Report Overview

Japan AI in Art Highlights

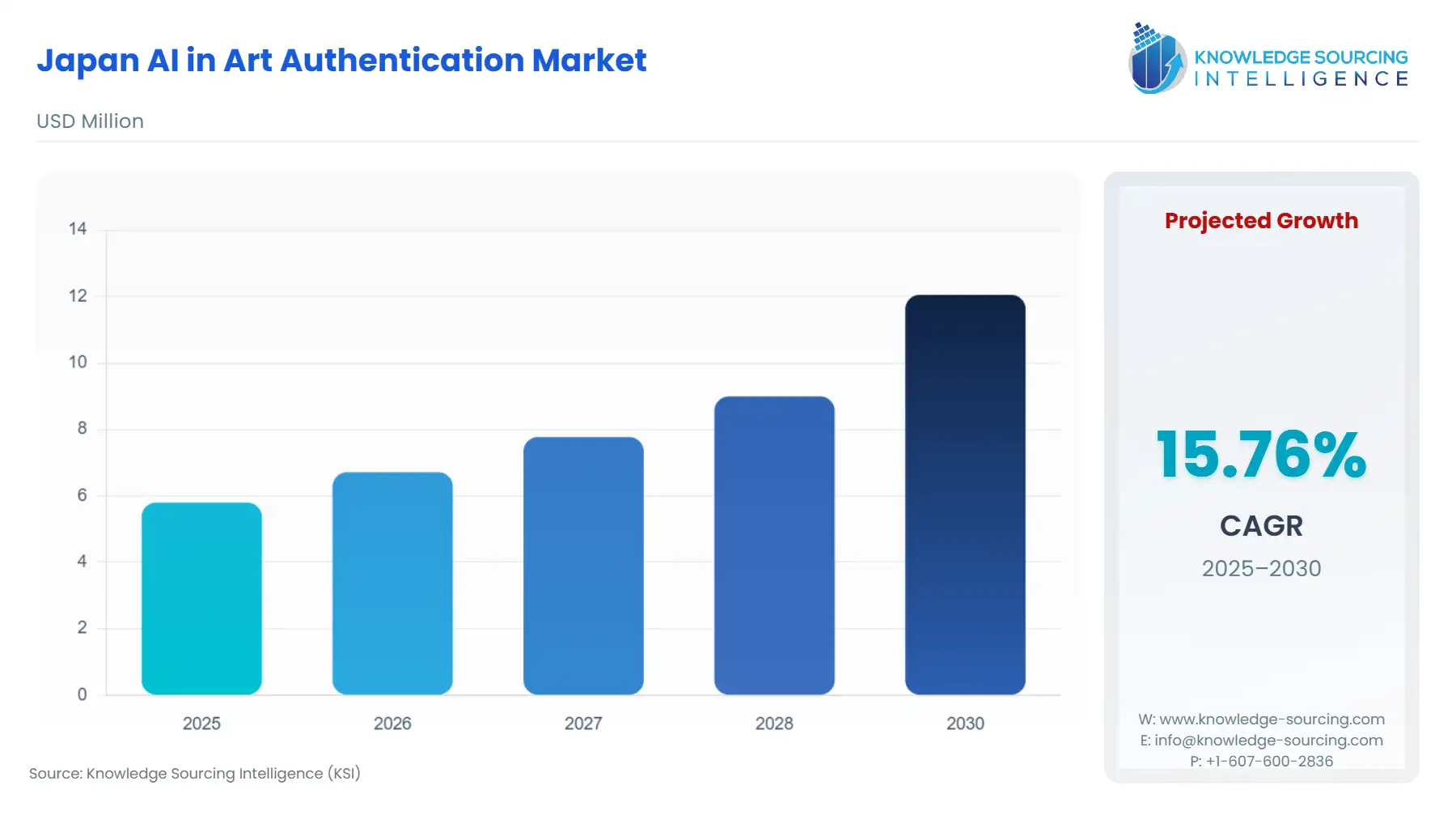

Japan AI in Art Authentication Market Size:

Japan AI in Art Authentication Market is set to grow from USD 5.7996 million in 2025 to USD 12.05453 million by 2030, at a CAGR of 15.76%.

The Japanese art authentication landscape is undergoing a critical transformation, moving from traditional expert-led verification to technologically augmented methods centered on Artificial Intelligence. This shift is an imperative response to the increasing sophistication of global art forgery and the market's non-negotiable requirement for enhanced transparency and trust. The inherent limitations of subjective human expertise—scalability constraints and potential for unconscious bias—are actively driving major art institutions and private collectors in Japan toward objective, data-driven AI systems. The market for AI in Art Authentication is defined by the confluence of advanced deep learning algorithms, capable of analyzing subtle stylistic and material fingerprints, and the financial necessity to mitigate risk in high-value transactions.

Japan AI in Art Authentication Market Analysis

Growth Drivers

- The escalating global prevalence of sophisticated art forgery acts as the primary growth catalyst, compelling Japanese art institutions and market intermediaries to adopt non-traditional verification methods. AI-driven machine vision and deep learning algorithms, which can identify minute brushstroke patterns and chemical compositions invisible to the human eye, directly address the need for a higher, objective evidentiary standard, thereby creating demand for Art Authentication and Forgery Detection services. Concurrently, the increasing use of blockchain technology for immutable record-keeping necessitates AI for cross-verification of digital and physical assets, directly accelerating demand for AI-based Provenance & Ownership Tracking solutions that seamlessly link a physical artwork's characteristics to its digital history.

Challenges and Opportunities

A primary challenge is the lingering scepticism among conservative Art Institutions, which traditionally rely on decades-long connoisseurship, posing a headwind to immediate AI adoption, thus constraining initial demand volume. This is compounded by the lack of universally standardized protocols for AI-generated authenticity reports, which introduces friction in the appraisal and insurance segments. However, a significant opportunity exists in the transition to Valuation, Restoration and Condition Analysis, where AI's objective analysis of an artwork's physical state and material degradation offers a distinct advantage over human assessment. This technological superiority drives a specific demand from insurance firms and conservation labs for AI systems capable of predictive deterioration modeling and automated condition reports.

Supply Chain Analysis

The Japanese AI in Art Authentication market supply chain is primarily software-centric, relying on a global network for core algorithmic development and a specialized, localized network for domain data acquisition. The global supply chain involves hyperscale cloud providers for computational power (GPU access) and non-Japanese AI development firms (e.g., Art Recognition AG, Verisart) specializing in core computer vision and deep learning models. The critical complexity lies in the localized dependency for high-resolution, authenticated data sets of Japanese masterpieces, which remain heavily guarded by domestic Art Institutions and are non-fungible. This data localization bottleneck mandates strategic partnerships between foreign AI vendors and local research bodies to train AI models effectively on culturally and historically specific artistic materials, which in turn elevates the value of domestic firms like Sakana AI and Qosmo. Logistical complexity is minimal, as the primary 'material'—high-resolution digital imagery—is transmitted via secure cloud infrastructure, prioritizing data security and intellectual property protection over physical logistics.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Japan | AI Promotion Act (Enacted 2025) / AI Strategic Headquarters | The Act’s "light-touch" regulatory philosophy and non-punitive focus on ethical AI development significantly de-risks private sector investment in AI-as-a-Service models, directly stimulating supply-side innovation and encouraging commercial adoption by minimizing compliance overhead. |

| Japan | Cultural Property Protection Act (Relevant Framework) / Agency for Cultural Affairs | While not directly regulating AI, the established framework for protecting and certifying cultural properties emphasizes verifiable documentation. AI-powered Provenance & Ownership Tracking systems satisfy the need for robust, digital, and tamper-proof records, aligning with the regulatory spirit and thereby boosting demand. |

Japan AI in Art Authentication Market Segment Analysis

- By Application: Art Authentication and Forgery Detection

The Art Authentication and Forgery Detection segment experiences the most immediate and pronounced surge in demand due to its direct role in mitigating catastrophic financial risk. The sophistication of modern forgeries, often replicating aged pigments and historical canvas structures, has pushed human connoisseurship to its limits. AI-powered systems respond to this imperative by providing an objective, statistically measurable basis for authentication. Its necessity is driven by two key factors: the need for non-invasive analysis and the imperative for scalability. AI models utilize high-resolution photographic and multi-spectral imaging data to analyze micro-features like the artist's unique 'micro-strokes' and pigment layer sequence, eliminating the need for physically disruptive sampling. This non-invasive nature is highly valued by museums and conservative collectors. Furthermore, the capacity of deep learning to instantly compare a questioned artwork against a database of thousands of authenticated works provides a crucial scalability factor for major auction houses and insurers, directly increasing demand for rapid, high-volume verification.

- By End-User: Art Market Intermediaries

Art Market Intermediaries—including auction houses, galleries, insurers, and art-secured lenders—represent a high-impact demand segment, as their professional liability is directly tied to the authenticity of the assets they trade or underwrite. For auction houses, the integration of AI-as-a-Service (AI-aaS) for pre-sale verification creates a demonstrable competitive advantage, signaling diligence and increasing buyer confidence, which is an immediate growth driver. Insurers use AI authentication reports to accurately price risk, effectively reducing the overall cost of insuring high-value collections and thus driving demand for these services as a necessary component of the underwriting process. Lenders offering art-secured loans rely on AI verification for collateral due diligence, transforming a highly subjective asset into a standardized, machine-verified financial instrument. This financialization of art, enabled by AI's objectivity, creates consistent demand for API integration models that allow intermediaries to embed authentication into their existing transaction platforms.

Japan AI in Art Authentication Market Competitive Environment and Analysis

The Japanese AI in Art Authentication market is a competitive ecosystem characterized by a blend of domestic AI innovators and specialized international art technology firms. Competition centers on the verifiable accuracy of proprietary algorithms, the size and quality of the training data set, and the strategic positioning of the service model (e.g., AI-as-a-Service vs. on-demand reporting). Domestic players like Sakana AI focus on foundational model innovation, leveraging Japan’s advanced AI R&D ecosystem, while international firms specialize in the art-specific application layer. The recent consolidation through mergers indicates a market maturity toward creating a comprehensive, hybrid service model that integrates data science with traditional material analysis.

- Art Recognition AG: This Swiss technology firm is strategically positioned as a purveyor of pure, objective, AI-based authentication reports. Its core product is an award-winning, proprietary deep learning system that verifies artwork authenticity solely based on a photograph. Art Recognition's positioning is rooted in providing a rapid, cost-effective, and 100% objective evaluation that eliminates human bias. The company emphasizes its peer-reviewed technology and its non-invasive, digital workflow, making its AI authentication report a fast, first-line-of-defense tool highly attractive to international buyers and online platforms seeking a verifiable, digital authenticity certificate without the logistics of moving the physical asset.

- Hephaestus Analytical: The company positions itself at the high end of the market, offering the "world's highest evidentiary standard" in art authentication through a multi-layered protocol that integrates AI (their proprietary 'Pictology' machine learning algorithms) with traditional provenance research and advanced chemical analysis. Hephaestus Analytical's strategic merger with ArtDiscovery in 2025 significantly bolstered its capability to offer a full-spectrum service, combining a world-leading scientific lab with AI-driven objectivity. Their unique selling proposition includes Blockchain-secured digital records for authenticated artworks, ensuring indelible linkage and forgery-proof certification, directly targeting the high-net-worth collector and the art-finance sector, where financial certainty is paramount.

Japan AI in Art Authentication Market Developments

- January 2025: Hephaestus Analytical, a firm specializing in AI (Pictology) and chemical analysis for authentication, merged with ArtDiscovery, a leading laboratory. This strategic merger is a major capacity addition for the combined entity, creating a global platform that offers a hybrid, end-to-end authentication service. The integration of high-level scientific testing with proprietary AI technology establishes a new, higher standard for due diligence, directly addressing the market's need for holistic and legally defensible authenticity reports.

- March 2024: The Tokyo-based startup, Sakana AI, announced the launch of three new AI models, including the open-sourced EvoLLM-JP (a Japanese Large Language Model), EvoVLM-JP (Vision-Language Model), and EvoSDXL-JP (an Image Generation Model). These models were developed using an innovative "model merging" technique, achieving enhanced performance on Japanese-specific data. This development is significant as it provides foundational, locally optimized vision-language models, which are the building blocks for sophisticated AI in art authentication systems, specifically enhancing the ability to analyze and interpret Japanese artistic styles, scripts, and historical texts relevant to provenance.

Japan AI in Art Authentication Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.7996 million |

| Total Market Size in 2031 | USD 12.05453 million |

| Growth Rate | 15.76% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Service Model, End-User |

| Companies |

|

Japan AI in Art Authentication Market Segmentation:

- BY APPLICATION

- Introduction

- Art Authentication and Forgery Detection

- Provenance & Ownership Tracking

- Valuation, Restoration and Condition Analysis

- BY SERVICE MODEL

- Introduction

- AI-as-a-Service

- On-Demand Authentication Services

- API integration

- BY END-USER

- Introduction

- Art Institutions

- Art Market Intermediaries

- Private Stakeholders