Report Overview

Military Satellite Market Size, Highlights

Military Satellite Market Size:

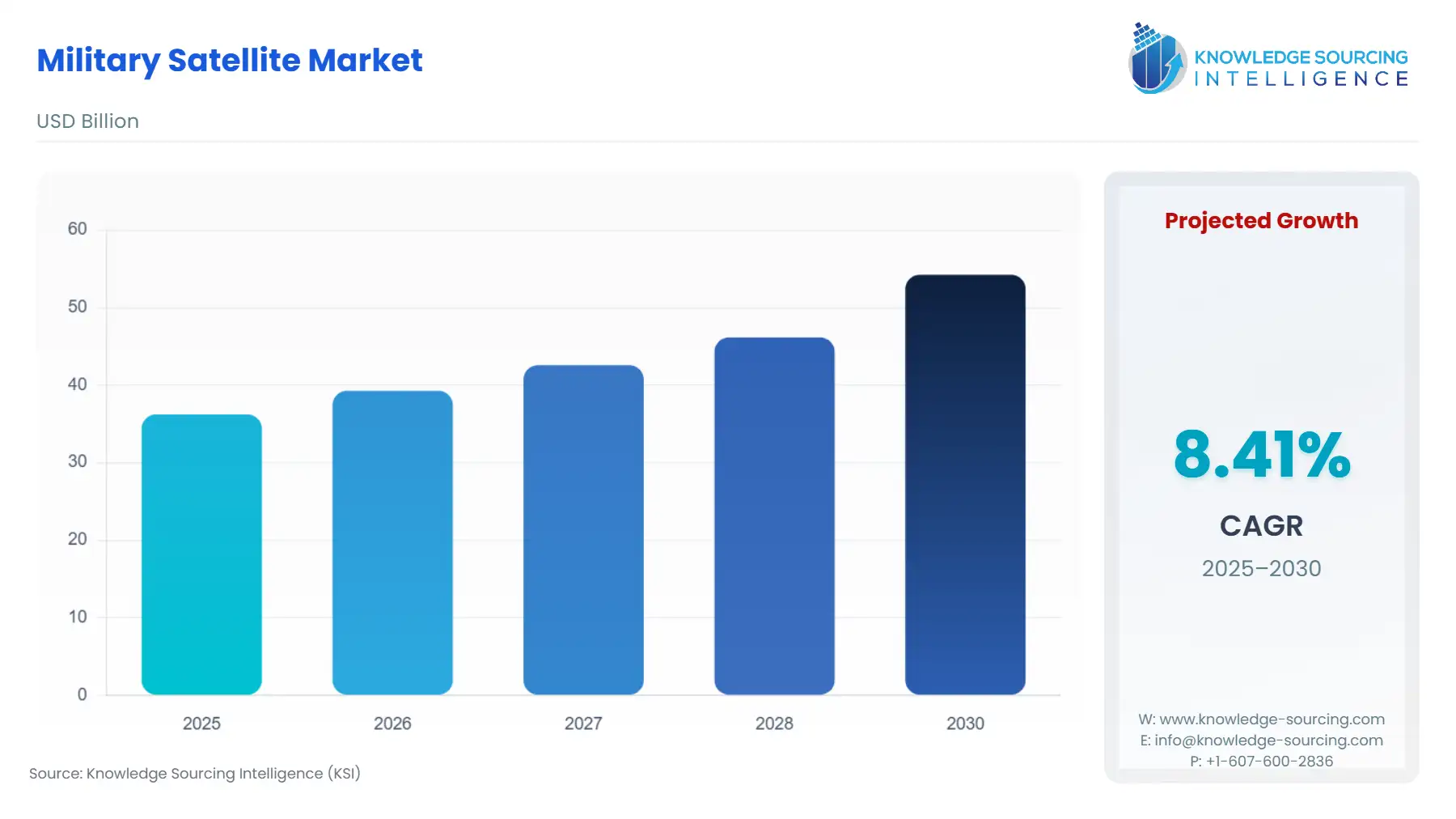

The military satellite market is estimated to grow at a CAGR of 8.41% from US$36.234 billion in 2025 to US$54.246 billion in 2030.

A military satellite is a type of artificial satellite that is developed and launched specifically for defense and national security. Such satellites are used to carry out numerous tasks such as reconnaissance, surveillance, secure communications, missile alert, navigation, and electronic intelligence collection. Military satellites differ from commercial or civilian satellites in the sense that they are often owned and controlled by a nation's defense or intelligence departments and are outfitted with sophisticated technologies to facilitate operations in hostile or contested terrains.

The military satellite market is experiencing sustained growth as a result of increasing international defense budgets, increasing geopolitical tensions, and increased reliance on space-based technology to conduct modern war. Primary drivers are the necessity of live data in ISR operations, the need for secure and strong lines of communication, and the elevated importance of space as a contested environment. Moreover, the miniaturization of satellites, AI-based analytics, and reusable launch vehicles has reduced expenses and increased capabilities, prompting countries to build or increase their military satellite constellations.

Military Satellite Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Military satellite market is segmented by:

- Satellite Type: This category comprises reconnaissance and surveillance satellites, communications satellites, navigation satellites, early warning systems, and ELINT/SIGINT satellites. Reconnaissance and surveillance satellites are central to contemporary warfare through the provision of real-time imagery and intelligence. Communication satellites provide secure, encrypted communication among forces. Navigation satellites provide accuracy in targeting and troop movement, and early warning satellites are necessary for missile launch detection. ELINT/SIGINT satellites are used to collect signal and vital electronic intelligence, tracking enemy communication and radar. Amongst these, communication satellites will be expected to lead these because of the increasing demand for secure and perpetual global military communication.

