Report Overview

India Electronic Health Records Highlights

India Electronic Health Records (EHR) Market Size:

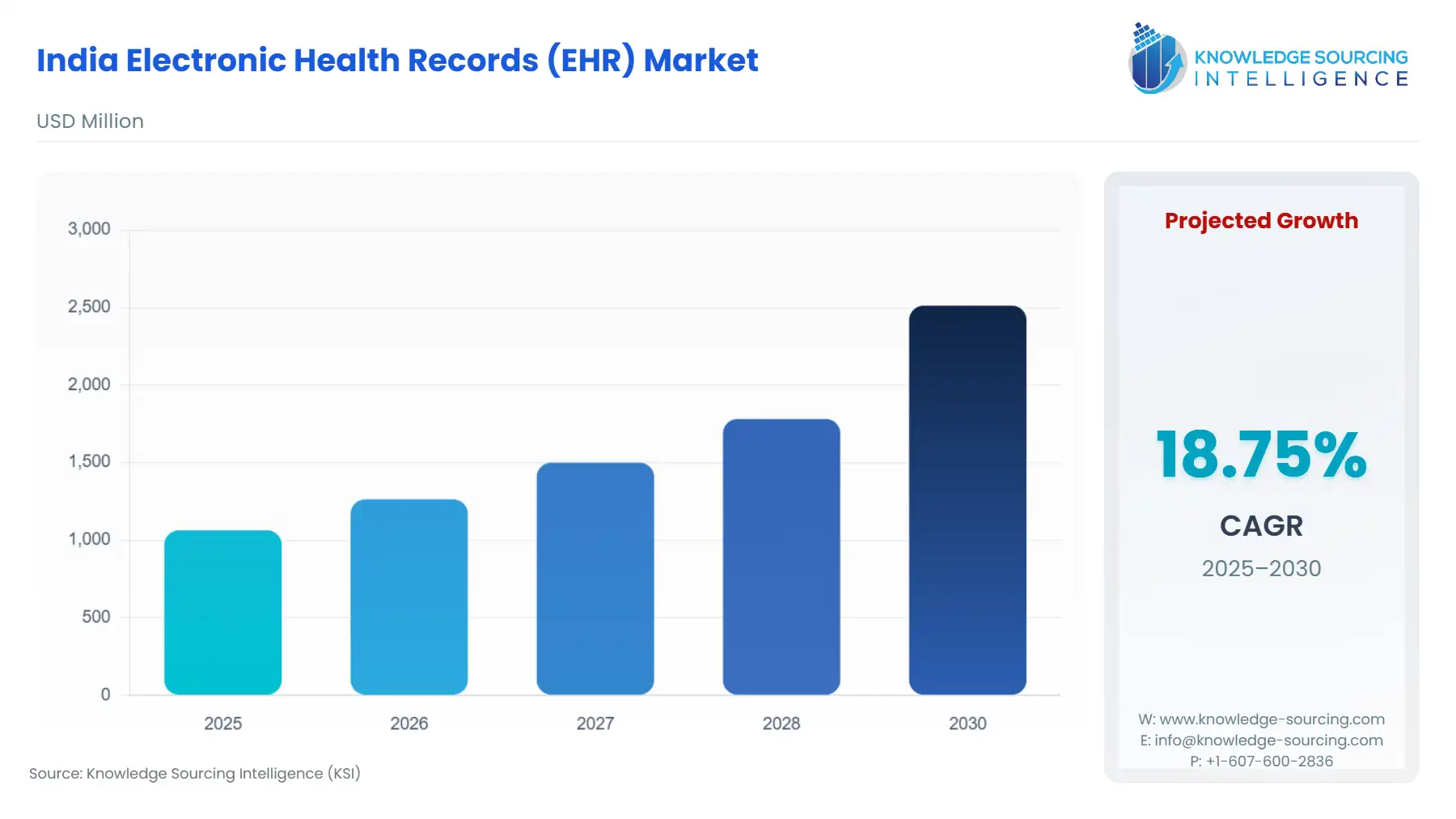

The India Electronic Health Records (EHR) market is estimated to grow at a CAGR of 18.75% during the forecast period, reaching a market size of USD 2.513 billion in 2030, from USD 1.064 billion in 2025.

The ongoing healthcare digital transformation in India, driven by government initiatives, policy reforms, and technological advancements to meet the goals of the rapidly growing population’s demand for quality healthcare, is the key factor driving India at a very high CAGR in the EHR market. Thus, the government programs and policies for adoption, rising demand for effective health records management, and cost-effectiveness gains will drive the market. However, interoperability standards issues, lack of funds, and shortage of suitable governance health policies are the major barriers to the adoption of EHR in India.

India Electronic Health Records (EHR) Market Overview & Scope

The India Electronic Health Records (EHR) Market is segmented by:

- Product: By product, cloud-based EHR and on-premise EHR are major two major types of product. Cloud-based EHRs are the dominant product adopted in the market, driven by their benefits such as accessibility from any location, cost-effectiveness by drastically reducing the upfront costs and hardware and IT staff costs. On the other hand, on-premise EHR holds significance, particularly among organizations requiring complete control.

