Report Overview

Italy ALD Precursors Market Highlights

Italy ALD Precursors Market Size:

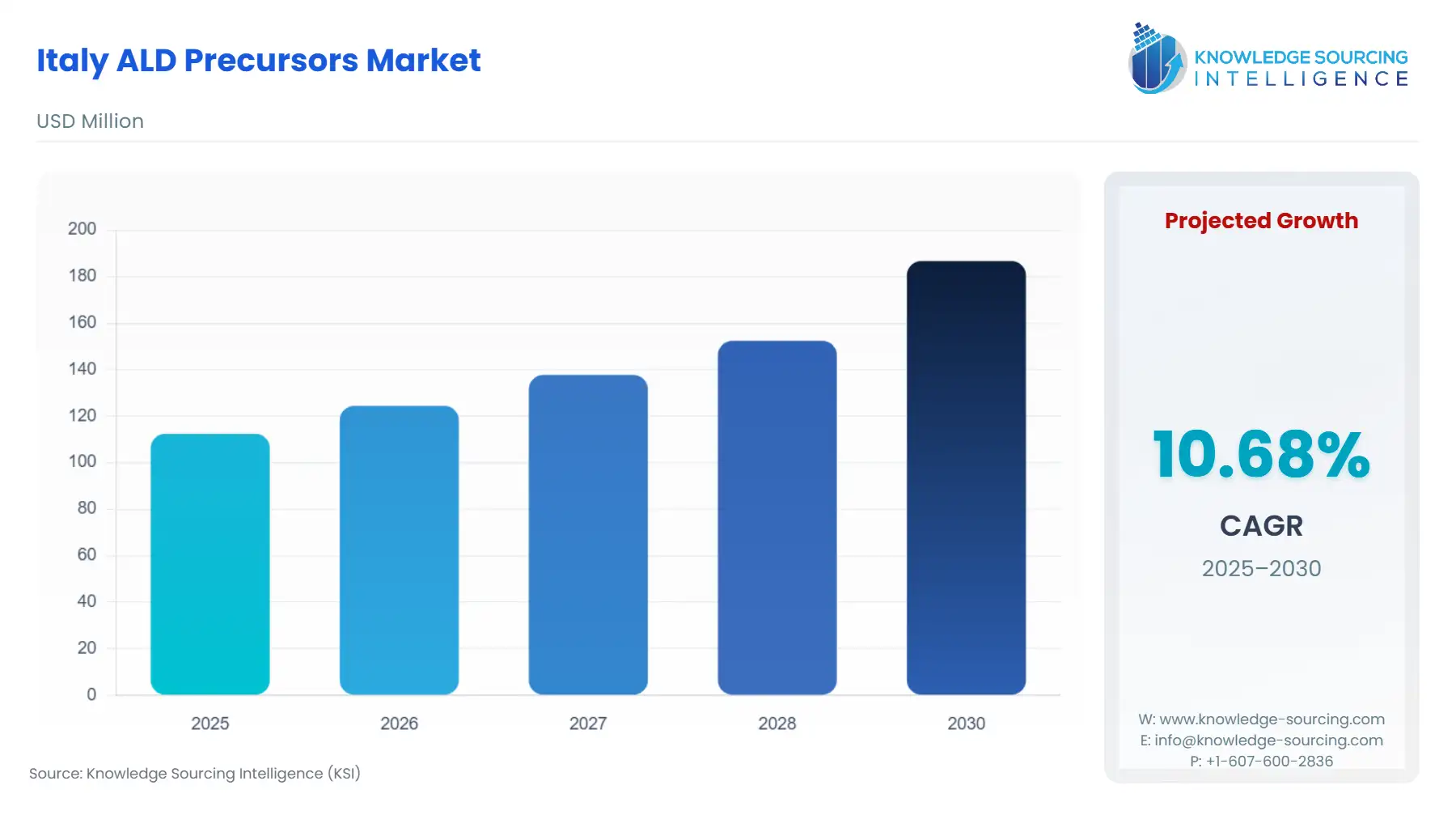

The Italy ALD Precursors Market is anticipated to rise at a CAGR of 10.68%, reaching USD 186.728 million in 2030 from USD 112.435 million in 2025.

