Report Overview

Robotic Vision Market - Highlights

Robotic Vision Market Size:

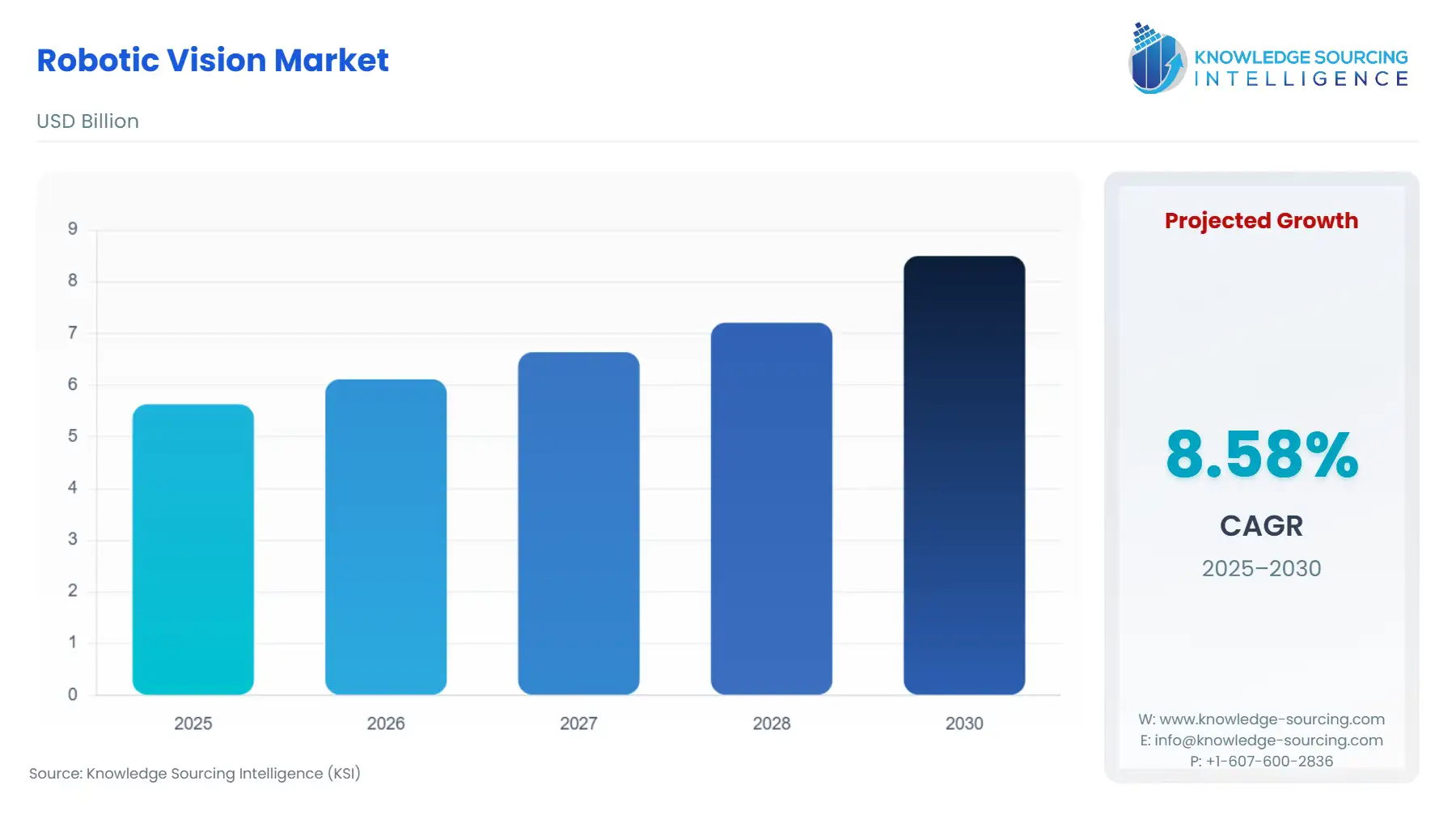

The global robotic vision market will grow at a CAGR of 8.59% to be valued at US$8.5 billion in 2030 from US$5.631 billion in 2025.

The robotic vision market has emerged as a pivotal segment within the broader robotics and automation industry, revolutionizing how machines perceive and interact with their environments. Robotic vision refers to the integration of advanced cameras,sensors, and artificial intelligence (AI) algorithms that enable robots to process visual data, make real-time decisions, and perform complex tasks with precision. This technology is integral to applications across manufacturing,logistics, healthcare, agriculture, and automotive industries, where vision-guided robots enhance efficiency, safety, and adaptability. The market is driven by the increasing adoption of cobots with vision, the rise of robotics as a service (RaaS) models, and the integration of AI and machine learning (ML) for enhanced perception.

