Report Overview

Regenerative Thermal Oxidizer Market Highlights

Regenerative Thermal Oxidizer Market Size:

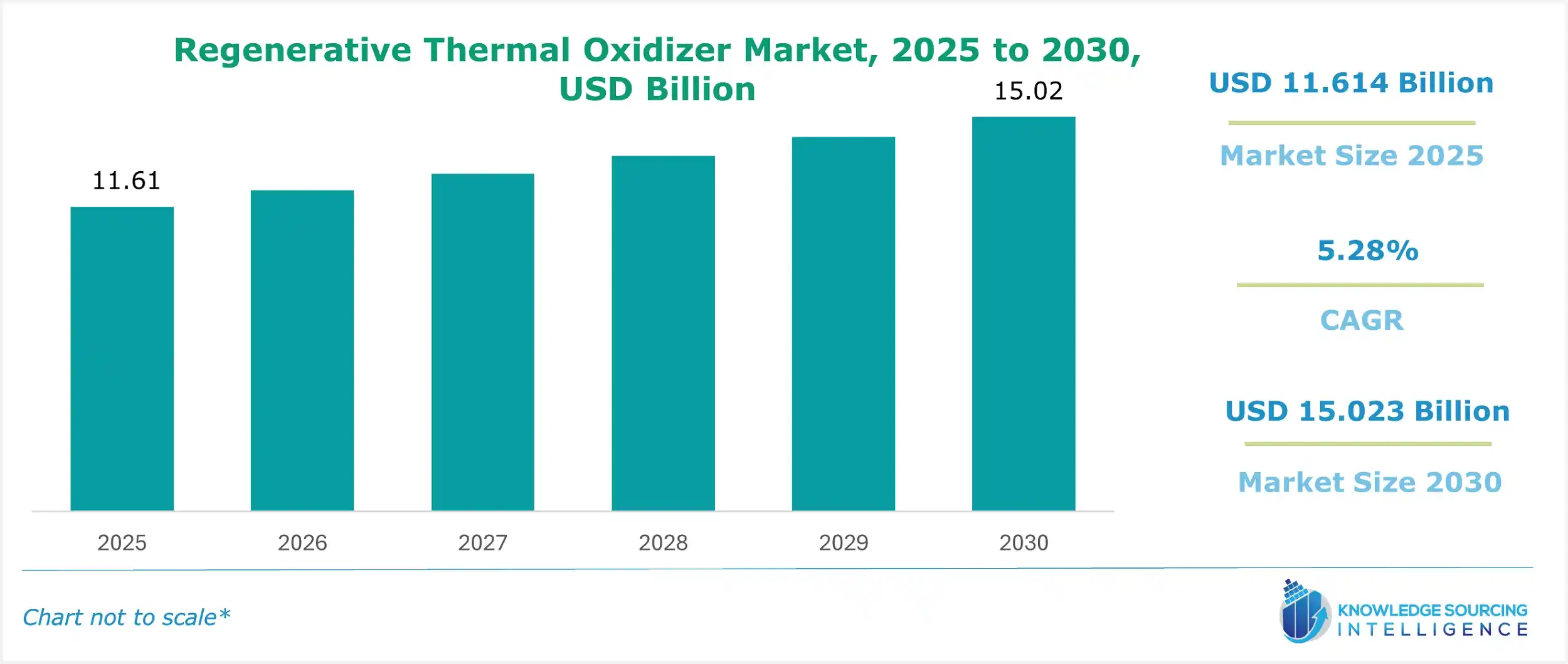

The regenerative thermal oxidizer market is expected to grow at a compound annual growth rate (CAGR) of 5.28%, from US$11.614 billion in 2025 to US$15.023 billion in 2030.

Regenerative thermal oxidizers (RTOs) are commercial devices that handle industrial exhaust gas. An RTO is made to eliminate dangerous emissions and volatile organic compounds that are released by businesses, preventing air pollution. Using a high-temperature thermal oxidation process, the RTO transforms the contaminants into carbon dioxide and water vapor, increasing its demand. Further, this device is used to treat pollutants like carbon monoxide, nitrogen oxides, and suspended particulate matter. Additionally, it is used in significant manufacturing sectors like mining, chemicals, automobiles, food & drinks, and others.

The RTO market is expected to grow considerably in the coming years due to its wide utilization in diverse industries, like chemical manufacturing, food and beverages, coating, and semiconductors. Moreover, the rising demand for sustainability and elimination of carbon footprint through diverse government initiatives and policies will also contribute to promoting demand for RTO among individuals during the projected period.

What are the Regenerative Thermal Oxidizer Market Drivers?

- Increasing industrialization to propel the regenerative thermal oxidizer market growth.

The regenerative thermal oxidizer market is increasing because of rapid industrialization. Due to the rise of manufacturing facilities and factories worldwide, the necessity for effective air-cleaning systems to preserve air quality and safety has become increasingly crucial. RTOs efficiently manage emissions and ensure that ever-stricter air quality rules are followed in industrial areas. Moreover, under the Clean Air Act (CAA), the U.S. Environmental Protection Agency establishes restrictions to decrease air pollution. Regenerative catalytic oxidizers offer a practical remedy for reducing these pollutants. As a result, they are increasingly being used in industrial applications.

- Growing demand for double-bed thermal oxidizers is predicted to boost the market expansion.

The need for RTOs is largest for double-bed thermal oxidizers. A 2-chamber ceramic medium bed design system is made more effective and compact by combining these designs with a well-designed poppet valve. These RTOs have an odd design but also use fewer resources and cost less to produce. Companies like Durr Group provide DürrMegtecVocsidizer, a flameless, single-bed RTO with a modular design that guarantees low operating costs for HAPS control and VOC abatement. The system guarantees high VOC destruction, has a simple design, and is energy efficient.

- Rising demand in the chemical industry is anticipated to promote the market growth for regenerative thermal oxidizers.

Due to the increasingly strict emission regulations, air pollution management is a common challenge in the chemical production business. As a result, there is a growing demand for cutting-edge biological, thermal, and chemical waste treatment solutions. Numerous hazardous and caustic inorganics must be scrubbed before oxidation is created during the manufacturing of chemicals. Hence, there is a growing need in the chemicals industry for scrubbers and oxidizers to treat corrosive and chemical gas emissions. This accelerates the market share of regenerative thermal oxidizers in the chemicals sector.

- Focus on energy conservation and carbon footprint reduction will lead to market expansion.

Across industries, there is a growing emphasis on cutting carbon emissions and improving energy efficiency. RTO systems are being developed with the support of regulatory and governmental entities. Advanced RTO technologies that are eco-friendly and energy-efficient are being researched and produced by manufacturers. These oxidizers are becoming increasingly popular across various industries because of this emphasis on energy efficiency.

What are the Regenerative Thermal Oxidizer Market Challenges?

- Availability of alternatives could restrain regenerative thermal oxidizer market growth.

The regenerative thermal oxidizer market size is hampered by alternatives to these devices, such as bio-filters and bio-scrubbers, which lower the demand. Further, low industrial awareness in emerging and undeveloped nations is another issue that could impede the market's expansion for regenerative thermal oxidizers.

The Regenerative Thermal Oxidizer Market is segmented into five regions worldwide:

Geography-wise, the regenerative thermal oxidizer is divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Regarding revenue share, the North American region is predicted to lead the regenerative thermal oxidizer market. The highly developed economy, supportive government policies against emissions and environment-friendly products, and rising industrialization are all factors for this supremacy. For instance, in October 2024, Solvay completed its largest GHG emissions reduction project, transforming U.S. Green River operations. The plant will drive a 4% reduction in Group-wide GHG emissions by 2025 by phasing out coal and implementing a new RTO process. This marks a significant milestone in the company's global efforts to reduce greenhouse gas emissions. This will allow the growth of regenerative thermal oxidizers in the regional market during the projected period.

Meanwhile, Europe is one of the significant marketplaces for RTO during the projected period. The discharge of VOCs, hydrocarbons, and other pollutants has increased quickly due to fast industrialization, expanding mining operations, and rising production of automobiles, chemicals, and pharmaceuticals. As a result, regulatory bodies like the European Environment Agency are enforcing laws requiring the use of emission control technology. European manufacturers abide by the rules set forth by the government to increase their production capacity and foster a sustainable environment. Regenerative thermal oxidizer demand has been sparked because of this. Further, the regenerative thermal oxidizers market size is anticipated to grow as the region's manufacturing and industrial activity increases.

Regenerative Thermal Oxidizer Market Key Developments:

- In June 2024, Ship & Shore Environmental, Inc. successfully delivered a 23,000 SCFM Regenerative Thermal Oxidizer specializing in air pollution control systems. As a trusted partner for industries seeking efficient emission control solutions, the company's commitment to innovation and customer satisfaction is evident.

Regenerative Thermal Oxidizer Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Regenerative Thermal Oxidizer Market Size in 2025 | US$11.614 billion |

| Regenerative Thermal Oxidizer Market Size in 2030 | US$15.023 billion |

| Growth Rate | CAGR of 5.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Regenerative Thermal Oxidizer Market | |

| Customization Scope | Free report customization with purchase |

The Regenerative Thermal Oxidizer Market is analyzed into the following segments:

- By Type

- Single Bed Regenerative Thermal Oxidizer

- Double Bed Thermal Oxidizer

- Triple Bed Regenerative Thermal Oxidizer

- By Power Source

- Gas

- Electric

- By Capacity

- Small & Medium

- Large

- By Industry Vertical

- Chemical

- Coating and Printing

- Food and Beverage

- Pharmaceutical

- Semiconductor

- Oil and Gas

- Petroleum

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America