Report Overview

LiDAR For ADAS Market Highlights

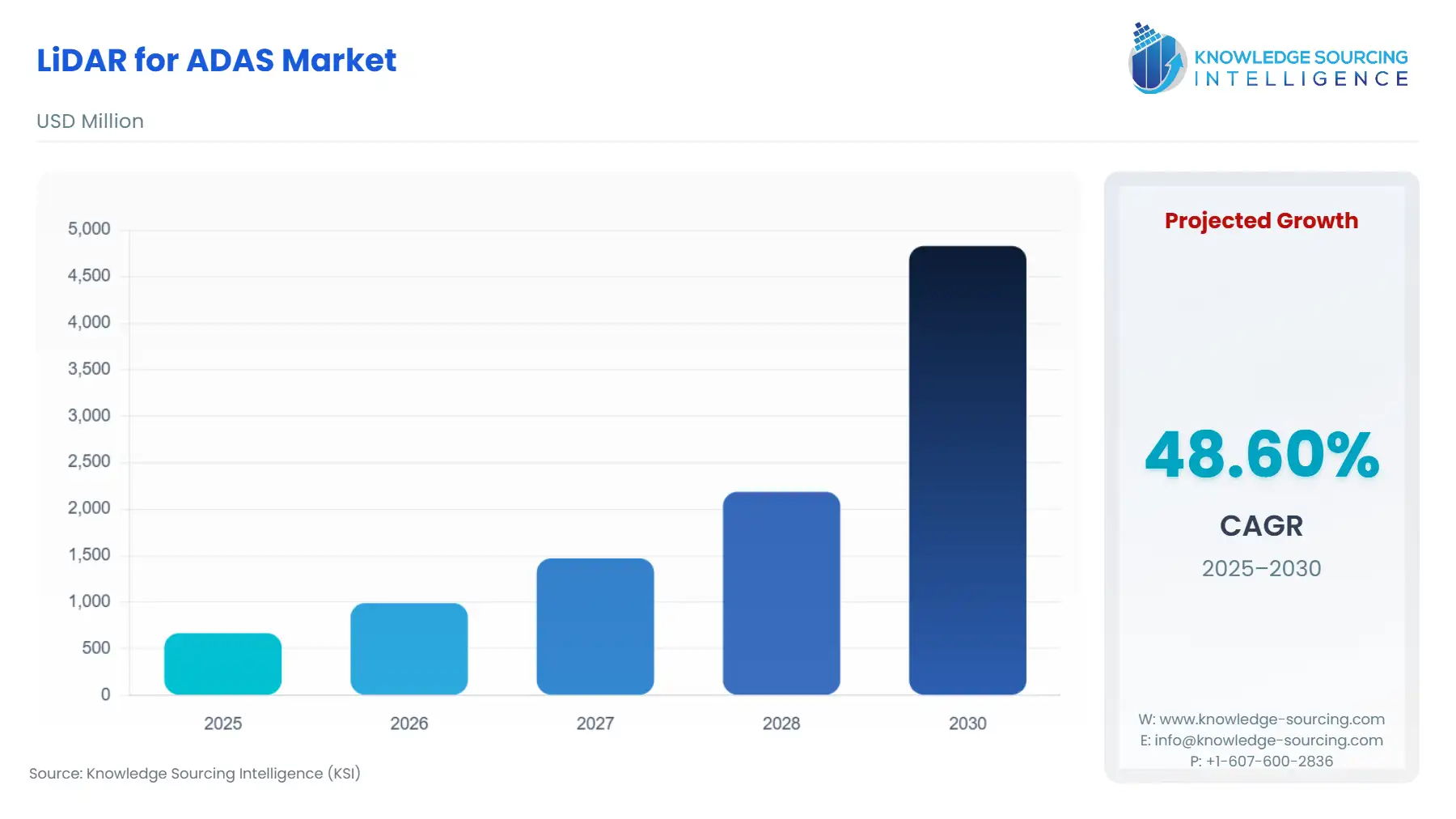

LiDAR For ADAS Market Size:

The LiDAR for ADAS market is expected to grow from USD 666.566 million in 2025 to USD 4,829.196 million in 2030, at a CAGR of 48.60%.

