Report Overview

Security System Integrators Market Highlights

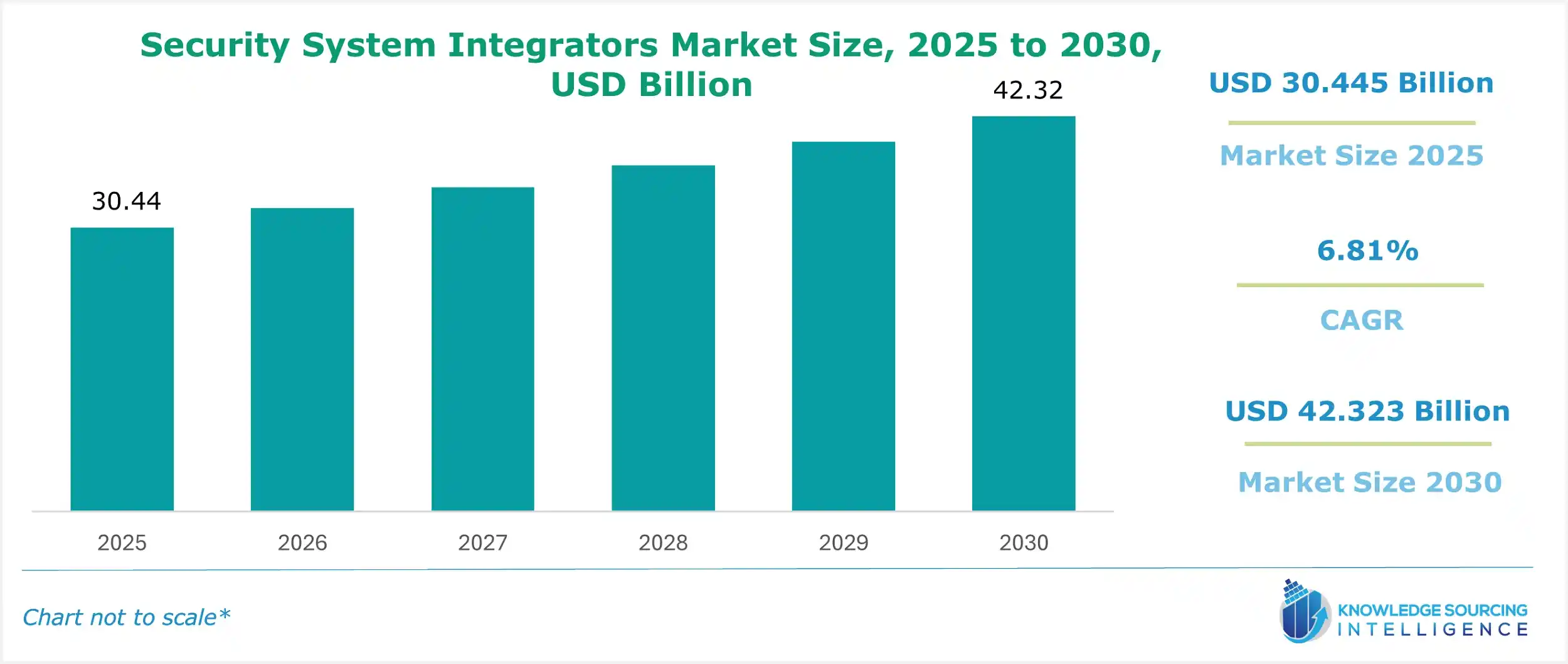

Security System Integrators Market Size:

The Security System Integrators Market is set to expand from USD 30.189 billion in 2025 to USD 41.206 billion by 2030, driven by a 6.42% CAGR.

The Security System Integrators Market is a critical component of the global security ecosystem, specializing in the design, deployment, and management of integrated security solutions that combine physical and cybersecurity technologies to protect organizations, assets, and data. Integrators unify systems such as video surveillance, access control, intrusion detection, firewalls, and encryption into cohesive platforms tailored to specific organizational requirements.

This market is pivotal in delivering comprehensive security solutions integration for modern enterprises. Converged security systems combine physical security integration, such as access control and surveillance, with robust cybersecurity services to protect against multifaceted threats. Enterprise security architecture ensures seamless IT/OT security integration, addressing vulnerabilities across operational and digital environments. Managed security services providers (MSSPs) offer scalable, end-to-end solutions, enhancing resilience through real-time monitoring and threat response. As organizations prioritize holistic security, system integrators leverage advanced technologies to deliver tailored, interoperable frameworks, meeting stringent compliance and risk management demands across industries.

