Report Overview

Global Substations Market - Highlights

Substations Market Size:

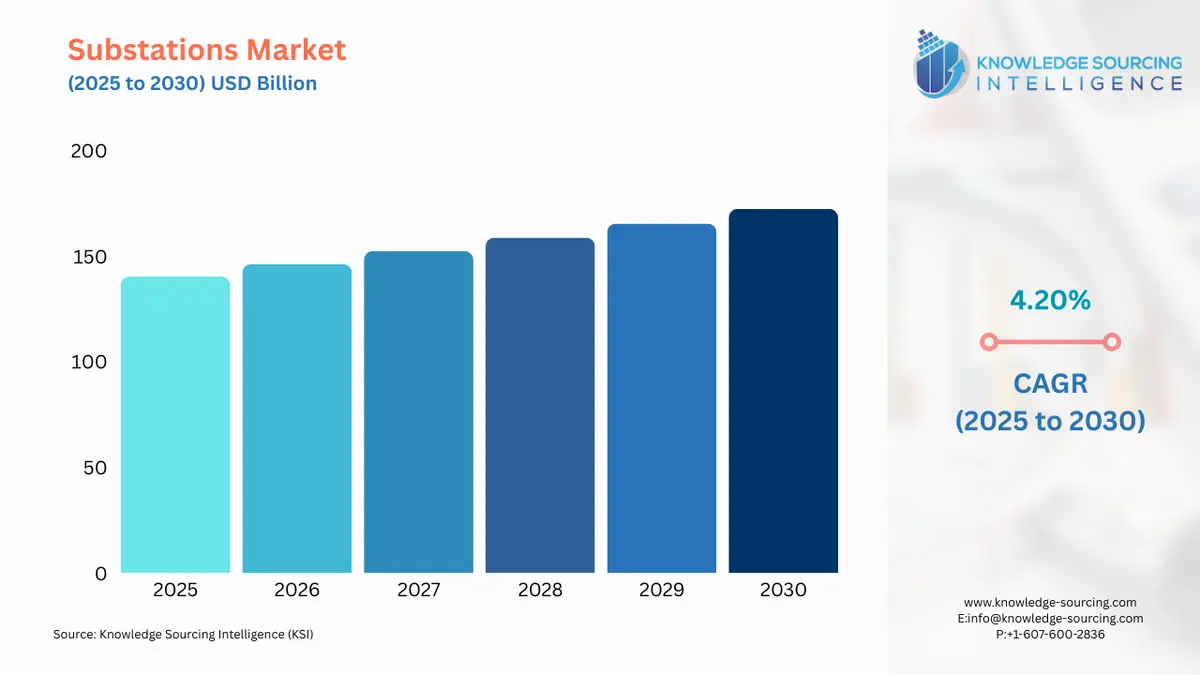

Global Substations Market, with a 4.20% CAGR, is anticipated to reach USD 172.338 billion in 2030 from USD 140.318 billion in 2025.

Two or more transmission lines are connected by a transmission substation. When all transmission lines have the same voltage, the situation is the simplest. When this occurs, the substation has high-voltage switches that enable the connection or isolation of lines for fault repair or maintenance. This setup, which comes in a variety of sizes and voltages and includes an integrated transformer and pertinent switches, is mostly used to convert AC to DC. Several transformer types, circuit breakers, switches, and other pieces of equipment are used in the construction of some of the large substations. Due to the rising number of infrastructure projects for smart cities, rising power consumption with constrained space availability, growing need to replace conventional substation infrastructure, rising interoperability, and rising safety, the global substation market will grow during the forecasted period.

Substations Market Growth Drivers:

- The rising demand for quality power distribution and transmission will boost the market growth

The growing demand for a safe, stable, and high-quality power supply is expected to drive market growth. Growing concerns about carbon footprint reduction and the need to replace aging infrastructure are shaping the global grids in addition, the energy supply must be managed in a regulated manner which is necessary to have a centralized substation. The government investments and upgradation in the power transmission and distribution sector will help the substation market to grow. in July 2021, the European Investment Bank (EIB) formally confirmed financial support of EUR 120 million to Romania's discom, Electrica Group, for the upgrade of the country's electricity distribution networks. Construction of new power lines, refurbishment of power stations, and installation of network automation components are all part of the development activity. Additionally, in December 2020, the Asian Development Bank (ADB) granted a USD 190 million sovereign and non-sovereign loan for the renovation and upgrade of electricity distribution infrastructure in Bengaluru, Karnataka, India. These government projects and developments in power transmission and distribution for a better quality of power will boost the global substation market.