The integration of Light Detection and Ranging (LiDAR) technology into Advanced Driver Assistance Systems (ADAS) fundamentally redefines the perception stack of modern vehicles. LiDAR operates by emitting laser pulses and measuring the return time, generating a high-resolution, three-dimensional point cloud that accurately maps the surrounding environment regardless of ambient light conditions. This capability provides the spatial depth and geometric precision necessary for the safe functional execution of higher-level ADAS features. The need for LiDAR is not intrinsic but is entirely derived from the OEM imperative to deploy commercially viable, safety-certified Level 3 highway autonomy and the market's continuous drive to enhance critical Application segments like Automatic Emergency Braking (AEB) and Object Detection & Collision Avoidance.

LiDAR For ADAS Market Analysis

- Growth Drivers

The global deployment of semi-autonomous driving capabilities, primarily Level 3 systems, is the key market catalyst, as these systems fundamentally require LiDAR’s precise 3D object detection for safe, hands-free operation. This technological shift directly generates demand for robust, reliable, and high-resolution Solid-State LiDAR. Furthermore, the phased implementation of government safety mandates, such as the EU's GSR2, drives OEM compliance in safety-critical applications like Automatic Emergency Braking (AEB). This regulatory floor increases the volume demand for LiDAR as a redundant sensor that effectively augments camera/radar systems, particularly in detecting vulnerable road users like pedestrians and cyclists in adverse lighting.

- Challenges and Opportunities

The primary market constraint is the persistently high system cost, where the Average Selling Price (ASP) of an automotive-grade LiDAR unit often exceeds commercial viability for non-premium Passenger Vehicles. This high cost creates a major headwind for Level 2 volume adoption. However, this challenge simultaneously creates a significant opportunity in the Technology segment by accelerating the transition to lower-cost manufacturing processes like Silicon Photonics and Micro-Electro-Mechanical Systems (MEMS) scanning, which underpin Solid-State LiDAR. Furthermore, the opportunity lies in developing AI-powered perception software (Luminar Sentinel) that tightly integrates the LiDAR point cloud with camera data, maximizing the functional value of the sensor and securing OEM design wins.

- Raw Material and Pricing Analysis

The pricing of Solid-State LiDAR systems is critically dependent on three key semiconductor components: Laser Diodes (VCSEL or Edge-Emitting Lasers), Photodetectors (SPAD or APD arrays), and the ASIC (Application-Specific Integrated Circuit) required for signal processing. The transition to 905nm and 1550nm InGaAs (Indium Gallium Arsenide) photodetectors for longer-range performance maintains a high cost structure due to complex, low-yield fabrication processes. Mass adoption is predicated on industrializing Silicon Photonics technology, which integrates light emitters and detectors onto a single silicon chip, drastically reducing component count and material cost. This industrialization is the critical determinant for dropping the unit price below the OEM threshold for widespread integration in Passenger Vehicles.

- Supply Chain Analysis

The supply chain for the LiDAR for ADAS market is characterized by a critical Tier-2/Tier-1 dependency structure, where specialized LiDAR sensor manufacturers (Ouster, Luminar, Innoviz) supply validated units to large automotive Tier-1s (Continental, Valeo, DENSO), who then integrate them into the final ADAS domain controller before delivery to the OEM. Key production hubs are concentrated in Asia-Pacific (China, Taiwan, South Korea) for semiconductor components and final assembly capacity, creating logistical complexities around global component sourcing and quality control. The dependency on a few specialized laser diode and photodetector manufacturers introduces a critical single-source risk, making vertical integration or strategic partnerships a competitive imperative for major sensor providers.

LiDAR For ADAS Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

General Safety Regulation (GSR2) Phase Two (Regulation (EU) 2019/2144) |

Increases Performance Demand: Mandates the implementation of advanced safety features like Automatic Emergency Braking (AEB) for pedestrians and cyclists on all new vehicle models from July 2024. This regulatory floor increases the minimum performance standard required for sensor suites, accelerating OEM adoption of LiDAR as it offers superior, unambiguous range and depth data critical for high-confidence VRU detection, especially in low-visibility conditions. |

|

United States |

National Highway Traffic Safety Administration (NHTSA) / New Car Assessment Program (NCAP) |

Drives Feature Enhancement: NHTSA updated its NCAP in November 2024 to include evaluations for enhanced ADAS features like Lane Keeping Assist (LKA) and Pedestrian AEB. While not a direct mandate, inclusion in NCAP ratings strongly compels OEMs to adopt high-performance sensor technologies, like LiDAR, to achieve the coveted 5-star safety rating and maintain competitive differentiation in Passenger Vehicles. |

|

China |

Ministry of Industry and Information Technology (MIIT) / Regulatory Framework for Level 3/4 Autonomy |

