Report Overview

Lab Automation Market - Highlights

Lab Automation Market Size:

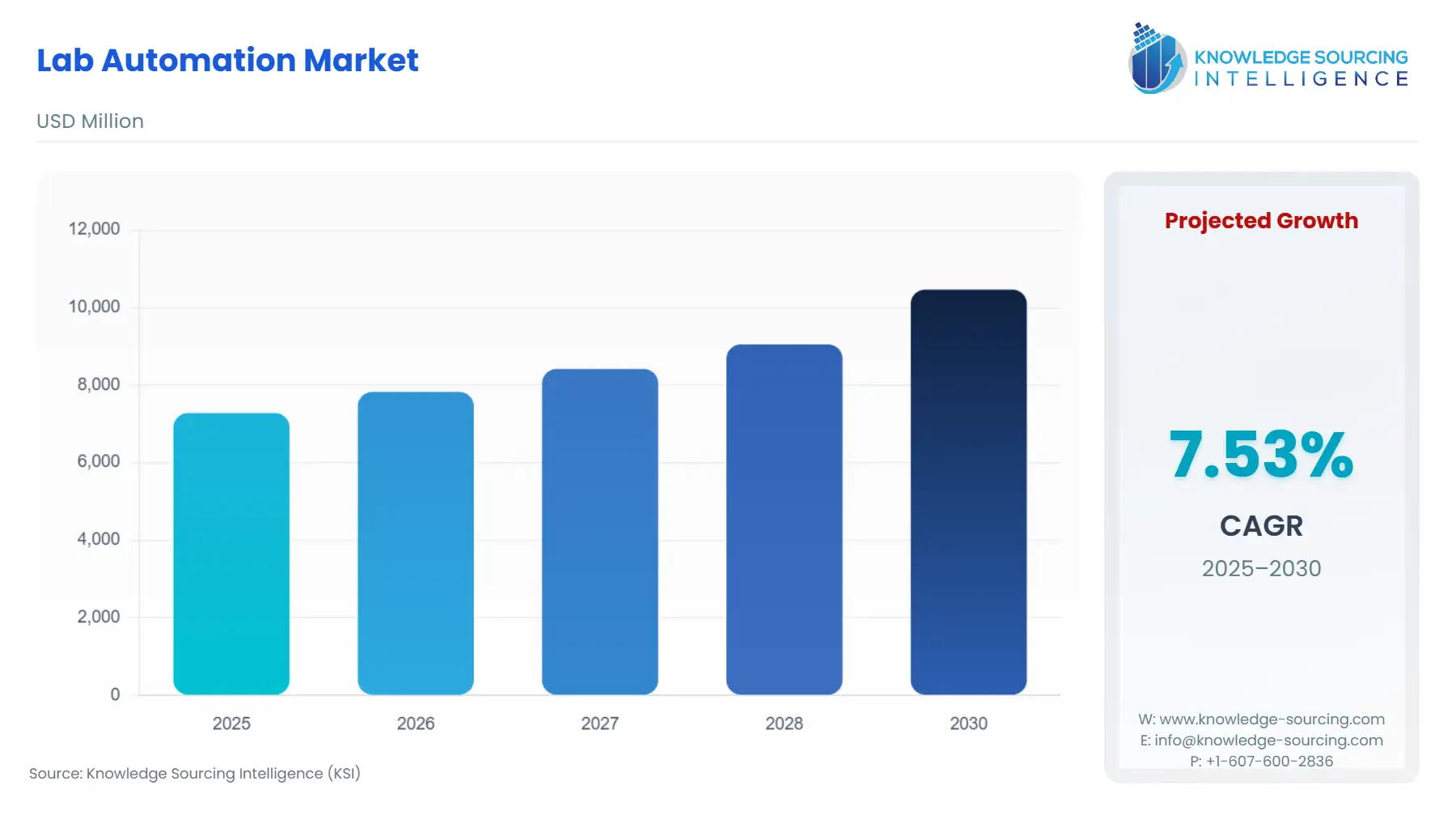

The lab automation market is forecasted to expand at a 7.3% CAGR, growing from USD 7.280 billion in 2025 to USD 11.113 billion in 2031.

Lab Automation Market Key Highlights:

The lab automation market is predicted to hold a significant market share during the forecast period. Automation in the laboratory utilizes new technology to speed up or replace manual manipulation of lab procedures and tools. The amount and extent of automation are chosen based on the laboratory process. Additionally, academic and research institutes are using automated instruments more frequently to cut down the time spent on various chores and increase overall production.

