Report Overview

Middle East and Africa Highlights

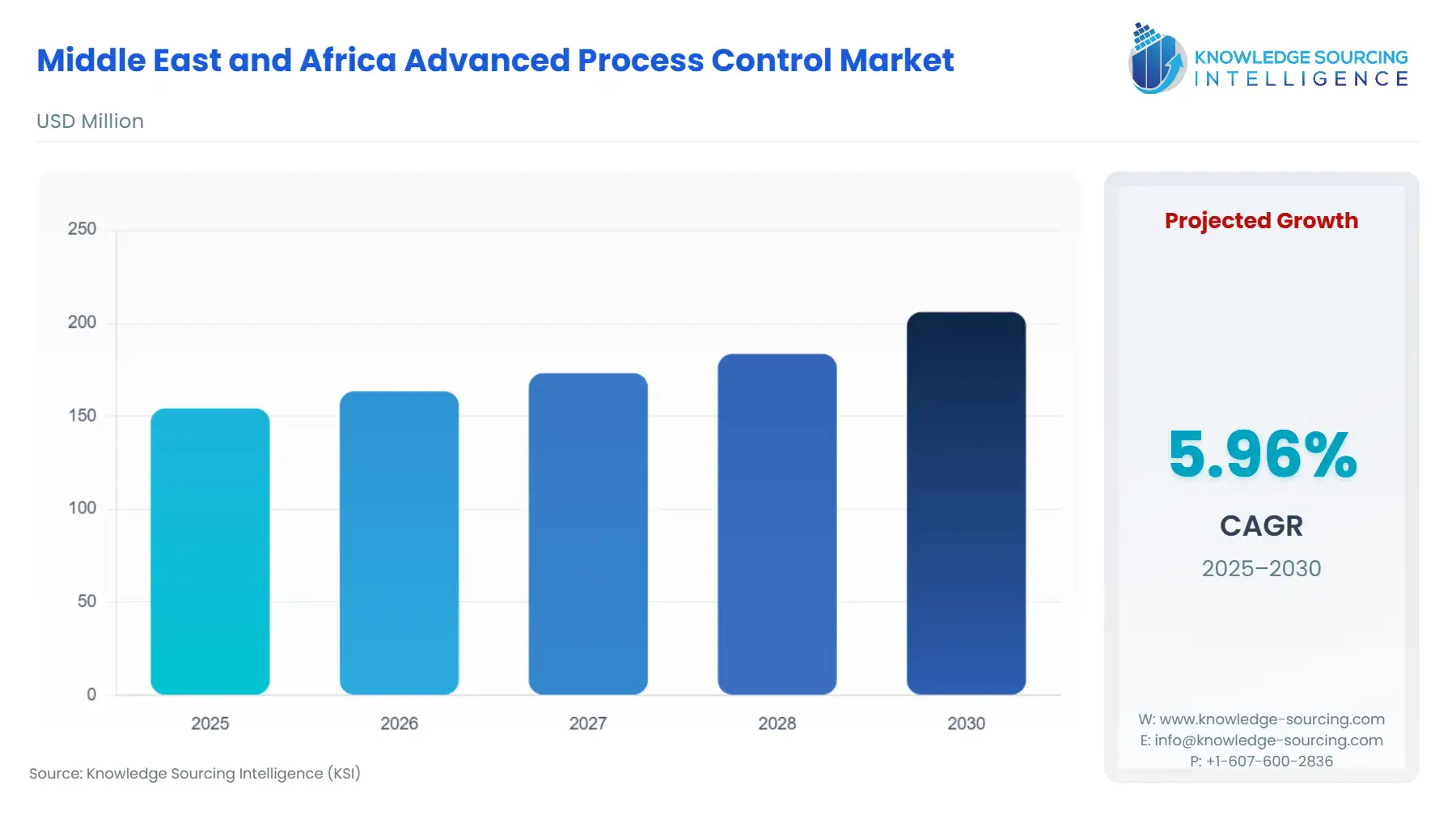

Middle East and Africa Advanced Process Control Market Size:

The Middle East and Africa Advanced Process Control Market will reach US$205.975 million in 2030 from US$154.191 million in 2025 at a CAGR of 5.96% during the forecast period.

