Report Overview

Maritime Robotics Market - Highlights

Maritime Robotics Market Size:

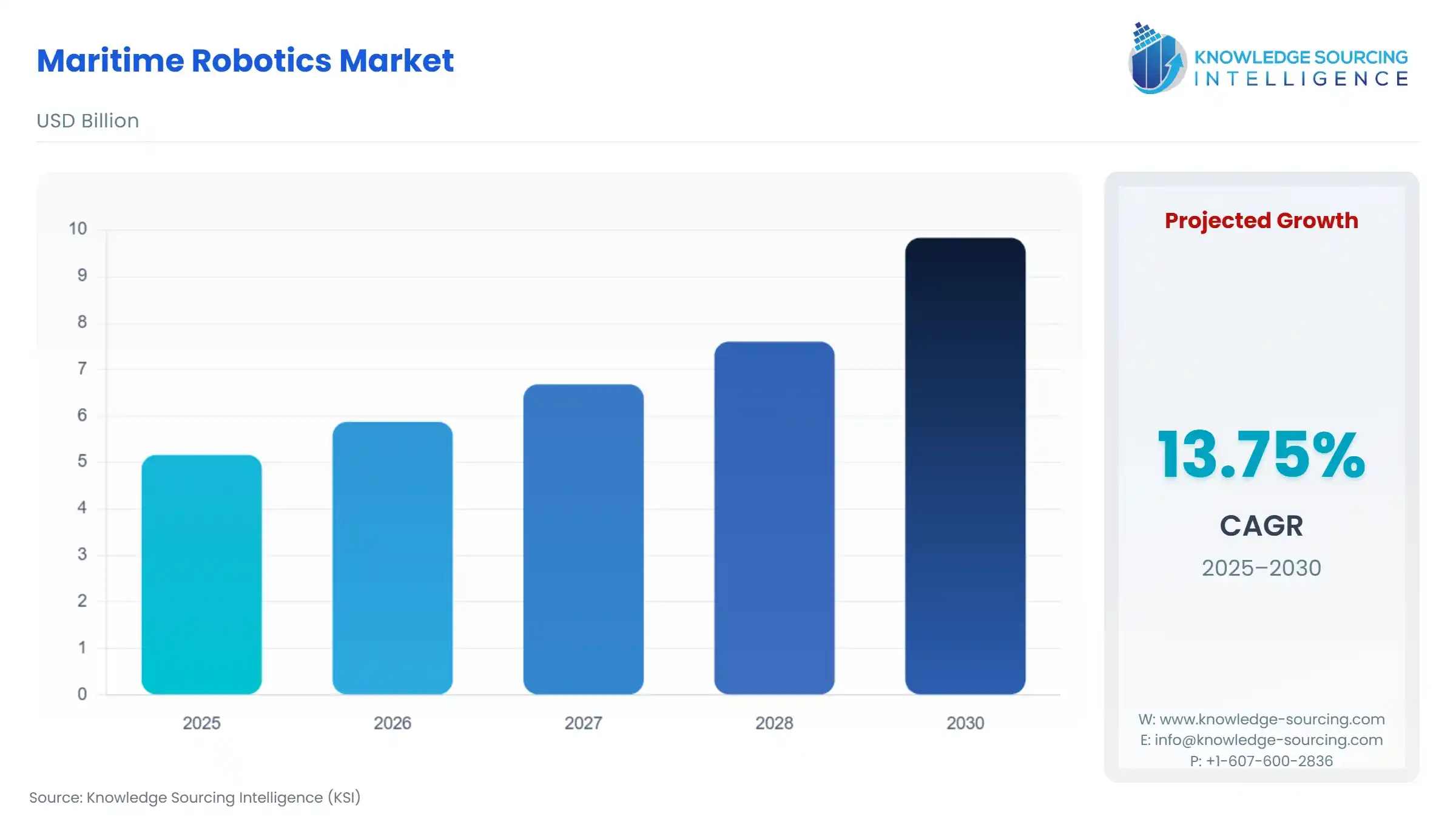

Maritime Robotics Market is expected to grow at a 13.75% CAGR, increasing from USD 5.163 billion in 2025 to USD 9.832 billion by 2030.

Maritime Robotics Market Overview & Scope

The maritime robotics market is segmented by:

- Type: Autonomous Underwater Vehicles (AUVs) hold a significant share of the maritime robotics market, driven by their effectiveness in intelligence gathering, mine detection, and undersea surveillance. Their stealth, endurance, and ability to operate in contested environments make them essential assets for modern naval operations across the region.

- Application: Underwater mapping and surveys account for a substantial share of the maritime robotics market, driven by demand in offshore energy, marine research, and defence applications.

- End User: The military maritime robotics market is expanding rapidly due to rising defence budgets, territorial security concerns, and advancements in autonomous technologies. Nations like China, India, Japan, and South Korea are deploying Uncrewed Surface Vessels (USVs) and underwater drones for surveillance, reconnaissance, and mine countermeasures, strengthening naval capabilities across the region.

- Region: The Asia-Pacific maritime robotics market is witnessing rapid growth driven by increasing investments in autonomous vessels, coastal surveillance, and offshore energy projects. Countries like China, Japan, South Korea, and Australia are leading the adoption of USVs for defence, research, and commercial use, fostering innovation and regional maritime autonomy.

Top Trends Shaping the Maritime Robotics Market

- Growth of Autonomous Surface and Underwater Vessels: Unmanned Surface Vessels (USVs) and Autonomous Underwater Vehicles (AUVs) are increasingly used for naval surveillance, seabed mapping, and offshore infrastructure inspection. Enhanced autonomy reduces human risk and operational costs in challenging marine environments.

- AI and Sensor Integration for Real-Time Decision-Making: Maritime robots are being equipped with advanced AI, sonar, LiDAR, and environmental sensors. These technologies enable real-time navigation, obstacle avoidance, and mission adaptability, crucial for defence, scientific exploration, and subsea construction.

- Environmental Monitoring and Sustainability Focus: Marine robots are playing a growing role in monitoring ocean health, tracking pollution, and studying climate change. Governments and research bodies are using robotics to collect critical data with minimal ecological impact.

- Expansion in Commercial Shipping and Port Automation: Autonomous maritime systems are being adopted in commercial shipping and port logistics to improve fuel efficiency, reduce emissions, and automate routine tasks such as docking, inspection, and cargo handling.

Maritime Robotics Market Growth Drivers vs. Challenges

Drivers:

- Rising Demand for Autonomous Naval and Defence Operations: Defence agencies are increasingly investing in unmanned maritime systems for surveillance, mine detection, reconnaissance, and anti-submarine warfare, reducing risk to human personnel and enhancing operational efficiency. The Indian Navy is enhancing its unmanned underwater capabilities through a ?2,500 crore project aimed at developing unmanned underwater vehicles (UUVs) weighing over 100 tonnes.

- Growth in Offshore Energy and Underwater Infrastructure: The expansion of offshore wind farms, oil and gas platforms, and undersea pipelines is driving demand for AUVs and remotely operated vehicles (ROVs) for tasks like inspection, maintenance, and mapping in deep-sea environments. According to the Indian Defence Research Wing, the Indian Navy is working to develop MALE UAVs, which will be designed in such a way that they can be operated from its aircraft carriers, such as INS Vikramaditya and INS Vikrant.

Challenges:

- High Cost: The maritime robotics market faces challenges such as high development and deployment costs, complex underwater communication, and limited battery life for autonomous systems. Harsh ocean environments can damage equipment, while regulatory uncertainties hinder widespread adoption. Additionally, the integration of advanced AI and sensors demands significant R&D investment. This ensures data security, system reliability, and skilled workforce availability, further complicating the growth and scalability of maritime robotics solutions.

Maritime Robotics Market Regional Analysis

- United States: The U.S. leads in maritime robotics due to strong defence investments, advanced naval R&D, and commercial applications in offshore energy and underwater exploration. Agencies like the U.S. Navy and DARPA support the development of autonomous underwater vehicles (AUVs) and unmanned surface vessels (USVs).

- Norway: Norway is a pioneer in autonomous maritime technology, especially for commercial shipping and offshore industries. It is home to world-leading projects like Yara Birkeland, the first fully electric autonomous cargo ship, and strong innovation in marine robotics for environmental monitoring and aquaculture.

- United Kingdom: The UK is a key player in maritime robotics for defence, research, and environmental applications. British firms and institutions are actively developing unmanned maritime systems and AI-powered robotic submarines used for ocean mapping, surveillance, and offshore energy operations.

- China: China is rapidly expanding its maritime robotics capabilities across military, commercial, and scientific domains. It has made significant progress in developing AUVs and autonomous ships, driven by state-supported initiatives and maritime expansion goals.

Maritime Robotics Market Competitive Landscape

The market has many notable players, including Kongsberg Gruppen ASA, Teledyne Technologies Incorporated, Saab AB., Exail Technologies, General Dynamics Mission Systems, Inc., Ocean Infinity Group Limited, Fugro N.V., Blue Robotics, Maritime Robotics, Atlas Elektronik, L3Harris Technologies, BAE Systems, Boeing, among others.

- Collaboration: In February 2025, Maritime Robotics expanded its collaboration with Jan De Nul by delivering an advanced Otter Uncrewed Surface Vessel (USV) to Dubai. The vessel, named Vaquita 04, is currently operating in Jebel Ali, conducting hydrographic surveys to support dredging and coastal development initiatives.

- Launch: In January 2025, Maritime Robotics, a leader in uncrewed surface vessel (USV) technology, announced the successful delivery of two state-of-the-art USVs to DEME, a global provider of maritime solutions. The delivery includes the compact 2-meter Otter USV and the larger, more advanced 6-meter Mariner USV.

- Funding: In September 2024, Maritime Robotics announced the successful completion of a USD 12 million funding round. The investment was co-led by Nordic cleantech fund NRP Zero and the Norwegian state-owned Nysnø Climate Investments, with substantial backing from Umoe AS and Holta Invest.

- Collaboration: In April 2024, Maritime Robotics partnered with AKVA group Helgeland Plast to advance sustainable production of its Uncrewed Surface Vessels (USVs). The collaboration marks a key step toward a greener future, as the hulls of the Mariner USV will now be manufactured using climate-neutral materials.

Maritime Robotics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Maritime Robotics Market Size in 2025 | USD 5.163 billion |

| Maritime Robotics Market Size in 2030 | USD 9.832 billion |

| Growth Rate | CAGR of 13.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Maritime Robotics Market |

|

| Customization Scope | Free report customization with purchase |

Maritime Robotics Market Segmentation:

- By Type

- Autonomous Underwater Vehicles (AUVs)

- Remotely Operated Vehicles (ROVs)

- Uncrewed Surface Vessels (USVs)

- By Application

- Underwater Mapping and Surveys

- Underwater Rescue

- Security and Surveillance

- Environmental Monitoring

- Others

- By End User

- Military

- Oil & Gas

- Commercial

- Scientific Research

- Others

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Others

- North America