Report Overview

Pre-Clinical CRO Market Size, Highlights

Pre-Clinical CRO Market Size:

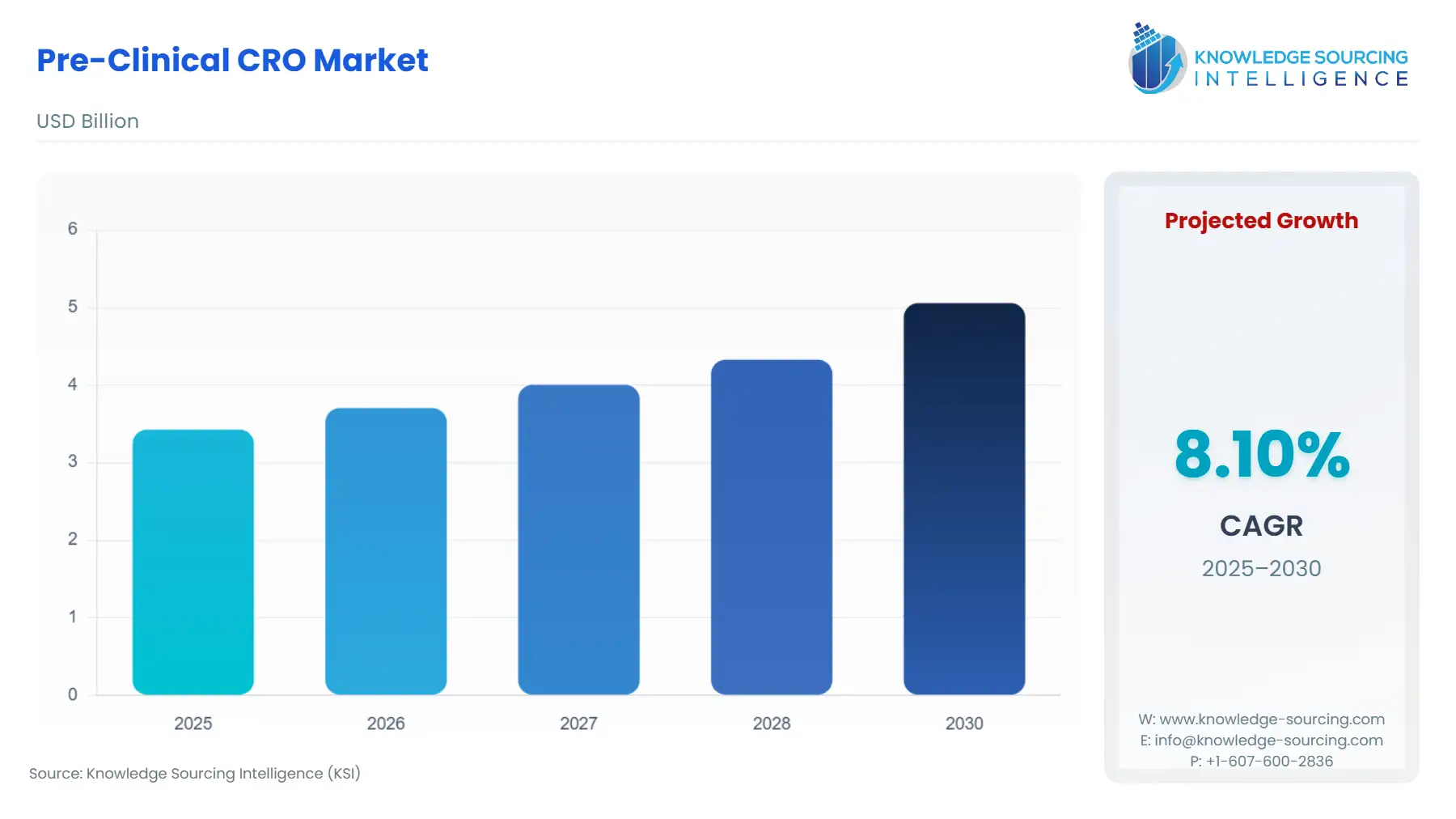

The Pre-Clinical CRO Market is projected to grow at a CAGR of 8.10% from 2025 to 2030, reaching US$5.059 billion in 2030 from US$3.427 billion in 2025.

Increasing number of drug delivery development and increasing research and development by the pharmaceutical and biotechnology companies will be the primary factors driving the pre-clinical CRO market. Specifically, the advancement in preclinical testing technologies, such as high-throughput screening and advanced in vitro models, is enhancing the efficiency and accuracy of early-stage drug development, leading to increasing adoption of pre-clinical CRO services by the pharmaceutical and biotech firms, helping them with cost reduction and accelerated timelines.

Pre-Clinical CRO Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Pre-Clinical CRO Market is segmented by:

- Service Type: Based on service type, the market is segmented into toxicology testing, pharmacokinetics (PK) and pharmacodynamics (PD), safety pharmacology, bioanalytical services, in vitro testing, and in vivo models.

- Drug Type: By drug type, the market is divided into small molecules, biologics, vaccines, and cell/gene therapies.

- Therapeutic Area: In terms of therapeutic area, oncology remains the largest segment, propelled by significant R&D investments and the growing global burden of cancer. Other key therapeutic areas include CNS disorders, infectious diseases, cardiovascular diseases, metabolic disorders, and rare diseases.

- End-User: The end-user segment comprises biotech startups, large pharmaceutical companies, medical device firms, and academic or government institutions. Large pharma companies dominate the market as they outsource to CROs for speed and global scalability.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. North America is expected to dominate the market while Asia-Pacific is growing at the highest rate.

________________________________________

Top Trends Shaping the Pre-Clinical CRO Market:

1. Adoption of Advanced In Vitro and Computational Models:

- There are advancements in In Vitro models, such as organ-on-chip and 3D cell culture, helping in reducing the reliance on animal testing and providing more human-related data. For instance, Emulate designs and builds Organ Chip microfluidics devices that are lined with living human cells for drug development, disease modelling and personalized medicine.

- Also, In Vivo models are being complemented by in vitro and computational preclinical models that help in the reduction of cost and timeline of early-stage drug development.

2. Integration of AI

- There is an increase in the recent past where AI is being integrated in preclinical studies as well by the CROs. These AI tools are used on multiple levels. Also, AI-based digital twins are used for quantitative solutions.

________________________________________

Pre-Clinical CRO Market Growth Drivers vs. Challenges:

Opportunities:

- Surge in preclinical trials: The increasing number of preclinical trials due to increasing drug development is one of the key factors driving the preclinical-CRO market. There is an increasing drug discovery across therapeutic areas such as oncology, neurology, and rare diseases. This leads to growth in preclinical studies. As per the data by the Congressional Budget Office, in the USA, between 2010 to 2019, there were 38 new drugs approved each year on average, and only 12% of drugs entering clinical trials are ultimately approved, making preclinical trials even more. Thus, the increasing number of drug development and demand for faster drug approvals is driving the adoption of preclinical CRO services.

- Rising R&D expenditure by pharmaceutical and biotechnology companies: One of the other key factors driving the pre-clinical CRO market is the increasing expenditure on R&d by the pharmaceutical and biotechnology companies. The increased investment covers a significant portion of key aspects of early-stage drug development, such as preclinical testing, toxicology studies, pharmacokinetics/pharmacodynamics assessments, in vitro and in vivo modeling, and regulatory documentation. The trend analysis on research and development in the pharmaceutical industry by the Congressional Budget Office of the U.S. Congress highlights that the pharmaceutical industry spent $83 billion on R&D in 2019, which is ten times that 1980s, and the number of new drugs approved for sale increased by 60 per cent between 2010 to 2019 compared with the previous decade. Europe’s R&D expenditure on pharmaceuticals has increased from € 39,442 million in 2020 to € 47,010 million in 2022. China’s R&D investment stands at € 14,817 million, the USA stands at € 71,459 million, and Japan at € 10,363 million.

Thus, the growing investment is leading these companies to outsource pre-clinical trials activities to specialized CROs.

Challenges:

- Regulatory Complexity and Variability: A key challenge faced by the pre-clinical CRO market is the complexity and variability in the regulatory framework across different countries. There are different regulations in the USA, the European Union, and different in different countries of Asia-Pacific, which pose a key challenge for the pre-clinical CROs as it leads to increased operational cost and delays in project timelines. For instance, the Good Laboratory Practice (GLP) regulations by the U.S. FDA mandate strict regulations for the conduct, documentation and quality assurance and focus heavily on data integrity, audit trails and traceability. In contrast, while GLP regulations in Europe are also based on harmonized principles set by the OECD, the level of enforcement and interpretation can vary across individual countries, leading to inconsistencies in compliance expectations. Also, changes in other regulations, such as data security laws and animal welfare laws, are leading companies to invest in compliance.

________________________________________

Pre-Clinical CRO Market Regional Analysis:

________________________________________

Pre-Clinical CRO Market Competitive Landscape:

The market is moderately fragmented, with Key players in the Pre-Clinical CRO market including Thermo Fisher Scientific Inc. (PPD), Covance - Laboratory Corporation of America Holdings, Parexel International Corporation, Charles River Laboratories International, Inc., Medpace Holdings, Inc., Eurofins Scientific SE, Crown Bioscience Inc., InSilico Trials S.r.l., Proscia Inc., WuXi AppTec Co., Ltd., and Fortrea Holdings Inc.

- Collaboration: In April 2025, Debiopharm and Oncodesign Services entered a strategic collaboration to advance radiopharmaceutical research in the preclinical phase, focusing on radioimmunotherapy for cancer. It enables the Oncodesign Services to use AbYlink™, a regio-selective antibody conjugation technology, for preclinical radiopharmaceutical R&D, highlighting the expansion of CROs in specialized and high-growth areas such as radiopharmaceuticals.

- Market Expansion: In March 2023, Proscia announced a significant expansion in preclinical R&D capabilities to accelerate the drug safety decisions through enhanced digital pathology capabilities. Its Concentriq for Research platform now supports both Good Laboratory Practice (GLP) compliant and non-GLP studies and GLP validation services.

________________________________________

Pre-Clinical CRO Market Segmentation:

By Service Type

- Toxicology Testing

- Pharmacokinetics (PK) & Pharmacodynamics (PD)

- Safety Pharmacology

- Bioanalytical Services

- In Vitro Testing

- In Vivo Models

By Drug Type

- Biologics

- Vaccines

- Small Molecules

- Cell/Gene Therapies

By Therapeutic Area

- Oncology

- CNS Disorders

- Infectious Diseases

- Cardiovascular Diseases

- Metabolic Disorders

- Rare Diseases

- Others

By End-User

- Biotech Startups

- Large Pharma

- Medical Device Companies

- Academic/Government Institutes

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others