Accelerates Commercialization: China’s proactive regulatory approach, which supports pilot programs and road testing for Level 3 and Level 4 autonomous vehicles, provides a massive proving ground for LiDAR deployment. This framework reduces regulatory uncertainty and rapidly accelerates the commercialization and mass-production ramp-up of LiDAR-equipped systems for domestic Passenger Vehicles and autonomous fleet operators. |

LiDAR For ADAS Market Segment Analysis

- By Type: Solid-State LiDAR

The market requirement for Solid-State LiDAR is overwhelmingly driven by the need for a solution that balances high performance with cost-effective mass production and long-term automotive reliability. Traditional Electro-Mechanical LiDAR (spinning-mirror systems) fails to meet the cost and durability thresholds required for high-volume, warranty-backed Passenger Vehicles. Solid-State technology, leveraging either MEMS or Flash architectures, directly addresses this constraint by removing bulk moving parts, improving mean time between failures (MTBF), and reducing the physical size for seamless integration behind the windshield or into vehicle bumpers. This fundamental shift allows suppliers to utilize low-cost, high-volume semiconductor manufacturing techniques, making the sensor scalable for Level 2+ and Level 3 platforms, thereby unlocking substantial volume demand from Tier-1 suppliers and OEMs. The commercial success of any LiDAR company now hinges entirely on its proven ability to industrialize a robust, solid-state design.

- By Vehicle Type: Passenger Vehicles

The Passenger Vehicles segment accounts for the vast majority of current and projected LiDAR unit volume, fueled by the consumer safety and convenience proposition of advanced ADAS. This segment’s growth drivers are split between the high-end need for Level 3 autonomy and the mass-market pull for enhanced Level 2 features. In premium vehicles, LiDAR serves as the critical enabler for conditional autonomy (L3), where the sensor’s superior range and all-weather point-cloud fidelity provide the redundancy required for the system to confidently assume control. In volume segments, the inclusion of LiDAR is driven by the necessity of achieving high scores in international safety assessment programs (Euro NCAP), particularly in Automatic Emergency Braking (AEB) scenarios involving vulnerable road users. OEMs use LiDAR adoption as a clear technological differentiator to command higher prices and secure safety ratings, directly increasing demand for automotive-grade sensors.

LiDAR For ADAS Market Geographical Analysis

- US Market Analysis

The US market is characterized by a strong push from premium automakers and technology players focused on achieving high-end Level 3 and Level 4 functionalities. The primary driver is OEM competition in the luxury and electric vehicle segments to differentiate products with superior hands-off driving capabilities. Regulatory influence is primarily driven by the NHTSA's NCAP program, which incentivizes the adoption of LiDAR to improve the performance of safety-critical systems like Object Detection & Collision Avoidance. The presence of major Silicon Valley and automotive tech hubs also creates significant demand from non-OEM end-users in the Commercial Vehicles segment (e.g., autonomous trucking and robo-taxi fleets), which require the longest-range, highest-reliability LiDAR sensors.

- Brazil Market Analysis

The LiDAR for ADAS market in Brazil is in a nascent phase, with demand restricted almost entirely to the imported, high-end of the Passenger Vehicles segment. Local demand for the LiDAR sensor itself is minimal, as domestic vehicle production remains focused on entry-level and mid-range vehicles where the high unit cost of LiDAR is prohibitive. The market is driven by global OEM decisions to standardize ADAS features across platforms, meaning LiDAR is included as a result of a global build decision rather than local market pull. Commercial Vehicles and mining operations represent a potential, localized demand pocket for specialized Electro-Mechanical LiDAR units used in industrial automation, but this is separated from the mass-market ADAS trend.

- Germany Market Analysis

Germany is a key growth center, strategically important due to the concentration of major global OEMs and Tier-1 suppliers. Market expansion is structurally driven by the necessity to comply with the EU's General Safety Regulation (GSR2), accelerating the fitment rate of LiDAR for safety features like AEB. Furthermore, the competitive focus among German premium OEMs on launching and scaling Level 3 certified vehicles (e.g., automated lane-keeping systems) creates a non-negotiable pull for advanced, high-resolution Solid-State LiDAR. Germany is a critical hub for Electro-Mechanical LiDAR integration into pre-production automated vehicle testing and validation fleets.

