Report Overview

Orthopedic Care Market - Highlights

Orthopedic Care Market Size:

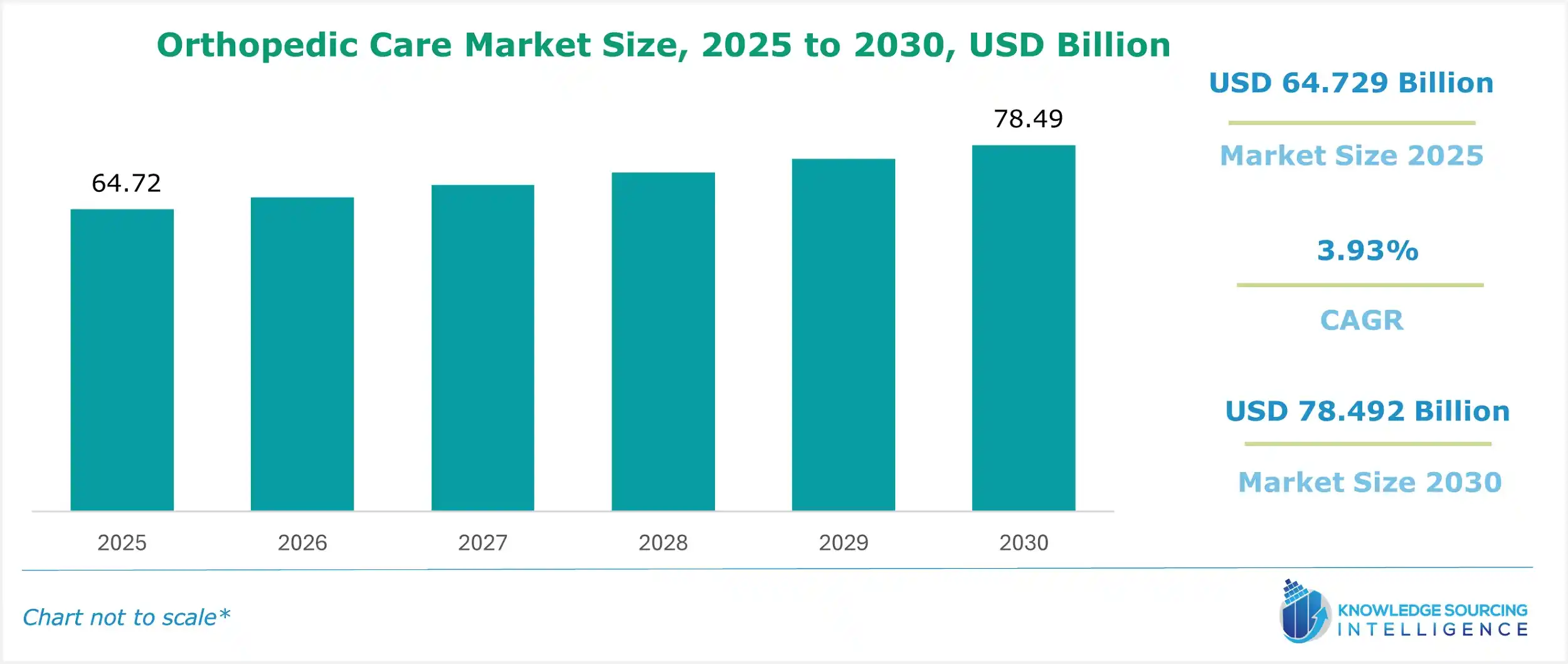

The orthopedic care market is projected to grow at a CAGR of 3.93% over the forecast period, increasing from US$64.729 billion in 2025 to US$78.492 billion by 2030.

Orthopedic Care Market Overview:

The orthopedic care market is an important segment of the healthcare sector that focuses on the diagnosis, treatment, and management of musculoskeletal illnesses and injuries. Orthopedics involves diagnosing, treating, preventing, and rehabilitating musculoskeletal issues affecting bones, muscles, ligaments, tendons, joints, and connective tissues. This market includes a wide variety of orthopaedic medical devices, equipment, and services, such as joint replacement, fracture repair, arthroscopy, and spinal surgery. With the rise in the population worldwide, the increasing prevalence of musculoskeletal problems related to age, such as osteoarthritis and osteoporosis, and the rising occurrence of chronic disorders, the size of the orthopedic care market will grow during the projected timeframe. As the world population ages and sports-related injuries increase, so does the demand for orthopaedic treatment. Medical technology advancements and minimally invasive surgical approaches have fueled market expansion even further. The emphasis on improving patient outcomes, shortening recovery time, and increasing quality of life drives innovation in the orthopedic care market, transforming it into a vital force in modern healthcare.

There is a rising prevalence of traumatic injuries requiring specialized orthopedic care due to an increase in participation in sports and recreational activities, coupled with the rising incidence of road accidents, which will also boost the market. The introduction of new technologies would also contribute to the orthopedic care market, as it can lead to more efficient and customized treatments for patients.

In October 2023, DePuy Synthes launched the VELYS™ Robotic-Assisted for the European market, which offers all for the benefit of capturing improved knowledge, more versatile execution, and confirmed performance in favor of optimizing patient outcomes. The solution was applied to cases in Germany, Belgium, and Switzerland concerning total knee surgeries.

Companies such as Johnson & Johnson, Stryker, Medtronic, and Zimmer Biomet are the prevailing corporations in the orthopedic care market, with small niche corporations including Globus Medical, Arthrex, and NuVasive Inc.

These companies provide various services for joint restorations, trauma, spine surgeries, and the widest research and development expenditure, and boast wide distribution networks worldwide.

Orthopedic Care Market Trends:

Orthopedic care is pivotal in addressing musculoskeletal health, focusing on conditions affecting bones, joints, muscles, and ligaments. The orthopaedics market encompasses advanced interventions like joint replacement, spinal surgery, trauma surgery, and sports medicine, catering to diverse patient needs from osteoarthritis to athletic injuries. These procedures enhance mobility, alleviate pain, and improve quality of life, driven by an aging population and rising musculoskeletal disorders. These cutting-edge technologies deliver precise diagnostics and treatments, ensuring optimal outcomes in complex cases. Orthopedic care continues to evolve, integrating innovative devices and techniques to meet the growing demand for effective musculoskeletal solutions.

The orthopedic care market is advancing through robotic-assisted orthopaedic surgery and AI in orthopaedics, enhancing precision in joint replacement and spinal procedures. 3D printing of orthopaedic implants enables personalized and patient-specific implants, improving fit and outcomes. Orthopaedic biologics and regenerative medicine in orthopaedics, such as stem cell therapies, promote tissue healing. Minimally invasive orthopaedic surgery (MIS) and arthroscopy reduce recovery times, while digital orthopaedics, including telehealth orthopaedics and remote patient monitoring, leverage wearable devices and navigation systems for real-time data. Market players must adopt these innovations to optimize surgical accuracy, patient recovery, and care delivery.

Orthopedic Care Market Drivers:

- Aging Population and Increasing Musculoskeletal Disorders Enhance the Orthopedic Care Market Growth

The orthopedic care market is being driven by two key growth factors: an ageing population and an increase in musculoskeletal disorders. The senior population is rapidly expanding as global life expectancy rises. There has been an increase in demand for orthopedic care as a result of the aging population. This is because age-related conditions, such as arthritis, osteoporosis, and degenerative disc disease, are all major influences on musculoskeletal health. According to the World Health Organization, there were more than 1 billion people aged 60 and above, increasing from 1 billion in 2020 to 1.4 billion older individuals worldwide in 2023. This demographic transition is associated with an increase in the prevalence of musculoskeletal ailments such as osteoarthritis, osteoporosis, and degenerative disc disease. Further, in 2022, diagnosed arthritis in the U.S. was prevalent among 44% of people aged 65 to 74 and 53.9% of individuals aged 75 and over, as disclosed by the February 2024 data by the Centers for Disease Control and Prevention. According to the CDC, approximately 32 million Americans suffer from osteoarthritis, resulting in a rise in demand for orthopedic care. As the geriatric population grows, so will the need for joint replacements, orthopaedic therapies, and innovative medical equipment, propelling market expansion. The benefits of improving health care are increased life expectancy and, hence, an increase in orthopedic risks. There can be possible injuries due to aging in the old population, which require orthopedic treatment, leading to a rise in the market in the coming years.

- Technological Advancements in Orthopaedic Devices and Implants in the Orthopedic Care Market

Technological advances in orthopaedic devices and implants are propelling the orthopedic care market. Continuous medical technology innovation has resulted in the creation of complex and advanced orthopaedic devices, which improve patient outcomes and quality of life. For example, robotic-assisted surgery has gained popularity, allowing more accurate and minimally invasive operations. Robotic-assisted knee replacements resulted in improved implant placement compared to conventional procedures, according to research published in the Journal of Orthopaedic Surgery and Research. Furthermore, 3D printing and biocompatible materials have transformed customised implants and personalised therapies. These innovations have improved the efficacy and durability of orthopaedic devices, resulting in market growth and patient satisfaction.

- Rising Prevalence of Sports Injuries and Trauma Cases Boosts the Orthopedic Care Market Size

The growing number of sports injuries and trauma cases has a substantial influence on the orthopedic care market. Sports-related injuries and trauma are on the rise as people participate in more sports and leisure activities. According to the American Academy of Orthopaedic Surgeons, 8.6 million sports injuries occur in the United States alone each year. These injuries frequently entail fractures, ligament tears, and joint dislocations, resulting in an increased need for orthopaedic treatment and surgical procedures. The increased recognition of the necessity of timely and effective treatment for sports injuries has prompted the use of improved orthopaedic devices and minimally invasive treatments, which have contributed to market expansion.

Orthopedic Care Market Segment Analysis:

- The use of orthopedic implants is rising in popularity

The orthopedic implants market is witnessing significant growth due to the factors that are transforming the healthcare landscape. Foremost among these is the rapidly aging global population, with a higher prevalence of age-related musculoskeletal disorders such as osteoarthritis and osteoporosis.

As per the Population Reference Bureau, the number of Americans above 65 is growing significantly from 58 million in 2022 to 82.5 million by 2050, a 47% increase. Additionally, the proportion of the population of people aged 65 or older will grow from 17% to 23% in the future.

Technological advancements in implant design and materials are contributing to market expansion. The establishment of minimally invasive surgical techniques, improved biocompatibility, and the introduction of advanced materials such as ceramics and polymers are improving performance, patient outcomes, and, therefore, demand for implants.

In this regard, in July 2024, the Orthopaedic Implant Company (OIC) announced the newest orthopedic care innovation, the OIC Flex-Fix™ System. Additionally, MicroPort Orthopedics Inc. is a leading global company that offers a comprehensive range of orthopedic implant solutions. As of September 2024, the company introduced the Evolution® Tibial Cones, which will be a new addition to the Evolution Revision Knee System.

In July 2024, Anika Therapeutics, Inc., a worldwide joint preservation company focused on early intervention orthopedics, announced that its Integrity Implant System has entered full market release and is now broadly available across the United States. With growing healthcare expenses in many regions and surging disposable income, people have better access to advanced orthopedic care. Further market growth is being stimulated by government investment and expansion into healthcare infrastructure.

In 2022, as per Eurostat, curative and rehabilitative care accounted for 51.9% of healthcare expenditure in Europe, while medical goods accounted for 17.8%. Other functions accounted for the remaining 30.3%. On the other hand, in India, Government Health Expenditure increased by a significant amount to Rs. 4,34,163 crores, which accounted for 48% of Total Healthcare Expenditure and 1.84% of the GDP as per PIB. This is equivalent to about 6.12% of General Government Expenditure in 2021-22.

- Surge in Orthopaedic Surgeries and Joint Replacements in Orthopedic Care Market.

The worldwide orthopedic care market is seeing an increase in Orthopaedic Surgeries and Joint Replacements. In 2020, approximately 1.8 million hip and knee replacements were done in the United States, according to the American Joint Replacement Registry. The ageing population and rising frequency of musculoskeletal problems are driving the need for joint replacement procedures. Furthermore, advances in surgical procedures, such as minimally invasive treatments, have improved patient outcomes and lowered recovery periods, raising demand for orthopaedic surgeries even further. The increase in joint replacements reflects the increasing relevance of orthopaedic treatment in managing mobility difficulties and improving patients' quality of life.

- Hospitals and clinics are expected to increase the market growth

The orthopedic care market for hospitals and clinics will experience significant growth due to several factors. First is the rapidly aging global population with a higher prevalence of age-related musculoskeletal disorders. In addition, the increasing number of traumatic injuries, sport-related injuries, and accident cases is on the rise, adding to the overall market growth. Increased active lifestyles and rising participation in sports increase the chances of fractures, ligament tears, or other musculoskeletal injuries. This increases demand for treatment and rehabilitation services and thus offers ample growth opportunities to hospitals and clinics specializing in orthopedic care.

The 2022-23 Australian Budget provided the ASC with $2.8 million over four years to develop and progress the National Sports Injury Data Program in collaboration with the AIHW. Other factors driving market expansion include the increased focus on patient-centered care and the rising demand for personalized treatment plans. The hospitals and clinics that invest in patient education, customized treatment plans, and comprehensive rehabilitation programs are better positioned to attract and retain patients.

The Saudi Arabian government, for instance, intends to invest more than $65 billion under Vision 2030 to build the nation's healthcare infrastructure, restructure and privatize insurance and health services, establish 21 "health clusters" nationwide, and increase the availability of e-health services.

Moreover, as per the International Trade Administration, US$161 billion was spent on healthcare in Brazil, representing 9.47% of GDP and holding the leading position in the healthcare market of Latin America. As of 2023, of the 7191 hospitals, 62% are privately owned in the nation, as shown by the data of the Brazilian Federation of Hospitals (FBH) and the National Healthcare Association (CNSaúde). Technological advancements within orthopedic care are increasingly driving the orthopedic prosthetics market further. The recent developments in various minimally invasive surgical techniques, advanced imaging, and creative rehabilitation methods that have improved clinical outcomes, lower recovery times, and increased patient satisfaction are attractive benefits for patients receiving the most highly advanced care and enhanced reputation and market competitiveness for providers.

Kolkata's Techno India DAMA Hospital, one of the top 320-bed super-specialty tertiary care institutions, launched advanced robotic technology for orthopedic care in January 2025. This is a major step forward in the region's medical landscape.

Moreover, in September 2024, Arthrex, a leader worldwide in minimally invasive surgical technology and medical education, launched the OrthoPedia Patient digital platform, allowing patients to easily explore easy-to-understand videos covering an immense range of orthopedic conditions and treatments.

Orthopedic Care Market Geographical Outlook:

- North America is expected to lead the Orthopedic Care Market

North America is regarded as the market leader in the orthopedic care market. Several reasons contribute to this region's importance. For starters, an ageing population and an increase in lifestyle-related injuries boost the demand for orthopaedic therapy. Second, North America has a sophisticated healthcare infrastructure and extensive research and development efforts, which promote the adoption of novel orthopaedic technology and treatments. Furthermore, the region's leadership in the orthopedic care market is supported by a well-established healthcare system, favourable payment rules, and an increasing emphasis on improving patient outcomes.

The orthopedic care market in the United States has witnessed remarkable growth, which can be attributed to several key drivers, including the aging population and the need for effective healthcare. This growth is due to the increasing demand for outpatient orthopedic procedures, which are often more cost-effective than traditional hospital-based surgeries, with ASCs typically offering treatments at about 40-65% lower costs. The rising prevalence of orthopedic disorders, particularly among the aging population, is another critical driver. Growing conditions in the population include arthritis and degenerative bone diseases that may require increased surgical interventions, particularly knee and hip replacements, which are among the most common orthopedic procedures performed in the United States.

Technological developments also contribute significantly to this market’s growth. The uptake of new surgical techniques, especially robotic-assisted surgeries and minimally invasive procedures, has improved patient care and reduced the recovery period, making surgical options even more attractive. Additionally, the growing number of orthopedic ASCs has increased accessibility to care so that more patients can receive appropriate care in time without the extended waiting times commonly associated with hospitals. The U.S. healthcare infrastructure is strong, and the distribution network is well spread to disseminate new technologies and treatments across healthcare facilities quickly.

In addition to technological advancements and cost efficiency, demographic trends influence market growth. The aging population is growing and remains active longer, increasing the likelihood of orthopedic injuries and conditions requiring intervention.

Moreover, key developments have also played a crucial role in the market. For instance, in February 2022, Stryker reported a conclusive consolidation consent to obtain all of Vocera Interchanges, Inc., which gave an exceptional normal stock for $79.25 per share, for a total value of roughly $2.97 billion and an overall business worth of approximately $3.09 billion (counting convertible notes). Vocera, sent off in 2000, has become the market leader in the computerized care coordination and correspondence space. The importance of this extended portion has developed during the pandemic since it endeavors to lighten carers’ mental overburden and empower them to give the ideal patient care.

Orthopedic Care Market Key Developments:

- In June 2024, Global healthcare technology leader Medtronic plc partnered with Merit Medical Systems, Inc., to provide a unipedicular, steerable balloon catheter for the treatment of vertebral compression fractures (VCF) in the United States.

- In April 2024, Medtronic plc announced that the U.S. Food and Drug Administration has approved the Inceptiv™ closed-loop rechargeable spinal cord stimulator (SCS) for chronic pain.

- In July 2023, the worldwide medical technology company Smith+Nephew announced the introduction of its REGENETEN Bioinductive Implant in India. The REGENETEN embed has affected how specialists approach rotator sleeve medical procedures, with more than 100,000 methods led universally since its beginning.

- In February 2022, Stryker reported a conclusive consolidation consent to obtain all of Vocera Interchanges, Inc., which gave an exceptional normal stock for $79.25 per share, for a total value of roughly $2.97 billion and an overall business worth of roughly $3.09 billion (counting convertible notes). Vocera, sent off in 2000, has risen as a market leader in the computerized care coordination and communication space. The importance of this extended portion has developed during the pandemic since it endeavours to lighten carers' mental burden and empower them to give the most ideal patient care.

Orthopedic Care Market Company Products:

- Orthopaedic Instruments: B. Braun Melsungen AG provides a comprehensive variety of orthopaedic surgical equipment for joint replacement and other orthopaedic operations.

- Orthobiologics: Smith & Nephew creates Orthobiologics solutions, such as biologics and tissue repair products, to improve recovery in orthopaedic surgeries.

- Joint Replacement Implants: Stryker offers a wide selection of joint replacement implants for hips, knees, shoulders, and ankles to patients suffering from arthritis or joint degeneration.

- Trauma Products: Trauma fixation devices and implants are available from Zimmer Biomet for the treatment of fractures and other traumatic injuries, giving stability and support during the healing process.

- Wound Management: Smith & Nephew offers orthopaedic wound care products such as dressings and negative pressure wound treatment devices.

List of Top Orthopedic Care Companies:

- Johnson & Johnson

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Medtronic plc

Orthopedic Care Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Orthopedic Care Market Size in 2025 | US$64.729 billion |

| Orthopedic Care Market Size in 2030 | US$78.492 billion |

| Growth Rate | CAGR of 3.93% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Orthopedic Care Market |

|

| Customization Scope | Free report customization with purchase |

Orthopedic Care Market Segmentation:

- BY PRODUCT TYPE

- Orthopedic Implants

- Orthopedic Devices and Instruments

- Orthopedic Braces and Supports

- Orthopedic Accessories

- BY PROCEDURE TYPE

- Introduction

- Joint Replacement Surgery

- Spinal Surgery

- Trauma and Fracture Fixation

- Arthroscopy

- Orthobiologics

- Others

- BY END-USER

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Orthopedic Specialty Centers

- Others

- By GEOGRAPHY

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Orthopedic Care Market Size:

- Orthopedic Care Market Highlights:

- Orthopedic Care Market Overview:

- Orthopedic Care Market Trends:

- Orthopedic Care Market Drivers:

- Orthopedic Care Market Segmentation Analysis:

- Orthopedic Care Market Key Developments:

- Orthopedic Care Market Company Products:

- List of Top Orthopedic Care Companies:

- Orthopedic Care Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 12, 2025