Report Overview

Material Jetting (MJ) 3D Highlights

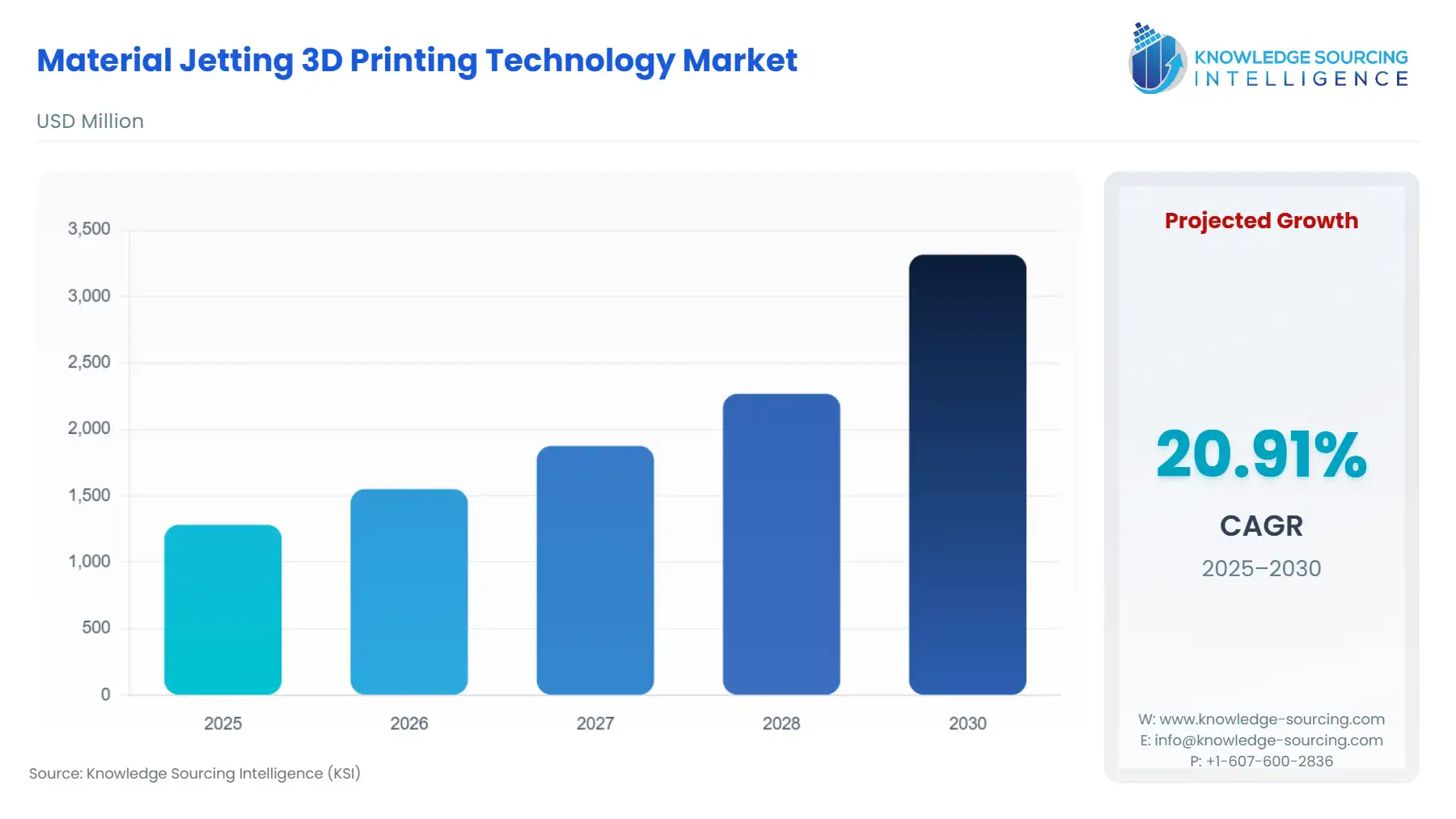

Material Jetting (MJ) 3D Printing Technology Market Size:

The material jetting 3D printing technology market is expected to grow from US$1.283 billion in 2025 to US$3.316 billion in 2030, at a CAGR of 20.92%.

Material Jetting (MJ) 3D Printing Technology, particularly the PolyJet and NanoParticle Jetting (NPJ) variants, represents a high-fidelity, high-resolution subset of additive manufacturing. Operating akin to a sophisticated inkjet printer, MJ systems precisely deposit tiny droplets of liquid Material, photopolymers, metals, or ceramics, which are instantly cured or solidified layer by layer. This capability is fundamentally non-substitutable in applications requiring complex geometries, multi-color realism, and variable shore hardness within a single monolithic build. Consequently, the market dynamics are governed by the technological race to reduce the cost of proprietary Hardware and Material while simultaneously expanding the range of functional properties to transition the technology from specialized prototyping and modeling toward end-use manufacturing.

Material Jetting (MJ) 3D Printing Technology Market Analysis

- Growth Drivers

The technology's core advantage in producing parts with true multi-material and full-color functionality is the primary factor propelling market growth. This capability creates direct demand in the Healthcare sector, where patient-specific anatomical models and surgical guides require precise replication of organic geometries and varying tissue densities. Furthermore, the high resolution and smooth surface finish inherent to the MJ process directly eliminate significant post-processing steps. This operational efficiency translates to accelerated product development cycles for Automotive and Consumer Goods firms, driving increased procurement of MJ Hardware to meet rapid design iteration needs.

- Challenges and Opportunities

The primary obstacles facing the MJ market are the high initial capital expenditure for the Hardware and the proprietary, high-cost structure of the Material (photopolymer resins). These constraints restrict the end-user base and limit the adoption of MJ systems for genuine high-volume manufacturing (HVM). However, this challenge simultaneously creates significant opportunities for technological expansion. The transition of MJ principles to NanoParticle Jetting (NPJ) for metal and ceramic applications and strategic technology acquisition (e.g., Stratasys's move into MoldJet) unlocks new, high-value demand in Aerospace and Defense for intricate, high-performance components previously inaccessible to polymer MJ systems.

- Raw Material and Pricing Analysis

The MJ market relies almost exclusively on specialized photopolymer resins, which are liquid, UV-curable Material formulations. The pricing structure is inherently high, driven by the specialized chemical synthesis required to achieve specific performance characteristics like transparency, flexibility, and Biocompatibility (for medical use). The supply chain is sensitive to geopolitical or macroeconomic volatility, which disrupts the availability and cost of precursor chemicals (e.g., sorbitol and maltitol). Since the leading system manufacturers, notably Stratasys, mandate the use of their proprietary resins to ensure print quality and warranty validity, this vertical integration sustains high Material margins and limits pricing competition for the end-user.

- Supply Chain Analysis

The MJ supply chain is characterized by strong vertical integration and intellectual property dependencies. Key production hubs for Hardware are concentrated in Israel and the United States, reflecting the R&D and manufacturing focus of core technology providers like Stratasys and XJet. The principal logistical complexity lies in managing the supply and transport of proprietary Photopolymer Resins, often manufactured in-house or by select chemical partners. The supply chain's rigidity stems from the necessity to validate materials and printer heads as an integrated system, creating a significant dependency on the Original Equipment Manufacturers (OEMs) for both consumables and replacement Hardware components.