- Saudi Arabia Market Analysis

The LiDAR for ADAS demand in Saudi Arabia is highly centralized and policy-driven, stemming from large-scale, state-backed infrastructure projects, such as smart cities, rather than organic mass-market adoption in Passenger Vehicles. While consumer ADAS adoption is limited to imported luxury vehicles, the primary growth driver for LiDAR units is the need for highly accurate 3D mapping and surveillance systems for autonomous public transport and logistical infrastructure. This demand generally targets high-end, long-range Electro-Mechanical LiDAR for initial surveying and early-stage Level 4 Commercial Vehicle piloting programs.

- South Korea Market Analysis

South Korea represents an aggressive early-adopter market for LiDAR in the Passenger Vehicles segment, driven by large domestic IDMs (Integrated Device Manufacturers) and a technology-forward consumer base. The market profile is characterized by a rapid integration of LiDAR into high-volume sedan and SUV models to secure a technological advantage over international competitors. Local demand acts as a crucial proving ground for Solid-State LiDAR technologies, particularly in dense urban environments that require high-object-density resolution for features like Automatic Emergency Braking (AEB) and sophisticated parking assistance systems, accelerating the industry's shift from pilot projects to true HVM.

LiDAR For ADAS Market Competitive Environment and Analysis

The LiDAR for ADAS competitive environment is segmented by technology, with legacy Tier-1s leveraging existing OEM relationships and pure-play sensor manufacturers competing on innovation and cost-per-unit metrics. The industry is rapidly consolidating around OEM design wins for Solid-State LiDAR platforms that can demonstrate proven automotive reliability and scale to hundreds of thousands of units annually.

- Continental AG

Continental AG is strategically positioned as a major Tier-1 system integrator that leverages its long-standing OEM relationships and full-stack ADAS expertise. The company’s strategy involves building redundant sensor suites, integrating its own radar/camera systems with third-party LiDAR technology, such as the partnership with AEye to industrialize a long-range LiDAR sensor (HRL131). Continental minimizes its direct R&D risk while ensuring a high-performance Level 3 offering, with a planned start of production for the AEye-based long-range LiDAR in its German facilities starting in 2024. This ensures they remain a dominant supplier for features like Object Detection & Collision Avoidance.

- Luminar Technologies, Inc.

Luminar Technologies, Inc. is a technology pure-play focused on a 1550nm InGaAs-based Solid-State LiDAR approach (Iris and Halo product lines), targeting premium Level 3 adoption. The company's strategic positioning relies on securing major serial production contracts, such as with Volvo Cars (for the EX90 SUV). Luminar's focus is on scaling production and reducing unit cost, exemplified by the Q1 2024 launch of its facility with TPK Group in Asia for the production of Iris sub-assemblies and components. Their competitive advantage is predicated on the superior range and performance of the 1550nm wavelength, which is non-visible and safer for higher-power operation, enabling long-range Adaptive Cruise Control performance.

- Innoviz Technologies Ltd

Innoviz Technologies Ltd focuses on high-performance Solid-State LiDAR (InnovizOne, InnovizTwo) based on MEMS scanning technology, securing strategic series production contracts with major global OEMs for Level 3 Passenger Vehicles. The company's strategy is to rapidly scale its automotive-grade technology, highlighted by a recent development agreement with a top-5 passenger OEM to modify the InnovizTwo LiDAR for a global L3 production vehicle. Innoviz also expanded its market by launching InnovizSMART in June 2025, which adapts its auto-grade LiDAR for use in industrial applications like robotics and security, leveraging its core technology for broader commercialization.

LiDAR For ADAS Market Developments

- September 2025: Innoviz Technologies announced it achieved a key certification for its LiDAR testing laboratories, enhancing its position as a Tier-1 supplier. This capacity milestone demonstrates the robust quality management required for mass series production of Solid-State LiDAR in Level 3 programs.

- June 2025: Innoviz Technologies launched InnovizSMART, adapting its automotive-grade Solid-State LiDAR for industrial applications such as security and robotics. This product launch expands the addressable market, leveraging existing production capacity to diversify revenue streams beyond the cyclical automotive OEM market.

- 2024: Luminar Technologies commenced production of certain Iris sub-assemblies and components at the new facility with TPK Group in Asia. This capacity addition was a critical step in lowering the cost of industrialization for the Solid-State LiDAR system ahead of volume production for major OEM partners.

LiDAR For ADAS Market Segmentation

- By Type

- Solid-State LiDAR

- Electro-Mechanical LiDAR

- By Autonomy Level

- Level 2

- Level 3

- Level 4

- By Application

- Adaptive Cruise Control

- Lane Departure Warning

- Object Detection & Collision Avoidance

- Automatic Emergency Braking (AEB)

- Others

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- Isreal

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America