The market is segmented by service type (design and consulting, installation and integration, maintenance and support, managed security services), application (application security, network security, data security), enterprise size (small, medium, large), end-user (government, Banking, Financial Services, and Insurance (BFSI), communication & technology, retail, manufacturing, others), and geography (North America, South America, Europe, Middle East and Africa, Asia Pacific). Driven by the surge in cyber and physical threats, regulatory compliance mandates, and the adoption of IoT and cloud technologies, the market is experiencing significant growth.

Security System Integrators Market Overview:

Security system integrators address the growing complexity of security challenges by delivering interoperable solutions that enhance organizational resilience. Design and consulting services involve crafting tailored security strategies, while installation and integration ensure seamless deployment of technologies like CCTV, biometrics, and network security systems. Maintenance and support services guarantee system reliability, and managed security services provide continuous monitoring and threat response. Applications focus on securing software environments (application security), network infrastructure (network security), and sensitive data (data security). The market serves enterprises of all sizes—small, medium, and large—across critical industries, including government, BFSI, communication & technology, retail, and manufacturing.

In June 2025, the global Security System Integrators Market was valued at approximately $12.5 billion, with projections estimating growth to $21 billion by 2030 at a compound annual growth rate (CAGR) of 9.0%. This growth is propelled by increasing cybersecurity threats, the proliferation of IoT devices, and global investments in smart infrastructure. Leading companies, such as Cisco Systems, Inc., IBM Corporation, and Honeywell International Inc., are advancing the market with AI-driven analytics and cloud-based integration platforms. The market’s expansion reflects the critical need for comprehensive, scalable security solutions in an increasingly interconnected and threat-prone world.

Security System Integrators Market Trends:

The Security System Integrators market is advancing with cyber-physical systems security, unifying protection for physical and digital assets. Digital transformation security drives the adoption of AI and cloud-based solutions, enhancing threat detection and response. Supply chain security integration addresses vulnerabilities in interconnected vendor ecosystems, ensuring end-to-end resilience. Regulatory compliance security remains critical, with integrators aligning solutions to meet GDPR, NIST, and industry-specific standards. Innovations in real-time monitoring and automated response systems empower enterprises to navigate evolving threats. These trends highlight the market’s shift toward integrated, scalable security frameworks, enabling robust protection in complex, digitally transformed environments.

Security System Integrators Market Growth Drivers

Several factors are fueling the Security System Integrators Market:

- Surge in Cyber and Physical Threats: The rise in cyberattacks, such as ransomware, and physical security breaches drives demand for integrated solutions. In 2024, the Cybersecurity and Infrastructure Security Agency (CISA) reported a 55% increase in ransomware attacks targeting critical infrastructure, emphasizing the need for robust integration services.

- Regulatory Compliance Mandates: Stringent regulations, such as the EU’s General Data Protection Regulation (GDPR) and the U.S. The Health Insurance Portability and Accountability Act (HIPAA) requires organizations to implement advanced security measures, prompting engagement with integrators for compliance-focused solutions.

- Adoption of IoT and Cloud Technologies: The growth of IoT devices and cloud-based systems increases the need for integrators to secure complex, distributed environments. In 2025, 63% of enterprises planned to expand cloud adoption, boosting demand for integrated security platforms.

- Smart City and Infrastructure Investments: Global smart city initiatives, such as Saudi Arabia’s $500 billion NEOM project, updated in 2024, drive demand for integrators to deploy comprehensive security systems for urban infrastructure.

Security System Integrators Market Restraints:

The market faces several challenges:

- High Implementation Costs: Designing and deploying integrated security systems requires substantial investment in technology and expertise, which can deter small and medium enterprises (SMEs).

- Shortage of Cybersecurity Talent: The complexity of integrated systems demands specialized skills, and a global shortage of cybersecurity professionals limits scalability and deployment efficiency.

- Interoperability Challenges: Integrating diverse security technologies with legacy systems can lead to compatibility issues, increasing project timelines and costs.

Security System Integrators Market Geographical Analysis:

- North America

North America holds the largest share of the Security System Integrators Market, accounting for approximately 41% of global revenue in 2025, driven by its advanced technological infrastructure and substantial cybersecurity investments. The U.S. leads due to its concentration of large enterprises and government agencies, with $3 billion allocated to federal cybersecurity in 2024. The BFSI segment dominates, as financial institutions face stringent regulations like the Payment Card Industry Data Security Standard (PCI DSS) and a 50% rise in cyberattacks targeting financial data in 2024. The network security application is also prominent, with 65% of U.S. enterprises investing in network protection solutions to counter sophisticated threats. Canada and Mexico contribute through digital transformation, particularly in communication & technology, where cloud-based integration is accelerating.

