Report Overview

Parking Management System Market Highlights

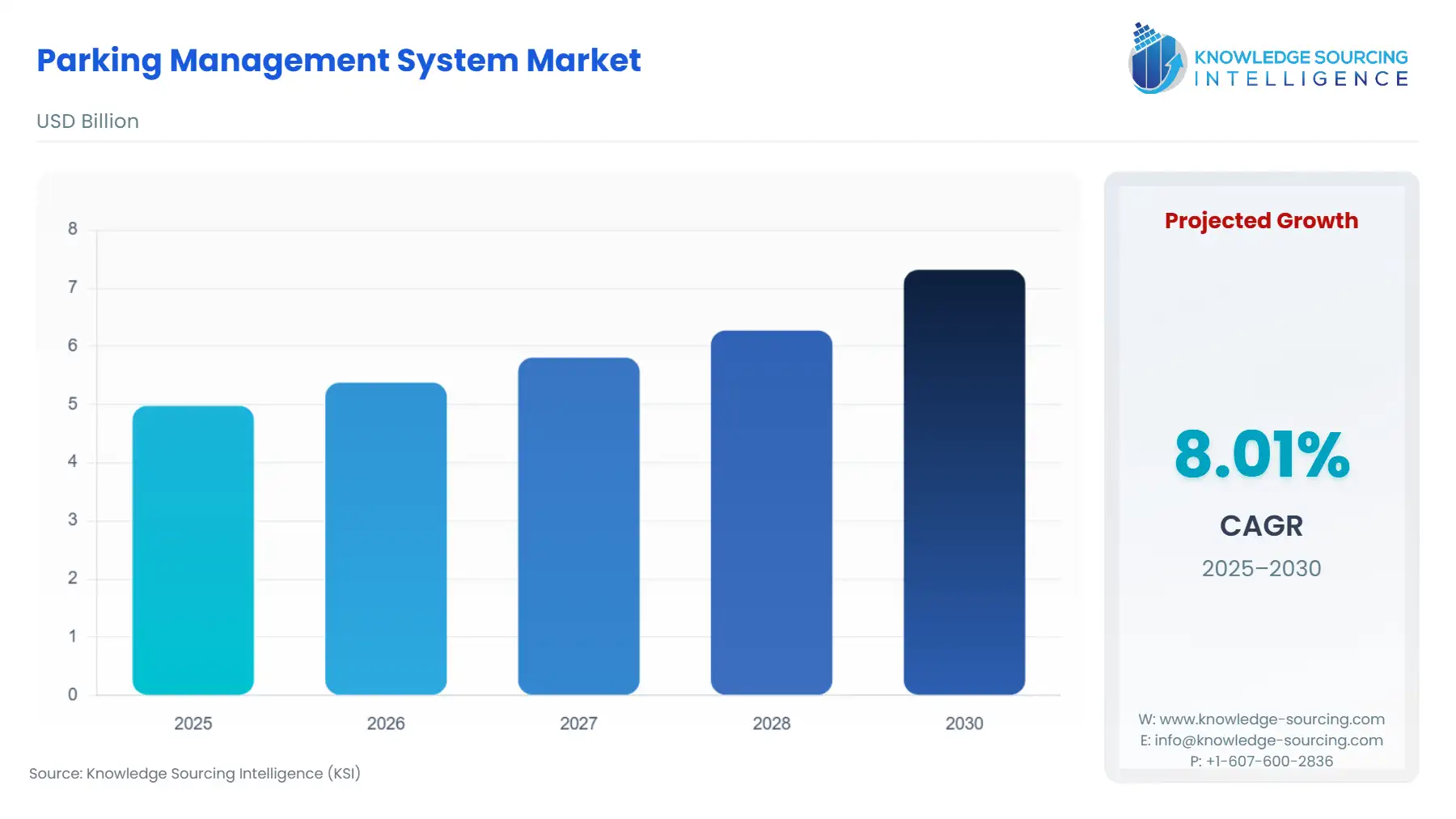

Parking Management System Market Size:

The Parking Management System Market will reach US$7.318 billion in 2030 from US$4.978 billion in 2025 at a CAGR of 8.01% during the forecast period.

Parking Management System Market Introduction

The parking management system market has emerged as a critical component of urban infrastructure, driven by the rapid pace of urbanization, technological advancements, and the increasing demand for efficient mobility solutions. As cities worldwide grapple with population growth and limited urban space, the need for sophisticated parking management systems has intensified. These systems leverage technologies such as Internet of Things (IoT), artificial intelligence (AI), and real-time data analytics to optimize parking operations, enhance user experience, and address environmental concerns. For industry experts, understanding the dynamics of this market is essential to capitalize on its opportunities and navigate its challenges.

Parking management systems encompass a range of solutions designed to streamline parking operations, including hardware (sensors, cameras, and payment kiosks), software (parking guidance systems and mobile applications), and services (consulting, maintenance, and analytics). These systems are deployed across various sectors, including commercial, residential, municipal, and institutional settings. The primary goal is to improve parking efficiency, reduce congestion, and enhance user convenience while minimizing environmental impact. The market has gained significant traction in recent years due to the proliferation of smart city initiatives and the integration of advanced technologies into urban infrastructure.

The global push for smart cities has positioned parking management systems as a cornerstone of intelligent transportation systems. Cities like Singapore, Amsterdam, and San Francisco have implemented advanced parking solutions to address urban congestion and improve mobility. For instance, Singapore’s Smart Nation initiative includes real-time parking availability systems, which have reduced circling times for drivers by up to 15%, according to a 2024 report by the Urban Redevelopment Authority of Singapore. Such initiatives highlight the market’s role in supporting sustainable urban development.

The parking management system market is evolving rapidly, with several notable developments in 2024 and 2025. As autonomous vehicles (AVs) gain traction, parking systems are being designed to accommodate AVs. In 2025, Mercedes-Benz partnered with Bosch to deploy an automated valet parking system in Stuttgart, allowing driverless vehicles to park autonomously. This development signals a shift toward future-ready parking infrastructure. Contactless payment solutions have gained popularity, with companies like ParkMobile reporting a 20% increase in user adoption in 2024. These platforms integrate with smart parking systems to offer seamless payment and reservation options. Companies are leveraging AI to forecast parking demand. In 2024, IBM introduced a predictive parking solution that improved space utilization by 25% in a pilot project in Dubai. Such innovations are enhancing operational efficiency. Public-Private Partnerships (PPPs) - Governments are increasingly collaborating with private firms to deploy parking solutions. In 2025, London’s Transport for London partnered with a tech consortium to roll out a city-wide smart parking network, expected to reduce congestion by 8%. These partnerships are accelerating market growth.

Parking Management System Market Trends

The Parking Management System market is evolving rapidly, driven by urbanization and smart city initiatives. Key trends shaping the industry include automated parking systems, license plate recognition (LPR), dynamic pricing, contactless payment, mobile parking app, AI in parking, cloud-based parking management, and vehicle detection sensors, enhancing efficiency and user experience in urban mobility.

Automated parking systems optimize space in congested cities like San Francisco, using robotics to streamline parking. LPR enhances security and automates entry/exit, reducing manual errors. Dynamic pricing adjusts rates based on demand, improving revenue, as seen in Chicago’s smart parking initiatives. Contactless payment via mobile parking app platforms, like ParkMobile’s upgrades, ensures seamless transactions. AI in parking predicts space availability, reducing congestion. Cloud-based parking management enables real-time monitoring, while vehicle detection sensors provide accurate occupancy data. These trends drive efficiency, sustainability, and user satisfaction in urban parking.

Parking Management System Market Dynamics

Market Drivers

Urbanization and Population Growth: The relentless pace of urbanization is a primary catalyst for the parking management system market. According to the United Nations, 68% of the global population is projected to reside in urban areas by 2050, with cities like Delhi, Tokyo, and New York already facing acute parking shortages. This surge in urban populations has led to a proportional increase in vehicle ownership, intensifying parking challenges. For instance, a 2024 report by the International Transport Forum noted that drivers in urban centers spend up to 30% of their driving time searching for parking, contributing to congestion and fuel waste. Parking management systems address this by deploying real-time availability tracking and dynamic pricing models, which optimize space utilization and reduce circling times. Cities like Singapore have reported a 15% reduction in parking search times due to such systems, as highlighted by the Urban Redevelopment Authority.

Technological Advancements: The integration of cutting-edge technologies, such as the IoT, AI, and cloud computing, has revolutionized parking management. IoT-enabled sensors and cameras provide real-time data on parking space availability, while AI algorithms predict demand patterns and optimize allocation. A notable example is San Francisco’s 2025 deployment of an AI-based parking guidance system, which reduced parking-related emissions by 10% by guiding drivers directly to available spaces. Additionally, mobile applications and contactless payment systems have streamlined user experiences. ParkMobile, a leading parking app, reported a 20% increase in user adoption in 2024, reflecting the growing reliance on digital solutions. These advancements enhance operational efficiency and enable seamless integration with broader smart city ecosystems.

