Report Overview

Robotic Quality Inspection Systems Highlights

Robotic Quality Inspection Systems Market Size:

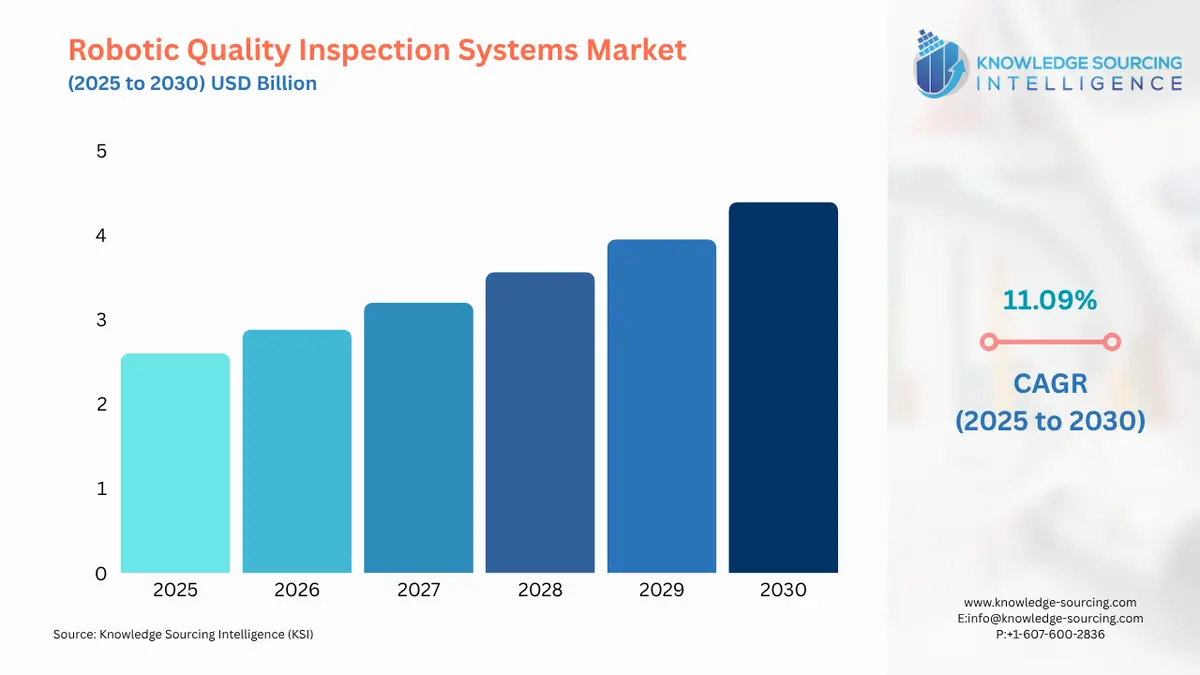

The Robotic Quality Inspection Systems Market is expected to rise at a CAGR of 11.09%, reaching USD 4.392 billion in 2030 from USD 2.596 billion in 2025.

Manufacturers and infrastructure operators are increasingly relying on robots to perform quality inspections, especially in small places, hazardous environments, and hard-to-reach situations. By using robots, manufacturers can achieve consistent quality inspections; robots simply don't get tired or cut corners during a physical examination. Furthermore, the data fed into powerful software from vision-guided, sensor-enabled systems enables it to flag potential defects faster and with fewer false alarms.

Ultimately, that implies a shift; quality control is transitioning from reactive checking to continuous assurance in the automation. The momentum is not slowing down. As Vision-Guided Robotics and NDE 4.0 (where digital testing converges with intelligent systems that are connected) become more mainstream and accepted practice, the distinctions between inspections and other systems/processes are blurring. Robots not only perform visual inspections, but they also share data with MES and other production systems to expedite decisions. All of these trends culminate in one direction: inspections are becoming smarter, omni-connected and increasingly automated.

Robotic Quality Inspection Systems Market Overview & Scope:

The robotic quality inspection systems market is segmented by:

- Type: The market consists of various segments such as 2D vision systems, 3D vision systems, coordinate measuring systems, optical inspection systems and others. 3D vision systems are becoming more popular because they are more accurate in providing depth perception and allowing a more accurate inspection of complex geometries. 3D scanning can find subtle shape deviations, surface defects and dimensional inaccuracies that are very hard to detect with the 2D systems, so as to undertake actions before the product is released. Robotics is ideal for industries, such as automotive and aerospace, where a minor defect or imperfection can affect human safety. The combination of AI and robotics is improving reliability and scalability and decreasing the time required to inspect products in near near-real-time manner.

- By Component: The market is categorised into Hardware, Software and Services.

- Hardware is the most substantial component. Hardware consists of robots, sensors, cameras, and controllers, which already have either the inspection process physically done to the product, or are interactive with the product during inspection. Advanced imaging sensors and high-resolution cameras are responsible for capturing particularly detailed product data. Robotic arms and standalone machines provide the positioning and scanning capabilities. The accuracy of the inspection process relies on the accuracy of the hardware components. Hardware continues to evolve with miniaturisation and AI-ready sensors and operates in various environments, including assembly lines and cleanrooms. Hardware enhancements will yield faster speeds to upgrade inspections while reducing downtime, which is why hardware is a big part of why companies keep investing heavily in this area.

- Application: The market can be segmented into Surface Inspection, Measurement & Gauging, Defect Detection, Assembly Verification, and Dimensional Inspection. Defect Detection is one of the most important applications because it prevents broken and faulty products from reaching consumers. Artificial intelligence and imaging robotic systems can identify very small cracks, scratches, or internal imperfections that would be impossible to see with the human eye.

- End-User Industry: The market is segmented into Automotive, Electronics & Semiconductors, Aerospace & Defence, Food & Beverages, Pharmaceuticals & Healthcare, Metal & Machinery, and Others. In the automotive industry, robotic inspection has become essential for ensuring safety, reliability, and efficiency.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Robotic Quality Inspection Systems Market:

- AI-Powered Predictive Inspection

Robots are increasingly using artificial intelligence to quickly analyse sensor and imaging data, allowing them to recognise disruptions and anomalies before they become failures and ultimately lead to expensive re-work. This transition shifts inspection from being reactive to being proactive, letting maintenance systems interface with robots to provide real-time data that reduces downtime and enhances quality.

- Adoption of Vision-Guided Robotic Inspection in Automotive Manufacturing

Companies like Ford are utilising AI-camera systems across their assembly lines to locate small misalignments and installation errors during the assembly process. As a result, they reduce the need for re-work or the risk of recalls, and their costs drop. These robots increase productivity and work alongside human inspectors.

Robotic Quality Inspection Systems Market Growth Drivers vs. Challenges:

Drivers:

- Safety and Risk Reduction in Hazardous Environments: Industries like oil and gas, energy, and infrastructure need to perform inspections in difficult-to-reach, dangerous, and confined areas. Robotic systems reduce and eliminate human exposure to toxic atmospheres, extreme heat, confined spaces, and high heights. By performing these tasks, they increase workplace safety to work, reduce the chance of injuries, and satisfy compliance obligations in high-risk operations.

- Advances in AI and Sensor Technologies Enabling Smarter Automation: Robots now have high-resolution cameras, thermal imaging, LiDAR, ultrasonic sensors, and AI algorithms. They can detect defects autonomously, process real-time data, and provide an adaptive workflow. They are moving robotic inspection away from strictly limited, manual checks to an integrated, self-driving quality assurance system that can produce better outcomes quicker than ever before.

Challenges:

- High Initial Investment and Integration Costs: Implementing robotic inspection has not historically been inexpensive, as the inherent upfront costs of hardware, sensors (advanced), implementation, integration, incorporation into existing lines, and training personnel in their use can be a great cost barrier for not only small- and medium-sized, but even large-sized organisations.

Robotic Quality Inspection Systems Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is definitely the fastest-growing market for robotic quality inspection systems due to rapid industrialisation and adoption of automation in the automotive, electronics and semiconductor manufacturing in countries like China, Japan and South Korea, spending heavily in robotics and AI in order to stay globally competitive and facilitate stricter quality controls. The continued development of smart factories, government-driven strategies for Industry 4.0, and increasing labour costs are also contributing towards increased uptake in robotic quality inspection. There is also a volume of production aspect to consider since to truly benefit and leverage the advantages of robotic inspection, you need high volume conditions which many manufacturers in Asia-Pacific meet, not to mention, quality control with zero defects is paramount in achieving profit margins amid higher levels of competition, therefore robotic inspections form a pillar of manufacturing strategies across the region.

List of Top Robotic Quality Inspection Systems Companies:

- ABB Ltd

- Cognex Corporation

- OMRON Corporation

- Keyence Corporation

- FANUC Corporation

Robotic Quality Inspection Systems Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2.596 billion |

| Total Market Size in 2031 | USD 4.392 billion |

| Growth Rate | 11.09% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Component, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Robotic Quality Inspection Systems Market Segmentation:

-

By Type

- 2D Vision Systems

- 3D Vision Systems

- Coordinate Measuring Systems

- Optical Inspection Systems

- Others

-

By Component

- Hardware

- Software

- Services

-

By Application

- Surface Inspection

- Measurement & Gauging

- Defect Detection

- Assembly Verification

- Dimensional Inspection

-

By End-User Industry

- Automotive

- Electronics & Semiconductors

- Aerospace & Defense

- Food & Beverages

- Pharmaceuticals & Healthcare

- Metal & Machinery

- Others

-

By Geography

-

North America

- United States

- Canada

- Mexico

-

South America

- Brazil

- Argentina

- Others

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

-

Middle East and Africa

- Saudi Arabia

- UAE

- Others

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

-