ash

- Light soda ash

By Application

- Glass

- Soaps and Detergents

- Chemicals

- Mining

- Paper and Pulp

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

Our Best-Performing Industry Reports:

Navigation:

- Sodium Carbonate Market Size:

- Sodium Carbonate Market Key Highlights:

- Sodium Carbonate Market Trends:

- Global Sodium Carbonate (Soda Ash) Market Overview & Scope:

- Top Trends Shaping the Global Sodium Carbonate (Soda Ash) Market:

- Global Sodium Carbonate (Soda Ash) Market Growth Drivers vs. Challenges:

- Sodium Carbonate (Soda Ash) Market Restraints:

- Global Sodium Carbonate (Soda Ash) Market Regional Analysis:

- Global Sodium Carbonate (Soda Ash) Market Key Developments:

- List of Top Sodium Carbonate Companies:

- Sodium Carbonate Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 17, 2025