Report Overview

Robotics Training and Simulation Highlights

Robotics Training and Simulation Market Size:

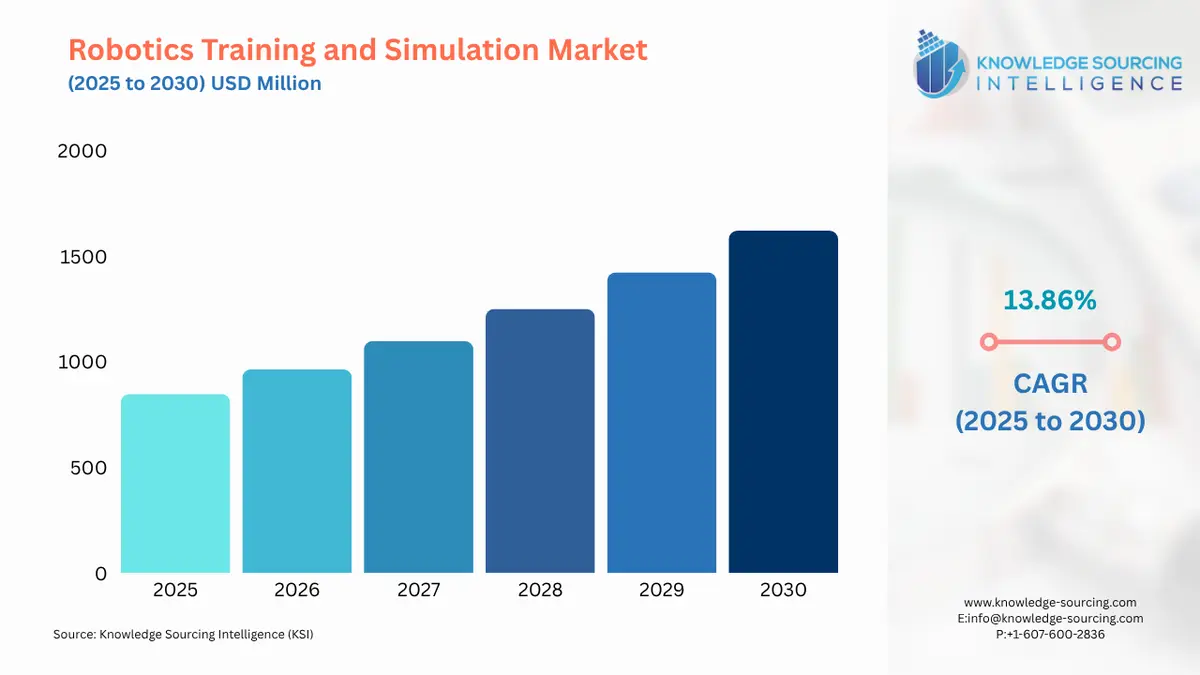

The Robotics Training and Simulation Market is set to advance at a CAGR of 13.86%, rising to USD 1,620.330 million in 2030 from USD 846.735 million in 2025.

Robotics Training and Simulation Market Key Highlights:

- Nvidia introduced Isaac GR00T N1 and the Newton physics engine to advance humanoid robot training and simulation realism.

- Google DeepMind launched Gemini Robotics AI, enabling robots to understand language, vision, and physical actions for safer real-world applications.

Robot training and simulation platforms are redefining how robots get developed, tested, and deployed in various applications, from manufacturing lines to healthcare and autonomous vehicles. These platforms provide engineers and operators the ability to safely test robot behaviors, confirm process flows, and get training on interactive virtual models before they go into real-world application. That means less potential for mistakes, faster ramp-up time, and more favorable safety outcomes. As companies embrace the benefits of automation, these platforms will only gain importance as a bridge between virtual design, planning, and physical implementation, allowing robots to learn how to accurately perform complex tasks, giving humans real hands-on experience, and enabling organizations to safely scale any project without costly trial-and-error.

Robotics Training and Simulation Market Overview & Scope

The robotics training and simulation market is segmented by:

- Simulation Type: The market is segmented into industrial robots, surgical robots, autonomous vehicle robots, service robots, and humanoid robots. A prime example is the use of industrial robot simulation to try out workflows and automation processes before implementing them on the production floor to mitigate downtime and potential human error. Surgical robot simulation provides doctors with training and enables them to practice complex procedures while minimising risk to the patient. Autonomous vehicle robot simulation enables operators to develop robust protocols for navigation and decision-making, while establishing safety measures, and to establish real-world protocols within a virtual environment. Service robot simulation can represent elements of logistics, retail, and hospitality. Humanoid robot simulation concentrates on the interaction between human beings and robots, as well as pushing the capabilities of advanced artificial intelligence.

- By Component: The market is segmented into software, hardware, and services. Software for simulations lays the groundwork for artificial working environments in which robots are programmed, tested, and optimised. Hardware encompasses devices like virtual reality headsets, controllers, motion trackers, and computer units, which can be used for interactive simulation of robots being tested. Services are used for training, consultation, and integration, ensuring that organisations will be able to use simulation platforms effectively.

- Application: The market is segmented into manufacturing and industrial automation, healthcare and surgical robotics, automotive and transportation, aerospace and defence, education and research, retail and hospitality, and others. In manufacturing, simulation is used to optimise assembly lines and automate robotic operations. In healthcare, simulation techniques can provide surgeons with improved surgical precision and provide medical professionals with an advanced simulator to augment their learning and training. There are opportunities in the automotive and transportation segment for autonomous driving systems that leverage simulation. Companies in Aerospace and Defence use robotics simulation for method planning, safety drills and simulated robotic maintenance tasks. Education and research utilise simulating a wide range of robots to instruct students and researchers in robotics programming and software that replicates robotics tasks. Retail and hospitality are beginning to adopt service robots and beginning to use service robots that use a simulation offer for various customer-facing tasks to maximise their operational performance.

- End-User Industry: The market is segmented into manufacturing companies, automotive companies, healthcare providers, aerospace and defence companies, education providers, and other consumers. Manufacturing companies depend on simulation to increase the efficiency of robotic automation. The automotive industry uses simulation to design applications to test autonomous vehicles, developing complex automation systems. Healthcare uses surgical simulators based on simulation to develop advanced modes of medical training. Aerospace and defence companies use simulation for planning safety-based robotics-driven operations and operational readiness for complex mission planning and execution. Educational companies use simulation-based programming drives to train students in areas such as robotics programming and artificial intelligence application development, and transactional-driven applications. Other consumers, such as retail and other service-based companies, have started to adopt simulator or simulation applications to optimise customer service and operating workflow.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Robotics Training and Simulation Market

- Integration of virtual reality (VR) and augmented reality (AR)

The Increased levels of VR and AR are being used for robotics training. VR simulations allow for an immersive environment where learners can interact with robots while practising skills, such as increased skill retention and improved patient safety, for realistic simulations when working with robotics. - Growth of cloud-based simulation platforms

Cloud adoption is quickly spreading in the robotic simulation market. This is an encouraging trend in today’s environment of global collaboration, scaled delivery, and cost restraints. Local government agencies and small-to-medium (SME) organisations may now access the ability to utilise robotics training and other simulation systems.

Robotics Training and Simulation Market Growth Drivers vs. Challenges

Drivers:

- Rising demand for robotics in manufacturing and automation: There is an increased demand for robotics in manufacturing as organisations are looking to be more productive, safe, and cost-effective. In this context, training and simulation platforms are of vital importance– this is where employees and engineers are able to work within a potentially complex automation environment before that robot is deployed on the factory floor. Missed training opportunities during a previous simulation mean loss of production time and money, along with accidents or disruption to production time. Additionally, as global supply chains increase in complexity, manufacturers have been increasingly reliant on simulation tools to be able to confirm that robots are effectively and reliably completing tasks from assembly to logistics. It shows that there is increased demand for adjacent robotics training or integration into workflows.

- Increasing focus on healthcare robotics and surgical training: Healthcare robotics, where accuracy, reliability, and precision are critical, has been growing at a rapid pace. Robotic surgical systems are already being deployed to assist surgeons in performing minimally invasive surgeries; however, the amount of resources that go into training surgeons to operate them safely requires real-world simulations to prepare surgical staff. Simulation platforms allow surgeons to practice simulated complex surgeries with no risk to the patient, which improves their experience and precision. They will also provide hospitals with improved learning experiences for surgical staff and reduced costs. As healthcare organisations deploy robotics broadly, their reliance on sophisticated training and simulation will see strong growth, which is a significant force driving this market’s growth.

Challenges:

- High implementation cost: The implementation of robotic simulation platforms includes expensive software, hardware, and infrastructure costs. These costs can limit the organisation's use of products to get access to deployable and accessible simulations, based on funding and budget levels.

Robotics Training and Simulation Market Regional Analysis

- North America: The North American region is contributing a significant share of the robotics training and simulation market. Various sectors are responsible for the widespread adoption of the robotics market, including manufacturing, healthcare, defence, and automotive sectors. The region includes significant technological and engineering infrastructure to test out a sophisticated research and development (R&D) agenda, making it an early adopter of robotics applications in the industrial and service sectors. The United States lead the other regional companies in health care robotics and autonomous vehicle R&D, which creates demand for simulation platforms for the development and training of said technology and personnel. Strong collaborative relationships exist in North America among universities, technology companies, and government organisations that encourage innovation in the robotics simulation market. Regional government policies and investments supporting and encouraging industries to invest in automation only help to solidify North America as a key geography for growth.

Robotics Training and Simulation Market Key Development:

- Nvidia launches Isaac GR00T N1 & Newton physics engine: At GTC 2025, Nvidia showcased Isaac GR00T N1, an open-source foundational model for humanoid robots, alongside the Newton physics engine developed with DeepMind and Disney Research, focused on the realism of simulation and physical reasoning.

List of Top Robotics Training and Simulation Companies:

Robotics Training and Simulation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 846.735 million |

| Total Market Size in 2031 | USD 1,620.330 million |

| Growth Rate | 13.86% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Simulation Type, Component, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Robotics Training and Simulation Market Segmentation:

- By Simulation Type

- Industrial robots

- Surgical robots

- Autonomous vehicle robots

- Service robots

- Humanoid robots

- By Component

- Software

- Hardware

- Services

- By Application

- Manufacturing and industrial automation

- Healthcare and surgical robotics

- Automotive and transportation

- Aerospace and defense

- Education and research

- Retail and hospitality

- Others

- By End-User Industry

- Manufacturing companies

- Automotive industry

- Healthcare providers

- Aerospace and defense organizations

- Educational institutions

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America