Material Jetting (MJ) 3D Printing Technology Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Medical Device Regulation (MDR) EU 2017/745 |

Increases Demand for Certified Materials: The MDR's stringent requirements for quality management, traceability, and clinical evaluation of custom-made and patient-matched devices directly compel Healthcare providers and manufacturers to procure MJ Hardware and Material (resins) with proven, CE-certified biocompatibility and validated workflows. This raises the barrier to entry but accelerates demand for high-compliance solutions. |

|

United States |

Food and Drug Administration (FDA) / 510(k) Pre-market Notification |

Validates End-Use Application: FDA approval or clearance (e.g., 510(k)) for 3D-printed medical devices, such as external prosthetics or surgical guides, validates MJ technology for clinical use. This regulatory precedent significantly increases demand from Healthcare End-Users (hospitals, medical device companies) who seek to adopt the technology for patient-specific solutions, such as the use of radiopaque resins. |

|

United States |

Export Administration Regulations (EAR) / Bureau of Industry and Security (BIS) |

Controls Technology Transfer: BIS controls on the export of certain advanced additive manufacturing equipment and Software restrict the proliferation of high-end MJ systems to certain foreign entities. This control ensures the strategic technological lead of US-aligned manufacturing sectors, channeling the most advanced Hardware demand primarily to domestic and allied End-Use Industry segments. |

Material Jetting (MJ) 3D Printing Technology Market Segment Analysis

- By Component: Material

The Material segment, overwhelmingly dominated by proprietary photopolymer resins, is critical to the Material Jetting market's current and future valuation. The need for these resins is not elastic but is driven by the specific functional requirement of the final part. The imperative to achieve new technical specifications directly increases the demand for specialized, high-performance resins, such as those with improved mechanical properties (e.g., the ToughONE™ WhiteS material launch in November 2025). Crucially, the need to develop Biocompatible Resins for the rapidly expanding Healthcare segment, and the R&D push towards Metal/Ceramic NanoParticle Jetting materials, demonstrates that the future growth trajectory of the MJ Hardware market is intrinsically linked to the continued expansion and technical certification of its Material portfolio.

- By End-User Industry: Healthcare

The Healthcare sector is a principal, high-growth engine for the Material Jetting market, driven by the unique capability of MJ technology to enable patient-specific solutions. Growth is catalyzed by the documented success of MJ in creating hyper-realistic Anatomical Models (Digital Anatomy™), which accurately mimic the tactile and structural properties of bone, soft tissue, and organs. This fidelity is essential for pre-surgical planning, reducing operative time, and improving surgical training, which translates into a compelling return on investment for hospital systems and medical device manufacturers. The continuous expansion of certified materials, such as the US availability of RadioMatrix™ Radiopaque Material in December 2025, further integrates MJ systems directly into the clinical workflow by allowing models to be used in conjunction with CT imaging for validation and planning.

Material Jetting (MJ) 3D Printing Technology Market Geographical Analysis

- US Market Analysis

The US market drives demand for MJ technology through aggressive adoption in high-value sectors: Aerospace and Defense, and Healthcare. Strong domestic manufacturing incentives and a robust research and development ecosystem fuel this growth. The key growth driver is the requirement for low-volume, high-complexity parts and the rapidly growing need for patient-matched Medical Devices and advanced Anatomical Models. Furthermore, the competitive nature of the Automotive sector in the US necessitates rapid prototyping with high visual fidelity, sustaining strong procurement of multi-color PolyJet Hardware systems for accelerated design cycles.

- Brazil Market Analysis

The MJ market in Brazil is emergent, focusing primarily on the Services segment and niche applications within the Automotive and educational sectors. The primary growth catalyst is the need for rapid, high-detail visualization prototypes to shorten product development timelines, compensating for logistical complexities in sourcing finished parts internationally. Procurement of the Hardware is concentrated in major industrial centers, but the high capital expenditure and proprietary Material costs act as a constraint, limiting broad adoption of the latest, high-throughput systems to specialized service bureaus.

- Germany Market Analysis

Germany represents a significant demand center, characterized by its focus on precision engineering and industrial production within the Automotive and advanced Manufacturing sectors. The key growth driver is the necessity for highly accurate, functional tooling and fixtures, where MJ’s superior resolution and material toughness provide a competitive edge over other additive technologies. Furthermore, Germany's strict regulatory environment, shaped by the EU MDR, compels local Healthcare and medical technology firms to invest in certified MJ Hardware and Material to ensure compliance and quality for their patient-matched product lines.

- Saudi Arabia Market Analysis

Material Jetting demand in Saudi Arabia is strategically driven by government-backed economic diversification and investment in high-technology R&D centers. The requirement is currently limited but highly concentrated on acquiring high-specification Hardware for academic and national industrial research projects within newly established technology parks. The primary application is high-detail conceptual modeling and limited tooling for new Aerospace and Defense and Oil & Gas initiatives, with procurement decisions largely influenced by government or national oil company technology mandates rather than organic commercial volume.

- China Market Analysis

China is characterized by surging growth driven by its vast Consumer Goods and domestic Automotive manufacturing bases, coupled with rapid expansion in the Healthcare sector. The primary catalyst is the aggressive time-to-market pressure, which necessitates high-throughput, multi-color MJ systems for iterative prototyping and low-volume production. Local competition is driving down the cost of entry-level systems, while the high demand for customized Medical Models and dental aligners sustains high-volume consumption of specialized, locally produced and internationally certified Photopolymer Resins.

Material Jetting (MJ) 3D Printing Technology Market Competitive Environment and Analysis

The Material Jetting market features intense competition among a small group of highly innovative, vertically integrated firms, where the competitive edge is secured through patented Hardware and proprietary Material formulations. The landscape is segmented into established photopolymer leaders and disruptive technology entrants focused on metal and ceramic applications.

- Stratasys Ltd.

Stratasys Ltd. is the market leader in photopolymer MJ (PolyJet technology), leveraging its patented multi-material and full-color capabilities to dominate the high-value Healthcare and prototyping segments. Its strategic positioning relies on continuous material innovation, such as the launch of the ToughONE™ WhiteS material in November 2025, which expands the functional applications of its mid-range J-series printers. Crucially, the company's investment and commercial agreement with Tritone Technologies in November 2025 to integrate MoldJet® technology demonstrates a strategic move to access the production-grade metal and ceramic market, significantly broadening its competitive scope beyond polymers.

- 3D Systems, Inc.

3D Systems, Inc. competes across the additive manufacturing spectrum, with a focused effort in the photopolymer space, which includes Material Jetting elements, particularly in the Dental and Casting segments. The company's competitive strategy centers on delivering certified, high-quality Hardware and Materials with a focus on repeatable industrial workflows. While the search results primarily highlighted their SLA advancements, their broader portfolio ensures they remain a formidable competitor in providing integrated solutions for high-precision, industrial-grade prototyping where MJ principles are sometimes employed in specialized applications.

- XJet

XJet is a disruptive competitor focused exclusively on the patented NanoParticle Jetting (NPJ) technology, specializing in high-performance metal and ceramic parts. Its strategy centers on addressing the demand for HVM in Aerospace and Defense and Medical markets that require the superior material properties of metal and ceramics, but the intricate detail of jetting technology. NPJ's unique process, which jets liquid suspensions of nanoparticles and a removable supporting Material, eliminates powder handling, offering a key differentiation point in the supply chain and clean-room environments.

Material Jetting (MJ) 3D Printing Technology Market Developments

- December 2025: Stratasys announced the expanded availability of its RadioMatrix™ Radiopaque Material for its PolyJet Hardware in the United States. This addition directly increases the utility and demand for MJ systems in the Healthcare segment for creating patient-specific, CT-compatible surgical planning models.

- November 2025: Stratasys announced a strategic investment and commercial collaboration with Tritone Technologies to utilize its MoldJet® metal and ceramic 3D printing technology. This capacity addition significantly expands Stratasys's offering beyond polymers into production-grade metal and ceramic Material applications.

- November 2025: Stratasys revealed the launch of the new ToughONE™ WhiteS Material for its J3™ and J5™ PolyJet™ Hardware at Formnext 2025. This product launch enhances the range of functional Materials, combining flexibility and strength for rapid prototyping in demanding industrial applications.

Material Jetting (MJ) 3D Printing Technology Market Segmentation:

- By Component

- Hardware

- Software

- Services

- Material

- By End-Use Industry

- Healthcare

- Automotive

- Aerospace and Defense

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America