________________________________________

Several key industrial shifts drive the Italian ALD precursors market. Italy's commitment to sustainable energy and technological innovation, particularly in the semiconductor and renewable energy industries, has significantly increased demand for ALD precursors. At the same time, the country’s advanced manufacturing capabilities have made it a central player in Europe’s ALD market. Technological progress, along with governmental regulatory frameworks, continues to shape the landscape, creating both opportunities and challenges for stakeholders.

________________________________________

Italy ALD Precursors Market Analysis:

Growth Drivers

- Semiconductor Industry Demand: Italy has a strong presence in the European semiconductor manufacturing ecosystem. As the semiconductor industry progresses toward smaller nodes and higher performance, there is an increasing need for precise deposition of thin films, which ALD technologies enable. Materials such as high-k dielectrics, conductive metals, and interlayer dielectrics, crucial for semiconductor fabrication, require specialized ALD precursors. The growing demand for advanced electronics, from consumer devices to automotive applications, propels the need for ALD in Italy.

- Advances in ALD Technology: Technological advancements, including Plasma-Enhanced ALD (PE-ALD) and Roll-to-Roll ALD, are changing the ALD landscape. PE-ALD enhances process efficiency and scalability, enabling industries to deposit uniform layers at lower temperatures, particularly important for energy storage applications like lithium-ion batteries. Roll-to-Roll ALD, which allows continuous processing of thin films, is gaining traction in photovoltaic production and flexible electronics. These technologies necessitate the development of highly specialized precursors, increasing demand within Italy’s industrial landscape.

- Renewable Energy Transition: Italy has long been a leader in renewable energy, particularly solar energy. With solar power playing a pivotal role in Italy’s commitment to the EU’s Green Deal and carbon reduction goals, the demand for high-efficiency solar cells has surged. ALD processes are essential for the fabrication of thin-film photovoltaic materials, where uniformity and precision are crucial. The development and scaling up of solar power installations drive the demand for ALD precursors in Italy, providing significant growth opportunities.

- Regulatory Pressures and Sustainability Goals: Italy’s regulatory framework is heavily influenced by EU regulations, which emphasize sustainability and carbon reduction. Industries, particularly automotive and energy storage, are under increasing pressure to adopt cleaner technologies. ALD precursors are pivotal in enhancing the performance of energy storage systems such as batteries and supercapacitors, which are key to Italy's decarbonization strategies. As a result, the increasing adoption of ALD in these sectors boosts precursor demand.

- Focus on Advanced Materials: The need for materials with highly specific properties—such as precise conductivity, barrier protection, and high-temperature stability—drives the demand for ALD. Industries in Italy, especially electronics and automotive, increasingly require these materials in their manufacturing processes. ALD is critical for creating films that improve performance and durability in components like memory chips, transistors, and electric vehicle batteries, fueling the precursor market.

Challenges and Opportunities

- Supply Chain Constraints: Italy's reliance on international supply chains for high-purity chemicals and ALD precursors, particularly from Asia, introduces a level of vulnerability. Geopolitical tensions, such as trade restrictions or natural disasters, can lead to fluctuations in material availability and pricing. The increased global demand for high-performance ALD materials further exacerbates these supply risks, creating potential cost pressures for Italian manufacturers.

- Volatility in Raw Material Pricing: The pricing of ALD precursors, which are primarily derived from metals, organometallic compounds, and halides, is sensitive to fluctuations in raw material costs. Price volatility in these materials, driven by factors such as scarcity, environmental regulations, and demand spikes, may lead to unpredictable cost increases for end-users in Italy. Companies will need to navigate these fluctuations carefully, potentially by diversifying supplier sources or investing in local production capacity.

- Opportunities in Energy Storage: The necessity for energy storage technologies, particularly lithium-ion batteries, is rising as Italy moves toward electric vehicle adoption and renewable energy integration. ALD’s ability to enhance battery performance—by improving electrode stability and increasing energy density—has created new opportunities in this sector. As the Italian government implements policies to incentivize EV adoption and energy storage infrastructure, the demand for ALD precursors in this space is expected to increase.

- Growing Demand in Healthcare: ALD is gaining traction in the healthcare sector for its role in enhancing the performance of medical devices and implants. Thin films deposited by ALD can improve biocompatibility and functionality in critical medical devices, including drug delivery systems and sensors. This growing trend in medical technology applications presents an emerging growth driver for ALD precursors in Italy.

Raw Material and Pricing Analysis

Italy’s ALD precursor market relies heavily on the availability of high-purity chemicals, particularly metal-organic precursors and halide-based materials. The production of these raw materials is concentrated in specialized regions, primarily in Asia and North America, with a few European suppliers. Pricing dynamics are influenced by fluctuations in the cost of base metals, regulatory compliance in raw material extraction, and environmental considerations. Supply chain interruptions or delays in the transportation of these raw materials, combined with the increasing global demand, can result in price volatility for ALD precursors in Italy.

Supply Chain Analysis

The global supply chain for ALD precursors is complex and highly specialized. Key production hubs are located in North America (primarily the United States), Europe (Germany, France), and Asia (China, Japan, South Korea). Italy’s dependence on these regions for precursor materials introduces logistical challenges, particularly in the transportation of high-purity chemicals. Given the stringent quality control measures required for ALD precursor materials, transportation must comply with strict standards to prevent contamination. Geopolitical risks, trade disputes, and natural disasters in major precursor-producing regions can create disruptions, posing risks to the steady flow of ALD materials into Italy.

Government Regulations:

|

Jurisdiction |

|

Key Regulation / Agency |

Market Impact Analysis |

|

EU |

|

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) |

REACH regulations ensure that ALD precursors meet stringent environmental and safety standards, creating demand for safer materials in Italy. |

|

Italy |

|

Ministry of the Environment and Energy Security |

Italy's national regulations on sustainable practices push industries to adopt greener technologies, increasing the need for ALD in clean tech. |

|

Italy |

|

Ministry of Economic Development |

Incentives for clean energy and advanced manufacturing processes boost demand for ALD technologies, particularly in renewable energy and electronics. |

Italy ALD Precursors Market Segment Analysis:

- By Application: High-k Dielectric

High-k dielectric materials are essential in semiconductor manufacturing, where miniaturization and performance improvements drive the need for advanced materials. These materials, which include hafnium oxide (HfO?), are critical for creating thin, high-performance insulating layers in transistors. In Italy, the increasing need for advanced semiconductors, driven by sectors like consumer electronics, automotive, and telecommunications, directly influences the demand for high-k dielectric ALD precursors. As semiconductor manufacturers in Italy move toward smaller geometries and enhanced chip performance, the role of ALD in producing these films becomes more pivotal, further fueling demand for high-k dielectric precursors.

- By End-User: Electronics & Semiconductors

The electronics and semiconductor sectors are among the largest consumers of ALD precursors in Italy. As Italy continues to position itself as a leader in Europe’s electronics manufacturing industry, there is a growing demand for precision materials in semiconductor production. ALD precursors are crucial for fabricating advanced semiconductor devices, such as memory chips, logic devices, and power electronics. The increasing push for more powerful and energy-efficient devices, along with the growing shift toward 5G telecommunications infrastructure, propels the demand for ALD-based solutions in this segment.

________________________________________

Italy ALD Precursors Market Competitive Analysis:

- Air Liquide

Air Liquide is a key player in the global ALD precursor market, with a significant presence in Italy. The company specializes in the supply of high-purity gases and chemicals for semiconductor and electronics manufacturing. Air Liquide has been enhancing its production capacity in Italy to meet the growing demand from industries like automotive, semiconductor, and energy storage. The company’s focus on sustainability and eco-friendly solutions positions it well within Italy’s regulatory framework, where green technology adoption is accelerating.

- Merck KGaA

Merck KGaA is a leading supplier of ALD precursors globally, offering a broad portfolio of chemicals used in semiconductor and energy storage applications. In Italy, Merck KGaA serves a wide range of industries, including electronics, energy, and healthcare. The company’s strategy of expanding its local production facilities and deepening its research into next-generation materials places it at the forefront of the Italian ALD precursor market.

________________________________________

Italy ALD Precursors Market Developments:

- May 2024: Hanwha Precision Machinery launched the I2FIT-Mo thermal ALD system in May 2024, designed for molybdenum deposition in semiconductor interconnects, enhancing chip performance by lowering resistivity. Distributed in Italy via local fab integrations, it supports high-volume production for 3nm nodes, integrating with existing precursor lines for Mo(CO)6. The system improves throughput notably, addressing EU Chips Act demands for domestic advanced manufacturing, and is projected to capture Europe's ALD tool market by 2025.

________________________________________

Italy ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 112.435 million |

| Total Market Size in 2031 | USD 186.728 million |

| Growth Rate | 10.68% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

Italy ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others