Report Overview

Precision Medicine Software Market Size:

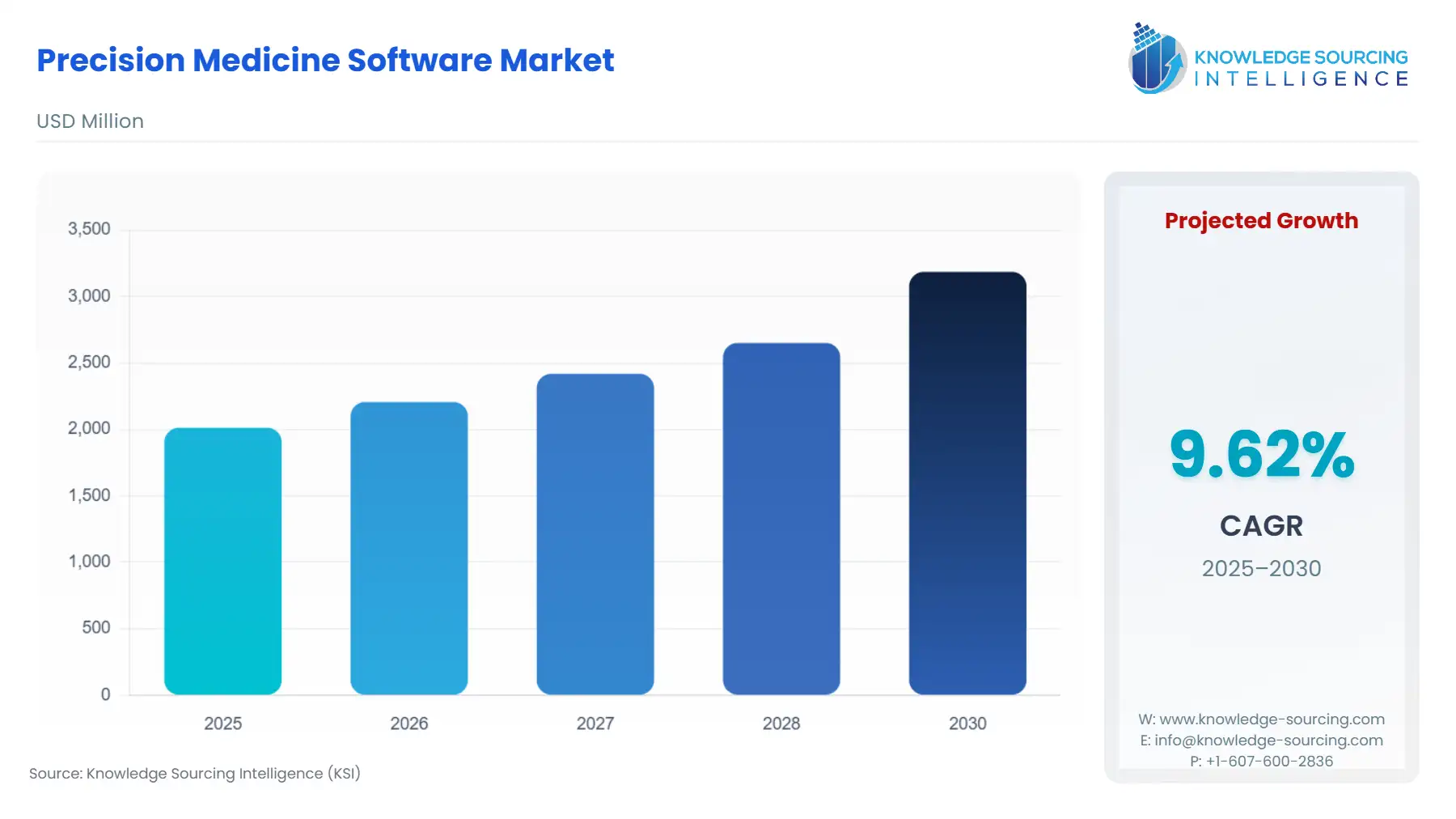

The precision medicine software market is estimated to grow at a CAGR of 9.62%, attaining US$3.186 billion by 2030, from US$2.013 billion in 2025.

Precision medicine is a process that tailors disease prevention and treatment. Precision medicine is also known as personalized medicine, and helps in predicting susceptibility to disease and preventing disease progression. They also help in reducing the trial-and-error prescribing of drugs and avoiding adverse drug reactions. Precision medicine software is a technological platform that offers data-driven personalized patient treatment.

The increasing global cases of cancer are among the key factors propelling the precision medicine software market during the forecasted timeline.

Precision medicine offers a key application in cancer treatment, as it helps in providing personalized treatment to patients. Similarly, the increasing adoption of artificial intelligence (AI) is among the major factors boosting the demand for precision medicine software. Countries worldwide have introduced key policies and strategies to boost the development and integration of AI in the healthcare sector.

Precision Medicine Software Market Growth Drivers:

- Advancement in the global AI-based technology

The increasing advancement in artificial intelligence technologies is a major factor propelling the global precision medicine software market expansion. The AI-based technology market has witnessed significant growth, mainly due to the increasing advancements in the technological sector. Various governments in countries like the USA, Canada, and India have introduced multiple policies and schemes to boost the development of AI technologies, especially in the healthcare sector.

For instance, in September 2024, the Ministry of Health and Family Welfare of the Indian Government announced the IIT Kanpur and National Health Authority for developing digital public goods for the AI-based platform in the healthcare sector. Similarly, in April 2024, the Medicines and Healthcare Products Regulatory Agency, or MHRA, introduced its strategic approach to artificial intelligence in its press release. The strategy is aimed at regulating and integrating AI platforms into the healthcare sector.

- Growing global cases of cancer

The growing global cases of cancer are among the key factors pushing the precision medicine software market’s expansion during the forecasted timeline. In the cancer care sector, precision medicine helps enhance the efficiency of cancer treatments. Precision medicine software also helps in reducing the cost of cancer treatment.

The global cases of cancer have witnessed significant growth in the past few years. The American Cancer Society, in its global report, stated that in the USA, about 2,001,140 new cases of cancer are reported, with about 611,720 cancer deaths. The agency stated that the number of new cases of cancer in the nation every month was recorded at 166,760. The association further noted that in 2024, the estimated new cases of breast cancer were recorded at 313,510, and of prostate and lung & bronchus were recorded at 299,010 and 234,580, respectively. Similarly, Macmillan Cancer Support, in its report, stated that in 2020, the total number of cancer cases in the nation was recorded at 3 million, which is expected to surge to 3.5 million in 2025, and about 5.3 million cases by 2040.

Precision Medicine Software Market Restraints:

- Rising risk of data breaches and cyber security

During the forecasted timeline, the rising risk of data breaches and cyber-attacks is among the major challenges to the global precision medicine software market expansion. The increasing risk of data breaches and cyber attacks in the global market increases the risk of leakage of personal information related to the company's technology and patient information.

The global cases of data breaches and cyber attacks witnessed significant growth in the past few years. The IT Governance UK, in its global data breach statistics, stated that in February 2024, 719,366,482 new cases of record breaches were recorded, and in March 2024, it was recorded at 299,368,075. In April 2024, the total recorded data breaches were recorded at 5,336,840,757. The agency further stated that in February 2024, the total number of data breaches in the healthcare sector was 33,000,000 for the Viamedis and Almery, an organization based in France. Similarly, the Optum organization also witnessed a record breach of 6TB. The agency stated that in February 2024, the healthcare sector witnessed about 182 incidents, which is about 29% of the total recorded cases, followed by 88 incidents in the manufacturing sector and 44 incidents in the public sector.

Precision Medicine Software Market Geographical Outlook:

- North America is forecasted to hold a major share of the precision medicine software market

The North American region is expected to grow significantly in the global precision medicine software market during the forecasted timeline. Various countries in the North American region, like the USA and Canada, have introduced key policies and strategies to integrate artificial intelligence into the healthcare sector. Similarly, the increasing global cases of cancer and other types of chronic diseases have also witnessed significant growth in the North American region, propelling the need for precision medicine technology and platforms.

Precision Medicine Software Market Products Offered by Key Companies:

- Accenture plc is among the global leaders in the technology sector and is based in Ireland. The company offers technological solutions for many industries, including automotives, health, energy, chemicals, consumer goods & services, and banking, among many others. Accenture offers multiple solutions, including cloud, cybersecurity, emerging technology, and infrastructure & capital projects. In the global healthcare sector, it provides solutions for health providers, health payers, and public health.

Precision Medicine Software Market Key Developments:

- In November 2024, Koninklijke Philips N.V., or Philips, in partnership with Icometrix, announced the advancement of precision diagnosis with innovative AI-based imaging solutions. The company stated that the next-generation BlueSeal MR scanner integrates perfectly with Icometrix’s FDA-cleared quantitative brain solution.

- In May 2024, OM1, a global leader in healthcare innovation, launched three new AI platforms to expedite the delivery of personalized medicines. The company further stated that its latest platform offers enhanced insight through prediction, precision, and discovery.

Precision Medicine Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Precision Medicine Software Market Size in 2025 | US$2.013 billion |

| Precision Medicine Software Market Size in 2030 | US$3.186 billion |

| Growth Rate | CAGR of 9.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Precision Medicine Software Market |

|

| Customization Scope | Free report customization with purchase |

The Precision Medicine Software Market is segmented and analyzed as follows:

- By Deployment

- Cloud

- On-Premise

- By Application

- Oncology

- Central Nervous System

- Immunology

- Cardiovascular

- Others

- By End User

- Hospitals and Clinics

- Pharmaceutical Research Institute

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- Spain

- United Kingdom

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- Australia

- India

- Indonesia

- Thailand

- Others

- North America