Middle East and Africa Advanced Process Control Market Trends:

The Middle East and Africa Advanced Process Control (APC) market is experiencing significant growth, driven by the region’s strategic focus on industrial modernization, energy efficiency, and digital transformation. Advanced Process Control systems, which leverage sophisticated algorithms, predictive modeling, and real-time data analytics, are pivotal in optimizing complex industrial processes across sectors such as oil and gas, petrochemicals, manufacturing, and power generation. In the Middle East, particularly in the Gulf Cooperation Council (GCC) countries like Saudi Arabia and the UAE, and in key African markets like South Africa, APC solutions are transforming operations by enabling process efficiency improvement and operational expenditure reduction. These systems are critical in addressing the region’s unique challenges, including volatile oil prices, stringent environmental regulations, and the need for sustainable industrial practices.

The Middle East and African APC market is propelled by several key drivers. First, the region’s focus on digital transformation, aligned with initiatives like Saudi Arabia’s Vision 2030 and the UAE’s Industry 4.0 strategy, drives adoption of APC systems to modernize industrial infrastructure. A recent report highlights how these initiatives prioritize smart technologies to enhance industrial competitiveness. Second, the oil and gas sector, a cornerstone of the region’s economy, relies on APC for plant-wide optimization, particularly in refineries and petrochemical plants, to maximize output amidst fluctuating crude oil prices. Third, stringent environmental regulations, such as the UAE’s sustainability goals, push industries to adopt safety instrumented systems (SIS) integrated with APC to reduce emissions and ensure compliance.

However, the market faces notable restraints. High initial investment costs for APC implementation, including hardware, software, and integration, pose challenges, especially for small and medium-sized enterprises (SMEs) in Africa. A 2024 article notes that limited financial resources hinder technology adoption in the region’s manufacturing sector. Additionally, the complexity of integrating APC with legacy systems requires specialized expertise, which is often scarce in developing markets.

How Advanced Ceramics Work

APC systems are advanced control technologies that use mathematical models, predictive algorithms, and real-time data to optimize industrial processes. Unlike traditional control systems, which rely on manual adjustments or basic proportional-integral-derivative (PID) controllers, APC employs model predictive control (MPC), advanced regulatory control (ARC), and multivariate algorithms to manage complex, interdependent process variables. These systems integrate with safety instrumented systems (SIS) to ensure operational safety by monitoring critical parameters like pressure, temperature, and flow rates. For instance, in oil refineries, APC adjusts distillation parameters in real time to optimize yield.

APC systems typically consist of software platforms, sensors, and digital control units that collect data from plant operations, analyze it using AI and machine learning, and adjust set points to maintain optimal conditions. In the Middle East and Africa Advanced Process Control market, cloud-based APC solutions, such as Schneider Electric’s EcoStruxure, upgraded with AI modules, enable remote monitoring and predictive maintenance. These systems ensure plant-wide optimization by coordinating multiple control loops, reducing variability, and enhancing equipment reliability.

Business Benefits: Profitability and Efficiency

APC systems deliver significant business benefits in terms of profitability and efficiency for industries in the Middle East and Africa. In the oil and gas sector, which dominates the region’s economy, APC enables operational expenditure reduction by optimizing refining processes, reducing energy consumption, and minimizing waste. For example, Petroleum Development Oman’s deployment of Honeywell’s APC solutions at its Government Gas Plant improved yield efficiency and reduced energy costs. This aligns with the region’s need to maximize profitability amidst volatile oil prices.

In South Africa, APC systems enhance process efficiency improvement in mining and manufacturing by reducing downtime and optimizing resource use. ABB’s OPT800 Lime APC solution at Andhra Paper’s South African facility reduced energy consumption in lime kiln operations, boosting profitability through lower operational costs. The integration of safety instrumented systems (SIS) ensures compliance with safety standards, minimizing risks and costly incidents, particularly in high-risk sectors like petrochemicals.

In the UAE, APC supports smart city initiatives by optimizing energy-intensive processes in utilities and construction. A recent report notes that APC systems in Dubai’s smart infrastructure projects improved energy efficiency, contributing to plant-wide optimization and cost savings. These systems also enable predictive maintenance, reducing unplanned downtime and enhancing efficiency, which directly impacts profitability by extending equipment lifecycles.

The Middle East and Africa Advanced Process Control market is poised for robust growth, driven by technological advancements and regional priorities. The adoption of AI and IoT, as seen in ABB’s brewery automation solution, enhances process efficiency improvement in the food and beverage sectors. Strategic partnerships, such as Yokogawa’s collaboration with Compressor Controls for turbomachinery solutions, strengthen market offerings. The focus on sustainability and operational expenditure reduction aligns with regional goals, ensuring continued investment in APC.