- Type: By type, acute, ambulatory and post-acute are major categories. Acute EHRs are specifically designed for electronic documentation of a patient's medical information during the acute care settings, such as in an emergency room. These are in demand due to their real-time updates, integration with other systems and help in maintaining workflow. The ambulatory EHR is designed for outpatient healthcare settings. They comprise a key significant share due to their demand for managing patient interactions, utilising patient portals and supporting billing and coding. Post-care EHR is also a growing segment.

- End User: Hospitals, clinics, pharmacies, laboratories and others mainly demand these electronic health records. Hospitals are the dominant segment due to the higher volume of demand for electronic health records systems.

Top Trends Shaping the India Electronic Health Records (EHR) Market

- High Demand for Cloud-Based EHR

- The market is experiencing high growth in cloud-based EHRs, due to cost-effectiveness, simple and mobile-friendly format. It drives high demand, especially among ambulatory and small clinics.

- It is gaining momentum, providing opportunities for vendors to offer scalable, cost-effective, and easily accessible cloud-based EHR solutions.

- For example, companies like Doctors App offer two products in EMR/HER, namely Silver and Gold pricing at RS. 8999 per year and Rs. 14999 per year respectively, for clinics.

- Companies like DocEngage also offer cloud-based EHR for clinics and hospitals.

- Growing AI Integration

- The market is growing towards AI integration in HER products. The integration of Artificial Intelligence in EHR software is transforming healthcare by automating routine tasks, reducing errors, and enhancing patient care.

- For example, companies like Doctors App are leveraging AI to automate documentation, enhance clinical making, optimize scheduling and workflows, and improve data security.

India Electronic Health Records (EHR) Market Growth Drivers vs. Challenges

Drivers:

- Growing Number of Hospitals or Healthcare Facilities: The number of tertiary hospitals and large hospital chains is growing, especially in metro cities and tier-1 and tier-2 cities in India. As per CHCs, there were 23,581 government hospitals and 22 central government hospitals in India in 2019. At the same time, as per various resources, private hospitals are also growing. This is driving the higher adoption of EHR in these hospitals.

- Growing Government Mandates and Support for EHR: Various government laws, such as the National Health Policy 2017 and programs such as Ayushman Bharat Digital Mission (ABDM) and the Digital Health Incentive Scheme (DHIS), National Health Mission program, National Digital Health Mission, PM-ABHIM and emerging interoperability and standardization in data exchange are driving the digital transformation, growing EHR as well. Under the Ayushman Bharat Digital Mission, India has employed an incentive system like the US to encourage EHR adoption. However, only 1,700 hospitals, clinics or diagnostic labs have signed up for the incentive scheme, though the 34 crore individual Ayushman Bharat Health Accounts (ABHAs) linked with health records are a good start for a nationwide EHR system.

Challenges:

- High Implementation Costs: Many smaller hospitals and clinics delay adoption due to higher implementation costs. Even for large hospitals, it is an extra cost. Besides, the advanced EHR systems, such as those integrated with AI and IoT, require a high implementation cost in software, hardware, training, and maintenance, slowing down the adoption. In India, being a price-sensitive market, the cost associated with EHR makes the adoption slow.

- Interoperability between Systems: One of the key challenges the market in India faces is the lack of interoperability between different healthcare systems. There is a lack of policy implementation for standardization of patient data and the adoption of EHR. Hospitals and clinics often use different kinds of solutions for EHR, making the standardization process fail. This limits the benefits of the EHR, slowing the adoption process.

India Electronic Health Records (EHR) Market Competitive Landscape

The Indian Electronic Health Record (EHR) market is highly fragmented, characterized by the presence of numerous players, including both global and domestic companies. Doctors App, Epic Systems Corporation, Oracle Health (Cerner), KareXpert, Athenahealth, eClinicalWorks, Allscripts (Veradigm), MEDITECH, Practo Technologies Pvt. Ltd., DocEngage Informatics, and many others.

- Product Launch: In January 2025, IntelligentDX is a healthcare technology company offering EMR/EHR, based in Pune, Maharashtra, India. It plans to expand with its Smart AI-Powered Software to transform US Healthcare and RCM with its Intelligent EHR/EMR solutions.

India Electronic Health Records (EHR) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| India Electronic Health Records (EHR) Market Size in 2025 | USD 1.064 billion |

| India Electronic Health Records (EHR) Market Size in 2030 | USD 2.513 billion |

| Growth Rate | CAGR of 18.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in the India Electronic Health Records (EHR) Market |

|

| Customization Scope | Free report customization with purchase |

India Electronic Health Records (EHR) Market Segmentation:

- By Product

- On-Premise

- Cloud-Based

- By Type

- Acute

- Ambulatory

- Post-Acute

- By End-User

- Hospitals

- Clinics

- Pharmacies

- Laboratories

- Others

Our Best-Performing Industry Reports:

- Healthcare Natural Language Processing (NLP) Market

- Healthcare Compliance Software Market

- Healthcare Data Storage Market