- Rising demand for electricity from industries and utilities will boost the market growth

A paradigm shift toward the integration of electric-powered transportation units and the requirement for a secure and reliable energy source across these transport peripherals will round out the industry spectrum. The market sector’s main driving for substations at the moment is utilities, and a similar trend is anticipated to be seen soon. Government efforts to modernize power infrastructure and rising financial investments in the production of electricity from renewable sources can be credited with market expansion. According to the International Energy Agency's Global Energy Investment 2020 report (IEA), During 2019 and 2020, respectively, the total investment in renewable energy sources was USD 259 billion and USD 226 billion. Government agencies and electricity-producing firms collaborate to automate wind farm development. General Electric (GE) signed a contract with DTEK in June 2019 to supply high-voltage equipment for the 150 kV central power distribution station and two 150/35/10 kV substations, which would guarantee the transfer of electricity from the Prymorska wind farm's first phase (Zaporizhia area) to the Ukrainian power grid. The wind farm will have a digital substation erected. As the electricity demand would rise in the end-user sector the market for global substations will also grow.

Substations Market Geographical Outlook:

- During the forecast period, the Asia Pacific region is anticipated to dominate the substation market

Throughout the projected timeframe, the Asia Pacific area will continue to occupy a sizable proportion. The region's population growth is causing a sharp rise in power demand. The demand for an uninterrupted power supply is also rising as urbanization and industrialization take off quickly. In China, India, and Australia, investments in the creation of efficient transmission and distribution networks are rising. Governments in the area are producing more power, which raises the need for the construction of such substation systems. The grid has been digitalized as part of the smart power infrastructure, which helps deliver continuous electricity to end users in the industrial, residential, and commercial sectors. Furthermore, according to IEA, in 2020 the Chinese government spent USD 31 billion to upgrade its grid infrastructure by putting in automated substations.

Similar to Indonesia, South Korea, and other nations are funding grid modernization initiatives. For instance, in November 2019, PT PLN (Persero), the state utility in Indonesia, granted a contract to CG Power Systems Indonesia, a division of CG Power and Industrial Solutions (CG) for the creation and provision of 25 power transformers with a USD 24 million worth. The order will aid in PLN's ambitious plan to improve the efficiency of its transmission system. All of these variables are pointing towards the that the Asia-pacific region will show a boost in the substation market during the forecasted period.

List of Top Substations Companies:

- Mitsubishi Heavy Industries Ltd

- ABB Ltd

- Siemens AG

- Ingeteam

- VEM Group

Substations Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 140.318 billion |

| Total Market Size in 2031 | USD 172.338 billion |

| Growth Rate | 4.20% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Voltage Type, Technology, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Substations Market Segmentation:

- GLOBAL SUBSTATIONS MARKET BY TYPE

- Step-Up Substation

- Step-Down Substation

- System Substation

- Customer Substation

- Others

- GLOBAL SUBSTATIONS MARKET BY VOLTAGE TYPE

- Low Voltage

- Medium Voltage

- High Voltage

- GLOBAL SUBSTATIONS MARKET BY TECHNOLOGY

- Air-Insulated

- Gas-Insulated

- Others

- GLOBAL SUBSTATIONS MARKET BY APPLICATION

- Power Transmission

- Power Distribution

- GLOBAL SUBSTATIONS MARKET BY GEOGRAPHY

- North America

- By Type

- By Voltage

- By Technology

- By Application

- By Country

- USA

- Canada

- Mexico

- South America

- By Type

- By Voltage

- By Technology

- By Application

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Type

- By Voltage

- By Technology

- By Application

- By Country

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- By Type

- By Voltage

- By Technology

- By Application

- By Country

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- By Type

- By Voltage

- By Technology

- By Application

- By Country

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America