Report Overview

Middle East and Africa Highlights

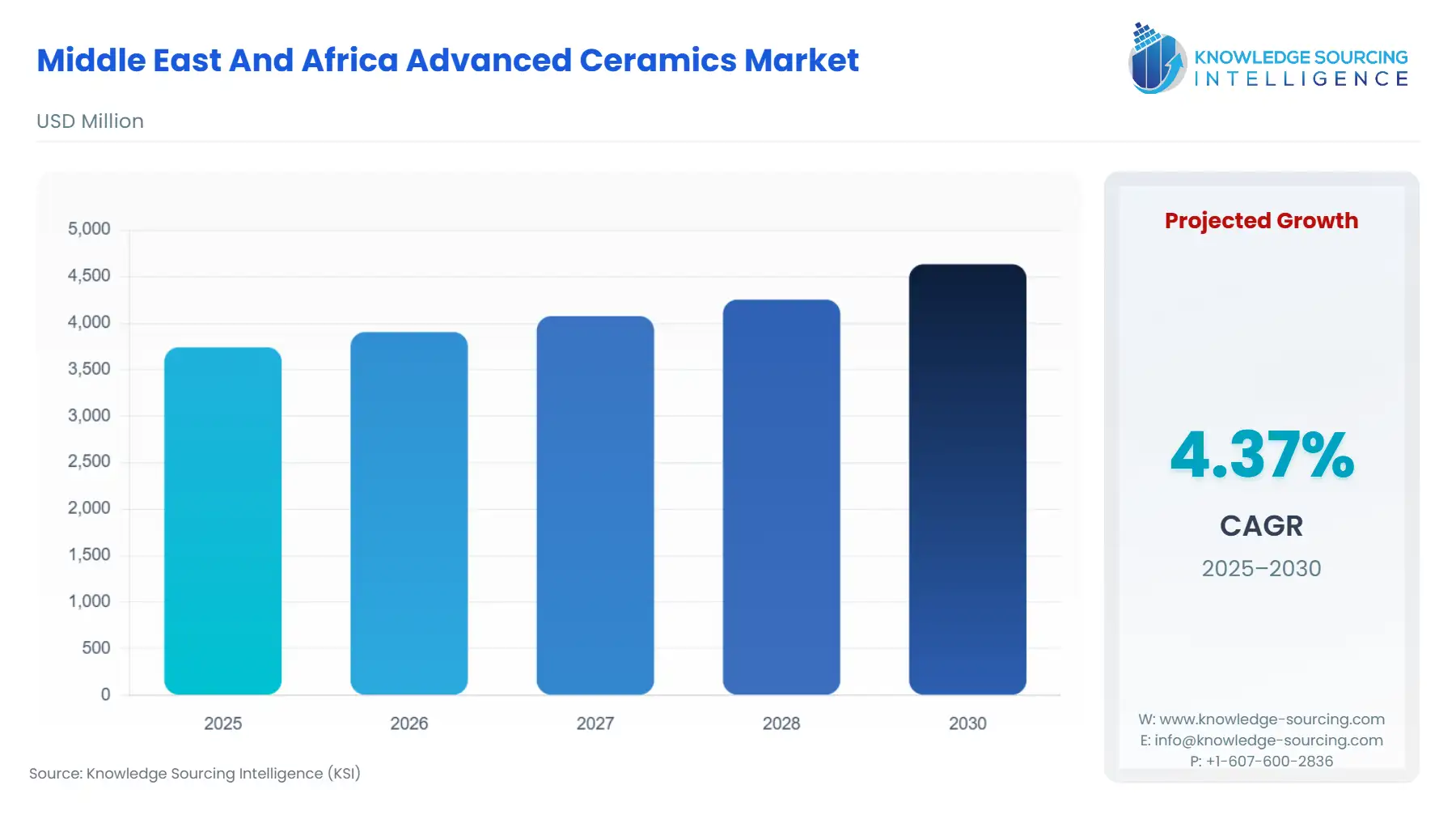

Middle East and Africa Advanced Ceramics Market Size:

The Middle East and Africa Advanced Ceramics Market will reach US$4.634 billion in 2030 from US$3.741 billion in 2025 at a CAGR of 4.38% during the forecast period.

The Middle East and Africa advanced ceramics market is emerging as a dynamic segment within the global advanced materials industry, driven by its critical applications across diverse sectors such as aerospace, defense, electronics, healthcare, and energy. Advanced ceramics, known for their exceptional properties like high-temperature resistance, corrosion resistance, and mechanical strength, are increasingly integral to high-performance applications in the region. The MEA advanced ceramics market is gaining momentum due to rapid industrialization, infrastructure development, and strategic government initiatives like Saudi Vision 2030’s advanced ceramics and the UAE's defense spending on ceramics. Countries such as Saudi Arabia, the UAE, and South Africa are pivotal in driving demand, with applications ranging from GCC ceramic materials in construction to South African industrial ceramics in manufacturing.

The MEA advanced ceramics market is propelled by several key drivers. First, significant investments in infrastructure and industrial diversification, particularly under Saudi Vision 2030, advanced ceramics, are fueling demand. This initiative aims to reduce oil dependency through projects like NEOM and the Red Sea Project, which require high-performance materials for construction and energy applications. A recent report highlights that these mega-projects are increasing the use of GCC ceramic materials for durable, energy-efficient building components. Second, the UAE’s defense spending on ceramics is a major driver, with the UAE’s focus on advanced defense systems, such as missile guidance and protective armor, leveraging ceramics’ lightweight and thermal stability. Another 2025 article notes increased UAE defense investments in high-tech materials. Third, the expanding healthcare sector in South Africa's industrial ceramics drives demand for bioceramics in medical implants and diagnostic equipment, supported by a recent report on rising medical technology adoption.

However, the market faces notable restraints. The high cost of advanced ceramics, due to complex manufacturing processes and raw material expenses, limits adoption, particularly for smaller enterprises. A 2024 article highlights that production costs for ceramics like alumina and silicon carbide remain a barrier in cost-sensitive markets. Additionally, technical challenges, such as the brittleness of ceramics, require ongoing R&D to enhance toughness. These restraints necessitate innovation to balance performance and affordability.

How Advanced Ceramics Work

Advanced ceramics are inorganic, non-metallic materials engineered for superior mechanical, thermal, electrical, and chemical properties compared to traditional ceramics. Materials like alumina, zirconia, silicon carbide, and silicon nitride are tailored for specific applications through precise control of composition and microstructure. The production process involves high-purity raw materials, such as oxides or carbides, which are shaped via pressing, molding, or 3D printing, followed by sintering at high temperatures (often exceeding 1,600°C) to achieve densification. For instance, CeramTec’s ROCAR 3D technology combines silicon carbide with 3D printing for complex components used in South African industrial ceramics.

In applications, ceramics’ properties—low thermal expansion, high hardness, and corrosion resistance—enable their use in extreme environments. In the UAE, defense spending on ceramics, silicon carbide is used in lightweight armor due to its high strength-to-weight ratio, while zirconia-toughened alumina is employed in medical implants in South Africa for biocompatibility. In GCC ceramic materials, alumina substrates in electronics provide thermal conductivity for high-power chips. These ceramics are often integrated into composites or coatings to enhance durability, making them critical for aerospace, energy, and industrial applications.

The MEA advanced ceramics market is poised for growth, driven by technological advancements and regional initiatives. Saudi Vision 2030's advanced ceramics are catalyzing investments in renewable energy, with ceramics used in solar panels and fuel cells, as highlighted in a 2025 report. In the UAE, defense applications are expanding, with ceramics in missile systems and sensors, supported by a recent article on defense innovation. South African industrial ceramics are seeing growth in mining and manufacturing, with ceramics used in wear-resistant components, according to a 2024 report.

Sustainability is a key trend, with manufacturers adopting eco-friendly production methods. For example, RAK Ceramics’ initiative incorporates recycled materials into tile production, aligning with regional green building standards. Nanotechnology and 3D printing are also transforming the market, enabling customized, high-precision components, as noted in a recent publication. The MEA advanced ceramics market is further supported by collaborations, such as Saudi Ceramics’ partnerships with tech firms for advanced manufacturing.

The international players are increasingly focusing on expanding their reach in MEA, which will augment regional market growth in the years ahead. Advanced ceramic features like high-temperature stability and corrosion resistance expand its number of applications. Increasing R&D investment will further propel the regional growth in the years ahead.

This research analyzes the Middle East and Africa (MEA) advanced ceramics market across various segments, detailing key drivers, restraints, and opportunities to provide a thorough understanding of the market landscape. It highlights current trends in demand, supply, and sales, alongside recent developments.

The study provides detailed insights into the development, trends, and industry policies and regulations across geographical segments of the MEA advanced ceramics market. It examines the regulatory framework to help stakeholders better understand the factors influencing the market environment.

