Report Overview

Hydrotherapy Equipment Market Size, Highlights

Hydrotherapy Equipment Market Size:

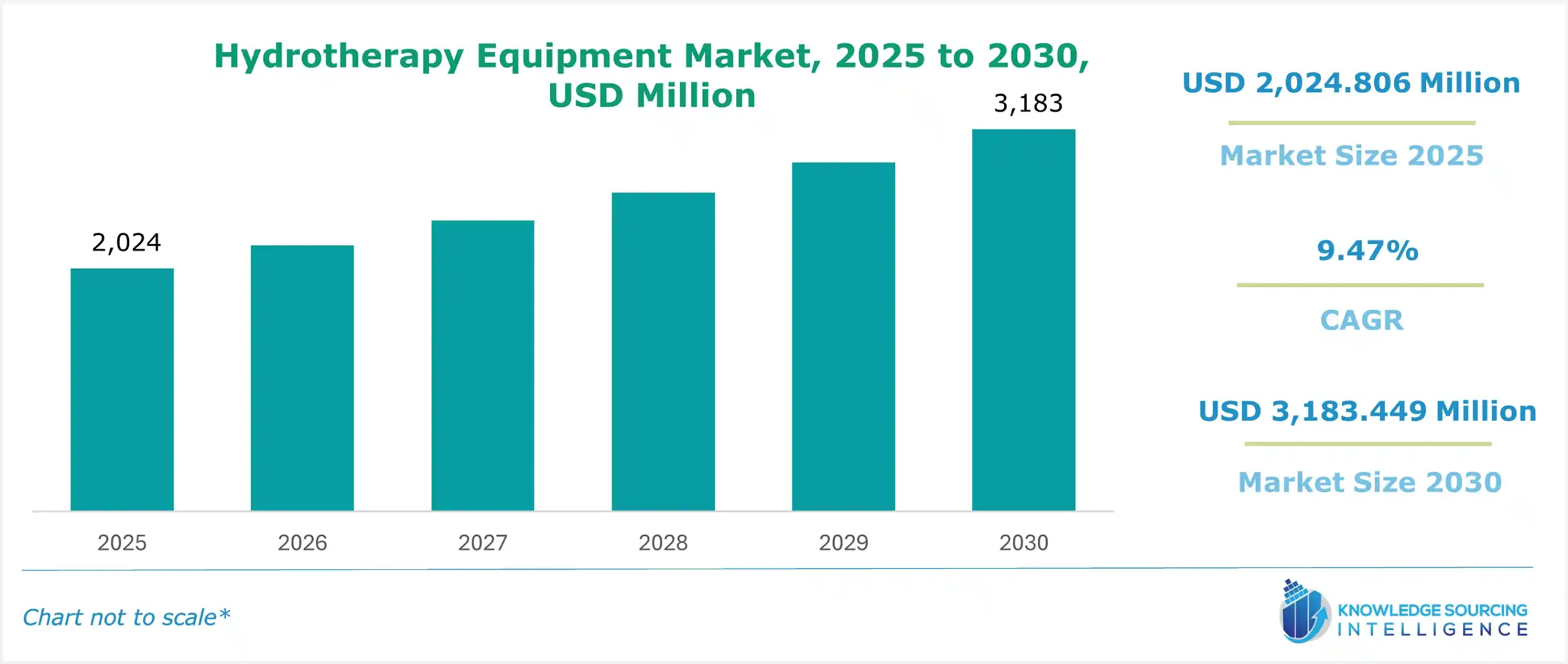

The Hydrotherapy Equipment Market, valued at US$2,024.806 million in 2025, is projected to grow at a CAGR of 9.47%, reaching a market size of US$3,183.449 million by 2030.

The growing prevalence of back pain or arthritis, either due to old age or the adoption of unhealthy living conditions, is projected to drive market expansion during the forecast period. The increasing number of injuries occurring due to sports activities is further augmenting the market growth. The growing geriatric population worldwide also provides an impetus to surging demand.

Hydrotherapy Equipment Market Overview & Scope:

The Hydrotherapy Equipment Market is segmented by:

- Product Type: The Hydrotherapy Equipment Market is segmented into hot tubes, pools, whirlpool spas, thermal capsules, and others.

- Hydrotherapy Type: The market is segmented into water circuit therapy, aquatic exercise, aquatic massage, steam baths, and saunas.

- End-User: The Hydrotherapy Equipment Market is segmented into health centers, spas, and homes.

- Region: The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Top Trends Shaping the Hydrotherapy Equipment Market:

1. Technology integration in hydrotherapy equipment

- There is a growing traction for smart hydrotherapy equipment. The Internet of Things (IoT) is increasingly being integrated for real-time patient monitoring. Integrating automated control systems such as pressure sensors and temperature sensors helps adjust temperature, pressure, and duration of therapy, depending on the patient's needs.

- There is a growing integration of artificial intelligence to analyze the data from these sensors for making data-driven decisions. Mobile applications are integrated to adjust the equipment settings, and interactive touchscreens are used to make real-time adjustments.

- For instance, the new series of BTL Whirlpools has integrated a unique feature of a colour touch screen for user interface making operating fast and easy.

2. Growing demand for personalized home hydrotherapy equipment

- There is a growing demand for personalized and home hydrotherapy equipment as people are seeking more accessible and convenient options at their homes. This trend is growing for compact hydrotherapy designs such as bathtubs, miniature hydrotherapy pools, etc.

Hydrotherapy Equipment Market Growth Drivers vs. Challenges:

Opportunities:

- The growing prevalence of musculoskeletal disorders worldwide is driving market opportunities: The number of cases of musculoskeletal disorders among people is rising due to lifestyle changes. This is leading to chronic pain, injuries, and stress, driving demand for physical rehabilitation to recover from these conditions. This is leading to an increase in opportunities for the hydrotherapy equipment market.

According to the WHO, approximately 1.71 billion people are facing musculoskeletal conditions. It is the leading contributor to disability worldwide, with low back pain being the single leading cause of disability in 160 countries, driving the market for hydrotherapy and, in turn, hydrotherapy equipment.

Challenges:

- Concern over infections due to contaminated water: The concerns regarding susceptibility to infections due to contaminated water in hydrotherapy pools may restrain the market growth during the forecast period. This is because the potential routes of infections from contaminated water include water ingestion, breathing sprays, and aerosols from water. In addition, allowing wounds to come into direct contact with water increases the chances of infections in individuals. It has been analyzed that infection control for hydrotherapy tanks or pools poses unique challenges. This is mainly because the naturally occurring microbes, which may not be dangerous for a healthy individual, are always present in the water during water treatment procedures.

Hydrotherapy Equipment Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is projected to experience high growth over the forecast period due to the increasing geriatric population, with Japan containing the maximum senior population globally. Increasing government investments in improving healthcare facilities provide an impetus to the burgeoning market growth in the forecast period.

- North America: North America is predicted to hold a significant market share owing to the high health expenditure of the United States among all the developed regions of the world. The prevalence of musculoskeletal disorders in the United States is further propelling the market demand during the forecast period. According to the United States Bone and Joint Initiative, chronic musculoskeletal conditions account for about $332 billion in healthcare spending, highlighting the high market that includes hydrotherapy equipment market share.

- Europe: Europe holds a significant share of the Hydrotherapy Equipment Market due to the demand for hydrotherapy solutions for pain relief from musculoskeletal disorders.

Hydrotherapy Equipment Market Competitive Landscape:

The market is fragmented, with some dominant players, such as BTL industries. Some established players such as BTL Industries, Technomex, and others are present. Alongside diverse product offerings, several medium-sized players are emerging, such as the expanding Reveal Group. There are key regional players, but they also have a limited market.

- Product Launch: In January 2023, Hydrophysio, a manufacturer of aquatic therapy treadmills based in the UK, launched a new hydrotherapy system in the Middle East market. The system provides solutions for individual hygienic aquatic therapy spaces. It includes a treadmill chamber, entrance foyer, and integrated water management equipment.

- Niche Player: India Medico Instruments offers hydrotherapy instruments such as hydrotherapy tanks, bath pools, and whirlpool baths to the regional Indian market.

Hydrotherapy Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Hydrotherapy Equipment Market Size in 2025 | US$2,024.806 million |

| Hydrotherapy Equipment Market Size in 2030 | US$3,183.449 million |

| Growth Rate | CAGR of 9.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Hydrotherapy Equipment Market |

|

| Customization Scope | Free report customization with purchase |

Hydrotherapy Equipment Market is analyzed into the following segments:

By Product Type

- Hot Tubs

- Pools

- Whirlpool Spas

- Thermal Capsules

- Others

By Hydrotherapy Type

By End-User

- Health Centers

- Spas

- Home

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa