Report Overview

Polyurethane microspheres market size

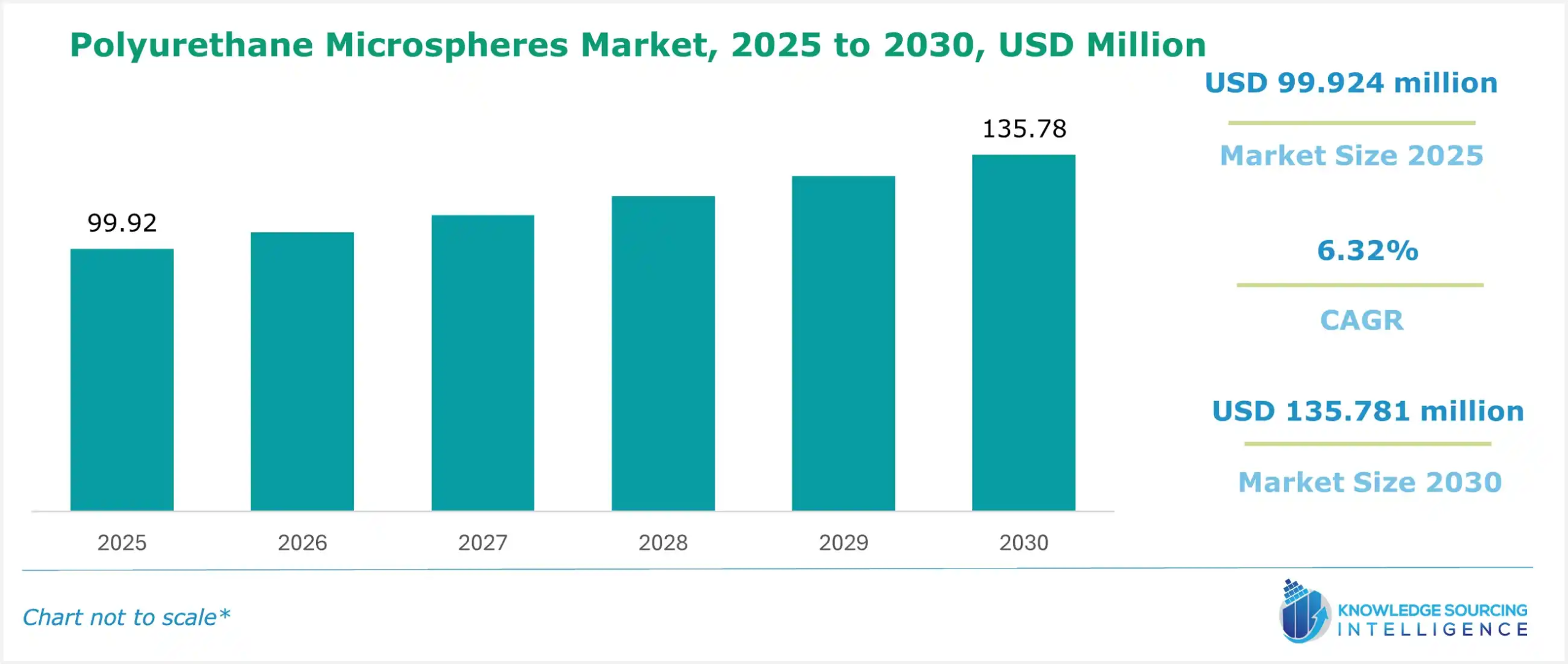

The polyurethane microspheres market is expected to grow at a CAGR of 6.32%, reaching a market size of US$135.781 million in 2030 from US$99.924 million in 2025.

Polyurethane microspheres are small spherical particles of this versatile polymer, polyurethane, based on the durability and flexibility coupled with chemical resistance. The application for such microspheres is increasing significantly as they are lightweight fillers or coating agents. They can also be found in drug delivery systems mainly because of their size uniformity, controlled-release properties, and ability to enhance the mechanical properties of materials.

These microspheres are widely used in the automotive, aerospace, electronics, and healthcare industries, especially coatings, adhesives, and composites. Because of their unique properties, these materials are very useful for structural and functional applications. Additionally, the rising application of polyurethane microspheres as encapsulating agents in industries such as paints and coatings, pharmaceuticals, and agrochemicals is expected to propel the market growth in the projected period.

Synthetic polyurethane microspheres are used in the healthcare sector as they are durable, biocompatible, and able to be engineered for specific applications. The surface properties and unique size make them ideal for application in drug delivery. The growing healthcare sector is expected to boost the market for polyurethane microspheres in the projected period. For instance, according to the U.S. Centers for Medicare & Medicaid Services (CMS), the National Healthcare spending grew by 4.1% and reached US$4.5 billion in 2022. Additionally, according to the CMS’s 2023-2032 National Healthcare Expenditure Projection, healthcare spending is anticipated to grow from 17.3% of the GDP in 2022 to 19.7% in 2032. Additionally, the NHE is projected to increase by 5.6% over 2023-2032.

What are polyurethane microspheres market growth drivers?

- Polyurethane is used in paints and coating as it helps enhance the mechanical properties of coatings, such as flexibility, durability, and scratch resistance, making the surface more resilient. Additionally, these microspheres are used to reduce surface defects and create more surfaces. The growing demand for paints and coatings is expected to propel the polyurethane microsphere market in the projected period. For instance, Akzo Nobel India, a leading paint manufacturer in India, claimed that during the fiscal year 2022-23, the prices of raw materials decreased from prior highs, which acted as a favorable development for the paints and coatings industry.

- Additionally, the increasing demand for eco-friendly and sustainable materials is expected to drive the market for polyurethane microspheres, as they are biodegradable and recyclable. Furthermore, various technological advancements coupled with increasing investment in research and development are anticipated to propel the market for polyurethane microspheres in the coming years.

- Increasing investment in infrastructure in various countries such as the United States, China, and India is anticipated to propel the market growth in the projected period. For instance, according to the India Brand Equity Foundation (IBEF), the total allocated investment for Smart Cities Mission in India stood at INR 7,20,000 crore (US$ 86.43 billion) as of February 2024. Additionally, of the total 7,742 projects that have been tendered, work orders have been issued for 2,740 projects, and 5,002 projects have been completed as of February 2024. Similarly, according to the U.S. Department of Commerce, the total construction spending in the United States in July 2024 was US$2,162.7 billion, which was 6.7% higher than that of 2023, with US$2,027.4 billion. Hence, with the increasing construction sector, the market for polyurethane microspheres is anticipated to grow in the forecasted period.

- Furthermore, polyurethane microspheres are primarily used in the cosmetic industry as texture enhancers, mattifying agents, and delivery systems. They enhance the texture and make the application of foundation products, powders, and creams by making them feel smooth and silky, thus minimizing wrinkles and pores. Additionally, the microspheres control shine by absorbing extra oil on the skin, giving it a matte finish.

- The growing demand for cosmetics in the projected period is expected to propel the market for polyurethane microspheres in the coming years. According to the Indian Brand Equity Foundation (IBEF), the cosmetic sector in India is expected to grow in the coming years as the number of homegrown brands increases and multinational corporations penetrate the country, owing to the rising disposable income of the people.

Analysis of polyurethane microspheres market segments:

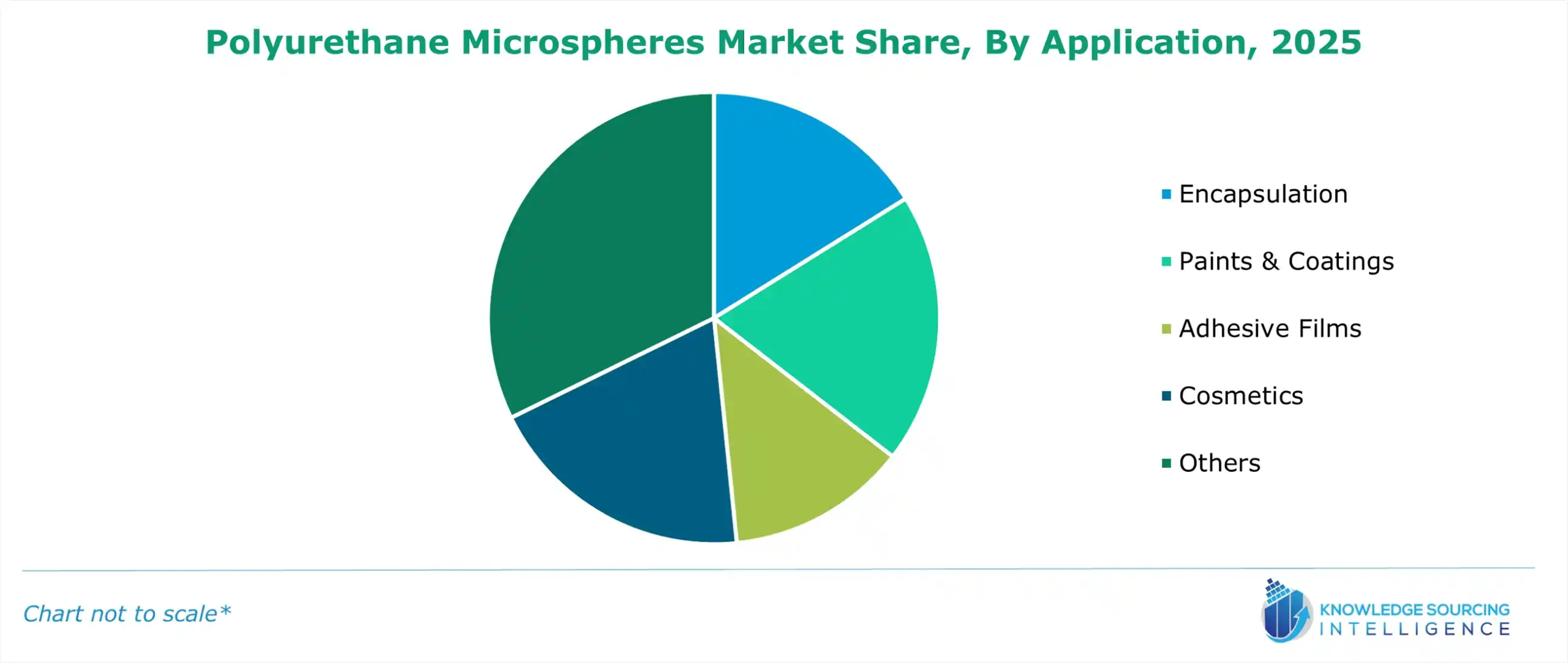

- By application, the encapsulation segment is expected to hold a significant share of the polyurethane microspheres market.

By application, the polyurethane microspheres market is segmented into paints and coatings, encapsulation, adhesive films, cosmetics, and others. The encapsulation sector is anticipated to hold a significant market share in the projected period, as it can be applied in various end-user industries such as agrochemicals, paints and coatings, and pharmaceuticals. The customizable size and surface properties of polyurethane microspheres are expected to increase the market for encapsulation in the coming years.

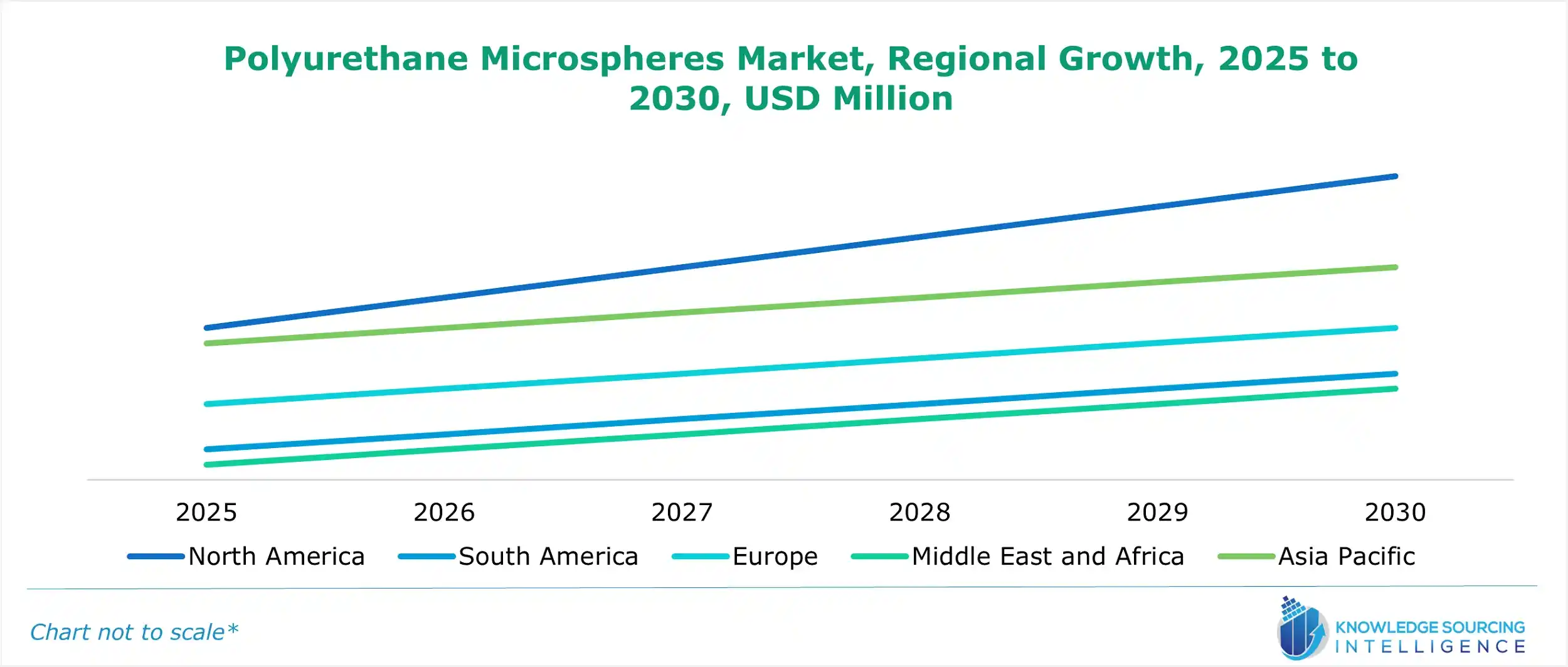

- The Asia Pacific region is anticipated to hold a significant share in the coming years.

The Asia Pacific region is expected to dominate the polyurethane market in the coming year, owing to the growing paints and coating industry in the region. The growing infrastructure market in countries such as India and China is also expected to boost market growth. For instance, according to the International Trade Administration (ITA), China’s 14th Five-year plan emphasizes new infrastructure projects in the energy, water, transportation, and urbanization sectors. Additionally, according to the plan, an estimated 27 trillion yuan is expected to be invested in this plan from 2021-2025.

Furthermore, increasing investment in the construction sector in various countries is anticipated to impact the market growth positively in the coming years. For instance, in September 2024, the Government of Indonesia and Millennium Challenge Corporation (MCC) launched a US$649 million Indonesia Infrastructure and Finance Compact. This five-year grant is focused on improving infrastructure quality and quantity and increasing the finance for medium and small enterprises, especially women-owned. Hence, the increased use of polyurethane microspheres in various end-use sectors is expected to boost the market in the coming years.

Polyurethane microspheres market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Polyurethane Microspheres Market Size in 2025 | US$99.924 million |

| Polyurethane Microspheres Market Size in 2030 | US$135.781 million |

| Growth Rate | CAGR of 6.32% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Polyurethane Microspheres Market |

|

| Customization Scope | Free report customization with purchase |

The Polyurethane Microspheres market is segmented and analyzed as follows:

- By Application:

- Encapsulation

- Paints & Coatings

- Adhesive Films

- Cosmetics

- Others

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America