- Asia Pacific

Asia Pacific is the fastest-growing region, with a projected CAGR of 10.5% from 2025 to 2030, fueled by rapid digitalization, urbanization, and government-led cybersecurity initiatives. China’s cybersecurity market, valued at $14 billion in 2025, drives demand for integrators in its IT and manufacturing sectors, supported by the Cybersecurity Law. India’s Digital India initiative, with $2 billion invested in cybersecurity in 2024, promotes integration for smart cities and IT infrastructure. The communication & technology segment dominates, as tech firms in Japan, South Korea, and India prioritize securing cloud and IoT environments, with 70% of enterprises adopting integrated solutions in 2025. The managed security services segment is also significant, with 60% of Asia Pacific enterprises outsourcing security management for cost efficiency and expertise.

- Europe

Europe accounts for 24% of global revenue in 2025, driven by stringent regulations and investments in smart infrastructure. Germany and the UK lead due to their focus on Industry 4.0 and cybersecurity resilience, with the UK’s National Cyber Security Centre reporting a 40% rise in cyberattacks in 2024. The government segment dominates, as public sector agencies adopt integrated solutions to protect critical infrastructure, with 75% of European governments investing in security integration in 2025. The data security application is critical, driven by GDPR compliance, with 80% of European enterprises prioritizing data protection solutions to avoid hefty fines.

Security System Integrators Market Segment Analysis

- Managed Security Services

The managed security services segment held the largest share in 2025, accounting for 32% of the market, driven by the increasing trend of outsourcing security operations. Enterprises, particularly SMEs, rely on managed services for 24/7 monitoring, threat detection, and incident response, alleviating the need for in-house expertise. In January 2025, IBM enhanced its X-Force Threat Management Services with AI-driven analytics, improving real-time threat response capabilities. The segment’s growth is fueled by the rising complexity of cyber threats, with 48% of organizations outsourcing security to integrators in 2025.

- Network Security

The network security application segment accounted for 34% of the market in 2025, driven by the need to protect enterprise networks from cyberattacks. Integrators deploy firewalls, intrusion detection systems, and secure VPNs to safeguard network infrastructure. In February 2025, Cisco launched its Secure Firewall 4300 Series, offering advanced threat protection for large enterprises. The segment’s dominance reflects the prevalence of network-based attacks, with 60% of cyberattacks in 2024 exploiting network vulnerabilities, necessitating robust integration solutions.

- BFSI End-User Segment

The BFSI segment represented 22% of the market in 2025, driven by the sector’s need to secure sensitive financial data and comply with regulations like PCI DSS. Integrators provide tailored solutions for payment systems and customer data protection. In March 2025, Accenture introduced its Cyber Defense Platform for financial institutions, integrating AI-driven threat detection and response. The segment’s growth is supported by the surge in digital banking, with global online transactions reaching $7.2 trillion in 2024.

- Large Enterprises

The large enterprise segment accounted for 46% of the market in 2025, as these organizations manage complex IT environments requiring comprehensive security integration. Large enterprises invest heavily in AI and cloud-based solutions, with 68% adopting integrated platforms in 2025. In February 2025, Honeywell launched an AI-powered security integration platform for global enterprises, enhancing scalability and interoperability. The segment’s dominance is driven by the need for enterprise-wide security solutions to protect global operations.

Security System Integrators Market Key Developments:

- IBM X-Force Threat Management Services Upgrade: In January 2025, IBM enhanced its X-Force Threat Management Services with AI-driven analytics for real-time threat detection and response.

- Cisco Secure Firewall 4300 Series Launch: In February 2025, Cisco introduced its Secure Firewall 4300 Series, strengthening network security for large enterprises with advanced threat protection.

- Accenture Cyber Defense Platform: In March 2025, Accenture launched its Cyber Defense Platform for BFSI, integrating AI for advanced threat detection and compliance.

- U.S. Federal Cybersecurity Funding: In 2024, the U.S. government allocated $3 billion to federal cybersecurity, including integration services for government agencies.

- India’s Digital India Initiative: In 2024, India invested $2 billion in cybersecurity under the Digital India program, boosting demand for security integration in smart cities.

List of Top Security System Integrators Companies:

- Cisco Systems

- Hewlett Packard Enterprise (HPE)

- IBM

- FireEye

- McAfee

Security System Integrators Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Security System Integrators Market Size in 2025 | USD 30.445 billion |

| Security System Integrators Market Size in 2030 | USD 42.323 billion |

| Growth Rate | CAGR of 6.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Security System Integrators Market |

|

| Customization Scope | Free report customization with purchase |

Security System Integrators Market Segmentation:

- By Service Type

- Design & Consulting

- Installation & Integration

- Maintenance & Support

- Managed Security Service

- By Enterprise Size

- Small

- Medium

- Large

- By Application

- Application Security

- Network Security

- Data Security

- Others

- By End-User

- Government

- BFSI

- IT & Telecommunication

- Retail

- Manufacturing

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America