- Orbit Type: Military satellites are stationed at different orbits, namely Geostationary Orbit – GEO, Medium Earth Orbit(MEO), and Low Earth Orbit(LEO). LEO is commonly used to perform tactical information and reconnaissance because it is close to the planet and has a lower latency. MEO is mainly used for navigation satellites, and it offers a compromise between resolution and coverage. Owing to their fixed position concerning Earth, GEO satellites are useful when persistent surveillance and strategic communication are desired. LEO is likely to dominate this market due to the obsession with utilising massive constellations of microscopic satellites for real-time intelligence and quick relay of data.

- End-User: Military satellites are utilized by different defense branches: the Army, the Navy, the Air Force, and joint defense authorities. Each uses space capabilities for certain operational requirements, ground movement monitoring (Army), maritime domain situational awareness (Navy), and airborne surveillance or precision strike assistance (Air Force). Joint defense authorities, however, are poised to dominate as future military operations will increasingly depend on combined, cross-domain command and control that necessitates common access to satellite information for all forces.

- Region: The geographical division of the market is North America, Europe, Asia-Pacific, the Middle East & Africa, and South America. North America, with high defense spending and large space capabilities, especially in the US, dominates the market, which is budding fast in Asia-Pacific, where big investments are made by China, India, and Japan. North America is likely to maintain its dominance because of the well-established space infrastructure, satellite technologies, and strategic defence plans that include space.

Top Trends Shaping the Military Satellite Market:

1. Proliferation of Small Satellites and LEO Constellations

- Militaries are adopting small satellites (smallsats) and launching them in massive constellations in Low Earth Orbit (LEO). The smallsats have advantages such as low prices for launching, rapid deployment abilities, and ease of substitution. Smallsat, compared to the conventional large satellite, is more flexible and provides real-time monitoring, faster data relay, and scalable coverage. LEO constellations are especially appealing for tactical edge operations and rapid-response surveillance. Defense agencies are funding this endeavor to strengthen resilience and maintain steady situational awareness across domains.

2. Integration of Artificial Intelligence and Machine Learning

- Satellite operations are being transformed by artificial intelligence (AI) and analytics on big data, which supports real-time data processing and clever decision-making. AI-powered image recognition, anomaly detection, and predictive analysis further form part of military satellites so that they can quickly scan high volumes of collected data gathered via ISR missions. This minimizes analysts' cognitive load and accelerates response time from data collection to actionable intelligence. AI further improves autonomy in satellite systems, enabling them to dynamically adapt operations to respond to mission requirements or threats.

Military Satellite Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Defense Expenses: As polarized geo-political environments threaten the world, especially in areas including Asia-Pacific and eastern Europe, defense budgets are increasing, and countries have put huge investments in next-generation technologies, such as satellite military assets. National security problems, such as missile defense and border tensions, are contributing to the need for new generation space assets to support a strategic advantage. Countries are rushing the development and deployment of military satellites to enhance the real-time surveillance, reconnaissance, and communication possibilities. This rise in budgets for defense accounts is ensuring that military projects relating to satellites receive the attention and amount of money they deserve.

- Demand for Real-Time Intelligence and Surveillance: The need for real-time intelligence and Surveillance; Contemporary battlefield is heavily dependent on data, and real-time intelligence to fulfill this role, most of the time, is key to success in operations. Military satellites are indispensable sources of surveillance and reconnaissance, which include real-time imagery, communications, and environmental information from space. This is particularly useful in opposing emerging threats, conducting strategic operations, and raising awareness of the battlefield. An increased reliance on satellite-based ISR systems in all branches of the military is the major growth driver of the market for satellites.

Challenges:

- High Initial Costs: Military satellites are very costly to develop, launch, and maintain. It requires a lot of money even in the first step to build quality and reliable satellites, in particular, complex satellite systems such as communications, ISR, or missile defense satellites. Besides, military satellites also have long development schedules as they experience intense tests and integration processes that will cause their deployment and procurement process to be very long. Such time and financial obstacles make it unfeasible for some countries or smaller defense contractors to enter or build distortions in the military satellite industry.

Military Satellite Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific military satellite industry is witnessing remarkable growth, which is being fuelled by expanding defense budgets, regional security concerns, and the fast pace of space technology evolution. Countries like China, India, Japan, and South Korea are investing extensively in space assets to boost their defense capabilities, especially in the fields of surveillance, communication, and navigation.

Military Satellite Market Competitive Landscape:

The Military satellite market is competitive, with a mix of established players and specialized innovators driving its growth.

- In March 2025, the CSO-3 (Composante Spatiale Optique) Earth observation satellite, built by Airbus for the French Armed Forces, was launched successfully by Arianespace on Ariane 6's inaugural commercial mission from the European Spaceport in Kourou.

- In February 2025, the Swedish Armed Forces released the launch of their first military satellite, a communications satellite named Gna-3.

Military Satellite Market Segmentation:

- Reconnaissance and Surveillance Satellites

- Communication Satellites

- Navigation Satellites

- Early Warning Satellites

- ELINT and SIGINT Satellites

By Orbit Type

By End-User

- Army

- Navy

- Air Force

- Joint Defense Agencies

By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa