Report Overview

Oil Conditioning Monitoring Market Highlights

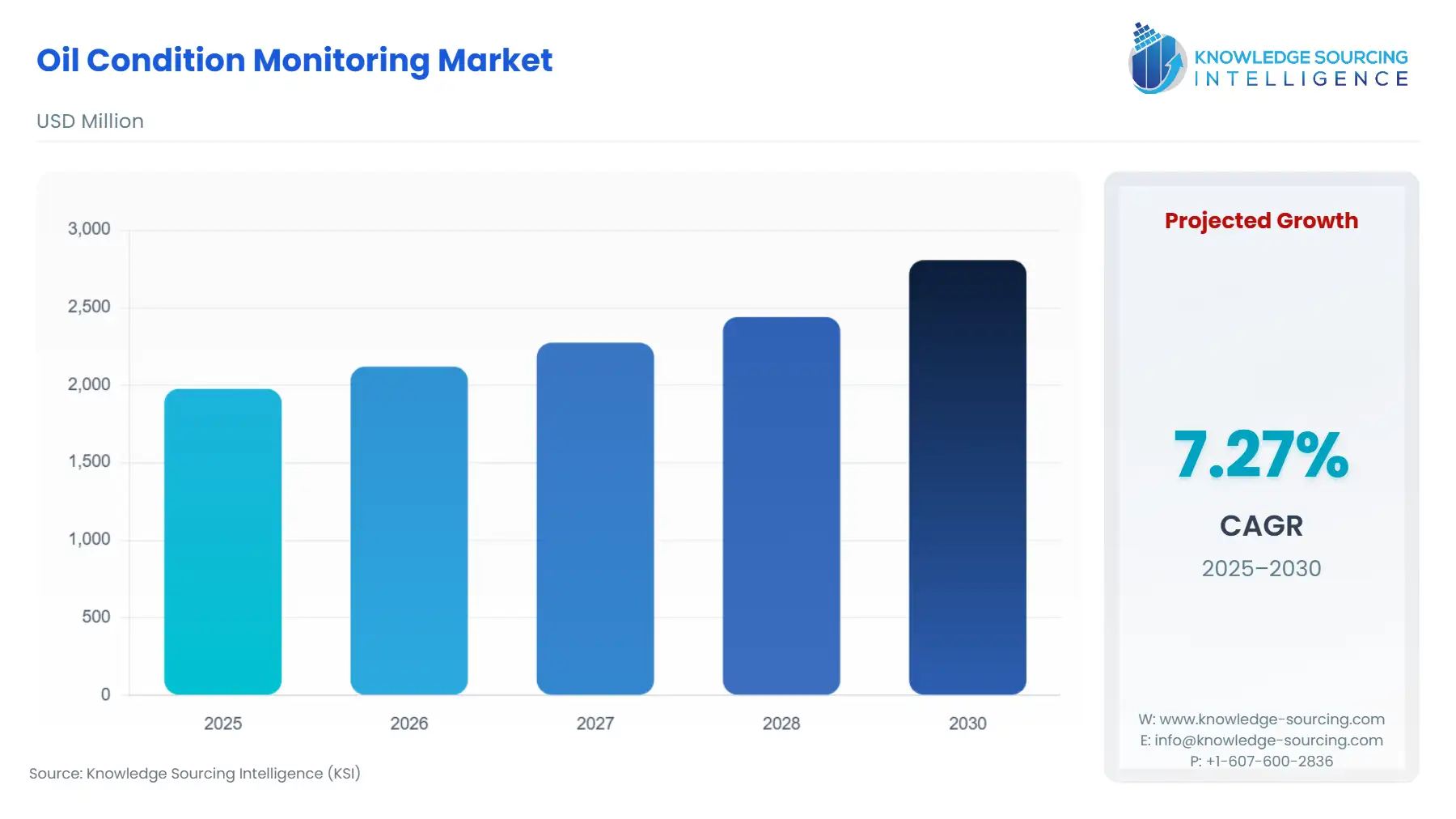

Oil Conditioning Monitoring Market Size:

The oil condition monitoring market is expected to grow from USD 1.976 billion in 2025 to USD 2.807 billion in 2030, at a CAGR of 7.27%.