Lab Automation Market Drivers:

Growth drivers for the lab automation market

The worldwide advancement in technology is driving up demand for the lab automation industry. Tools and equipment for lab automation are utilised in the healthcare industry. The top pharmaceutical and healthcare corporations automate the labs to provide cutting-edge healthcare services at the door in a shorter period. During the projection period, it is also predicted that the increasing usage of automated instruments for drug discovery and development would fuel lab automation market growth.

Miniaturization to show significant market growth potential

An important factor driving the worldwide lab automation industry is the rise in demand for process miniaturisation. The use of automated technologies in clinical laboratories is driven by the need to speed up the miniaturisation of research methods to find answers for a variety of challenging lab automation problems in fields like microbiology, biotechnology, and clinical chemistry. Additionally, miniaturisation facilitates cell expansion, monitoring, and cultivation, which reduces turnaround times, especially in point-of-care settings.

Increasing utilization of automated storage systems

Using automated storage and retrieval systems helps in improving inventory control. When using manual inventory control, an operator often checks the inventory to get relevant data. By completely enclosing the inventory, automated storage and retrieval systems (ASRS) keep it safe, secure, and under control. ASRS helps to find lost or stolen items, increasing accountability and security and reducing inventory shrinkage.

Modular automation systems show growth potential

Modular automation systems' flexibility features are responsible for increasing lab automation market growth. Modular automation systems are appropriate for laboratories that require automation for particular procedures. These automation systems are anticipated to increase as a result of the growing demand for innovative automation systems and their capacity to provide customisation services based on laboratory requirements. These systems work effectively in laboratories with high volumes and provide accurate quality control standards.

Usage of automated liquid handling systems

The laboratory automation industry is predicted to be dominated by automated liquid handling systems. Academic laboratories as well as pharma and biotech labs have boosted their use of liquid-handling equipment. Market players are incorporating the most recent features into automatic liquid handling technology, which is continuously developing. The newly launched automated liquid handling systems combine cutting-edge features, adaptability, and user-friendliness while maintaining a clean, clear aesthetic.

The continuous flow process is being used largely by labs

The continuous flow lab automation market is anticipated to have the highest revenue share. The rising demand for continuous flow systems in industries and the increasing usage of continuous flow in labs for the provision of high-quality services are responsible for higher revenue growth. Additionally, continuous flow is one of the most popular procedures and is appropriate when a lot of samples need to be analysed. Furthermore, the pharmaceutical and biotechnology industries' strong demand for continuous flow processes and market participants' growing attempts to launch innovative products using continuous flow processes are expected to fuel lab automation market growth.

Lab Automation Market Geographical Outlook:

The North American lab automation market is anticipated to grow significantly.

The presence of an established healthcare system and the strong need for automation systems throughout laboratories due to speed, uniformity, and precision are factors involved in the North American lab automation industry rapid growth. The lab automation market in the Asia Pacific region is also predicted to have a large market share. Rising investment by market leaders for product innovation in the Asia Pacific region and an increasing number of laboratories are the key market drivers. Another aspect promoting the growth of the regional industry is the favourable government regulations for lab automation.

Increasing investment and product innovation by key players

The growing demand for specialised, cutting-edge automated services that do not rely on human mistakes is driving the growth of the laboratory automation market. Growing investment in cutting-edge technology and product innovation are key strategies used by market players. These players are more concerned with minimising manual labour and hands-on time for customarily time-consuming operations propelling the lab automation market growth.

Lab Automation Market Key Developments:

In May 2023, Accuris Instruments AutoMATE 96 by Benchmark Scientific was released by Scientific Laboratory Supplies.

In February 2023, a leading provider of lab automation services Automata announced its expansion in the United States.

In January 2023, Becton, Dickinson and Company (BD) introduced a third-generation lab automation system.

In March 2022, a potent remedy for manual sample preparation and data management bottlenecks in clinical flow cytometry has been made available by Beckman Coulter Life Sciences, a global leader in life sciences lab automation and innovation and a subsidiary of Danaher Corporation.

List of Top Lab Automation Companies:

QIAGEN

PerkinElmer Inc.

Thermo Fisher Scientific, Inc.

Siemens Healthcare GmbH

Danaher

Lab Automation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Lab Automation Market Size in 2025 | USD 7.280 billion |

Lab Automation Market Size in 2030 | USD 10.467 billion |

Growth Rate | CAGR of 7.53% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Lab Automation Market |

|

Customization Scope | Free report customization with purchase |

Lab Automation Market Segmentation

By Process

Continuous Flow

Discrete Flow

By Application

Photometry & Fluorometry

Immunoassay Analysis

Electrolyte Analysis

Others

By Automation

Total Automation Systems

Modular Automation Systems

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others