Report Overview

India AI in Finance Highlights

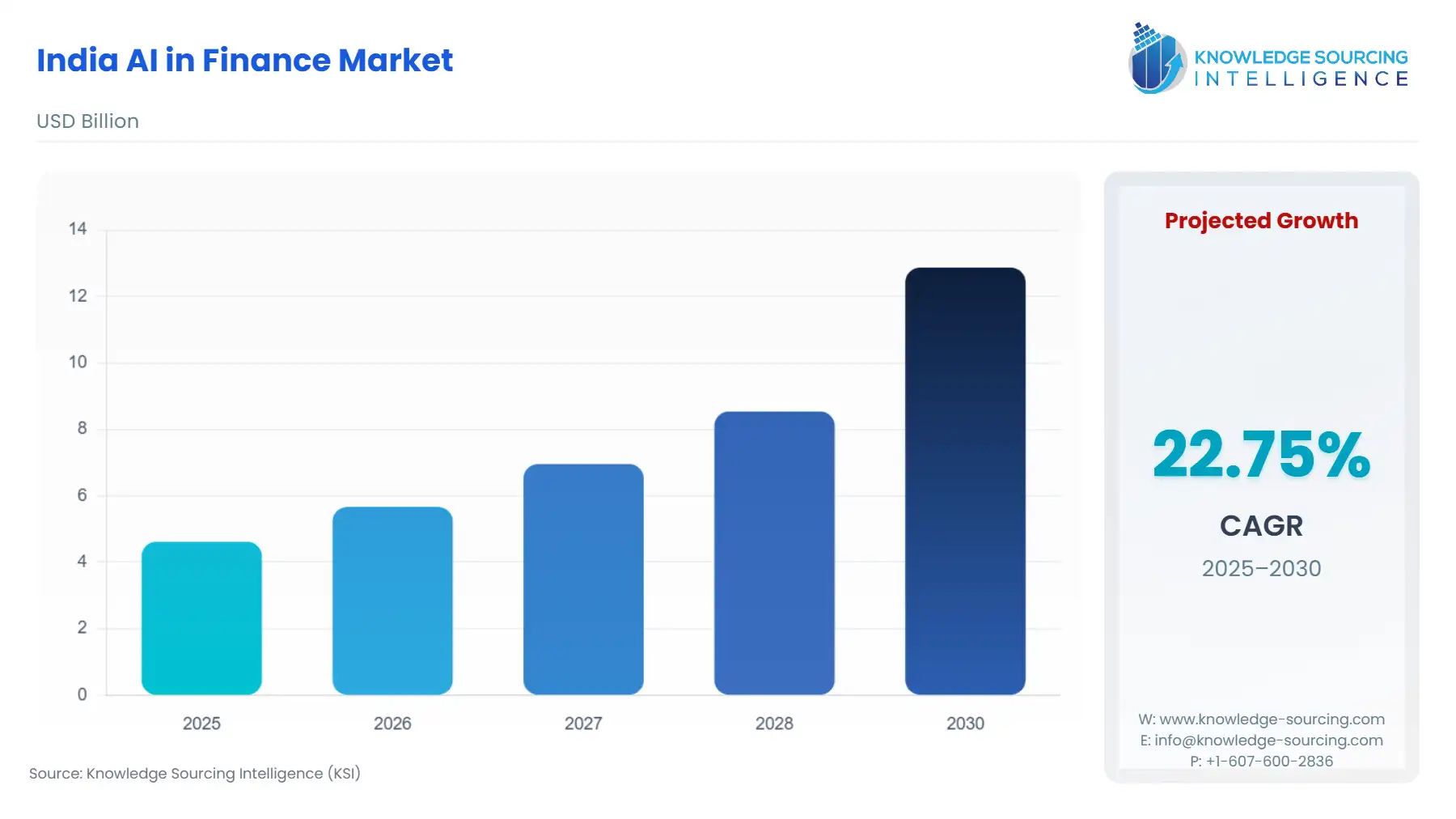

India AI in Finance Market Size:

The India AI in Finance Market is expected to grow at a CAGR of 22.75%, reaching USD 12.871 billion in 2030 from USD 4.618 billion in 2025.