The growing adoption of factory automation is the major factor driving the regional growth. Oil production and the development of shale gas further drive the need for an APC system due to the growing need for an automated process to avoid industrial accidents and lower the industrial expenditure. Other drivers include growing regulations for workplace safety and the rising need to conserve energy. The need to minimise the cost and maximise the efficiency with growing competition in the market will augment the regional market growth in the years ahead.

The research provides comprehensive insights into the development, trends, and industry policies and regulations across various geographical segments of the Middle East and Africa (MEA) Advanced Process Control market. It examines the overall regulatory framework, offering stakeholders a clearer understanding of the key factors shaping the market environment.

The Middle East and Africa APC market is rapidly evolving, driven by technological advancements and regional industrial priorities. Key trends include IIoT in process control, predictive control software, model predictive control (MPC), real-time optimization (RTO), advanced regulatory control (ARC), digital twin for the process industry, and AI for process optimization, transforming sectors like oil and gas, petrochemicals, and manufacturing.

IIoT in process control enhances connectivity, enabling seamless data exchange for real-time monitoring in Saudi Arabia’s refineries. Predictive control software leverages AI for process optimization to anticipate equipment failures, reducing downtime in the UAE’s energy sector. MPC dominates for its ability to manage complex multivariable processes, improving yields in South Africa’s chemical plants. RTO enhances efficiency in Oman’s gas processing. ARC ensures stability in smaller-scale operations, while a digital twin for the process industry enables virtual process simulations, boosting efficiency in Qatar’s petrochemicals. These trends drive sustainability and competitiveness across the region.

Middle East and Africa Advanced Process Control Market Dynamics

Drivers:

Digital Transformation Initiatives: The region’s aggressive push toward digital transformation, driven by initiatives like Saudi Arabia’s Vision 2030 and the UAE’s Industry 4.0 strategy, is a major driver for APC adoption. These programs prioritize smart technologies to enhance industrial competitiveness, encouraging industries to implement IIoT in process control and AI for process optimization. A recent report highlights how Vision 2030’s investments in digital infrastructure are transforming Saudi Arabia’s oil and manufacturing sectors, with APC systems optimizing complex processes like refining and petrochemical production. The UAE’s smart city projects, such as Dubai’s Smart City initiative, further drive demand for RTO to manage energy-intensive operations. This focus on digitalization fosters process efficiency improvement, making APC systems critical for modernizing industrial operations across the region.

Demand for Energy Efficiency and Sustainability: The MEA advanced process control market is propelled by the region’s emphasis on energy efficiency and sustainability, driven by volatile energy prices and stringent environmental regulations. APC systems, including MPC, optimize energy-intensive processes in oil refineries and power plants, reducing operational expenditure. A recent report notes that Oman’s gas processing facilities use APC to cut energy consumption by optimizing flow rates and separation processes. In South Africa, the mining sector leverages ARC to enhance energy management, aligning with national sustainability goals. These systems also ensure compliance with environmental standards, such as the UAE’s green initiatives, reducing emissions and waste. This driver enhances profitability by lowering costs and meeting regulatory demands.

Growth in Oil and Gas Sector Automation: The oil and gas sector, a cornerstone of the MEA economy, drives APC adoption through its focus on automation and plant-wide optimization. Predictive control software enables real-time adjustments in refining and gas processing, maximizing yields and reducing costs. Petroleum Development Oman’s deployment of Honeywell’s APC solutions at its Government Gas Plant improved operational efficiency. Saudi Arabia’s Aramco is also investing in a digital twin for the process industry to simulate and optimize refinery operations. This trend extends to the UAE, where APC systems support integrated refinery-petrochemical complexes, enhancing throughput and profitability. The sector’s need to remain competitive amidst fluctuating oil prices drives investment in APC, ensuring precise control and operational resilience across the region.

Challenges:

High Initial Investment Costs: The high cost of implementing APC systems is a significant restraint, particularly for SMEs in Africa and smaller enterprises in the Middle East. Deploying predictive control software and MPC requires substantial investments in hardware, software, and integration with existing systems, often leading to prolonged payback periods. A 2024 article highlights that financial constraints limit technology adoption in South Africa’s manufacturing sector, where upfront costs for APC can be prohibitive. Additionally, plant downtime during installation disrupts production, further increasing costs. This restraint hinders widespread adoption, requiring vendors to offer cost-effective, scalable solutions to expand market reach.

Integration Complexity with Legacy Systems: The complexity of integrating APC systems with legacy infrastructure poses a significant challenge. Many industries in the MEA region, particularly in developing African markets, rely on outdated control systems that are incompatible with modern IIoT in process control and digital twin for process industry technologies. Retrofitting these systems demands specialized expertise and significant time, increasing implementation costs. A 2025 report notes that South Africa’s chemical plants face challenges in aligning legacy systems with ARC, delaying APC deployment. In the Middle East, even advanced facilities like refineries require extensive reconfiguration to incorporate RTO. This restraint limits market growth, necessitating tailored integration strategies to bridge technological gaps.

Middle East and Africa Advanced Process Control Market Segmentation Analysis

By Type: Model Predictive Control (MPC): Model predictive control (MPC) dominates the MEA advanced process control market due to its ability to manage complex, multivariable processes with high precision, making it ideal for industries requiring RTO. MPC uses dynamic mathematical models to predict process behavior and optimize control actions, ensuring process efficiency improvement in sectors like oil and gas and chemicals. In Saudi Arabia, MPC is widely adopted in refineries to maximize throughput and reduce energy consumption. South Africa’s chemical plants leverage MPC for stable production. The integration of AI for process optimization enhances MPC’s predictive accuracy. MPC’s adaptability and scalability ensure its leadership in delivering operational expenditure reduction across the region’s industrial landscape.

By Application: Oil and Gas: The oil and gas sector is the largest application segment, driven by the region’s economic reliance on hydrocarbons and the need for plant-wide optimization. APC systems, particularly MPC and ARC, optimize refining, gas processing, and extraction, enhancing yields and reducing costs. In Oman, Petroleum Development Oman’s APC deployment at its Government Gas Plant improved operational efficiency. Saudi Arabia’s Vision 2030 initiatives drive APC adoption in integrated refinery-petrochemical complexes. The UAE uses APC to support sustainable energy transitions, integrating IIoT in process control for real-time monitoring. This segment’s dominance reflects its critical role in ensuring profitability and operational resilience in volatile markets.

Middle East and Africa Advanced Process Control Market Geographical Outlook

By Country: Saudi Arabia: Saudi Arabia leads the MEA advanced process control market, fueled by Vision 2030’s focus on industrial diversification and digital transformation. The country’s oil and gas sector, a global leader, relies on APC for real-time optimization (RTO) in refineries and petrochemical plants. Investments in smart manufacturing and digital twins for process industry technologies enhance efficiency in the chemicals and power sectors. Saudi Arabia’s infrastructure projects, like NEOM, integrate APC for energy management. The country’s strategic partnerships, such as Yokogawa’s collaboration with Compressor Controls, strengthen its APC ecosystem. Saudi Arabia’s focus on sustainability and efficiency cements its market dominance.

Middle East and Africa Advanced Process Control Market Competitive Landscape

Some of the major players covered in this report include Honeywell International Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., and Schneider Electric SE, among others.

List of major companies:

ABB Ltd.

Siemens AG

Schneider Electric SE

Emerson Electric Co.

Honeywell International Inc.

Middle East and Africa Advanced Process Control Market Key Developments:

In April 2025, Yokogawa Electric Corporation, a global leader in industrial automation, announced its acquisition of Web Synergies, a provider of IT and integrated IT/OT (Information Technology/Operational Technology) solutions. This strategic acquisition is designed to strengthen Yokogawa's capabilities in delivering digital transformation solutions to its customers. The move is significant for the Middle East and Africa market as it allows Yokogawa to offer a more comprehensive portfolio of services that integrate APC with IT infrastructure, addressing the increasing demand for seamless digital integration in industrial operations.

In February 2024, Schneider Electric, a specialist in energy management and automation, launched its Distributed Control Node (DCN) software framework. This product, an extension of its EcoStruxure Automation platform, enables industrial companies to implement a software-defined, "plug-and-produce" solution. The DCN framework is designed to help businesses in the region enhance operational efficiency, ensure product quality, and reduce complexity and costs by moving away from traditional, hardware-centric control systems. This launch signifies a push toward more flexible and scalable automation solutions.

Middle East and Africa Advanced Process Control Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 154.191 million |

| Total Market Size in 2031 | USD 205.975 million |

| Growth Rate | 5.96% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Component, Application, Geography |

| Geographical Segmentation | South Africa, UAE, Saudi Arabia, Others |

| Companies |

|

Middle East and Africa Advanced Process Control Market Segmentation:

By Type:

Sequential Control

Compressor Control

Advanced Regulatory Control

Inferential Control

Others

By Component:

Software

Hardware

Services

By Application:

Power

Oil and Gas

Pharmaceuticals

Chemicals

Food and Beverage

Others

By Country:

South Africa

UAE

Saudi Arabia

Others