The global Oil Conditioning Monitoring (OCM) market is undergoing a significant strategic evolution, moving beyond traditional, periodic off-site laboratory testing toward integrated, continuous, and autonomous digital solutions. This transition is not merely an operational upgrade but an economic and regulatory imperative across industries with high capital expenditure and severe penalties for failure. OCM technologies, which analyze lubricant parameters such as viscosity, particle contamination, and chemical degradation have become foundational to Enterprise Asset Management (EAM) strategies. The market dynamic is driven by a singular focus: maximizing asset uptime and extending the lifecycle of complex, high-speed rotating and hydraulic equipment. The following analysis examines the forces driving and restraining market expansion, detailing the regional and competitive environments that define the current landscape.

Global Oil Conditioning Monitoring Market Analysis

- Growth Drivers

The core growth driver is the economic imperative for asset life extension, which directly propels the demand for real-time sensor integration. As industries push machinery to operate longer under more demanding cycles, OCM provides the only data-driven mechanism to safely defer major component replacement, thereby creating consistent demand for advanced, multi-parameter sensors. Concurrently, the proliferation of Industry 4.0 protocols necessitates the integration of OCM data into centralized predictive maintenance software, increasing the demand for sophisticated cloud-based analytics platforms. This digital infrastructure enables operators to move from a reactive cost center to a proactive optimization strategy, a shift that elevates OCM from a discretionary spend to an essential operational technology.

- Challenges and Opportunities

The primary constraint facing market expansion is the high initial capital investment required for continuous, on-site monitoring hardware, which limits adoption among smaller and mid-sized industrial enterprises. This cost barrier reduces the immediate demand for advanced sensor fleets and centralized data aggregation platforms. Conversely, a significant opportunity lies in the integration of AI and Machine Learning (ML) diagnostics. Deploying AI-powered OCM software transforms raw sensor data into explicit, prescriptive maintenance recommendations, thereby lowering the need for highly specialized human analysts. This reduction in the operational expenditure associated with data interpretation fundamentally enhances the Return on Investment (ROI) for CBM programs, driving sustained long-term demand for smart software solutions, particularly in remote or autonomous environments.

- Raw Material and Pricing Analysis

The OCM market, particularly the on-site and continuous monitoring segment, is materially dependent on the supply of specialty electronic components, including advanced microprocessors, infrared (IR) spectrometers, and high-tolerance ceramic or metal sensor casings. The pricing trajectory for these core components remains highly sensitive to global trade dynamics. For instance, US tariffs on specific categories of industrial control and sensing equipment imported from major Asian manufacturing hubs directly increase the landed cost of finished OCM hardware. This tariff-induced pricing pressure forces OCM manufacturers to either absorb the cost, constraining R&D budgets, or pass it on to end-users, which can dampen the initial demand for large-scale sensor network deployments. The resulting higher bill-of-materials cost presents a persistent challenge to achieving price-point accessibility for mass adoption.

- Supply Chain Analysis

The global OCM hardware supply chain is complex, characterized by critical dependencies on specialized electronic component manufacturers, predominantly located in Asia-Pacific. Key production hubs for the finished analysis units are concentrated in North America and Europe, which serve as the primary markets for intellectual property and integration. The logistical complexity centers on the rapid, reliable delivery of high-precision sensors, which are fragile and require specific handling, from component suppliers to the final assembly points. A major dependency is the consistent supply of chemical reagents and certified oil standards required for calibration and off-site laboratory testing services. Disruptions in the semiconductor industry or shipping bottlenecks create significant headwinds, delaying product deployment timelines and restricting the pace at which new, advanced CBM solutions can be introduced to the market.