The robotic vision market is propelled by several key drivers. First, the global push for industrial automation and Industry 4.0 initiatives drives demand for vision-guided robots to optimize production processes. Cobots with vision, such as those from Universal Robots, enhance human-robot collaboration in manufacturing and logistics by performing tasks like pick-and-place and quality inspection with high precision. Second, advancements in AI and 3D vision systems enable robots to handle complex tasks in dynamic environments, such as autonomous navigation in warehouses or surgical assistance in healthcare. For example, Google’s Gemini Robotics models, launched in March 2025, integrate vision and spatial reasoning for industrial applications. Third, the rise of RaaS models lowers entry barriers, enabling small and medium-sized enterprises (SMEs) to adopt robotic vision solutions without significant upfront costs. These models, supported by cloud computing, facilitate scalable deployment in logistics and retail. Finally, increasing demand for contactless operations in healthcare and e-commerce, spurred by global health concerns, accelerates the adoption of vision-guided robots for tasks like disinfection and inventory management.

Despite its growth, the robotic vision market faces notable restraints. High initial investment costs for hardware, such as advanced cameras and sensors, and software integration pose challenges, particularly for SMEs. The complexity of integrating robotic vision systems with existing infrastructure requires specialized expertise, limiting adoption in less technologically advanced regions. Data privacy and cybersecurity concerns also arise, as cloud-based vision systems process sensitive data, necessitating robust security measures. Additionally, the lack of standardization in robotic vision protocols can hinder interoperability, slowing market expansion. These restraints require ongoing innovation in cost-effective solutions and standardized frameworks to broaden market accessibility.

The robotic vision market size is experiencing robust growth, driven by technological advancements and increasing automation across industries. By 2030, the market is estimated to account for USD 8.5 billion, reflecting strong demand in manufacturing, automotive, and logistics. The adoption of cobots with vision and AI-powered vision systems contributes significantly to this growth, with 3D vision technologies enhancing applications like bin picking and quality control. The market growth is fueled by the expansion of robotics as a service (RaaS) models, which make vision-guided robots more accessible, and the increasing integration of edge computing and IoT for real-time processing. The Asia Pacific region, particularly China and Japan, is expected to lead due to heavy investments in smart factories and automation. Emerging applications in healthcare, such as robotic surgery, and logistics, including autonomous warehousing, will further drive the market, with robotic vision trends 2025 emphasizing AI, 3D vision, and collaborative robotics.

Several robotic vision trends are shaping the market’s trajectory. The integration of AI and machine learning enhances object recognition and scene understanding, enabling robots to adapt to dynamic environments. For instance, ABB’s AI-powered vision modules for logistics, launched in February 2025, optimize item picking in e-commerce. Cobots with vision are increasingly adopted in manufacturing and healthcare, with systems like Techman Robot’s TM AI Cobot TM30S, unveiled in May 2024, offering advanced vision capabilities for assembly and inspection. The rise of robotics as a service (RaaS) is transforming deployment models, with cloud-based vision systems enabling scalable, cost-effective solutions for SMEs. For example, Lanner Electronics’ vehicle-grade NVR solutions support cloud-integrated vision for fleet surveillance. Additionally, 3D vision systems are gaining traction for their superior depth perception, critical for complex tasks in automotive and pharmaceuticals. The focus on sustainability, driven by green manufacturing initiatives, further encourages the adoption of energy-efficient vision systems.

Hence, the robotic vision market is poised for significant growth, driven by the increasing adoption of cobots with vision, advancements in AI and 3D vision, and the scalability of robotics as a service (RaaS) models. The market is transforming industries through enhanced automation, precision, and safety. Key drivers include Industry 4.0, contactless operations, and technological advancements, while restraints like high costs and cybersecurity concerns require ongoing innovation. Robotic vision trends for 2025 highlight the integration of AI,edge computing, and collaborative robotics, positioning the market as a cornerstone of modern automation. As industries continue to embrace vision-guided robots, the robotic vision market will play a critical role in shaping the future of intelligent automation.

Robotic Vision Market Trends

Robotic vision is among the latest innovations in robotics and automation used in robots for better identification of things, navigation, finding objects, and inspection, among others. Robotic vision technology is useful for cost-cutting and creating a straightforward solution for all types of automation. Robotic vision has various applications across various industries. Robotics vision makes the manufacturing and packaging process easy by ensuring the quality of the products, checking product safety, preventing defective or damaged products from entering the market, and tracing the products. Some common examples of the application of robotic vision include barcode readers, scanners, autonomous vehicles, facial recognition, and others.

The Robotic Vision market is advancing rapidly, driven by technological innovations and the push for Industry 4.0 automation. 3D robotic vision is a leading trend, enabling robots to perceive depth and navigate complex environments for tasks like bin picking solutions and robotic guidance. For instance, ABB’s 3D vision modules, launched in February 2025, enhance bin picking accuracy in logistics. AI in robotics and deep learning vision systems is transforming visual inspection, offering precise defect detection in manufacturing. Fanuc’s AI-driven vision systems, updated in 2025, optimize quality control in automotive production.

Machine vision software is evolving with edge computing, enabling real-time processing for robotic guidance in dynamic settings like warehouses. Yaskawa’s 2025 vision solutions integrate edge computing for faster decision-making in smart factories. The adoption of Industry 4.0 automation drives demand for 3D robotic vision in pharmaceuticals and electronics, where precision is critical. These trends, supported by AI and deep learning, are enhancing automation, improving efficiency, and redefining robotic vision applications across industries.

Some of the major players covered in this report include Cognex Corporation, Keyence Corporation, Basler AG, Omron Corporation, Sick AG, Teledyne Technologies Incorporated, ISRA VISION AG, ABB Ltd., FANUC Corporation, Zivid AS, and MVTec Software GmbH, among others.

Robotic Vision Market Drivers:

Surge in Industrial Automation and Quality Control and Inspection

The Robotic Vision market is significantly driven by the global surge in industrial automation, particularly in quality control and inspection. Vision-guided robots equipped with 3D vision systems and AI algorithms enable precise inspection in manufacturing, ensuring defect-free products in industries like automotive and electronics. For instance, FANUC’s vision systems, updated in 2025, enhance quality control by detecting microscopic defects in real-time. Industrial automation demands robotic vision for tasks like surface inspection and traceability, reducing human error and increasing throughput. The push for smart factories under Industry 4.0 initiatives further accelerates adoption, as vision systems integrate with IoT and cloud platforms to provide data-driven insights. This trend supports quality control in high-precision sectors, positioning robotic vision as a cornerstone of modern automation, enhancing efficiency and compliance with stringent industry standards.

Advancements in Material Handling, Robotics, and Logistics Automation

Advancements in material handling robotics and logistics automation are key drivers of the Robotic Vision market. Vision-guided robots, equipped with 3D cameras and AI, excel in material handling tasks like bin picking,palletizing, and sorting in warehouses and distribution centers. ABB’s 3D vision modules, launched in February 2025, optimize material handling in e-commerce logistics, improving speed and accuracy. Logistics automation benefits from robotic vision systems that enable autonomous navigation and obstacle detection, critical for automated guided vehicles (AGVs) and drones. These systems reduce operational costs and enhance scalability, meeting the demands of e-commerce and supply chain optimization. The integration of edge computing further enhances real-time processing, making material handling robotics more efficient and adaptable, driving market growth as industries prioritize automation to address labor shortages and rising demand.

Growth in Welding Robotics and Assembly and Disassembly

The Robotic Vision market is fueled by the growing adoption of welding robotics and assembly and disassembly applications, particularly in automotive and aerospace industries. Vision-guided robots use 3D vision and AI to perform precise welding tasks, ensuring consistent seam quality and reducing defects. Yaskawa’s 2025 vision solutions for welding robotics enhance accuracy in arc welding and spot welding. Similarly, assembly and disassembly processes benefit from robotic vision for tasks like component alignment and fastener verification, improving production efficiency. For example, Ford’s Van Dyke transmission plant employs vision-guided robots for the assembly of gears and clutches, ensuring high-quality output. The demand for flexible manufacturing drives robotic vision adoption, as these systems enable robots to adapt to varying components, supporting automation in complex production lines and boosting market expansion.

Robotic Vision Market Restraints:

High Initial Investment Costs

The Robotic Vision market faces significant challenges due to high initial investment costs for hardware like 3D cameras, sensors, and processors, as well as software for AI integration. Implementing vision-guided systems in industrial automation requires substantial upfront expenditure, particularly for SMEs with limited budgets. Retrofitting existing production lines with robotic vision technologies adds complexity and costs, as compatibility issues often necessitate additional upgrades. Ongoing maintenance and training for specialized vision systems further increase expenses, deterring adoption in cost-sensitive markets. For instance, deploying 3D vision for material handling robotics involves costly calibration and integration, limiting scalability in smaller facilities. These financial barriers slow market growth, despite long-term benefits like improved quality control and efficiency, requiring cost-effective solutions to broaden accessibility.

Complexity of Integration and Lack of Standardization

The complexity of integrating robotic vision systems with existing infrastructure and the lack of standardization pose significant restraints for the Robotic Vision market. Vision systems require seamless compatibility with diverse robotic platforms, controllers, and software, which vary across industries like logistics and manufacturing. The absence of universal protocols complicates integration, increasing deployment time and costs. For example, welding robotics and assembly applications often require customized vision software, leading to interoperability challenges. Additionally, cybersecurity concerns arise with cloud-based vision systems, necessitating robust security measures that further complicate implementation. This lack of standardization hinders scalability, particularly for logistics automation and material handling, where diverse equipment is common, slowing market adoption and requiring industry-wide efforts to develop unified standards.

Robotic Vision Market Segmentation Analysis:

By Technology, the demand for 3D Vision Systems is increasing significantly

3D Vision Systems dominate the Robotic Vision market due to their superior depth perception and versatility in complex environments. Unlike 2D Vision Systems, 3D Vision Systems use stereo cameras, laser triangulation, or time-of-flight sensors to capture three-dimensional data, enabling precise tasks like bin picking, robotic guidance, and quality inspection. For instance, ABB’s 3D vision modules enhance bin picking accuracy in manufacturing and logistics, supporting Industry 4.0 automation. These systems are critical for cobots in assembly and welding, offering real-time adaptability to varying object shapes and positions. Their integration with AI and edge computing further boosts performance, enabling applications in automotive, electronics, and logistics. The widespread adoption of 3D Vision Systems is driven by their ability to handle dynamic environments, making them essential for modern automation solutions.

By Application, the Manufacturing & Industrial segment is gaining traction

Manufacturing & Industrial applications lead the Robotic Vision market, driven by the demand for automation, precision, and efficiency in smart factories. Vision-guided robots equipped with 3D vision and AI perform tasks like quality control, material handling, and assembly in industries such as automotive, electronics, and pharmaceuticals. FANUC’s vision systems optimize inspection and welding in manufacturing, ensuring high-quality output. Robotic vision enhances pick-and-place operations and defect detection, reducing errors and costs. The integration of machine vision software with IoT supports real-time data analytics, aligning with Industry 4.0 goals. For example, Yaskawa’s vision solutions, introduced in 2025, improve robotic guidance in smart manufacturing. This segment’s dominance is fueled by the need for scalable, flexible automation to address labor shortages and increasing production demands.

By End-User, the Automotive Manufacturing sector is leading the market growth

Automotive Manufacturing is the leading end-user segment in the Robotic Vision market, driven by the industry’s reliance on vision-guided robots for welding, assembly, and inspection.3D Vision Systems and AI-powered machine vision enable precise component alignment, seam tracking, and defect detection, critical for producing vehicles with high safety and quality standards. Ford’s Van Dyke transmission plant, for instance, employs vision-guided robots for the assembly of gears and clutches, enhancing efficiency. Robotic vision also supports automated quality control, ensuring compliance with stringent regulations. The adoption of cobots with vision, such as those from Universal Robots, facilitates human-robot collaboration in automotive production lines. This segment’s growth is propelled by the automotive industry’s shift toward electric vehicles and smart manufacturing, requiring advanced vision systems to handle complex components and streamline production processes.

Robotic Vision Market Key Developments:

Hikrobot's 3D Laser Profile Sensor and Smart Code Reader (August 2025): Launched at Automation Expo 2025, Hikrobot introduced its new 3D Laser Profile Sensor, which uses laser triangulation to deliver high-precision, real-time measurements. They also unveiled the new ID3000 Series Smart Code Reader, which is an AI-powered code reader designed for high-speed industrial applications.

NEURA Robotics' 4NE1 Humanoid Robot and Neuraverse Ecosystem (June 2025): At Automatica 2025, NEURA Robotics launched the third generation of its 4NE1 humanoid robot. They also introduced the MiPA cognitive household and service robot and the Neuraverse, an open robotics ecosystem.

RoboSense's Active Camera Platform (2025): At a global launch event, RoboSense unveiled its Active Camera platform, which integrates multiple sensors into a single hardware unit to provide color, depth, and motion data. The first product in this series, AC1, was released, with a new product, AC2, making a public appearance later in the year.

Cognex In-Sight L38 3D Vision System (April 2024): Cognex launched the In-Sight L38, a 3D vision system that integrates AI and 2D/3D vision technologies. The system simplifies the setup process by using pre-trained AI models, allowing for example-based training instead of complex programming.

Robotic Vision Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 5.631 billion |

| Total Market Size in 2030 | USD 8.5 billion |

| Forecast Unit | Billion |

| Growth Rate | 8.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Technology, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Robotic Vision Market Segmentation:

By Technology

2D Vision Systems

3D Vision Systems

Hyperspectral & Multispectral Imaging

Thermal Imaging Systems

AI-Powered Machine Vision

By Component

Cameras

Optics & Lenses

Lighting Systems

Frame Grabbers & Processors

Software

Sensors

By Application

Manufacturing & Industrial

Healthcare & Medical

Agriculture & Agritech

Logistics & E-commerce

Defense & Public Sector

Consumer & Commercial Services

By End-User

Automotive Manufacturing

Electronics & Semiconductor

Food & Beverage Processing

Pharmaceutical & Medical Devices

Logistics & Warehousing

Agriculture & Farming

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others