Report Overview

PLC Splitter Market Size, Highlights

PLC Splitter Market Size:

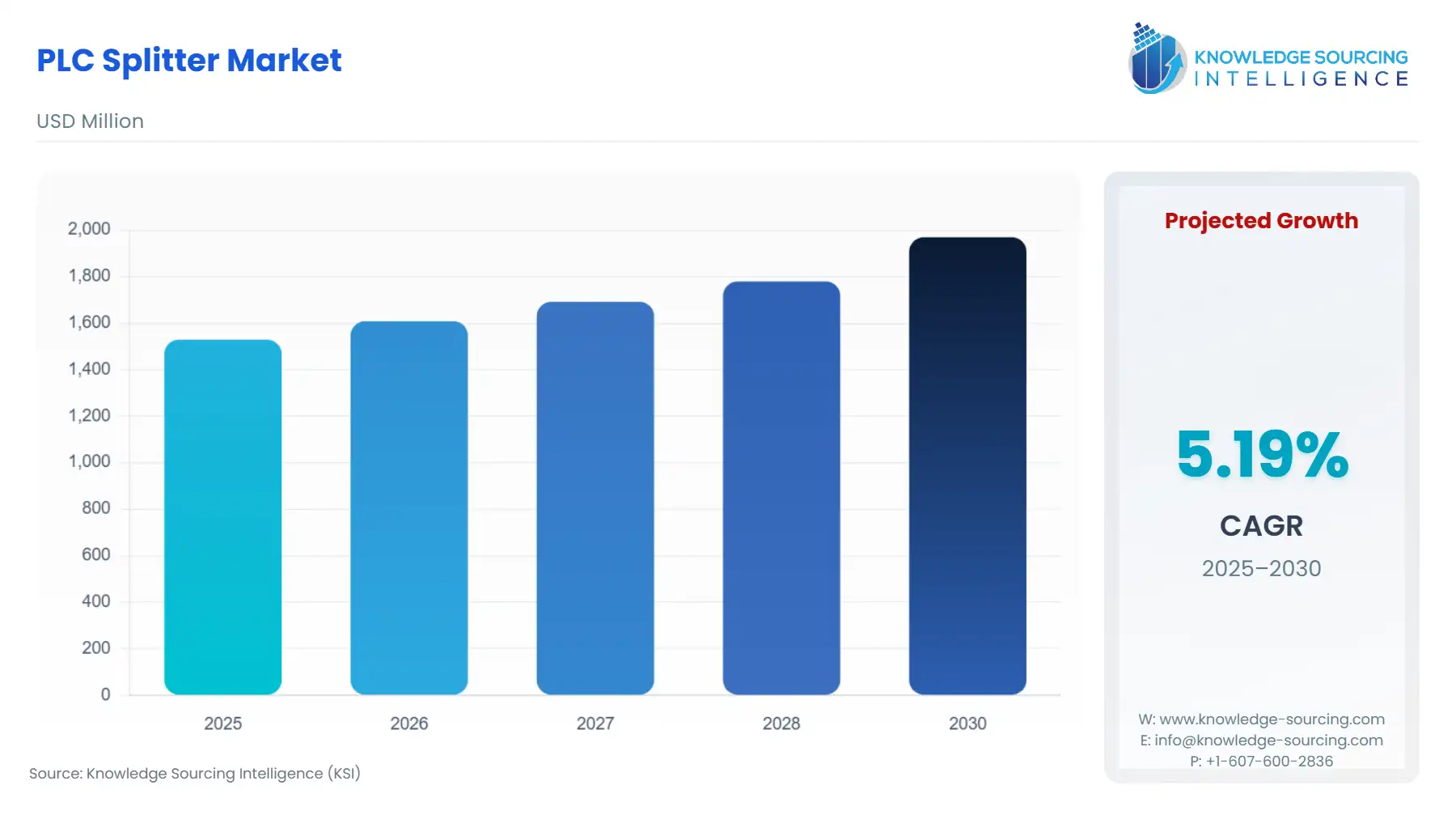

The PLC Splitter Market is projected to grow at a CAGR of 5.19% during 2025-2030, reaching a market size of US$1,969.456 million by 2030 from US$1,528.916 million in 2025.

The rapid expansion of fibre-to-the-home and fibre-to-the-networks due to the growing push for high-speed broadband is the major factor driving the market of PLC splitters for its critical role in splitting optical signals from a single fiber to multiple users in PONs. The growing deployment of 5G networks, along with increasing adoption of IoT and growing smart cities projects, are leading the market to grow. Alongside, the technological advancement in PON technologies is leading the market to propel.

PLC Splitter Market Overview

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

The PLC Splitter Market is segmented by:

- Type: The PLC Splitter market is segmented into 1×N Splitters, 2×N Splitters, Cascaded Splitters, and Specialized Splitters (such as ultra-low-loss, wideband, and miniaturized variants). During the mentioned timeframe, 1x N splitters will continue to dominate due to their widespread adoption in GPON and FTTx networks. However, the market will witness the growing emergence of specialized splitters for deployments in high-performance and space-constrained environments such as data centers.

- By Technology Compatibility: By technology compatibility, the market includes BPON, EPON, GPON, XG-PON/XGS-PON, NG-PON2, and WDM-PON. GPON and EPON currently dominate due to their maturity and deployment across global broadband networks. The growing next-gen networks are driving demand for newer technologies such as XGS-PON and NG-PON2.

- By Deployment Location: By deployment location, the market is segmented into Central Offices, Outside Plant, Premises/End-user Locations, and Edge Nodes/Small Cells. Outside plant will constitute the major share.

- Application: Based on application, the market is categorized into PON-based FTTx (including FTTH, FTTB, and FTTC), Cable TV (CATV), Optical Signal Monitoring, Testing Equipment, IoT Networks, and 5G Fronthaul/Backhaul. FTTx, particularly FTTH are primary application area, thus holds the largest share.

- End-Use Industry: The end-user segment includes Telecom Operators, Data Centers, ISPs (Internet Service Providers), Enterprises, IoT Solution Providers, and Cable/MSOs. ISPs and data centers are emerging as new end-users of PLC splitters due to the growing demand for bandwidth and network densification.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. Asia-Pacific will dominate the market, and it will be growing at the fastest CAGR.

________________________________________

Top Trends Shaping the PLC Splitter Market:

1. Emerging demand for miniaturized and compact designs

- The market has an emerging demand for miniaturized and compact designs due to increasing demand from IoT networks, 5G small cells and data centers for space constraints and supporting high-port-count applications. For example, FS offers mini 1x4 PLC splitters with 90 μm to split 1260nm to 1650nm signals.

- Companies such as Fujikura also offer the FSC114 series, which is a compact splitter module. Its FSC114-1X2-SC is in dimensions of w28.4 X H55 XD105 mm.

2. Growing adoption of low-loss splitters

- The growth in 5G fronthaul and data centers has increased the demand for wideband splitters and ultra-low-loss design splitters to support higher bandwidths and longer distances. The growth in these markets will impact the PLC splitters market to emerge in low-loss splitters.

- For example, the Corning Incorporated PLC Splitter LGX module features low insertion loss, low polarization dependent loss, and high port-to-port uniformity

________________________________________

PLC Splitter Market Growth Drivers vs. Challenges:

Opportunities:

- Rapid expansion of Fibre-to-the-Home (FTTH) and FTTx networks: As there is increasing internet consumption, there is a global push for high-speed broadband, which has accelerated the deployments of FTTH and FTTx. This is increasingly accelerating the market of PLC splitters, which have a critical role in splitting optical signals from a single fiber to multiple users in PONs. The Fiber Broadband Association, in its 2024 report, has highlighted that the broadband deployments reached a new annual record of 10.3 million U.S. homes passed in 2024, bringing the total to 88.1 million. The 2025-29 period will witness a 50% increase in homes passed. It highlights the growth in FTTH and FTTx deployments.

- Growing deployments of 5G networks: The growing expansion of 4 G and increasing 5G rollout is driving the PLC splitters market, as PLC Splitters have a crucial role in distributing signals in C-RAN and fronthaul architectures. The report by Ericsson highlights that global 5G population coverage reached 55% at the end of 2024. China, a major country in 5G deployment, is planning to construct over 4.5 million 5G base stations in 2025.

Challenges:

- Complex manufacturing processes: The market faces a constant restraint due to the complex manufacturing process associated with PLC splitters, especially specialized splitters. It required advanced planar waveguide technology, photolithography, and precision packaging, leading the process to be technically complex and capital-intensive. This leads to an entry barrier for small and local manufacturers. Alongside, the complex manufacturing process increases the cost, which makes small manufacturers lose due to technical barriers as well as lack of scaling.

______________________________________

PLC Splitter Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific will be growing at a significant rate during the forecast period. It will continue to dominate the market, led by countries such as China, Japan and South Korea. The market is growing due to massive FTTH rollouts in countries such as China, Japan, South Korea and India. Additionally, there is a growing market of 5G, increasing demand for faster internet, growth in IoT, smart cities and others like cloud services, offering a major boost to the PLC splitter market. Also, the increasing focus of the government on broadband, such as BharatNet and Digital India by the Indian government, is leading the market to propel. As of January 2025, BharatNet, the Indian government initiative to provide high-speed internet to rural areas, has connected 2,14,323 Gram Panchayats, and 6,92,676 Km of OFC have been laid. Additionally, 12,21,014 Fibre-To-The-Home (FTTH) connections are commissioned, driving the demand for PLC Splitters. The study by Fierce network highlights the China dominate in the FTTH adoption. By the end of 2027, fiber broadband users will make up at least 90% of total broadband subscribers in mainland China, a report by Kagan estimates so, highlighting the dominance of Asia-Pacific region in the PLC splitter as well.

________________________________________

PLC Splitter Market Competitive Landscape:

The market is moderately fragmented with a blend of global giants, regional players and smaller local manufacturers as well. Some of the key market players include Corning, NTT Electronics, Fujikura, and Sumitomo Electric. Companies such as Broadex Technologies, Browave Corporation, T&S Communications, and Shijia Photons are strong in specific regions, particularly Asia-Pacific. Some niche local players, such as Qualfiber Technology Co., Ltd. are focusing on niche and cost-sensitive markets.

________________________________________

PLC Splitter Market Segmentation:

By Type

- 1×N Splitters

- 2×N Splitters

- Cascaded Splitters

- Specialized Splitters (ultra-low-loss, wideband, miniaturized splitters and others)

By Technology Compatibility

- BPON

- EPON

- GPON

- XG-PON/XGS-PON

- NG-PON2

- WDM-PON2

By Application

- PON-based FTTx

- FTTH

- FTTB

- FTTC

- Cable TV (CATV)

- Optical Signal Monitoring

- Testing Equipment

- IoT Networks

- 5G Fronthaul/Backhaul

By Deployment Location

- Central Offices

- Outside Plant

- Premises/End-user Location

- Edge Nodes/Small Cells

By End-User

- Telecom Operators

- Data Centers

- ISPs (Internet Service Providers)

- Enterprises

- IoT solution providers

- Cable/MSOs

By Region

- North America

- USA

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others