Report Overview

Horn Antenna Market Size, Highlights

Horn Antenna Market Size:

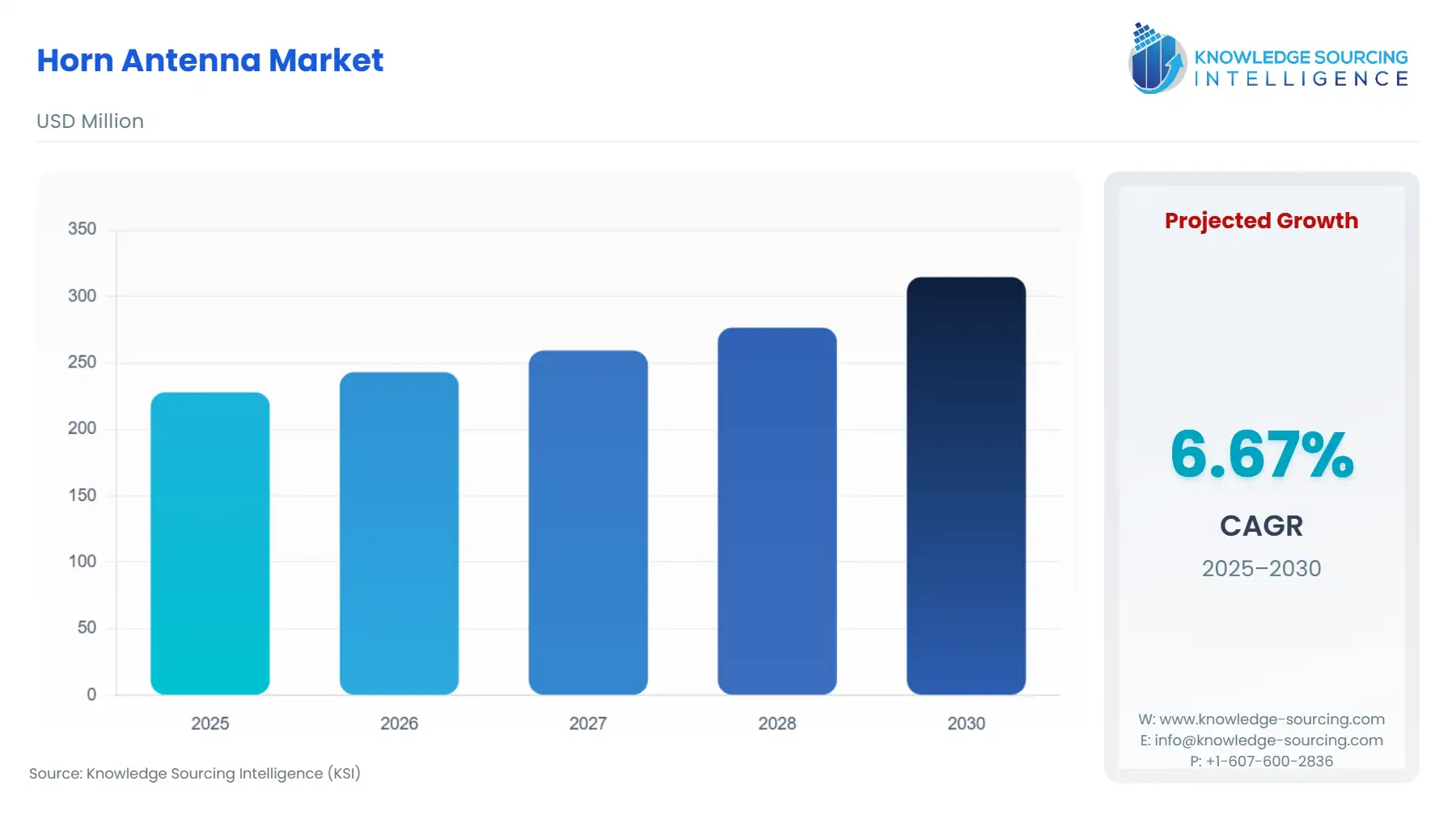

The horn antenna market is anticipated to grow from US$227.949 million in 2025 to US$314.739 million in 2030 at a CAGR of 6.67%.

Horn Antenna Market Trends:

The horn antenna market comprises all businesses that produce distribute and deploy horn antennas which resemble flared metal waveguides in horn shape design. Horn antennas find extensive usage because of their exceptional gain capabilities combined with their directivity features and wide bandwidth characteristics and therefore serve applications in radar systems alongside satellite communications along with electromagnetic compatibility tests and microwave frequency measurement systems. The basic structure and trustworthy operation of horn antennas make them essential components in communication systems of defense and commercial applications primarily used at radio and microwave frequencies.

High-frequency testing and communications requirements within aerospace and defense sectors alongside telecommunications and automotive industries fuel the primary consumption of horn antennas in the market today. Global 5G network expansion together with satellite internet services and sophisticated radar systems leads to increasing demand for accurate signal transmission and reception systems that drive the market for horn antennas. The market grows because of growing research and development in electromagnetic wave propagation and microwave technology domains. Ongoing market demand receives support from horn antenna use in EMC testing and antenna calibration even though accuracy remains critical to these applications.

Horn Antenna Market Overview & Scope:

The horn antenna market is segmented by:

- Type: Standard Gain Horn Antennas lead the horn antenna market in terms of type primarily because they are suitable for diverse applications and cost-effective and reliable. Horn antennas provide stability in large frequency bands so they serve extensively in electromagnetic compatibility testing and antenna calibration applications and research facilities. The easy structures of this antenna design reduce production costs and manufacturing complexity compared to dedicated dual-polarized and corrugated horn antennas. Their well-predictable performance characteristics also render them perfect to use as reference antennas in measuring systems, thereby solidifying their market-leading status.

- Application: The prevailing segment by application within the market of horn antennas is the EMC (Electromagnetic Compatibility) Testing segment. This leadership results from the instrumental nature that horn antennas undertake to fulfill testing in compliance with industry applications within sectors such as electronics, automobile, aerospace, and telecommunication. EMC testing will guarantee that electronic equipment does not radiate or is not subject to unwanted electromagnetic interference, and standard gain horn antennas are used for this because they have a wide bandwidth, stable gain, and predictable radiation patterns. The demand for stable EMC test solutions continues to grow as regulations gain worldwide importance while electronic systems increase their complexity which makes this application the largest in market share terms.

- Region: The North American horn antenna market expands because the region controls telecommunications aerospace and defense industries which require advanced microwave and RF systems. Military radar and electronic warfare systems combine with major 5G infrastructure investments and dominant research and development in electromagnetic compatibility which results in increased demand for horn antennas in this region. The U.S. and Canada experience market expansion because they have principal manufacturers along with research centers and high electromagnetic compatibility regulatory standards.

Top Trends Shaping the Horn Antenna Market:

1. Expansion of 5G and Next-Generation Communication Technologies

- The current 5G installation and upcoming 6G development initiatives worldwide create substantial market demand for horn antennas that feature both high beam efficiency and high operating frequencies. Horn antennas play an essential role in the millimeter-wave range since telecommunication operators require them for network performance tests along with antenna calibration and component verification purposes to build faster dense communication networks with reduced latency. Horn antennas function best for signal measurement accuracy in laboratory and field installations because of their wide bandwidth along with directional attributes.

2. Growth in Electromagnetic Compatibility (EMC) Testing

- Electronic components applied in automotive electronics and aerospace equipment together with consumer electronics and medical devices result in electromagnetic compatibility becoming necessary for both regulators and functional requirements. Horn antennas serve as crucial measurement tools used for conducting radiated immunity testing and emissions testing because of their reliable performance characteristics along with stable gain and wide frequency operational capabilities. Market expansion results from tightening international standards that apply especially to Europe and North America which leads to increased utilization of horn antennas throughout the test process.

Horn Antenna Market Growth Drivers vs. Challenges:

Drivers:

- Aerospace and Defense Modernization: Governments and commercial space industries are making heavy investments in advanced radar, surveillance, and communication systems, all of which demand high and rugged antennas. Civil aviation is one of the most rapidly expanding industries in India. India is likely to have over 500 million domestic and international air passengers by the year 2030 and has the potential to be the world's leading aviation market by the year 2047. Horn antennas are ideally suited for such purposes owing to their high gain, low VSWR, and directional accuracy. They find use in military use in radar cross-section measurements, antenna calibration, and signal intelligence activities. Their use in defense systems due to the requirement for dependable performance in adverse conditions is another factor in their popularity.

- Increased R&D Activities: The increasing emphasis on innovation in wireless communication, electromagnetic wave propagation, and antenna design is pushing the applications of horn antennas in R&D. They are employed in test setups by universities, defense research laboratories, and technology companies because of their reliable response, high directivity, and ease of calibration. Whether testing new materials, designing new antenna configurations, or checking simulation models, horn antennas are instrumental in furthering research objectives.

Challenges:

- High Cost of Precision Horn Antennas: High-performance horn antennas, particularly those in millimeter-wave or custom-designed frequency bands, may be costly because of the precision engineering and materials used. This cost aspect can be a deterrent for small test labs, startups, or educational institutions with tight budgets, hindering wider adoption in cost-conscious segments of the market.

Horn Antenna Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific horn antenna market is witnessing extensive growth due to several key drivers. Industrialization and growth in telecommunication networks in nations such as China, India, and Japan are propelling the demand for high-frequency, high-gain antennas required in sophisticated communication systems. The region's large investments in 5G networks and growing usage of Internet of Things (IoT) devices further support the demand. The Japanese government is pushing for additional digitalization to combat Japan's graying population, in addition to improving the nation's competitiveness and economic security. With the vision of achieving a Society 5.0, the government is implementing major projects, including the Ouranos Ecosystem (explained below), and is taking numerous steps to draw foreign firms.

Moreover, increasing defense budgets and military and aerospace sector modernization require efficient and accurate antenna solutions, making horn antennas the favored option based on their performance as well as longevity. The convergence of these points highlights the strong growth path of the horn antenna market in the Asia Pacific region.

Horn Antenna Market Competitive Landscape:

The horn antenna market is moderately competitive with a combination of established global players and specialized manufacturers emphasizing innovation, frequency range extension, and customization.

- In May 2024, Pasternack, an Infinite Electronics company and one of the largest providers of RF, microwave, and millimeter-wave products, introduced its new family of millimeter-wave horn antennas. They were created to serve the changing needs of test and measurement applications for the rapidly paced tech industry.

Horn Antenna Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Horn Antenna Market Size in 2025 | US$227.949 million |

| Horn Antenna Market Size in 2030 | US$314.739 million |

| Growth Rate | CAGR of 6.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Horn Antenna Market | |

| Customization Scope | Free report customization with purchase |

Horn Antenna Market Segmentation:

By Type

- Standard Gain Horn Antennas

- Dual Polarized Horn Antennas

- Corrugated Horn Antennas

- Pyramidal Horn Antennas

- Conical Horn Antennas

By Application

- Radar Systems

- Satellite Communications

- EMC Testing

- Antenna Measurements

- Wireless Communication Testing

- R&D and Laboratory Use

By End-User

- Aerospace & Defense

- Telecommunications

- Automotive

- Research Institutes and Universities

- Electronics and Semiconductor Industries

By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa