Report Overview

Global V2X for Vehicle Highlights

V2X For Vehicle Market Size:

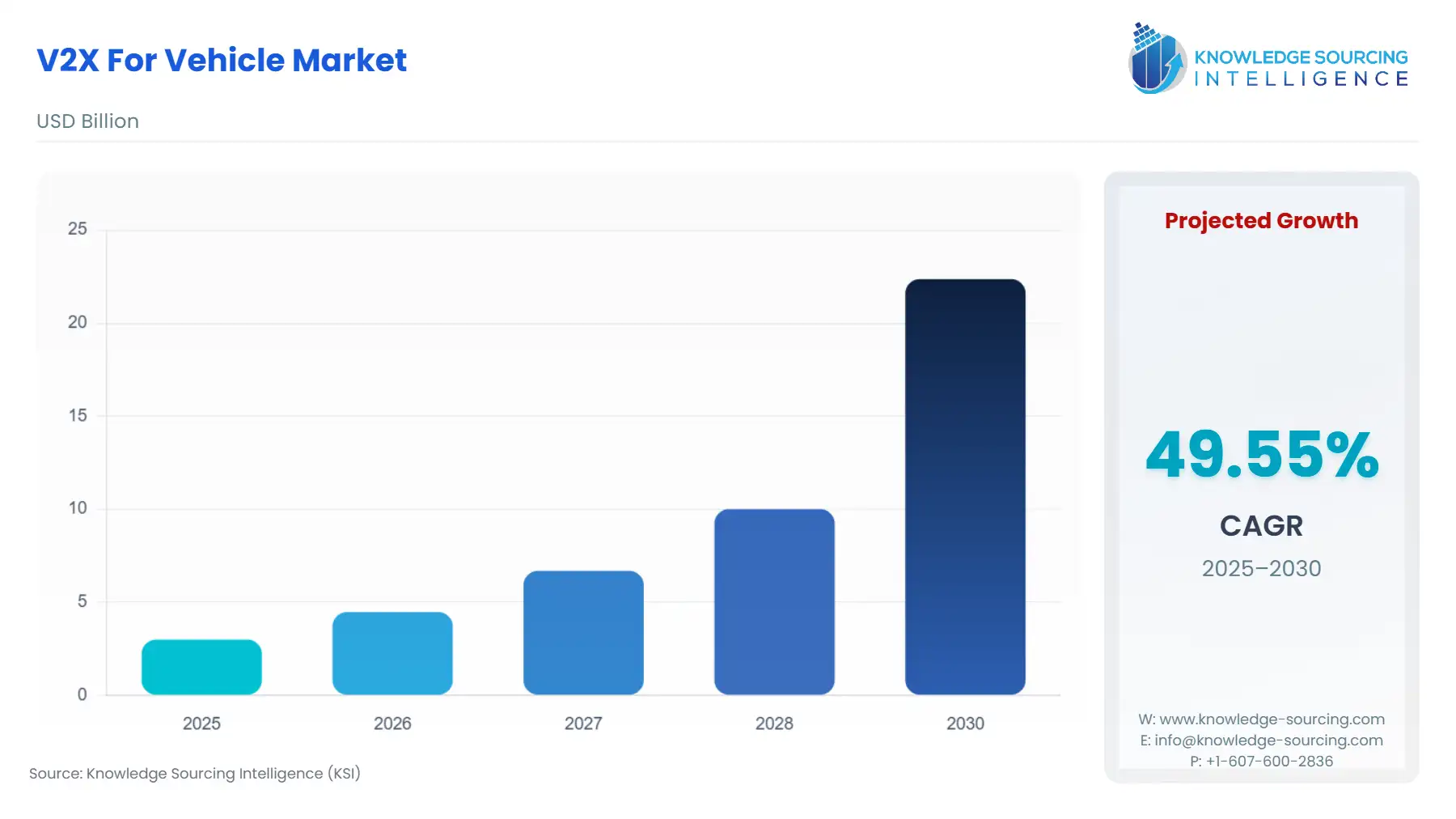

The Global V2X For Vehicle Market is expected to grow from USD 2.991 billion in 2025 to USD 22.371 billion in 2030, at a CAGR of 49.55%.

V2X For Vehicle Market Trends:

This growth is attributed to the increasing need to improve human-vehicle interaction, driving experience, and driving efficiency. V2X systems also known as Vehicle to Everything communications and their solutions help to enable the exchange of information between vehicles and vehicle network infrastructure. V2X systems improve road safety, increase the efficient flow of traffic, reduce environmental impacts, and provide additional traveler information services. Generally, V2X communications consist of four types of basic communications: V2V (vehicle to vehicle), V2I (vehicle to infrastructure), V2N (vehicle to network), and V2P (vehicle to person).

4.5 million crashes can be addressed, which is 81% of all multi-vehicle, unimpaired crash types. There are many key players that are involved and responsible for the developments and innovations in the V2X for the vehicle market. For example, Qualcomm sells its C-V2X technology or cellular-based V2X technology for the betterment of human interaction with the automobile and vehicle interaction with other vehicles, infrastructure, networks, and pedestrians. Another company, DANLAW, sells a product called RouteLink RSU, which warns the driver of adverse driving conditions and is designed to ensure safety and mobility on the road. Thus, as key players are investing and taking part in the development of better and more efficient V2X technologies, an increase in the demand for better and safer driving practices will drive the V2X market growth during the forecast period.

V2X For Vehicle Market Segment Analysis:

- By Solution

By solution, the global V2X for the vehicle market can be segmented as hardware and software. The software-based V2X systems are in more demand as they are pre-installed with some of the new vehicles that are being sold and produced.

- By Technology

By technology, the global V2X for the vehicle market is segmented as WLAN-based and cellular-based. Due to the standardization of WLAN-based V2X, it is demanded more in demand than cellular-based technology. The WLAN-based technology is also known as the DSRC

- By Communication Type

On the basis of communication type, the global V2X for vehicle market is segmented into V2V (vehicle to vehicle), V2I (vehicle to infrastructure), V2N (vehicle to network), and V2P (vehicle to pedestrian). Because of the importance of vehicle-to-vehicle communication in safer and more efficient driving on the road, vehicle-to-vehicle communication has a significant market share.

- By Vehicle Type

On the basis of vehicle type, the global V2X for vehicles market is segmented as passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles hold a significant amount of share in the vehicle emission sensor market as the production and demand for passenger cars is more as compared to the others.

- By Application

By application, the global V2X for vehicle market has been segmented as forwarding collision warning, lane change warning/blind spot warning, emergency electric brake light warning, intersection movement assist, an emergency vehicle approaching, roadworks warning, and platooning. Forward collision warning holds a notable amount of market share due to the fact that it is the most common scenario faced by drivers on the road while driving. Lane change warning/blind-spot warning is also one of the most important scenarios faced on-road and holds a notable amount of market share.

- By Geography

By geography, the global V2X for the vehicle market is segmented as follows: North America, Europe, Middle East & Africa, Asia-Pacific, and South America. North America is estimated to hold a good amount of market share in the market due to increasing production and demand for automobiles combined with the demand for safer and more efficient driver-vehicle interaction systems.

V2X For Vehicle Market Product Offerings:

- Continental Cellular V2X (C-V2X): Cellular V2X (Vehicle to Everything) connectivity has a great deal of potential to be a key enabler for automated cars and intelligent mobility. C-V2X enables communication over the 3GPP Release 14 LTE network and, in the future, the 5G mobile network. Additionally, cellular V2X is intended to connect vehicles directly to other vehicles, infrastructure, and other road users. C-V2X communication enables the exchange of time-sensitive and safety-critical information, such as alerts of potentially hazardous circumstances, even in places without mobile network service.

- Qualcomm C-V2X: The foundation for vehicle communication will be cellular vehicle-to-everything (C-V2X), which offers 360-degree non-line-of-sight awareness and a better level of predictability for improved road safety and autonomous driving. Two transmission modes that C-V2X provides allow for a variety of use scenarios. In addition to network communications in conventional mobile broadband licensed spectrum, Direct C-V2X, which contains vehicle-to-vehicle, vehicle-to-pedestrian, and vehicle-to-infrastructure, offers improved communication range and reliability in dedicated ITS 5.9 GHz spectrum that is not dependent on a cellular connection.

V2X for Vehicle Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.991 billion |

| Total Market Size in 2031 | USD 22.371 billion |

| Growth Rate | 49.55% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Solution, Technology, Communication Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

V2X for Vehicle Market Segmentation:

- By Solution

- Hardware

- Software and Services

- By Technology

- WLAN

- Cellular

- By Communication Type

- V2V (vehicle to vehicle)

- V2I (vehicle to infrastructure)

- V2N (vehicle to network)

- V2P (vehicle to pedestrian)

- By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- By Application

- Forward Collision Warning

- Lane Change Warning/Blind Spot Warning

- Emergency Electric Brake Light Warning

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Thailand

- Indonesia

- Others

- North America