The Middle East and Africa Advanced Ceramics Market report delivers an in-depth analysis of the regional industry, providing strategic and executive-level insights backed by data-driven forecasts. Regularly updated, it equips decision-makers with actionable intelligence on market trends, emerging opportunities, and competitive dynamics. The report evaluates demand for advanced ceramics materials, such as Alumina, Zirconate, and Titanate, and their applications across key industries and countries in the MEA region. It also analyzes technological advancements, government policies, regulations, and macroeconomic factors to offer a holistic view of the market.

Middle East and Africa Advanced Ceramics Market Trends

The Middle East and Africa advanced ceramics market is witnessing robust growth, driven by technological advancements and regional industrial demands. Key trends shaping the industry include alumina ceramics, zirconia, silicon carbide, silicon nitride, ceramic matrix composites (CMCs), 3D printing ceramics, bioceramics, and ceramic coatings, each enhancing performance across aerospace, defense, healthcare, and energy sectors.

Alumina ceramics dominate due to their durability in electronics and industrial applications, with Saudi Ceramics expanding production. Zirconia is gaining traction in medical implants, as South Africa’s healthcare sector adopts biocompatible materials. Silicon carbide excels in UAE defense for lightweight armor. Silicon nitride enhances wear resistance in South African mining.

Ceramic matrix composites (CMCs) are revolutionizing aerospace with high-temperature resistance, with NEOM projects adopting them. 3D printing ceramics enables complex components, as CeramTec’s ROCAR 3D technology demonstrates. Bioceramics advance dental and orthopedic applications, while ceramic coatings improve durability in energy systems. These trends drive innovation, sustainability, and regional industrial growth.

Middle East and Africa Advanced Ceramics Market Dynamics

Drivers:

Government-Led Industrial Diversification Initiatives: Strategic government initiatives, particularly Saudi Vision 2030, are a primary driver, fostering demand through large-scale infrastructure and industrial projects. Saudi Arabia’s push to diversify its economy beyond oil has led to mega-projects like NEOM and the Red Sea Project, which require advanced ceramics for construction, energy, and manufacturing applications due to their durability and thermal resistance. A 2025 report highlights how these projects leverage alumina ceramics and CMCs for sustainable building components. The initiative also promotes renewable energy, with ceramics used in solar panels and fuel cells. These investments drive market growth by creating demand for high-performance materials across the Gulf Cooperation Council (GCC) region.

Rising Defense and Aerospace Investments: UAE’s defense spending on ceramics significantly propels the market, driven by the region’s focus on advanced defense systems and aerospace innovation. Ceramics like silicon carbide and zirconia are critical for lightweight armor, missile guidance systems, and turbine components due to their high strength-to-weight ratio and thermal stability. The UAE’s increased defense budget, as reported by a 2025 Defense News article, supports the adoption of ceramics in next-generation military technologies. Similarly, aerospace applications in the region, including satellite components and engine parts, rely on ceramic coatings for durability under extreme conditions. A 2025 report underscores the UAE’s investment in aerospace innovation, boosting ceramic demand. This driver enhances the market’s growth by aligning with the region’s strategic focus on security and technological advancement.

Growing Healthcare Sector Demand: The expanding healthcare sector, particularly in South Africa's industrial ceramics, drives demand for bioceramics used in medical implants, dental restorations, and diagnostic equipment. Ceramics like zirconia and alumina offer biocompatibility and wear resistance, making them ideal for orthopedic and dental applications. A recent report highlights South Africa’s increasing adoption of advanced medical technologies, spurred by rising healthcare investments. The region’s focus on improving healthcare infrastructure, coupled with growing demand for minimally invasive procedures, fuels the use of ceramics in precision instruments. Additionally, the Middle East’s healthcare expansion, supported by initiatives like Saudi Arabia’s Health Sector Transformation Program, further boosts demand for ceramic-based medical solutions. This driver strengthens the market by addressing critical healthcare needs with high-performance materials.

Challenges:

High Production and Material Costs: The high cost of manufacturing advanced ceramics poses a significant restraint for the MEA advanced ceramics market. Producing materials like silicon nitride and ceramic matrix composites (CMCs) involves complex processes, such as high-temperature sintering and precise raw material preparation, which increase expenses. These costs are particularly challenging for small and medium-sized enterprises in cost-sensitive markets like Africa. A 2024 article notes that the high cost of raw materials, such as high-purity oxides, and energy-intensive production limit widespread adoption. Additionally, the need for specialized equipment, such as 3D printing ceramics systems, further escalates costs. This restraint hinders market penetration, requiring manufacturers to balance cost and performance through innovation.

Technical Challenges in Material Properties: Technical limitations, particularly the brittleness of ceramics, present a significant restraint. While silicon carbide and zirconia offer exceptional hardness and thermal resistance, their susceptibility to cracking under mechanical stress limits their use in some applications. Overcoming this requires advanced toughening techniques, such as fiber reinforcement in ceramic matrix composites (CMCs), which increase complexity and cost. A 2025 report emphasizes ongoing R&D to improve ceramic toughness, but challenges persist in scaling these solutions. In industries like South African industrial ceramics, where ceramics are used in harsh mining environments, brittleness can lead to premature component failure. This restraint necessitates continuous innovation to enhance material reliability and expand applications, particularly in high-stress environments.

Middle East and Africa Advanced Ceramics Market Segmentation Analysis

By Material: Alumina: Alumina leads the MEA advanced ceramics market due to its cost-effectiveness, versatility, and superior properties, including high hardness, wear resistance, and thermal stability. Widely used in electrical & electronics for substrates and insulators, alumina ceramics are critical in high-power semiconductor components and circuit carriers, supporting the region’s growing electronics sector. In Saudi Arabia, alumina’s application in industrial machinery and petrochemical equipment aligns with Vision 2030’s push for advanced manufacturing. Its corrosion resistance and durability also make it ideal for South African industrial ceramics in mining and chemical processing. Additionally, alumina is used in ceramic coatings for wear-resistant components, enhancing longevity in harsh environments. Its affordability and scalability ensure dominance, with companies like Saudi Ceramics expanding production.

By End-User Industry: Electrical & Electronics: The electrical & electronics sector dominates the market, driven by the region’s increasing demand for consumer electronics, telecommunications infrastructure, and renewable energy systems. Alumina ceramics and silicon nitride are integral to substrates, capacitors, and sensors, offering excellent electrical insulation and thermal conductivity. In the UAE, the rise of 5G technology and smart city projects, such as Dubai’s Smart City initiative, boosts demand for ceramics in high-frequency circuits. In Saudi Arabia, Vision 2030’s focus on digital transformation fuels investments in electronics manufacturing. South Africa leverages ceramics in solar panel components, supporting renewable energy growth. The sector’s reliance on ceramic matrix composites (CMCs) for durable, high-performance electronics further solidifies its market leadership, ensuring robust demand across the MEA region.

Middle East and Africa Advanced Ceramics Market Geographical Outlook

By Country: Saudi Arabia: Saudi Arabia is the leading market in the MEA advanced ceramics market, propelled by Vision 2030’s ambitious diversification goals and mega-projects like NEOM and the Red Sea Project. These initiatives drive demand for GCC ceramic materials in construction, energy, and manufacturing, with alumina ceramics and ceramic coatings used in sustainable building components and renewable energy systems. The country’s petrochemical industry relies on ceramics for high-temperature equipment, while its growing healthcare sector adopts bioceramics for medical implants. Saudi Arabia’s investment in advanced manufacturing, supported by partnerships like Saudi Ceramics’ tech collaborations, enhances production capacity. The country’s strategic focus on industrialization and sustainability positions it as a market leader, driving regional ceramic adoption.

Middle East and Africa Advanced Ceramics Market Competitive Landscape

Some of the major players covered in this report include CeramTec GmbH, Morgan Advanced Materials, Imerys Ceramics, RAK Ceramics, and CERadvance, among others.

List of major companies:

Kyocera Corporation

CeramTec GmbH

CoorsTek Inc.

Saint-Gobain Ceramic Materials

Morgan Advanced Materials plc

RAK Ceramics

Middle East and Africa Advanced Ceramics Market Key Developments:

RAK Ceramics, a major advanced ceramics manufacturer headquartered in the UAE, has continued to invest in expanding its production capabilities in 2024 and 2025. This includes the implementation of new, highly automated production lines for a range of technical ceramic products, particularly those used in building and construction. This strategic investment is not a traditional product launch but a significant expansion that introduces new production capacity and a wider product portfolio to the market.

Middle East and Africa Advanced Ceramics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$3.741 billion |

| Total Market Size in 2031 | US$4.634 billion |

| Growth Rate | 4.38% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Material, Product, End-User Industry, Country |

| Geographical Segmentation | Saudi Arabia, UAE, South Africa, Others |

| Companies |

|

Middle East and Africa Advanced Ceramics Market Segmentation:

By Material:

Alumina

Zirconate

Titanate

Ferrite

Others

By Product:

Monolithic

Ceramic Coatings

Ceramic Matrix Composites

Others

By End-User Industry:

Electrical & Electronics

Automotive

Machinery

Environmental

Medical

Others

By Country:

South Africa

UAE

Saudi Arabia

Others