Report Overview

Global Touch Screen Switches Highlights

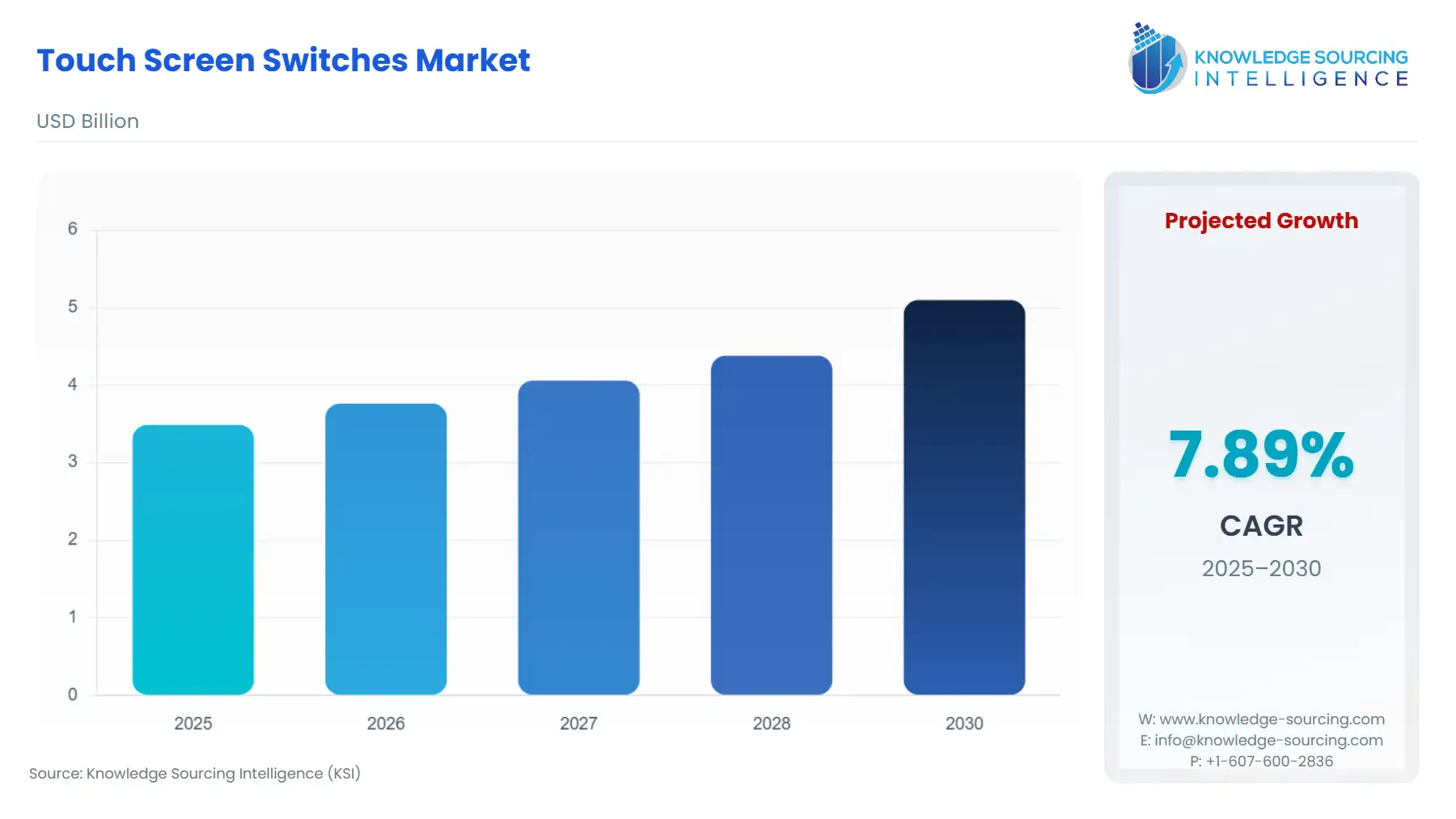

The Touch Screen Switches Market will reach US$5.098 billion in 2030 from US$3.487 billion in 2025 at a CAGR of 7.89% during the forecast period.

Global Touch Screen Switches Market Key Highlights:

The global touch screen switches market is undergoing a structural transformation, shifting from a commodity electrical product to a critical component of integrated digital building infrastructure. This evolution is fundamentally driven by the convergence of consumer demand for sophisticated aesthetics and the industry's imperative for energy-efficient, interconnected smart environments. The touch screen switch, once a simple on/off mechanism, now functions as a vital, highly visible Human-Machine Interface (HMI) within the overarching framework of Building Automation Systems (BAS) and the Internet of Things (IoT). Market participants must navigate a landscape where product differentiation hinges on connectivity standards, user experience, and verifiable compliance with a complex, evolving set of regional electrical and digital safety regulations.

________________________________________________________________

Global Touch Screen Switches Market Analysis

Growth Drivers

The primary drivers propelling demand for touch screen switches stem directly from the digitization of built environments.

Smart Home and Building Automation Proliferation: The exponential growth of the smart home ecosystem and commercial BAS directly catalyzes demand. Touch screen switches serve as the primary physical access point for controlling complex smart systems. Specifically, the mandate for seamless integration with platforms like Apple HomeKit, Google Home, and various proprietary BAS requires switches to incorporate embedded microcontrollers and wireless communication modules (Wi-Fi, Zigbee, Z-Wave). This technical requirement inherently elevates the value and complexity of the switch, increasing demand for higher-specification, network-compatible models over basic touch-sensitive units.

Energy Efficiency and Sustainability Mandates: Governmental and corporate sustainability initiatives are demanding better energy management in buildings. Touch screen switches, particularly those with integrated dimming, scheduling, and energy monitoring capabilities, directly contribute to this goal. By enabling granular control over lighting and HVAC sub-systems based on occupancy or pre-set routines, these devices facilitate energy savings. This functional improvement is a non-negotiable feature in new commercial and high-end residential projects, therefore driving demand for models compliant with energy management protocols.

Aesthetic Preference and Modernization: Traditional mechanical switches are being displaced by the minimalist and sleek design of capacitive glass or plastic touch panels. The aesthetic appeal of a unified, clean interface aligns with modern architectural design, particularly in premium residential and hospitality sectors. This design imperative, often linked to brand image in the commercial space, is not merely a preference but a procurement specification that increases demand for glass-faced, customizable touch-sensitive products.

Challenges and Opportunities

The market faces specific headwinds, alongside compelling opportunities for growth, both framed by their impact on demand.

Challenges: Installation and Retrofitting Complexity: A significant challenge is the complexity and cost associated with retrofitting touch screen switches, especially in older buildings. Smart touch switches often require a neutral wire for continuous power to maintain connectivity and embedded intelligence, a requirement frequently absent in legacy wiring systems. This infrastructural constraint acts as a restraint on demand in the vast retrofit market, limiting adoption primarily to new construction or complete electrical overhauls.

Opportunities: Open Standards and Interoperability: The lack of universal interoperability standards can create fragmented systems, which discourages end-users from adopting a full suite of touch screen switches. The move towards open standards, such as Matter and Thread, represents a key opportunity. A switch that guarantees interoperability with multiple manufacturers and ecosystems reduces consumer risk and friction, thereby increasing demand by broadening the accessible market. Manufacturers that actively embrace and certify to these open protocols will capture market share.

Raw Material and Pricing Analysis

As the touch screen switch is a physical electronic hardware product, the underlying raw material dynamics are crucial. The product's core components include the touch-sensitive panel (typically glass or a polymer), the plastic/metal housing, and the Printed Circuit Board (PCB) assembly, which incorporates semiconductors (microcontrollers, communication chips) and passive components (capacitors, resistors).

The pricing structure is highly sensitive to the supply chain of semiconductors. The global semiconductor shortage demonstrated that volatility in upstream component availability, particularly microcontrollers critical for processing touch input and managing wireless communication, can cause unpredictable extensions in lead times and sharp price increases for manufacturers. This increased input cost is often passed onto the end-user, creating price sensitivity that can temporarily dampen discretionary residential demand for higher-end models. The pricing of rare earth elements and copper used in wiring and connectors, though relatively stable in the short-term, introduces long-term cost pressure as global electrification accelerates.

Supply Chain Analysis

The global supply chain for touch screen switches is complex, exhibiting a tiered structure with significant geographical dependencies. Key production hubs for the finished electrical and digital hardware are predominantly located in the Asia-Pacific, specifically China, due to established electronics manufacturing infrastructure and component sourcing proximity. The logistical complexity involves the movement of high-value, small-form-factor electronic components (semiconductors, passive components) from Asia to final assembly plants globally, and then the distribution of finished goods through wholesale electrical distributors and retail channels (e-commerce, big-box retailers) to the installation site. A key vulnerability is the concentration of semiconductor fabrication, which creates a single point of failure and logistics risk in the event of geopolitical or natural disruptions, directly impacting the ability of the supply chain to meet sudden demand spikes.

Government Regulations

Regulatory compliance is a non-negotiable gatekeeper for market entry and product deployment, directly influencing product design and market access.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

European Union (EU) | CE Marking (Low Voltage Directive 2014/35/EU, EMC Directive 2014/30/EU) | Mandates compliance with essential health and safety requirements for electrical equipment (LVD) and electromagnetic compatibility (EMC). Non-compliance halts product sales, thereby constraining market supply and potentially decreasing demand for uncertified products. |

India | Bureau of Indian Standards (BIS) Certification | Makes certification mandatory for switchgear and control gear equipment to ensure safety, performance, and quality. This regulatory hurdle increases time-to-market and manufacturing costs, particularly for foreign manufacturers operating under the Foreign Manufacturer Certification Scheme (FMCS), which can temper price competitiveness and overall market penetration. |

United States | Underwriters Laboratories (UL) Standards (e.g., UL 916 for Energy Management Equipment) | While often voluntary, UL listing is a de facto requirement for insurance and local building code approval. Compliance ensures product safety and reliability, which acts as a catalyst for professional installer acceptance, thereby increasing demand by reducing liability concerns for builders and electricians. |

________________________________________________________________

In-Depth Segment Analysis

By Technology: Capacitive Touch Screen Switches

The Capacitive technology segment is the dominant driver of growth and feature adoption within the touch screen switches market. Capacitive switches, which register input by sensing a change in the electrical field caused by a user's finger, offer superior durability, a completely sealed, non-mechanical surface, and high aesthetic value (glass-like finish). This technology is essential for incorporating advanced features such as multi-touch gesture control, proximity sensing, and integrated LED feedback, which are hallmarks of modern smart devices. The direct demand driver for Capacitive technology is the seamless aesthetic integration into high-end residential, hotel, and premium commercial environments where hygiene, longevity, and a sophisticated user experience are paramount. The ability of this technology to support a completely flat, non-porous design also addresses commercial cleaning and sterilization requirements, further propelling its use in healthcare and institutional settings. This functional and aesthetic superiority ensures capacitive switches command a price premium and see continually growing demand against resistive or mechanical alternatives.

By Application: Residential

The Residential segment is characterized by a high volume of consumer-driven demand, primarily for retrofit and smart home integration projects. The critical demand driver here is end-user convenience and the democratization of home automation. The proliferation of affordable, Wi-Fi-enabled touch switches that are simple for a homeowner to install (DIY market) has fundamentally changed the adoption curve. Residential demand is not solely focused on functionality but also on compatibility with established consumer ecosystems like Amazon Alexa, Google Home, and Apple HomeKit, enabling voice control and remote access. This sector sees a strong pull from the desire to modernize a home's appearance and to gain energy control capabilities without engaging in major renovations. The focus is on the unit's user interface, app connectivity, and aesthetic blend with interior design, creating a distinct, high-volume market for aesthetically pleasing, user-friendly, and cost-effective smart touch screen switches.

________________________________________________________________

Geographical Analysis

US Market Analysis (North America)

The US market for touch screen switches is characterized by high consumer purchasing power and a mature smart home ecosystem. Local factors impacting demand include the widespread adoption of specific high-bandwidth wireless protocols (Wi-Fi 6, Thread) and the fragmented nature of local building codes, where UL certification is a major factor for professional installation. Demand is robust in both the new construction of high-end, custom homes, where integrated smart lighting systems are standard, and in the retrofit market, driven by consumer-friendly product availability in major retail channels. The market's high disposable income allows for rapid adoption of premium, feature-rich, multi-gang capacitive switches that integrate with whole-home energy management and security platforms.

Brazil Market Analysis (South America)

Brazil presents a significant but cost-sensitive market. The local factor most impacting demand is the high initial cost of imported electronic components, which makes premium, foreign-manufactured touch screen switches less accessible to the mass market. However, a growing affluent class and a rising focus on energy efficiency in new multi-family residential developments in urban centers like São Paulo and Rio de Janeiro generate targeted demand. The demand is heavily skewed towards solutions that balance modern aesthetics with competitive pricing, often favoring locally assembled or produced units that can manage import tariffs and provide local technical support.

Germany Market Analysis (Europe)

The German market is defined by a strong emphasis on engineering quality, energy efficiency, and compliance with rigorous European standards. Local demand is catalyzed by strict Energieeinsparverordnung (EnEV) regulations, which mandate high energy performance in new buildings. This drives commercial and high-end residential demand for advanced touch panels that are natively compatible with established industrial BAS standards like KNX and EnOcean. Consumers and builders prioritize verifiable long-term reliability and secure data handling, placing a premium on brands with a proven track record of quality and robust security features over basic low-cost alternatives.

United Arab Emirates (UAE) Market Analysis (Middle East & Africa)

Demand in the UAE is strongly correlated with large-scale, luxury real estate and hospitality projects. The primary local factor is the relentless pursuit of premium, high-specification building technologies to differentiate commercial and residential complexes. This drives demand for aesthetically superior, highly customized touch screen interfaces that are often centralized and fully integrated with advanced facility management and environmental control systems (HVAC, dynamic shading). The high average temperature also necessitates switches capable of managing sophisticated climate control systems, generating demand for feature-rich products.

China Market Analysis (Asia-Pacific)

China is characterized by unparalleled manufacturing capacity and rapidly escalating domestic demand, particularly in the high-volume residential and commercial sectors. The local factor fueling demand is the massive volume of new urban construction and the rapid digital transformation of its cities. Demand is highly sensitive to the integration of local proprietary smart platforms (e.g., those driven by local tech giants). Furthermore, the domestic supply chain's ability to rapidly innovate and scale production of cost-effective, aesthetically pleasing capacitive switches creates intense price competition while simultaneously accelerating the replacement cycle for older technologies.

________________________________________________________________

Competitive Environment and Analysis

The Global Touch Screen Switches Market is dominated by a few major multinational electrical and building technology conglomerates, supplemented by specialized, innovative smart home manufacturers. Competition centers on ecosystem completeness, verified interoperability, and design aesthetics. Major players leverage their existing global distribution networks and established relationships with professional electricians and builders to maintain market share. Strategic differentiation is shifting from basic switch functionality to providing a comprehensive, secure, and user-friendly smart control ecosystem.

Company Profile: Legrand

Legrand maintains a strategic positioning as a global specialist in electrical and digital building infrastructures, leveraging a vast, established distribution network. The company focuses on offering a complete range of products, including premium smart switches, designed for both residential and commercial markets. Legrand's key strategy is based on providing integrated solutions that are simple to install and compatible with major smart home platforms, notably through products in its Eliot program (Electricity and IoT). The company often uses an acquisition strategy to enter new geographic markets and technology segments, as evidenced by its September 2024 announcement of the acquisitions of UPSistemas in Colombia and APP in Australia, focusing on data centers but reinforcing its overall building infrastructure presence.

Company Profile: Siemens AG

Siemens AG holds a competitive position primarily focused on high-specification commercial and industrial building automation, where its Smart Infrastructure division provides integrated solutions. The company's touch screen products are typically positioned within comprehensive Building Management Systems (BMS), prioritizing reliability, deep network integration (e.g., BACnet, KNX), and industrial-grade durability. Siemens' strategy revolves around digitalization and leveraging its Xcelerator portfolio to integrate the physical switch hardware with advanced software and data analytics for optimal facility performance. Their strategic actions emphasize core technological leadership, exemplified by its agreement to acquire Excellicon, which focuses on advanced timing constraint capabilities for IC design, a foundational technology for future smart devices.

Company Profile: Honeywell International Inc.

Honeywell is a diversified technology and manufacturing conglomerate that leverages its global leadership in Building Technologies to drive its touch screen switch market presence. Its strategic positioning is strong in the commercial, industrial, and institutional sectors, where its products are bundled with its HVAC, security, and fire safety systems. Honeywell’s competitive advantage lies in providing end-to-end building performance solutions, ensuring that the switch is not a standalone device but a fully integrated part of a unified BAS. This is demonstrated by its Building Technologies focus, such as being selected by Exide Energy in December 2024 to power building automation at a major lithium-ion gigafactory in India, underscoring its role in large, complex projects requiring integrated controls.

________________________________________________________________

Recent Market Developments

The following verifiable developments highlight strategic shifts in the market through capacity additions, mergers, acquisitions, or product launches, ensuring an up-to-date competitive analysis:

October 2024: Honeywell Product Launch - Honeywell launched a new generation of AI-capable mobile devices, the CT37, CK67, and CK62, designed to optimize workflows in demanding environments like warehouses and retail. Although not a stationary wall switch, this development is critical as it highlights Honeywell's ongoing commitment to developing user-friendly, AI-enabled touch-based devices, which will inevitably inform the feature set and integration capabilities of its future touch screen switch portfolio for the building technologies sector.

September 2024: Legrand Acquisitions - Legrand announced the acquisitions of UPSistemas in Colombia and APP in Australia. While these acquisitions strengthen Legrand's presence in the data center segment, they demonstrate a broader strategic commitment to expanding the company's geographical footprint and product scope in integrated electrical and digital building infrastructure, which underpins the market for smart, connected touch screen switches.

________________________________________________________________

Global Touch Screen Switches Market Segmentation

By Type

Capacitive

Resistive

Piezo

Others

By Modular Size

Up to 2 M

2 to 4 M

Greater than 4 M

By Compatibility

Android

iOS

By Application

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others