The Indian AI in Finance market is undergoing a rapid, structurally-driven transformation, moving beyond basic automation to deep, decision-making integration across the financial services value chain. This evolution is not a speculative phenomenon but a direct consequence of a massive, government-backed push for digital inclusion and the corresponding volume surge in digital transactions, especially through the Unified Payments Interface (UPI) network. This market is primarily characterized by the competitive interplay between incumbent banks leveraging their vast proprietary data reserves and agile FinTechs that deploy cloud-native, specialized AI models to address efficiency and compliance gaps. The core strategic imperative for financial institutions has shifted from if to how quickly they can integrate intelligent automation to manage risk and exploit hyper-personalization opportunities at scale.

India AI in Finance Market Analysis:

Growth Drivers

The surge in digital transaction volume is the single largest factor driving demand for AI solutions. Total UPI transactions for FY 2023-24 reached 131 billion, a scale that mandates machine learning for real-time fraud prevention, as manual or rules-based systems are wholly inadequate. Furthermore, the Indian government's commitment, articulated through the over ?10,300 crore allocation for the IndiaAI Mission, fundamentally alters the supply-side economics. By subsidizing high-performance computing resources, this mission effectively drives demand by de-risking the development phase and lowering the initial capital expenditure for financial institutions and startups looking to implement sophisticated Large Language Models (LLMs) and deep learning for credit scoring and customer service. This direct state support creates a robust ecosystem that accelerates the shift from pilot projects to enterprise-wide AI deployment.

Challenges and Opportunities

A significant challenge confronting the market is the critical shortage of high-quality, labeled proprietary data essential for training robust AI models, particularly for unique Indian language and demographic contexts, which constrains the development of accurate localized solutions. This constraint directly limits the demand for generic AI tools, instead funneling investment into bespoke DataOps platforms. Concurrently, a substantial opportunity lies in the burgeoning regulatory compliance sector, particularly with the RBI's guidance on Ethical AI. This creates a direct and immediate demand for governance and Explainable AI (XAI) tools, enabling financial institutions to audit, document, and transparently demonstrate model fairness, thereby turning a potential compliance headwind into a high-value software opportunity for specialized providers.

Supply Chain Analysis

The Indian AI in Finance supply chain is largely intangible and anchored by three primary layers: Compute Infrastructure (dependent on global semiconductor supply and hyperscale cloud providers like AWS, Azure, and GCP), AI Model Development (driven by domestic and global FinTech/SaaS firms), and Data Enablement (focused on domestic data aggregators and financial institutions' proprietary data lakes). The dependence on global semiconductor-based computing for high-end AI training introduces a significant geopolitical and logistical risk, a vulnerability that the IndiaAI mission attempts to mitigate via domestic GPU deployment. The logistical complexity is not in physical movement but in the secure, compliant, and real-time transmission of massive, sensitive financial data sets, creating dependency on secure, low-latency, localized cloud zones for data processing and deployment, thereby increasing demand for sovereign-cloud or highly secure, on-premise solutions.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Reserve Bank of India (RBI) | Responsible AI Framework (FREE-AI Committee) | Defines a "tolerant supervisory stance" for initial AI mistakes, increasing institutional risk appetite for adoption. Simultaneously, the focus on Ethical AI and Explainability drives demand for specialized XAI/governance platforms. |

| Ministry of Electronics and IT (MeitY) | IndiaAI Mission and Subsidized GPU Access | Direct, quantifiable state intervention lowers the cost of development for domestic AI companies, immediately accelerating demand for AI R&D and deployment by reducing capital expenditure constraints. |

| RBI | Digital Lending Guidelines (2022) | Mandates greater transparency and disclosure regarding algorithms used for credit scoring and decision-making, significantly increasing demand for transparent AI models that can be easily auditable and compliance-checked. |

India AI in Finance Market Segment Analysis:

By Application: Front Office

The Front Office segment encompasses all customer-facing applications, ranging from conversational AI chatbots and voice assistants to hyper-personalized marketing and product recommendation engines. The imperative to scale customer engagement without proportionately increasing human capital costs, directly increasing the deployment of Natural Language Processing (NLP) and Large Language Models (LLMs), drives this segment's expansion. With India hosting the world's largest number of digital banking users, the volume of service inquiries necessitates intelligent automation. AI models, by analyzing vast customer interaction history and transaction data, enable financial institutions to move beyond simple segmentation to delivering personalized financial advice and product offers in real-time, thereby increasing demand for highly-localized, multi-lingual AI/ML platforms that can comprehend diverse regional languages and colloquialisms to improve resolution rates and customer lifetime value.