Global Oil Conditioning Monitoring Market Government Regulations

Key regulatory and standardization frameworks actively bolster demand for OCM solutions by mandating reliability and safety protocols in high-risk environments.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Global/International |

ISO 4406:1999 (Fluid power—Fluids—Method for coding the level of contamination by solid particles) & ASTM D7718/D7918 (Standard Test Methods) |

Establishes the non-negotiable standards for fluid cleanliness, creating mandatory demand for certified particle count and analysis hardware (both on-site and off-site) for compliance in all ISO-certified facilities. |

|

European Union (EU) |

Health and Safety at Work Directives (e.g., ATEX, Machinery Directive) |

Enforces operational reliability and safety, particularly for machinery in explosive atmospheres (Oil & Gas, Chemical). This mandates the adoption of continuous OCM to detect early signs of failure (e.g., bearing wear) that could lead to catastrophic equipment breakdown. |

|

United States (US) |

Environmental Protection Agency (EPA) and Maritime Regulations (USCG) |

Drive demand by penalizing oil leakage and failure in marine/offshore environments. OCM solutions are demanded as a verifiable, proactive measure to extend lubricant life and prevent environmental incidents. |

Global Oil Conditioning Monitoring Market Segment Analysis

- By Application: Hydraulics

The Hydraulics application segment is a critical demand center for OCM, driven by the inherent operating stress and sensitivity of hydraulic systems. Unlike engines or gearboxes, hydraulic systems rely on an exceptionally clean fluid medium to function, with contaminants leading directly to pump, valve, and cylinder failure. The demand for OCM in this segment is directly correlated with the rise of high-pressure, electro-hydraulic systems prevalent in construction, mining, and aerospace industries. These sophisticated systems require highly granular, real-time particle counting and water contamination monitoring to maintain operational integrity. The cost of replacing a high-tolerance hydraulic servo valve, or the downtime of an excavator, far exceeds the cost of a continuous monitoring sensor, creating an undeniable economic justification that fuels robust, persistent demand for advanced, multi-parameter OCM hardware. Manufacturers of hydraulic components often embed OCM as a non-negotiable part of their warranty structure, further cementing its demand.

- By Industry Vertical: Oil & Gas

The Oil & Gas industry constitutes a dominant end-user vertical, with its demand for OCM driven by the extreme capital intensity and geographic remoteness of its assets. Offshore platforms, LNG facilities, and major pipeline compressor stations operate under a zero-tolerance policy for unplanned downtime, as a single failure can lead to millions in lost revenue, safety hazards, and regulatory sanctions. This environment creates a powerful, persistent demand for autonomous, continuous OCM solutions integrated into Enterprise Resource Planning (ERP) systems. The market is increasingly demanding specialized wear debris analysis and corrosion monitoring for critical, non-redundant assets like subsea pumps and gas turbines. Furthermore, OCM is a crucial element of safety and regulatory compliance on drilling rigs, where proactive component failure prediction is essential to mitigate the risk of major incidents, thereby solidifying its position as a mission-critical technology rather than a maintenance accessory.

Global Oil Conditioning Monitoring Market Geographical Analysis

US Market Analysis (North America)

The US market for Oil Conditioning Monitoring is characterized by a mature industrial base and the rapid adoption of digital infrastructure. Demand is primarily driven by the nation’s large Oil & Gas exploration and pipeline network, as well as the advanced manufacturing sector, which is rapidly implementing IIoT and digital twin strategies. A key factor influencing supply-side pricing remains the geopolitical landscape: targeted US tariffs on industrial electronics have demonstrably increased the cost of imported OCM sensors and analysis equipment, influencing purchasing decisions toward long-term service contracts or domestically assembled final products. The proactive emphasis on asset uptime and safety compliance across the US energy and maritime sectors ensures a consistently high demand for advanced, integrated OCM services.

