Report Overview

Hepatitis Diagnostic And Treatment Highlights

Hepatitis Diagnostic and Treatment Market:

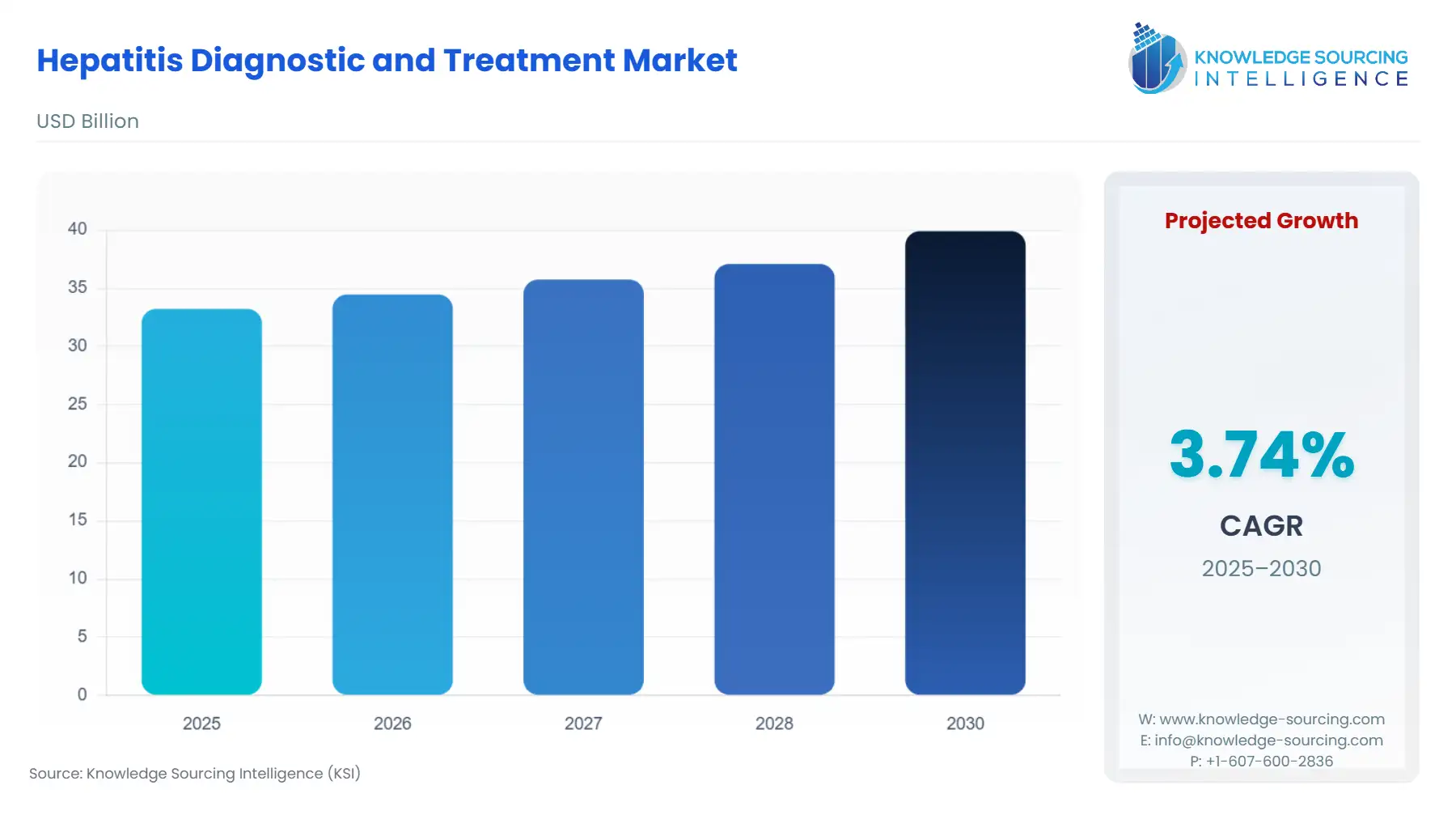

The Hepatitis Diagnostic and Treatment Market is expected to grow from USD 33.224 billion in 2025 to USD 39.915 billion in 2030, at a CAGR of 3.74%.

The Hepatitis Diagnostic and Treatment Market addresses the global health burden of viral hepatitis, a group of infectious diseases affecting the liver. The market's products and services are essential for identifying infections, monitoring disease progression, and curing or managing chronic conditions. The need for these solutions is not static; it is a direct function of public health initiatives, technological advancements in both diagnostics and pharmaceuticals, and the persistent global prevalence of the disease. The market's structure is a duality, encompassing both diagnostic tools that enable the identification of the virus and therapeutic agents that target and mitigate the disease. This symbiotic relationship ensures that as diagnostic capabilities expand, the demand for subsequent treatment rises in tandem. The market is propelled by a global commitment to disease elimination, which has catalyzed a shift from reactive care to proactive screening and intervention.

Hepatitis Diagnostic and Treatment Market Analysis

Growth Drivers

The primary growth drivers for the Hepatitis Diagnostic and Treatment Market are rooted in global and national public health strategies and advancements in clinical practice. The most significant catalyst is the concerted effort by global health organizations and governments to meet the World Health Organization's (WHO) 2030 elimination targets for viral hepatitis. This strategic objective is not merely a policy goal; it translates into tangible demand for diagnostic and treatment products. Governments and non-governmental organizations are increasing funding for large-scale screening programs, particularly for high-risk populations and in regions with high disease prevalence. The Centers for Disease Control and Prevention (CDC) in the U.S., for instance, recommends universal hepatitis C screening for all adults and pregnant women, which directly increases the volume of diagnostic tests performed. This proactive screening approach fundamentally expands the market by bringing previously undiagnosed individuals into the care cascade.

The second major driver is the advent of innovative, highly effective therapeutic agents. The introduction of pan-genotypic Direct-Acting Antivirals (DAAs) for Hepatitis C, for example, transformed the treatment landscape. These drugs offer cure rates exceeding 95% with a short treatment duration, in stark contrast to older, less effective, and side-effect-laden therapies. This paradigm shift makes treatment a viable and attractive option for a wider population, thereby directly increasing demand for these pharmaceutical products. The effectiveness and simplicity of these regimens have reduced the logistical and clinical barriers to treatment, making it feasible for a broader range of healthcare settings, from specialized clinics to primary care providers. This expansion of the treatment pathway is a direct demand-pull factor for both the drugs and the diagnostic tests required for patient monitoring.

Challenges and Opportunities

The Hepatitis Diagnostic and Treatment Market faces significant challenges, which in turn present clear opportunities. A primary challenge is the low rate of diagnosis, which acts as a major constraint on market expansion. A substantial number of people with chronic hepatitis B and C are unaware of their infection status. The WHO's 2024 report on viral hepatitis highlights that globally, only a small fraction of people living with chronic hepatitis B and C have been diagnosed. This "missing millions" phenomenon means that the potential demand for both diagnostics and treatment remains largely unrealized. Overcoming this barrier requires sustained public awareness campaigns and the implementation of accessible, universal screening programs.

This challenge, however, presents a significant opportunity. The undiagnosed population is the largest untapped market segment. The opportunity lies in deploying innovative, user-friendly diagnostic technologies that can facilitate widespread screening. Point-of-care (POC) tests that provide rapid results without the need for complex laboratory infrastructure can be a game-changer, especially in low-resource settings. Furthermore, there is a strategic opportunity for pharmaceutical companies to work with governments and public health organizations to develop and implement "test and treat" models. These models would leverage the short treatment duration of modern therapies to streamline the patient journey from diagnosis to cure, thereby improving treatment rates and driving demand for both diagnostic kits and drugs. Addressing the stigma associated with viral hepatitis is also crucial, as it is a behavioral barrier that can impede individuals from seeking testing and care.

Supply Chain Analysis

The supply chain for the Hepatitis Diagnostic and Treatment Market is complex, involving the production of biological and chemical reagents for diagnostics and active pharmaceutical ingredients (APIs) for treatments. The diagnostic segment relies on a global network of specialized reagent and component manufacturers. Key production hubs for these components are located in North America, Europe, and Asia. Logistical complexities include the need for cold chain management for many diagnostic reagents and the stringent quality control required for medical products. The pharmaceutical segment's supply chain is highly regulated, with APIs often produced in a limited number of certified facilities worldwide. This concentration can create dependencies and vulnerabilities, as demonstrated by past global supply chain disruptions. The entire chain is dependent on the ability of manufacturers to produce certified, high-quality products that meet the rigorous standards of global regulatory bodies like the FDA and EMA. This dependency underscores the need for robust supply chain management and resilience planning to ensure a continuous and reliable flow of critical medical supplies.

Government Regulations

Government regulations and the directives of public health agencies are a foundational element of the Hepatitis Diagnostic and Treatment Market. These regulations and guidelines directly create and shape demand by mandating screening, guiding treatment protocols, and setting the standards for product approval and use.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis

- United States: CDC and FDA Regulations. The CDC's universal screening recommendations for Hepatitis C in all adults and pregnant women have a direct and measurable impact on demand for diagnostic tests. This change in clinical practice shifts the market from risk-based to population-wide screening. The FDA's role is also critical, as its approval of new drugs and diagnostic tests (e.g., the approval of pan-genotypic DAA regimens) enables market entry and drives demand by making more effective and accessible treatments available to the public.

- European Union: European Medicines Agency (EMA) and National Guidelines. The EMA's centralized procedure for drug approval and the European Association for the Study of the Liver (EASL) guidelines for diagnosis and treatment create a cohesive regulatory environment across member states. The approval of new DAA treatments by the EMA facilitates their rapid adoption across the EU, thereby increasing demand. EASL guidelines provide the clinical framework that healthcare professionals use to determine when to test and how to treat, directly influencing the volume and type of products required.

- China: National Health Commission. China’s National Health Commission plays a decisive role in shaping the market through its national hepatitis B prevention and treatment programs. The government's extensive vaccination campaign for newborns and efforts to improve screening awareness directly reduce new infections while simultaneously increasing the diagnosed patient pool for chronic cases. These initiatives create significant demand for both diagnostic tests and antiviral treatments, as the government is a key purchaser for these large-scale public health programs.

In-Depth Segment Analysis

By Type: DNA Test

DNA testing, specifically Nucleic Acid Testing (NAT) for Hepatitis B virus (HBV) and RNA testing for Hepatitis C virus (HCV), represents a critical and high-value segment of the diagnostic market. The need for these tests is directly driven by their necessity in confirming active viral replication and monitoring treatment efficacy. While initial screening often uses a simpler blood test to detect antibodies, a positive result necessitates a confirmatory DNA or RNA test to determine if a patient has an active, chronic infection. This two-step process ensures accurate diagnosis and prevents unnecessary treatment. Furthermore, throughout a patient's treatment regimen, a DNA/RNA test is used to measure viral load and confirm the success of the therapy. For chronic hepatitis B, a DNA test is also essential for determining when to start and stop antiviral therapy. The necessity for these tests is directly linked to the number of patients undergoing treatment and the increased emphasis on monitoring treatment outcomes, a key component of modern clinical practice guidelines.

By Disease Type: Hepatitis C

The Hepatitis C (HCV) segment is a primary driver of market value due to the transformative impact of Direct-Acting Antivirals (DAAs). The market's expansion is driven by the fact that hepatitis C is now considered a curable disease. This shift in medical consensus from long-term management to a short-term cure has fundamentally altered the demand curve. The availability of highly effective, oral, and well-tolerated therapies has spurred public health initiatives and clinical guidelines to prioritize screening and treatment. The market is further fueled by the large reservoir of undiagnosed and untreated individuals, a population that represents the primary target for elimination strategies. Companies are leveraging the high efficacy of their DAA products to partner with governments on national elimination programs, thereby generating large-scale, sustained demand. Unlike Hepatitis B, which requires long-term management, the Hepatitis C market is driven by the promise of a complete cure, making treatment a one-time, high-value transaction for each patient that is successfully diagnosed and treated.

Geographical Analysis

US Market Analysis

The US market is a dominant force in the Hepatitis Diagnostic and Treatment sector, characterized by high-value treatment products and a robust regulatory environment. The primary growth driver is the CDC's recommendation for universal screening of all adults for Hepatitis C, which expands the potential patient pool. Additionally, the high prevalence of Hepatitis B and C among specific populations, such as baby boomers and individuals who inject drugs, creates a persistent need for both diagnostics and treatment. The market is also defined by the high cost of brand-name DAA therapies, which are often covered by private insurance or government programs like Medicare and Medicaid. This strong payer landscape ensures that patients who are diagnosed have access to treatment, thereby sustaining demand. The market is further influenced by ongoing efforts to increase access to care for marginalized communities and address health disparities.

Brazil Market Analysis

Brazil’s market for hepatitis diagnostics and treatment is shaped by its public health system and government-led initiatives. The Ministry of Health's national programs for hepatitis prevention and control are a central growth driver. The government's commitment to providing free access to testing and treatment through the public health system creates a large and accessible patient base. This approach, while different from a market-driven model, generates consistent demand for diagnostic kits and generic versions of antiviral drugs. The market is also fueled by the need to manage a high disease prevalence, particularly in specific regions and among at-risk populations. The market is increasingly focused on decentralizing care and deploying rapid diagnostic tests to improve screening rates in primary care settings, which directly increases the volume of tests required.

Germany Market Analysis

Germany’s hepatitis market is a highly structured environment defined by its national healthcare system and a strong emphasis on evidence-based medicine. The market for both diagnostics and treatment is driven by established national guidelines that are often aligned with the European Association for the Study of the Liver (EASL). The healthcare system provides broad reimbursement for both diagnostic tests and advanced DAA treatments, ensuring that diagnosed patients receive care. The market's requirement for treatment is a function of the physician-led decisions within this system, with a strong preference for high-quality, proven therapies. The country's focus on data collection and public health surveillance also provides a clear picture of the diagnosed population, which allows for targeted treatment and management strategies.

Saudi Arabia Market Analysis

The market in Saudi Arabia is rapidly expanding, fueled by a combination of public health initiatives and substantial government investment in healthcare. The Saudi Ministry of Health has implemented various campaigns to increase hepatitis awareness and screening. The need for diagnostics and treatment is directly tied to the government's efforts to modernize its healthcare infrastructure and improve public health outcomes. The market relies on the import of high-quality diagnostic and pharmaceutical products, often from US and European companies. The market is also influenced by the high prevalence of Hepatitis C in the region, which has led to a push for screening and treatment programs. The market presents an opportunity for global pharmaceutical and diagnostic companies that can navigate the local regulatory and procurement landscape and provide products that meet international standards.

China Market Analysis

China’s market is vast and complex, representing one of the largest patient populations globally, particularly for chronic hepatitis B. The market is driven by a two-pronged strategy: a national hepatitis B vaccination program for infants and a push for screening and treatment for the existing chronic population. Government initiatives are a key growth driver, with large-scale procurement of diagnostic kits and antiviral drugs for its public health campaigns. The market is also shifting towards a more localized, community-based approach to screening, which increases demand for point-of-care diagnostics. While the prevalence of Hepatitis B is a primary growth driver, the market is also a significant player in the Hepatitis C sector, with a growing number of patients being diagnosed and treated with generic or locally produced DAA therapies.

Competitive Environment and Analysis

The competitive landscape of the Hepatitis Diagnostic and Treatment Market is concentrated, with a few major pharmaceutical and diagnostic companies holding significant market share. The competition is based on product efficacy, safety, pricing, and the ability to partner with governments on large-scale public health initiatives.

- AbbVie Inc.: AbbVie is a key player in the Hepatitis C treatment market with its pan-genotypic DAA product, MAVYRET® (glecaprevir/pibrentasvir). AbbVie's strategic positioning is to provide a highly effective, short-duration oral treatment that simplifies the patient journey. The company's focus on making MAVYRET a cornerstone of "test and treat" models has been a critical market growth driver. MAVYRET is a once-daily, eight-week treatment that has demonstrated high cure rates, making it a preferred option for many patients and healthcare providers.

- Merck & Co., Inc.: Merck has a long-standing history in the viral hepatitis market, with a portfolio that includes both diagnostic and therapeutic products. While it is a major competitor in the broader infectious disease space, its strategic positioning in hepatitis is to leverage its research capabilities to develop innovative therapies and vaccines. The company's acquisition of Idenix Pharmaceuticals in 2014, a developer of nucleoside and nucleotide analogues for viral diseases, significantly bolstered its pipeline and intellectual property in the Hepatitis C space. This acquisition was a clear strategic move to increase its competitive standing in the direct-acting antiviral market.

- Gilead Sciences, Inc.: Gilead Sciences is a dominant force in the Hepatitis C treatment market with its portfolio of DAA drugs, including Harvoni® (ledipasvir/sofosbuvir) and Epclusa® (sofosbuvir/velpatasvir). Gilead's strategic positioning is rooted in its development of highly effective, groundbreaking therapies that transformed the treatment landscape. The company's products have consistently demonstrated high cure rates across various genotypes, which has made them the standard of care. This success has allowed Gilead to command significant market share and partner with governments and international organizations to expand access to treatment globally, which generates massive demand.

Recent Market Developments

- September 2025: Gilead Sciences announced a partnership with PEPFAR to deliver its twice-yearly injectable drug, lenacapavir, for HIV prevention in low- and lower-middle-income countries. While not a hepatitis product, this development demonstrates Gilead's strategic focus on expanding access to its innovative therapies in underserved regions, a model that could be applied to its hepatitis portfolio to generate new demand.

- June 2025: AbbVie announced that the U.S. Food and Drug Administration (FDA) approved a label expansion for its oral pan-genotypic DAA therapy, MAVYRET® (glecaprevir/pibrentasvir). The new approval allows MAVYRET to be used for the treatment of adults and pediatric patients aged three years and older with acute or chronic hepatitis C virus (HCV) infection. This expansion provides a direct demand increase by making MAVYRET the first and only DAA therapy approved to treat patients with acute HCV.

- April 2025: Merck & Co., Inc. entered into a definitive agreement to acquire SpringWorks Therapeutics, a move aimed at strengthening its presence in the rare disease and oncology space. This strategic acquisition of a company with a focus on severe rare diseases and cancer, including some with links to viral infections, positions Merck to potentially leverage new therapeutic areas that may have a tangential relationship to its existing viral disease portfolio.

Hepatitis Diagnostic and Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 33.224 billion |

| Total Market Size in 2031 | USD 39.915 billion |

| Growth Rate | 3.74% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Disease Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Hepatitis Diagnostic and Treatment Market Segmentation

- By Type

- Blood Test

- DNA Test

- Liver Biopsy

- RNA Testing

- Liver Ultrasound

- Treatment

- Drugs

- Injectable alpha Interferons

- Liver Transplant

- By Disease Type

- Hepatitis A

- Hepatitis B

- Hepatitis C

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America