Report Overview

Ground Penetrating Radar Market Highlights

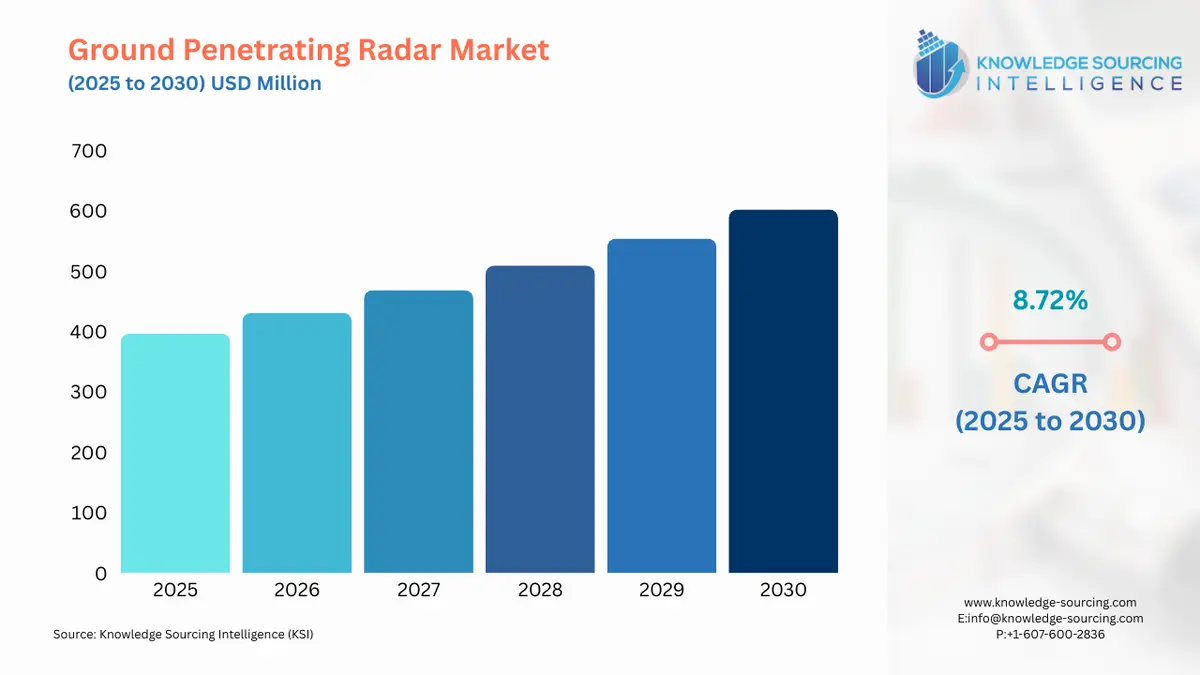

Ground Penetrating Radar Market Size:

The Ground Penetrating Radar Market is projected to grow to a market size of US$602.248 million by 2030, growing at 8.72% CAGR from a valuation of US$396.517 million in 2025.

Ground Penetrating Radar Market Introduction:

Ground Penetrating Radar (GPR) is a non-invasive method of material analysis. It is based on transmitting an ultra-wideband EM signal into the materials. When an electromagnetic (EM) wave reaches a boundary between two materials with different electrical properties, part of the signal is reflected. This reflected signal is captured at the source and shown to the operator, often being recorded for further analysis. Originally developed for mining, this technology is now widely used across various sectors. Increasing investment in construction, road maintenance, and urban planning, i.e, infrastructure development, growing use of utility detection, archaeological and environmental studies, is driving the demand for ground penetrating radar. Additionally, usage in other sectors, such as defense and security, is leading to market growth. Moreover, the improvements in GPR systems and increasing integration with AI and GPS technology are making them more effective, leading to a surge in demand for these systems.

The increasing demand for GPR in construction and infrastructure, driven by its utility for assessing concrete structures and evaluating road and bridge conditions, as well as the growth in the construction industry, is leading to market expansion. In addition, the growing advancements in GPR technology, such as AI-driven data processing, multi-channel antennas, and cloud-based software, are significantly boosting its market adoption. Furthermore, a rise in demand for GPR in military and security applications is propelling market growth. Thus, rising demand in various industries, technological advancements, and increasing integration with AI and GPS technology are making them more effective, leading to a surge in demand for these systems.

Increasing government investment in military and defense is driving the demand for ground penetrating radar systems, particularly for applications in border security, threat detection, and emergency response. These systems are utilized to locate and identify buried explosive devices, unexploded ordnance (UXO), improvised explosive devices (IEDs), and concealed fusing mechanisms. For instance, the U.S. government is significantly investing in GPR technology for military and defense. It has awarded $200 million for developing Husky Mounted Detection System kits, spare parts, maintenance, and training.

There is increasing technological innovation, such as real-time sampling and advanced signal processing, which is driving market adoption and enhancing the performance of the GPR system. These advanced technologies, such as real-time sampling and enhanced signal processing, are helping to overcome the limitations of traditional methods like increasing voltage, thereby improving penetration depth and improving GPR performance. For instance, increased signal-to-noise ratio (SNR) using real-time sampling receivers has more than doubled GPR penetration in electrically resistive environments. (Geo Convention, Canada, 2022)

Moreover, there is increasing integration of GPS and AI technology into ground penetrating radar, enabling precise location mapping and enhancing detection accuracy and data processing, respectively.

For instance, in March 2025, Hexagon AB’s subsidiary NovAtel announced that they are integrating SPAN GNSS+INS (Global Navigation Satellite Systems + Inertial Navigation System) solution with ground-penetrating radar sensors- GPR’s Wave Sense of GPR, Inc. This demonstrates the growing use of GPR as a core component of sensor fusion for high-precision positioning, especially in GNSS-denied environments.

Additionally, there is an increasing use of AI technologies for improving signal interpretation, automating feature recognition, accuracy, and processing data. For instance, in 2022, IDS GeoRadar, part of Hexagon, integrated AiMaps, which enables cloud-processing of Ground Penetrating Radar (GPR) data to provide faster, clearer, and more cost-effective results by automating complex radar data analysis.

Ground Penetrating Radar Market Overview & Scope:

The Ground Penetrating Radar Market is segmented by:

- By Type: The Ground Penetrating Radar Market is segmented into Handheld Systems, Cart-Based Systems, Vehicle-Mounted Systems, and Drone-Based Systems.

- By Offering: Based on offering, the market is categorized into Equipment, Software, and Services. The equipment segment holds a dominant share, driven by the high demand for advanced and portable GPR devices, while there is a growing market for the services segment as users are increasingly outsourcing surveying and inspection to minimize cost.

- By Frequency: By frequency, the market is divided into Low Frequency (< 500 MHz), Mid Frequency (500 MHz–1 GHz), and High Frequency (> 1 GHz).

- By End-User: By end-user, the market is segmented into Construction, Oil and Gas, Government and Military, and Archaeology and Research.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. The market is dominated by North America and Europe, due to the use of advanced capabilities. However, the Asia-Pacific is the merging market with the fastest CAGR growth.

Top Trends Shaping the Ground Penetrating Radar Market:

1. Growth in rental services

- The market is shifting rental offerings of ground penetrating radar, as it is expensive and needs skilled professionals. Thus, many companies are offering rental equipment and professional services as well, increasing their adoption by small-scale and medium-sized firms. Even large firms are using rental services for skilled professionals and have experience with different models of radar.

- For example, US Radar Inc. offers GPR for rent. Also, companies like Ground Penetrating Radar System offer GPR for rent.

2. Integration of AI and real-time data processing

- There is an emerging trend for the integration of AI and real-time data processing in ground penetrating radar that helps it in enabling real-time analysis, more accurate detection, and automating detection. In recent years, AI has been reshaping the workflow of GPR by automating feature detection, classification, and predictive modelling. Machine learning and deep learning are analyzing patterns in GPR data, pre-processing, and feeding the processed data into a trained AI system.

- For example, in 2022, IDS GeoRadar of Hexagon AB launched AiMaps that integrated artificial intelligence for utility professionals, offering an advanced cloud solution and deep learning service to handle the complexity of radar data processing. It further enhanced its capabilities and launched AiMaps 2.0, increasing productivity and achieving 70% cost savings by processing radar data and interpreting it to speed productivity. Its deep learning algorithms use clean, uncluttered data for faster interpretation of the hidden underground surface.

Ground Penetrating Radar Market Growth Drivers vs. Challenges:

Opportunities:

- Rapid infrastructure development is driving the market: The growth in the construction sector is also driving the market for ester gum. As per the data from the Global Infrastructure Outlook forecast trend, the global estimated infrastructure investment has increased substantially from $2.0 trillion in 2012 to $2.8 trillion in 2022, $2.9 trillion in 2024 and is forecasted to reach $3.3 trillion by 2030, highlighting the growing infrastructure, increasing development of roads, tunnels, highways, dams and others. As the infrastructure development is rapidly growing, it is driving the demand for ground penetrating radar for utility detection, subsurface mapping, and excavation.

- Rising investment for military and defense applications: The growth in investment by governments in military and defense is propelling the demand for ground penetrating radar for border security, threat detection, and emergency measures. It is used for locating and detecting buried explosive devices, UXO, IEDs, and buried fusing mechanisms.

- Infrastructure rehabilitation and pavement assessment: Infrastructure rehabilitation and pavement assessment are cornerstone growth drivers for the adoption of ground-penetrating radar technology. With roads, bridges, and highways aging and experiencing increased traffic volumes and loads, non-intrusive and reliable evaluation is crucial. Ground penetrating radar provides agencies with the ability to assess subsurface status without interfering with traffic and/ or implementing costly core extraction programs.

GPR provides a good level of measurement accuracy in terms of pavement layer thickness. A journal article published in the Journal of Performance of Constructed Facilities found that, if calibrated properly with, for example, metal plates and concrete cores, the average accuracy achieved on concrete thickness measurements exceeded 98.5 per cent. Concerning asphalt layers, the Transportation Research Board found that, typically, GPR measurements are, on average, only 10.3 per cent different from measurements made using cores; this error margin improved to 7.6 per cent when GPR data were combined with falling weight deflectometer data. A further European review concluded that average GPR thickness accuracy lies between 3 per cent and 10 per cent, depending on interpretation methods and pavement conditions.

This degree of accuracy is immensely valuable. Conventional coring is slow, costly, and provides point data only. GPR systems have the potential to survey hundreds of lane-miles each day when mounted on moving vehicles, and at highway speed. Studies show coverage possibilities of 200 to 300 lane-miles a day. Because GPR collects continuous, tailored subsurface profiles, agencies can conduct more accurate condition assessments, locate deterioration hotspots like voids, accumulation of moisture, or bond failure, and schedule interventions only where needed. This results in significant cost savings, not just from reduced lane closures and traffic management but also from maintenance that can be strategic rather than preventive or emergency.

Cost effectiveness has been established with highway agency pilots. Michigan DOT investigated overlay design on a 10-mile stretch of asphalt and found benefit-to-cost ratios from 80 to 200 for GPR data-enhanced falling-weight deflectometer inputs. In Ontario, using GPR surveys instead of coring reduced the costs of destructive testing and associated traffic disruptions, which would otherwise cost an estimated CAD?166 billion a year.

Merging GPR with digital asset management systems is a way to improve predictive maintenance. By storing subsurface data over time, it can be overlaid with traffic load histories and weather data to map transportation deterioration models. Therefore, agencies can intervene before defects expand to save both lifecycle costs and the public's safety. Infrastructure rehabilitation and pavement assessment are the main drivers of ground penetrating radar use because it is accurate to within 3 to 10% of cores and does so in a fraction of the time and cost. It allows for continual surveys at normal speeds and creates digitised subsurface data. Together with falling-weight datasets and historical performance datasets, it is the basis for a proactive maintenance strategy that has saved agencies millions of dollars and increased the service life of transportation infrastructure.

In addition to this, the ground penetrating radar systems can survey between 100-200 lane miles a day based on fieldwork from the Florida Department of Transportation's Phase IIA report by Infrasense Inc. This performance is directly indexed with the growth driver, infrastructure rehabilitation, and pavement assessment. The GPR allows transportation agencies to conduct rapid, large-scale, and non-invasive subsurface evaluations that lack the time and expense of coring. Being able to cover the amount of lane miles in a day allows agencies to spend less time dealing with asset management issues and more time focusing on maintaining and/or upgrading ageing infrastructure with minimal disruption to traffic.

Challenges:

- High initial costs: GPR systems are expensive, which acts as a major limiting factor for small-scale firms to adopt the system, thereby limiting their market adoption for the majority of small-scale firms. The high initial cost becomes more major restraint in developing countries where firms are price-sensitive, leading to limited growth of the market.

- Requirement of skilled operators: Apart from the high initial cost, the handling of GPR systems requires skilled operators who need specialized training, increasing the cost of GPR systems. Thus, the shortage of skilled operator and the money invested in them for their training limit their adoption in small-scale firms.

Ground Penetrating Radar Market Regional Analysis:

- North America: The North American region will constitute a major share of the ground penetrating radar market. The advancement in technologies, higher adoption of technologies including ground penetrating radar, extensive utility detection projects, and significant investment in defense are the major factors leading the market to constitute a considerable share. For example, since 2002, it has been a federal requirement to use the 811 system before any dig. In 2021 alone, over 39.5 million 811 locate requests were made, reflecting the immense volume of subsurface excavation activity.

The United States Ground Penetrating Radar (GPR) market is experiencing strong growth due to the rising demand for high-resolution, non-invasive subsurface imaging solutions. Technological advancements, such as multi-frequency radar systems, 3D real-time imaging, and AI-based signal processing, are increasing the accuracy and depth penetration of GPR systems. These advances allow for more precise detection of underground structures, utilities, voids, and anomalies in various geophysical conditions, such as clay, sand, and rocky terrains. Combining synthetic aperture radar (SAR) techniques with advanced time-domain analysis has also boosted performance for deep and shallow scanning applications. This makes modern GPR systems more versatile and accurate across civil engineering, environmental assessment, and archaeology.

A key driver of the U.S. GPR market is its use in military and defense, especially in tactical and combat settings. According to recently released data from the Stockholm International Peace Research Institute (SIPRI), U.S. defence spending in 2024 accounted for nearly 40% of all military expenditure by nations worldwide. The United States spent $997 billion on defence in 2024, more than the combined spending of the next nine nations. In contrast, the second-largest defence spender, China, spent $314 billion on military expenditures in 2024.

The Department of Defense is continuing to invest in GPR to detect buried threats like landmines, IEDs, unexploded ordnance (UXO), and underground tunnels. The military is pushing for rugged, mobile, and miniaturized GPR systems, leading to solutions that can be handheld, mounted on vehicles, or integrated into drones. These systems are increasingly used in combat engineering, route clearance, and securing forward bases. There is also a growing interest in autonomous platforms where GPR is combined with navigation, robotics, and multispectral sensors. This combination allows platforms to scan, analyze, and identify subsurface threats in real-time without putting personnel at risk.

Key defense contractors in the United States are leading the development of GPR systems designed for defense applications. L3Harris Technologies is developing multi-mission GPR platforms for integration into robotic and tactical vehicles, focusing on adapting to various terrains and detecting in high-interference areas. Leonardo DRS is involved in the U.S. Army’s Vehicle Mounted Mine Detector (VMMD) program, concentrating on programmable radar frequencies and using machine learning for pattern recognition. Raytheon Technologies is developing GPR systems that are part of modular ISR (Intelligence, Surveillance, Reconnaissance) platforms suitable for both manned and unmanned operations. These systems are built for flexibility in battlefield conditions, allowing for route reconnaissance and underground facility detection in hostile areas.

Other significant contributors include Northrop Grumman, which is designing low-frequency GPR systems intended to find deep-buried tunnels and hardened bunkers. This is particularly important for counter-terrorism and asymmetric warfare scenarios. Furthermore, in June 2025, Infrasense carried out a comprehensive assessment of the pavement structure using Ground Penetrating Radar (GPR) in a few specific locations of a large California airport. The purpose of this multi-frequency GPR survey was to determine the thicknesses and other underlying conditions of the Cement-Treated Base (CTB), Portland Cement Concrete (PCC), and upper and lower Asphalt Concrete (AC) layers.

Overall, the U.S. GPR market is set for strong growth, driven by applications in both infrastructure and defense, supported by significant research and development funding and innovations specific to military needs.

- Europe: Europe also constitutes a major share in the ground penetrating radar market due to higher adoption of this system for utility detection, archaeological excavation and preservation, infrastructure safety, and others.

- Asia-Pacific: The Asia-Pacific will be growing at the fastest rate during the forecast period, due to the growing use of technologies in various sectors. Defence and security are one of the major drivers, requiring the need for ground penetrating radar. Additionally, the increasing infrastructure development in China, India, and other countries is driving demand in construction, utility detection, and environmental monitoring.

Ground Penetrating Radar Market Competitive Landscape:

The market is moderately fragmented, with some important key players such as Hexagon AB, SPX Corporation, Geophysical Survey Systems Inc., Guideline Geo AB, Chemring Group plc, Sensors and Software Inc., and UTSI Electronics Ltd.

- Product Launch: In October 2024, SPH Engineering launched Zond Aero 500 NG, a Ground Penetrating Radar, in collaboration with Radar Systems Inc. The Zond Aero 500 NG is a fully universal GPR system that can operate in both airborne and ground-based models, specifically engineered from the ground up for both terrestrial and airborne applications.

- Product Launch: In September 2024, Guideline Geo launches the MALÅ GeoDrone 600. It is an advanced and intelligent Ground Penetrating Radar (GPR) solution designed specifically for near-surface airborne surveys. It is made using the GPR HDR technology.

- Collaboration: In February 2024, IDS GeoRadar, part of Hexagon, launched the C-thrue XS, a handheld, dual-polarisation GPR scanner, and NDT Reveal, an integrated software solution for analysing and managing subsurface data.

Ground Penetrating Radar Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ground Penetrating Radar Market Size in 2025 | US$396.517 million |

| Ground Penetrating Radar Market Size in 2030 | US$602.248 million |

| Growth Rate | CAGR of 8.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Ground Penetrating Radar Market |

|

| Customization Scope | Free report customization with purchase |

Ground Penetrating Radar Market Segmentation:

By Type

- Handheld Systems

- Cart-Based Systems

- Vehicle-Mounted Systems

- Drone-Based Systems

By Offering

- Equipment

- Software

- Services

By Frequency

- Low Frequency (< 500 MHz)

- Mid Frequency (500 MHz–1 GHz)

- High Frequency (> 1 GHz)

By End-User

- Construction

- Oil and Gas

- Government and Military

- Archaeology and Research

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others