- Brazil Market Analysis (South America)

Brazil's OCM demand is heavily concentrated in its massive resource extraction industries—specifically deep-water Oil & Gas (Pre-Salt) and Mining. The operational environment is defined by remoteness and extreme environmental conditions, creating an essential demand for highly robust, on-board and remote-monitoring systems. The national oil company, Petrobras, sets a high standard for maintenance and safety, which trickles down to all contractors, spurring demand for reliable, accredited testing services. Furthermore, the country's extensive, often poorly maintained logistics infrastructure (trucking fleets and port machinery) drives a parallel market for portable and off-site testing kits to manage oil quality across distributed transportation assets.

- Germany Market Analysis (Europe)

Germany's OCM market is fundamentally shaped by its globally recognized high-precision manufacturing and automotive sectors (Industrie 4.0). Demand is characterized by an exacting requirement for analytical precision and proactive CBM to protect intricate, expensive machining tools and automated production lines. The focus is less on sheer volume and more on the quality of data, driving demand for advanced spectroscopic and elemental analysis instruments capable of detecting microscopic wear particles. Strict European Union environmental and worker safety standards also act as a regulatory driver, compelling heavy industry to employ OCM as a verifiable mechanism for maximizing lubricant life and minimizing waste oil.

- Saudi Arabia Market Analysis (Middle East & Africa)

Demand in Saudi Arabia is almost exclusively tied to the vast scale and criticality of its upstream and downstream Oil & Gas operations. The national imperative is maintaining peak efficiency and avoiding any interruption to the massive crude oil and natural gas production infrastructure. This drives significant, large-scale demand for permanent, continuous online monitoring systems on turbines, pumps, and compressors across immense refining and processing facilities. Local factors, such as the harsh desert environment, necessitate specialized, robust OCM hardware capable of withstanding extreme temperatures and high dust/sand loads, concentrating demand towards established vendors who can supply ruggedized, high-reliability equipment.

- China Market Analysis (Asia-Pacific)

China’s market expansion is fueled by unparalleled industrial scale, encompassing the world’s largest manufacturing base and rapidly expanding infrastructure projects (Energy & Power, Transportation). The local demand driver is the sheer volume of newly deployed machinery and the increasing regulatory crackdown on environmental non-compliance and production safety. This combination is accelerating the shift from highly reactive maintenance to a CBM model. The demand profile is highly bifurcated, encompassing a need for both high-volume, cost-effective on-site analysis kits for smaller factories and highly sophisticated, sensor-based systems for major state-owned enterprises in power generation and petrochemicals.

Global Oil Conditioning Monitoring Market Competitive Environment and Analysis

The Global Oil Conditioning Monitoring market is moderately consolidated, with strong competition across all layers, from specialized hardware manufacturers to global integrated service providers. Differentiation centers on sensor accuracy, data analytics capability, and the ability to integrate into established Enterprise Asset Management platforms.

- Parker Hannifin Corporation: Parker Hannifin’s presence is robust in the hardware segment, particularly through its dedicated filtration and fluid management divisions. Its strategic positioning is rooted in providing high-quality, reliable, inline fluid purity sensors and portable analysis kits that complement its broader portfolio of hydraulic and filtration components. This synergy allows Parker Hannifin to offer OCM as a complete fluid power reliability solution, not just an add-on service.

- TE Connectivity Ltd.: TE Connectivity, a global leader in connectivity and sensors, positions itself as a core technology enabler for real-time OCM. While they may not offer the final integrated software, their strategic position is in supplying the fundamental, highly reliable sensing elements (e.g., temperature, pressure, and viscosity sensors) that are embedded into the machinery itself or integrated into OCM products by Original Equipment Manufacturers (OEMs). Their focus on miniaturization and ruggedization of sensor technology directly addresses the market's growing demand for seamless, durable, on-board monitoring capability in harsh industrial environments.

Global Oil Conditioning Monitoring Market Segmentation

- By Type

- Off-site

- On-site

- By Application

- Engines

- Gear Box

- Transformers

- Hydraulics

- Turbines

- By Industry Vertical

- Automotive

- Aerospace

- Marine

- Oil & Gas

- Manufacturing

- Energy & Power

- Mining

- Renewable Energy

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America