Government Initiatives and Regulations: Governments worldwide are prioritizing smart parking solutions to address urban congestion and environmental goals. The European Union’s 2024 mandate under the Green Deal requires major cities to integrate real-time parking data into urban mobility platforms, fostering the adoption of smart parking systems. Similarly, in 2025, London’s Transport for London launched a city-wide smart parking network through a public-private partnership, aiming to reduce congestion by 8%. These initiatives provide financial and regulatory incentives for municipalities and private operators to invest in advanced parking infrastructure, driving market growth.

Demand for Sustainability: Environmental sustainability is a critical driver, as parking management systems reduce fuel consumption and emissions associated with parking searches. A 2025 study by the World Resources Institute found that smart parking systems in pilot cities reduced CO2 emissions by up to 12% by minimizing idle driving. This aligns with global climate goals, such as those outlined in the Paris Agreement. Additionally, smart parking systems support electric vehicle (EV) adoption by integrating EV charging stations with parking management platforms, as seen in Amsterdam’s 2024 city-wide rollout of EV-compatible parking systems. This focus on sustainability attracts investment from environmentally conscious stakeholders and enhances market appeal.

Market Restraints

High Initial Costs: The deployment of smart parking systems entails significant upfront costs, including hardware (sensors, cameras, and payment kiosks), software development, and infrastructure upgrades. A 2024 World Bank analysis estimated that initial setup costs for smart parking systems in developing cities range from $500,000 to $2 million, depending on scale and complexity. For smaller municipalities or private operators with limited budgets, these costs can be prohibitive, slowing market penetration. While long-term savings from operational efficiency and reduced congestion are significant, the high initial investment remains a barrier, particularly in emerging markets.

Integration Challenges: Retrofitting existing parking infrastructure with modern systems poses significant technical challenges. Many cities rely on legacy systems that are incompatible with new technologies, leading to interoperability issues. A 2025 whitepaper by the International Parking & Mobility Institute highlighted that 40% of smart parking projects face delays due to integration complexities with disparate vendor systems. For example, integrating IoT sensors with existing municipal traffic management systems often requires costly customizations, limiting scalability and increasing project timelines.

Data Privacy and Security Concerns: The reliance on IoT and cloud-based platforms raises significant concerns about data privacy and cybersecurity. Parking management systems collect sensitive user data, such as location and payment information, making them potential targets for cyberattacks. A 2024 data breach in a European parking app exposed the personal details of thousands of users, prompting calls for stricter data protection regulations. Ensuring robust encryption and compliance with regulations like the EU’s General Data Protection Regulation (GDPR) is critical but costly, posing a challenge for market players. User trust is paramount, and any security lapses could deter adoption.

Resistance to Change and Market Fragmentation: Resistance from traditional parking operators and fragmented market structures can impede growth. Many parking facilities are managed by small, localized operators who may lack the resources or incentive to adopt advanced systems. Additionally, the market is fragmented with numerous vendors offering proprietary solutions, leading to a lack of standardization. A 2024 industry report by the Smart Cities Council noted that the absence of universal standards for parking management systems complicates large-scale deployments. This fragmentation can deter investment and slow the adoption of innovative solutions.

Parking Management System Segmentation Analysis

By Type, smart parking systems are expected to lead the market: Among the types of parking management systems, Smart Parking Systems dominate due to their advanced integration of IoT, AI, and real-time data analytics, which address urban congestion and enhance user experience. These systems use sensors, cameras, and connected platforms to provide real-time parking availability, dynamic pricing, and guidance to drivers, significantly reducing search times and emissions. Their scalability and adaptability make them the most widely adopted type across urban centers.

Smart Parking Systems are at the forefront of the market due to their ability to integrate with smart city initiatives. A 2025 report by the Urban Redevelopment Authority of Singapore highlighted that smart parking systems reduced parking search times by 15% in the city, improving traffic flow. Additionally, San Francisco’s 2025 AI-driven smart parking initiative reduced parking-related emissions by 10%, showcasing environmental benefits.

In 2024, IBM launched a predictive smart parking solution in Dubai, improving space utilization by 25% through AI-driven demand forecasting. This reflects the growing adoption of smart systems in high-density urban areas. The rise of smart cities, government mandates for real-time parking data, and increasing vehicle ownership fuel demand for smart parking systems.

By Deployment Type, the cloud-based segment is growing notably: Cloud-based deployment is the leading segment due to its flexibility, scalability, and cost-effectiveness compared to on-premises solutions. These systems enable real-time data processing, remote management, and seamless integration with mobile apps and other smart city platforms, making them ideal for modern urban environments.

Cloud-based systems are preferred for their lower upfront costs and ability to handle large-scale data from IoT devices. The Smart Cities Council noted that 60% of new parking management deployments in 2024 were cloud-based, driven by their ease of updates and integration.

In 2025, London’s Transport for London deployed a cloud-based smart parking network, reducing congestion by 8% through real-time data sharing. This highlights the segment’s role in large-scale urban projects.

The shift toward cloud infrastructure, driven by advancements in 5G and IoT, supports the scalability of these systems. Additionally, cloud-based platforms facilitate contactless payment solutions, with ParkMobile reporting a 20% increase in user adoption in 2024.

By Component, the software segment is rising rapidly: Software is the dominant component in the parking management system market, as it serves as the backbone for data processing, user interfaces, and integration with hardware. Parking management software includes mobile applications, analytics platforms, and parking guidance systems, which are critical for operational efficiency and user engagement.

Software enables real-time analytics and user-friendly interfaces, driving adoption across sectors. A 2025 study by the World Resources Institute noted that software-driven smart parking systems reduced CO2 emissions by 12% in pilot cities by optimizing space allocation.

In 2024, ParkMobile’s software platform expanded to integrate with EV charging stations in Amsterdam, enhancing user convenience. Similarly, a 2025 software upgrade in Singapore’s parking systems improved real-time data accuracy, as reported by the Urban Redevelopment Authority.

The rise of mobile apps, AI analytics, and cloud integration fuels demand for advanced software solutions. Government mandates for data-driven urban planning further bolster this segment.

By Application, the commercial segment is expected to witness considerable growth: The commercial application segment, encompassing shopping malls, office complexes, and airports, leads the market due to high parking demand and revenue potential. Commercial facilities prioritize efficient parking to enhance customer satisfaction and operational efficiency, making them key adopters of advanced parking systems. Commercial parking facilities benefit from high foot traffic and require scalable solutions.

In 2025, Dubai’s Mall of the Emirates implemented a smart parking system with real-time guidance, reducing parking time by 20%. This underscores the segment’s importance in high-traffic commercial hubs. The growth of retail and office spaces in urban areas, coupled with the need for seamless customer experiences, drives investment in smart parking solutions for commercial applications.

Parking Management System Market Geographical Outlook:

The North American market is predicted to experience substantial growth: North America, particularly the US and Canada, is the leading region for the parking management system market due to its advanced infrastructure, high vehicle ownership, and strong adoption of smart city technologies. The region’s focus on reducing urban congestion and emissions further supports market growth.

North America leads due to its early adoption of smart parking technologies and supportive policies. A 2025 report by the San Francisco Municipal Transportation Agency highlighted that smart parking systems reduced emissions by 10% in the city. In 2024, ParkMobile expanded its services across 500 US cities, reflecting strong regional demand for mobile-based parking solutions. Additionally, Canada’s Toronto implemented a city-wide smart parking initiative in 2025, improving traffic flow. High urbanization rates, government funding for smart city projects, and consumer demand for convenient parking solutions drive North America’s dominance.

Parking Management System Key Industry Developments

London’s City-Wide Smart Parking Network: In 2025, Transport for London partnered with a tech consortium to deploy a cloud-based smart parking network across the city. This public-private partnership leverages IoT and real-time data to reduce congestion by 8%, integrating parking availability with mobile apps and traffic management systems.

XPENG’s AI Parking with Remote-Free Valet Feature: In May 2024, XPENG Motors introduced the world’s first mass-market remote-free valet parking and auto-summon feature for its vehicles. This AI-driven system enables automated parking in complex scenarios, such as tight spaces and dead-end roads, using advanced vision-based technology.

Parking Management System Market Segmentation:

The Parking Management System Market is analyzed by type, including:

Automatic Pay Stations and Barriers

Smart Parking Systems

Robotic Parking Systems

Mobile-Based Parking Systems

By Deployment Type:

The report segments the market by deployment type, covering:

On-Premises

Cloud-Based

By Component:

The market is evaluated by component, including:

Software

Hardware

Services

By Application:

The market is assessed by application, including:

Transport and Transit

Commercial

Government

Parking Management System Market Segmentation by regions:

The study also analysed the Parking Management System Market into the following regions, with country level forecasts and analysis as below:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and the Rest of South America)

Europe (Germany, UK, France, Spain, and the Rest of Europe)

Middle East and Africa (Saudi Arabia, UAE, and the Rest of the Middle East and Africa)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)