By End-User: Corporate Finance

The Corporate Finance segment requires AI for processes such as treasury management, complex financial modeling, trade finance automation, and regulatory compliance reporting. Operational efficiency, risk mitigation, and the ability to process high-volume, cross-platform data are factors driving this segment's growth. For large corporations and banks, AI is crucial for real-time liquidity and working capital management, where ML algorithms flag anomalous cash flows or predict currency exposure with greater precision than traditional models, creating a direct demand for predictive analytics engines and robotic process automation (RPA) integrated with core banking systems. Furthermore, AI-powered reconciliation tools, as demonstrated by Razorpay's 'Recon' launch, significantly reduce man-hours and error rates in matching complex transaction logs, making the shift from manual, error-prone spreadsheets to automated, AI-driven systems an operational necessity for large-scale enterprise finance departments.

India AI in Finance Market Competitive Environment and Analysis:

The Indian AI in Finance market presents a dual competitive structure: established Public and Private Sector Banks (ICICI Bank, IndusInd Bank) that command vast data and capital, and innovative FinTech players (Paytm, Razorpay) that leverage technology and agility. Competition is intensifying around specialized services like automated risk scoring and payment orchestration, with FinTechs focusing on modular, API-first AI solutions for businesses, while large banks integrate AI into their proprietary core banking platforms for operational leverage and fraud detection.

ICICI Bank

ICICI Bank, a leading private sector bank, leverages AI primarily for internal efficiencies and risk management. The institution uses machine learning for real-time fraud detection across its high-volume UPI and card networks. Their strategic positioning centers on leveraging proprietary customer data and established trust to embed AI deep into the loan life cycle, including real-time AI-powered loan assessment. The focus is on a comprehensive, end-to-end digital strategy, incorporating AI-powered chatbots and voice biometrics for enhanced customer service and authentication across its diverse product portfolio.

Razorpay

Razorpay is strategically positioned as a full-stack financial technology layer, specifically targeting businesses and enterprises. Their core competitive advantage is creating AI-powered infrastructure that simplifies complex payment and business banking operations. Key products, such as the AI-powered 'Optimizer' for payment routing and the recently launched 'Razorpay Recon' for automated reconciliation, demonstrate a focus on high-efficiency, B2B-centric AI tools. The company's strategy is not just about payments, but about processing massive data streams to offer ancillary AI services like fraud reduction and operational savings, positioning them as an essential operational partner rather than a mere payment gateway.

India AI in Finance Market Recent Developments:

- October 2025: Paytm announced the launch of the AI Soundbox for Payments, described as India's first. This physical product launch integrates artificial intelligence into the widely adopted merchant payment confirmation device. The development reflects a strategy to enhance the point-of-sale experience and deepen merchant adoption by leveraging AI for potentially smarter audio confirmation, greater language comprehension, or enhanced fraud alerts, furthering the integration of AI into the last mile of digital commerce.

- December 2024: Razorpay POS, the offline payments arm of the FinTech, introduced 'Razorpay Recon,' an industry-first AI-powered reconciliation solution. Designed to tackle inefficiencies in manual reconciliation for offline retail, the solution automates the matching of various transaction logs, including bank files and POS data, aiming to boost financial operations efficiency by 80%. This launch explicitly addresses a major pain point in corporate finance operations, creating immediate demand for automation tools that improve accuracy and efficiency in managing high-volume transaction data.

- October 2024: ICICI Lombard, a group company of ICICI Bank, launched TripSecure+, an AI-powered, adaptive travel insurance solution. The company utilized an industry-first AI-generated song as part of its marketing campaign to make the product relatable and engaging. This development signifies a strategic shift toward employing AI in both the product's core functionality—offering personalized and real-time risk coverage—and in the creative marketing and customer engagement process, signalling the growing maturity of AI-as-a-tool beyond back-office operations.

India AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.618 billion |

| Total Market Size in 2031 | USD 12.871 billion |

| Growth Rate | 22.75% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

India AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office