Report Overview

Microencapsulation Market - Strategic Highlights

Microencapsulation Market Size:

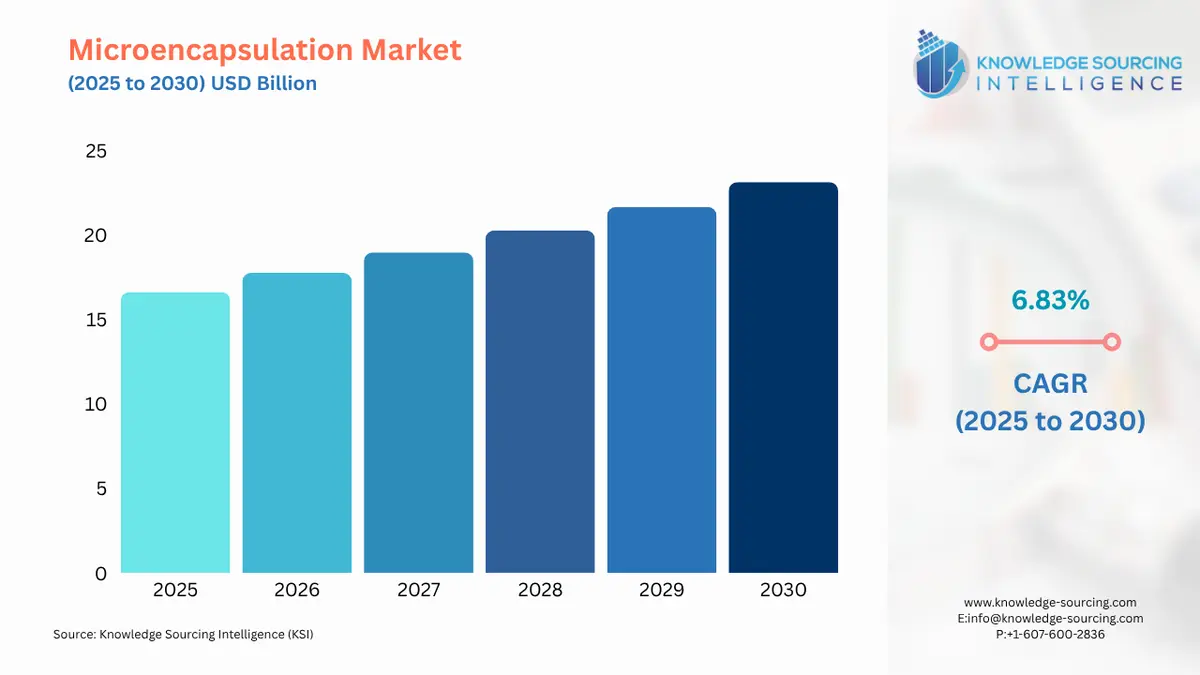

The microencapsulation market is valued at US$16.626 billion in 2025 and is projected to expand at a CAGR of 6.83% over the forecast period, reaching US$23.131 billion by 2030.

Microencapsulation Market Introduction

Microencapsulation is a cutting-edge technology that encapsulates active ingredients, such as pharmaceuticals, nutrients, flavors, or agrochemicals, within a protective coating to enhance stability, enable controlled release, and improve functionality. This technology is pivotal across industries like pharmaceuticals, food and beverage, personal care, and agriculture, offering solutions for targeted delivery, extended shelf life, and protection against environmental factors. By encasing sensitive compounds in microcapsules ranging from micrometers to millimeters, microencapsulation ensures precise delivery and enhanced performance, making it a cornerstone of innovation in product development. Its versatility supports applications from controlled drug release to flavor preservation in functional foods, driving its adoption globally. The pharmaceutical industry leverages microencapsulation for sustained and targeted drug delivery, improving bioavailability and patient compliance. In the food and beverage sector, it enhances the stability of vitamins, probiotics, and flavors, meeting consumer demand for fortified and functional foods. The rise in demand for sustainable and biodegradable materials has spurred innovation in eco-friendly coatings, aligning with global environmental goals. The personal care industry uses microencapsulation to deliver active ingredients in cosmetics, ensuring long-lasting effects, while agriculture employs it for controlled-release fertilizers and pesticides. Advancements in AI-driven encapsulation processes are optimizing production efficiency, further boosting market appeal. Major market drivers include the growing demand for functional foods, driven by health-conscious consumers seeking nutrient-rich products. Increasing pharmaceutical applications for controlled drug delivery are expanding the market, particularly for chronic disease management. Rising investments in R&D for innovative encapsulation technologies are also fueling growth, supported by government funding in biotechnology. Market restraints include high production costs, which limit adoption by smaller enterprises, and complex regulatory frameworks that delay product approvals.

Microencapsulation Market Overview

Microencapsulation coats an active compound with an encapsulating agent, also known as a wall material, that isolates the active material by protecting it from adverse changes or concealing its sensory properties. The technology is used in the pharmaceutical, cosmetics, agrochemical, and food industries. The technique is used in the food industry to reduce the adverse aromas, volatility, and reactivity of food products, thereby providing them with greater stability against adverse conditions. Additionally, microencapsulation has numerous applications in the pharmaceutical industry, including altering drug release, reducing the reactivity of the core ingredient with the surrounding environment, enhancing drug stability, and masking the taste and odor of certain drugs.

Microencapsulation Market Trends:

Rising Demand from Pharmaceutical Industries: The pharmaceutical sector is increasingly turning to microencapsulation, especially for developing and producing drug delivery systems. This technique minimizes a drug’s adverse effects, enhances its stability against external factors, and allows for controlled release from encapsulated microparticles. In pharmaceuticals, microencapsulation is widely applied through methods like the pan technique, where drugs are coated on spherical substrates such as nonpareil sugar seeds. Additionally, modern techniques like in situ polymerization for microcapsule coatings have boosted demand further. For instance, microencapsulated drugs like sustained-release Aspirin help reduce gastric irritation and GI bleeding, driving its adoption.

Advancements in Global Agriculture: Progress in the worldwide agricultural industry is a major driver of the microencapsulation market’s growth during the forecast period. Microencapsulation safeguards sensitive compounds in this sector while enabling the controlled release of fertilizers and pesticides, supporting sustainable practices.

North America: In North America, the demand for microencapsulation in pharmaceuticals has surged due to the need to address drug incompatibilities and reduce toxicity and gastrointestinal issues, such as those caused by ferrous sulfate and KCI. Furthermore, microencapsulation’s ability to control drug release and lower medicine toxicity has increased its appeal, helping mitigate prolonged side effects and associated health risks.

Some of the major players covered in this report include Glanbia plc, MIKROCAPS, Capsularis, Givaudan, Koehler Innovative Solutions, Prinova, Ronald T. Dodge Company, Encapsys, LLC, Calyxia, Balchem Corporation, INCAPTEK Sàrl, and Innoleague Technologies, among others.

Microencapsulation Market Growth Drivers vs. Challenges

Drivers:

Growing Demand for Functional Foods: The rising demand for functional and fortified foods is a key driver for the microencapsulation market, as health-conscious consumers seek nutrient-rich products. Microencapsulation enhances the stability and bioavailability of vitamins, probiotics, and flavors, ensuring controlled release and extended shelf life. A 2024 World Health Organization report highlighted a notable increase in global demand for functional foods, driven by wellness trends. This technology protects sensitive ingredients like omega-3 fatty acids and antioxidants from degradation, improving product efficacy. In the food industry, microencapsulation supports clean-label trends by masking off-flavors and odors. The growing popularity of nutraceuticals and dietary supplements further fuels demand, as manufacturers prioritize innovative delivery systems. As consumer preferences shift toward health-oriented products, microencapsulation’s role in ensuring nutrient stability drives market growth across the food and beverage sector.

Increasing Pharmaceutical Applications: The pharmaceutical industry’s adoption of microencapsulation for controlled and targeted drug delivery is a significant market driver. This technology enhances bioavailability, reduces side effects, and improves patient compliance by ensuring precise drug release. A recent National Institutes of Health report noted that microencapsulation is used in the majority of new drug formulations for chronic diseases like diabetes and cancer. It protects active pharmaceutical ingredients (APIs) from environmental factors and masks unpleasant tastes, as seen in pediatric and geriatric formulations. The rise of personalized medicine further amplifies demand, with microencapsulation enabling tailored therapies. A recent Pharmaceutical Technology article highlighted its role in improving insulin delivery systems. As pharmaceutical companies invest in advanced delivery systems, microencapsulation’s ability to enhance therapeutic efficacy drives market expansion, particularly in high-growth regions like North America and Asia-Pacific.

Rising Investments in R&D: Increasing investments in research and development (R&D) are propelling the microencapsulation market by fostering innovation in encapsulation technologies. Governments and private sectors are funding advancements in biodegradable coatings and scalable production methods. A recent National Science Foundation report noted that global biotech R&D spending reached $150 billion, with significant allocations for encapsulation technologies. These investments support the development of novel applications, such as nanocapsules for targeted drug delivery and eco-friendly coatings for agriculture. Collaborations between universities and industry players, like BASF’s 2024 partnership with MIT, are driving breakthroughs in polymer-based encapsulation. The focus on sustainability and precision in industries like pharmaceuticals and cosmetics further accelerates R&D efforts. As companies innovate to meet regulatory and consumer demands, microencapsulation’s versatility and performance drive market growth, positioning it as a critical technology for future applications.

Challenges:

High Production Costs: High production costs are a significant restraint for the microencapsulation market, particularly for small and medium-sized enterprises (SMEs). Advanced techniques like spray drying and coacervation require specialized equipment and skilled labor, increasing manufacturing expenses. A recent report noted that production costs for microencapsulated products have risen notably due to premium material requirements. These costs limit adoption in cost-sensitive markets like agriculture and food, where scalability is critical. While innovations like LED-based systems aim to reduce costs, their implementation remains limited. The financial burden of R&D for new coating materials further exacerbates this restraint, deterring smaller players from entering the market. As a result, high costs hinder widespread adoption, slowing market growth in regions with limited capital investment, despite the technology’s proven benefits in enhancing product performance.

Complex Regulatory Frameworks: Complex regulatory frameworks pose a significant restraint for the microencapsulation market, particularly in pharmaceuticals and food applications. Stringent approval processes by agencies like the FDA and EFSA delay product commercialization, increasing compliance costs. An FDA report highlighted that several encapsulated drug formulations face extended approval timelines due to safety and efficacy concerns. In the food industry, regulations on encapsulated ingredients, such as probiotics, require rigorous testing. These complexities vary across regions, creating barriers for global market expansion. Smaller companies struggle to navigate these frameworks, limiting their ability to compete. While regulatory support for sustainable materials offers some relief, the overall complexity slows market growth, particularly for innovative applications requiring rapid market entry.

Microencapsulation Market Segmentation Analysis

Spray Technology is experiencing significant growth in the market: Spray technology dominates the microencapsulation market due to its scalability, cost-effectiveness, and high encapsulation efficiency. Widely used in pharmaceuticals, food, and agriculture, it produces uniform microcapsules with excellent stability, ideal for heat-sensitive materials like vitamins and APIs. A recent report noted that spray drying is used in 50% of functional food production for its ability to protect flavors and nutrients. Its low process costs and compatibility with industrial-scale production make it the preferred choice for large manufacturers. In pharmaceuticals, spray technology supports controlled-release formulations, enhancing drug efficacy. Its versatility also extends to agrochemicals, where it ensures the gradual release of fertilizers. The integration of AI-driven process optimization further improves efficiency. As industries prioritize scalable and sustainable solutions, spray technology’s dominance drives market growth, supporting diverse applications with high-performance encapsulation.

The Pharmaceutical segment is expected to be the most common application: The pharmaceutical segment leads the microencapsulation market, driven by its critical role in advanced drug delivery systems. Microencapsulation enables controlled and targeted release of APIs, improving bioavailability and reducing side effects. A recent report noted that most of new drug formulations use microencapsulation for sustained release, particularly for chronic conditions like diabetes. It protects sensitive compounds, masks unpleasant tastes, and enhances patient compliance, especially in pediatric and geriatric applications. The rise of personalized medicine further amplifies demand, with microencapsulation supporting tailored therapies. Innovations in biodegradable coatings, like PLA, align with regulatory demands for safety, as noted in a recent FDA update. This segment’s dominance is fueled by robust R&D investments and the growing prevalence of chronic diseases, driving market growth through its ability to deliver precise, effective therapeutic solutions.

North America is leading the market expansion: North America dominates the microencapsulation market, driven by its advanced technological infrastructure and significant R&D investments. The presence of major players like BASF SE and robust pharmaceutical and food industries in the U.S. and Canada fuels market leadership. A 2024 National Institutes of Health report highlighted that numerous U.S. biotech funding supports encapsulation technologies for drug delivery. The region’s focus on functional foods, driven by health-conscious consumers, boosts demand for microencapsulated nutrients. Stringent FDA regulations ensure high-quality standards, encouraging innovation in eco-friendly coatings. North America’s advanced manufacturing capabilities and strong regulatory framework support the adoption of spray and emulsion technologies, solidifying its market dominance. As industries prioritize precision and sustainability, North America drives market growth through its leadership in innovative encapsulation solutions.

Microencapsulation Market Key Developments

In July 2024, in a significant move for the food and beverage sector, a major dairy company announced a collaboration with Xampla, a company specializing in natural polymer technology. This partnership focuses on the development and integration of microcapsule technology into dairy products. The goal is to enhance the delivery of nutrients, such as vitamins and minerals, by protecting them from degradation and improving their stability within the food matrix. This development highlights a broader trend in the market towards using microencapsulation to create more fortified, functional foods. By protecting sensitive ingredients, the technology ensures that the nutritional value of products is maintained from manufacturing through consumption, catering to the increasing consumer demand for healthier, more effective food options.

In May 2024, at a major European nutraceutical conference, the specialty chemical company Lubrizol Corporation introduced its LIPOFER microcapsules. These are specifically designed to address challenges in delivering iron, a crucial micronutrient often associated with poor taste and limited bioavailability. The new microcapsules aim to improve the performance of iron delivery systems, masking the undesirable metallic taste and increasing their absorption in the body. This product launch is a response to the rising demand for advanced nutritional delivery systems in the nutraceutical and functional food industries. It showcases how microencapsulation is being used to overcome sensory and stability issues, making it possible to create more palatable and effective dietary supplements and food fortifications.

Microencapsulation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | US$16.626 billion |

| Total Market Size in 2030 | US$23.131 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Technology, Application, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Microencapsulation Market Segmentation:

By Technology

Spray

Emulsion

Coating

Dripping

Others

By Application

Pharmaceutical

Food and Beverage

Household and Personal Care

Agrochemicals

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East & Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others