Report Overview

United Kingdom Electronic Health Highlights

United Kingdom Electronic Health Record (EHR) Market Size:

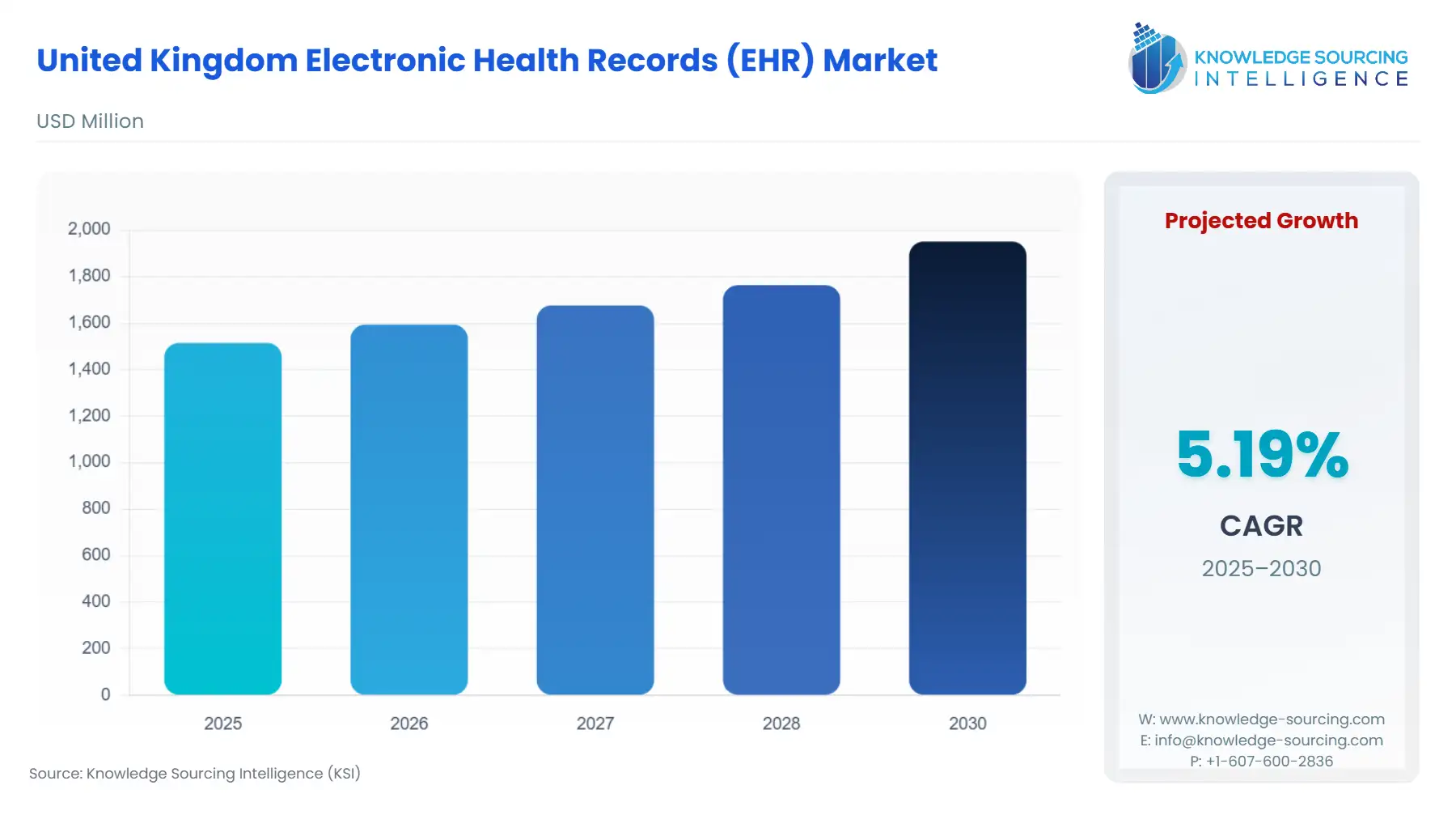

The United Kingdom electronic health record (EHR) market is projected to expand from USD 1.515 billion in 2025 to USD 1.951 billion by 2030, growing at a CAGR of 5.19%.

United Kingdom Electronic Health Record (EHR) Market Key Highlights:

- The United Kingdom EHR market is estimated to grow due to diverse factors such as the country's push towards digital modernization with the introduction of diverse programs, initiatives that promote the EHR system across both primary and secondary healthcare in the country.

- Moreover, the EHR is growing in demand as it reduces the workload for administration, along with streamlining the workflow while also improving the data accuracy with a reduction in errors, which boosts the patient health outcomes.

United Kingdom Electronic Health Record (EHR) Market Overview & Scope

The United Kingdom Electronic Health Record (EHR) Market is segmented by:

- Product: The cloud-based HER is expected to grow at a fast pace in the product segment, driven by demand for web-based services in the country and reduced installation and maintenance costs involved with this product type.

- Type: The ambulatory care segment is predicted to hold a significant market share. This is due to a rise in the shift towards outpatient care among the population of the country in order to decrease the crowding in hospitals.

- End User: The hospital segment is projected to hold a substantial share in the end-user segment of the United Kingdom EHR market due to the segment producing a large volume of patient health data, which leads to increased demand for EHR solutions for effectively managing patient data records.

United Kingdom Electronic Health Record (EHR) Market Growth Drivers vs. Challenges

Drivers:

Challenges:

- High Data Privacy and Security Concern: The cybersecurity risk, along with patient-sensitive data breaches, increases concern over patient data protection, which could slow down the HER adoption process in the country, hindering the market expansion.

United Kingdom Electronic Health Record (EHR) Market Competitive Landscape

The market is fragmented, with many notable players, including Medical Information Technology, Inc., GE HealthCare, Secure Clinic, Pabau, Oracle, Leidos, Dedalus, Cegedim, and Altera Digital Health Inc., among others.

- Oracle Health HER Integration: In May 2024, North West London ICS's acute care announced the completion of the integration of Oracle Health EHR. These acute care facilities are enabled by EHRs for the viewing of patient information in real time and thereby making better decisions and better coordination of care. The domain is shared by 12 acute care facilities, serving approximately 2.4 million people, giving the very first opportunity for collaboration amongst four NHS Trusts in the joint sharing of one EHR domain. Additionally, the Oracle Health EHR has been rolled out at London North West University Healthcare NHS Trust and The Hillingdon Hospitals NHS Foundation Trust, in addition to the existing EHR domain in operation at Chelsea, Westminster Hospital NHS Foundation Trust, and Imperial College Healthcare NHS Trust. On days of peak utilization, the users of EHR can go up to 7600 in numbers.

United Kingdom Electronic Health Record (EHR) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| United Kingdom Electronic Health Records (EHR) Market Size in 2025 | USD 1.515 billion |

| United Kingdom Electronic Health Records (EHR) Market Size in 2030 | USD 1.951 billion |

| Growth Rate | CAGR of 5.19% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in the United Kingdom Electronic Health Records (EHR) Market |

|

| Customization Scope | Free report customization with purchase |

United Kingdom Electronic Health Record (EHR) Market Segmentation:

- By Product

- On-Premise

- Cloud-Based

- By Type

- Acute

- Ambulatory

- Post-Acute

- By End-User

- Hospitals

- Clinics

- Pharmacies

- Laboratories

- Others

Our Best-Performing Industry Reports:

- Healthcare Natural Language Processing (NLP) Market

- Healthcare Compliance Software Market

- Healthcare Data Storage Market