Report Overview

Security Orchestration Automation and Highlights

Security Orchestration Automation and Response Market Size:

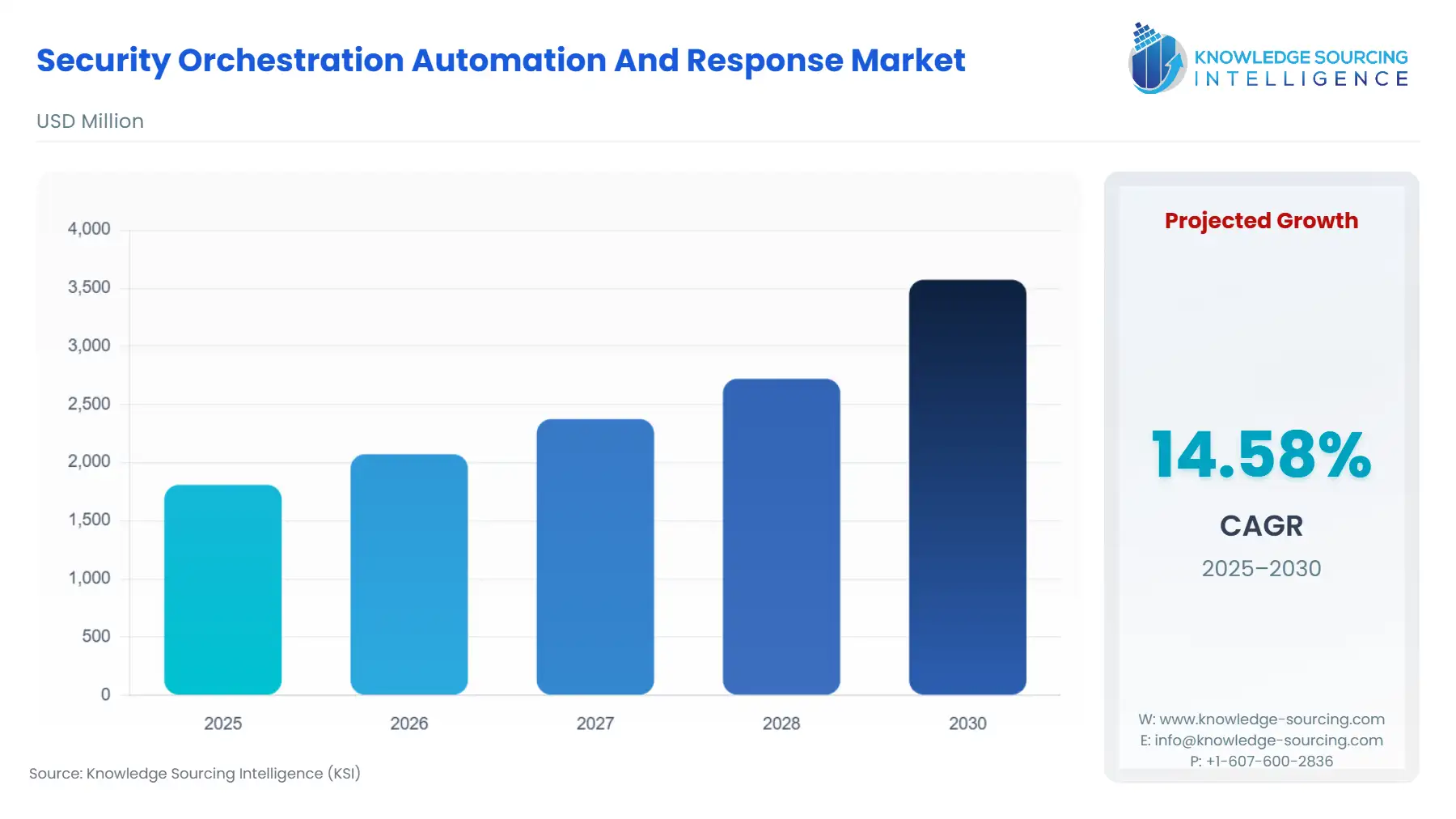

Security Orchestration Automation And Response Market, sustaining a 14.14% CAGR, is expected to grow from USD 1.809 billion in 2025 to USD 4.001 billion in 2031.

Security Orchestration Automation and Response Market Trends:

Security orchestration automation and response (SOAR) stands as a pivotal software solution, mandated to propel security teams toward enhanced efficiency by seamlessly integrating and coordinating tools within streamlined threat response workflows. Within the intricate landscape of large organizations, Security Operations Centers (SOCs) grapple with an array of tools dedicated to tracking and mitigating cyber threats. In this intricate mosaic, these tools often lack inherent compatibility, compelling SOCs to manually orchestrate their integration in response to each security incident. SOAR platforms, acting as a unifying force, provide SOCs with a centralized console, affording the ability to harmonize these diverse tools into optimized threat response workflows. Furthermore, these platforms usher in a new era of efficiency by automating low-level, repetitive tasks intrinsic to these workflows. The centralized console also emerges as a command center for managing all security alerts generated by these tools, consolidating the often-disparate streams of information into a singular, comprehensive view.

The security orchestration automation and response (SOAR) market is currently amid substantial growth, and this trend is anticipated to persist in the forthcoming years. Major industry players are dedicating substantial resources to research and development endeavors aimed at advancing their products, thereby propelling the continuous expansion of the SOAR market. The market's upward trajectory is further fueled by strategic initiatives such as the introduction of new products, the establishment of contractual agreements, participation in mergers and acquisitions, and collaborations with other organizations. Simultaneously, there is a growing demand for on-premise SOAR solutions, providing organizations with heightened control and flexibility in overseeing their security operations. This shift underscores the evolving landscape of security solutions as the market responds to the ever-changing needs of enterprises for robust and adaptable security measures.

Security Orchestration Automation and Response Market Growth Drivers:

Increasing Complexity and Frequency of Cyber Threats: The cybersecurity threat landscape is becoming increasingly complex and sophisticated, with cyberattacks growing in frequency and severity. This has led to a greater need for proactive threat detection and response, driving the demand for SOAR solutions.

Incorporation of Advanced Technologies: The incorporation of advanced technologies such as artificial intelligence and machine learning is driving innovation in the SOAR market. These technologies enable organizations to automate and orchestrate security processes, leading to more effective threat detection and response.

Growing Recognition of the Importance of Cybersecurity Among SMEs: Small and medium-sized enterprises (SMEs) are increasingly recognizing the importance of robust cybersecurity. This growing awareness is driving the demand for SOAR solutions tailored to the unique needs and constraints of SMEs.

Need for Efficient Incident Response and Security Operations Automation: The need for efficient incident response and security operations automation is driving the adoption of SOAR solutions. These solutions enable organizations to streamline security operations, automate repetitive tasks, and orchestrate complex processes, leading to more rapid and effective threat detection and response.

Rising Demand for SOAR Solutions in the IT and Telecommunications Sector: The IT and telecommunications sector faces a higher risk of data loss, security breaches, and hacking due to the highly confidential nature of the data they handle. As a result, there is a rising demand for SOAR solutions in this sector to simplify threat detection and response processes.

Security Orchestration Automation and Response Market Key Players:

Products offered by key companies:

FortiSOAR by Fortinet is a comprehensive Security Orchestration, Automation, and Response (SOAR) platform designed to help IT/OT security teams thwart attacks by streamlining workflows and improve incident response times by consolidating security data and activities from various sources into a single platform.

Swimlane's security orchestration solution empowers organizations to unify and optimize their security operations center (SOC) by integrating disparate security tools and processes into a single platform for holistic visibility and streamlined workflows.

Security Orchestration Automation and Response Market Segment Analysis:

Prominent growth in the IT and telecom segment within the security orchestration automation and response market:

The security orchestration automation and response (soar) market is currently witnessing significant growth in the IT and telecom segment, driven by various compelling factors. To begin with, the IT and telecom industries find themselves increasingly susceptible to sophisticated cyber threats, underscoring the critical need for efficient incident response strategies. In this context, SOAR platforms emerge as indispensable tools, enabling IT and telecom companies to promptly identify and mitigate threats. These platforms achieve this by streamlining security operations, automating repetitive tasks, and orchestrating intricate processes, thereby fortifying the overall cybersecurity framework.

Moreover, the accelerated integration of cutting-edge technologies such as artificial intelligence and machine learning within the IT and telecom sectors contributes to the escalating demand for SOAR solutions. The incorporation of these advanced technologies serves to augment the automation and response capabilities of security systems, fostering an environment where cybersecurity measures become more efficient and effective.

Additionally, the rising frequency of cybersecurity threats and the concurrent shortage of skilled security professionals in the IT and telecom industries are compelling organizations to embrace SOAR platforms. By doing so, these entities aim to not only streamline their incident response mechanisms but also enhance their overall security posture. In essence, the adoption of SOAR solutions in the IT and telecom segment represents a proactive response to the evolving landscape of cyber threats, aligning these industries with robust and adaptive cybersecurity measures.

Security Orchestration Automation and Response Market Geographical Outlook:

The North American region is expected to hold a significant share of the security orchestration, automation and response market:

The security orchestration, automation and response market in the North American region is poised to claim a substantial share, driven by various compelling factors. Foremost among these is the persistent and ever-evolving threat landscape in the region, marked by a surge in the frequency and severity of cyberattacks. In response to this challenging environment, organizations are increasingly adopting SOAR platforms to enhance the efficiency of their security operations and fortify their overall security posture.

Additionally, the rapid integration of cybersecurity solutions within key industrial sectors such as healthcare, BFSI (Banking, Financial Services, and Insurance), and IT & and telecommunications is a pivotal catalyst for the growth of the SOAR market in North America. This widespread adoption underscores the recognition of SOAR platforms as indispensable tools for managing and mitigating cyber threats effectively. The escalating costs associated with data breaches further accentuate the need for advanced security solutions in the region. Organizations are compelled to invest in cutting-edge technologies like SOAR platforms to proactively address and minimize the risks posed by cyber threats. This heightened focus on security is instrumental in propelling the expansion of the SOAR market.

Security Orchestration Automation and Response Market Key Developments:

Nov 2025: Microsoft Defender XDR added an Indicators tab in Threat Analytics that lists real-time Indicators of Compromise (IOCs) curated by Microsoft researchers to speed automated enrichment, correlation and response workflows.

Oct 2025: Palo Alto Networks (Cortex XSOAR) published an automated playbook for the Microsoft SharePoint “ToolShell” vulnerability chain (CVE-2025-49704 / 49706 / 53770 / 53771), enabling detection, IOC hunting, blocking, and remediation via XSOAR workflows.

Sep 2025: Splunk SOAR (On-Prem / Cloud) released major platform updates (release notes for 6.4.x ? 7.0.0), delivering orchestration and playbook engine improvements for SOAR deployments used by enterprise SOCs.

Security Orchestration Automation and Response Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Security Orchestration Automation and Response Market Size in 2025 | USD 1.809 billion |

Security Orchestration Automation and Response Market Size in 2030 | USD 3.573 billion |

Growth Rate | CAGR of 14.58% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Security Orchestration Automation and Response Market |

|

Customization Scope | Free report customization with purchase |

Security Orchestration Automation and Response Market Segmentation

By Component

Hardware

Software

Services

By Deployment

Cloud

On-Premise

By Enterprise Size

Small & Medium Enterprise

Large Enterprise

By Application

Threat Detection

Incident Response

Compliance Management

Others

By End-User

BFSI

IT & Telecommunication

Healthcare

Retail & E-Commerce

Manufacturing

Energy & Utilities

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others