Report Overview

Single-Use Bioreactors Market Size, Highlights

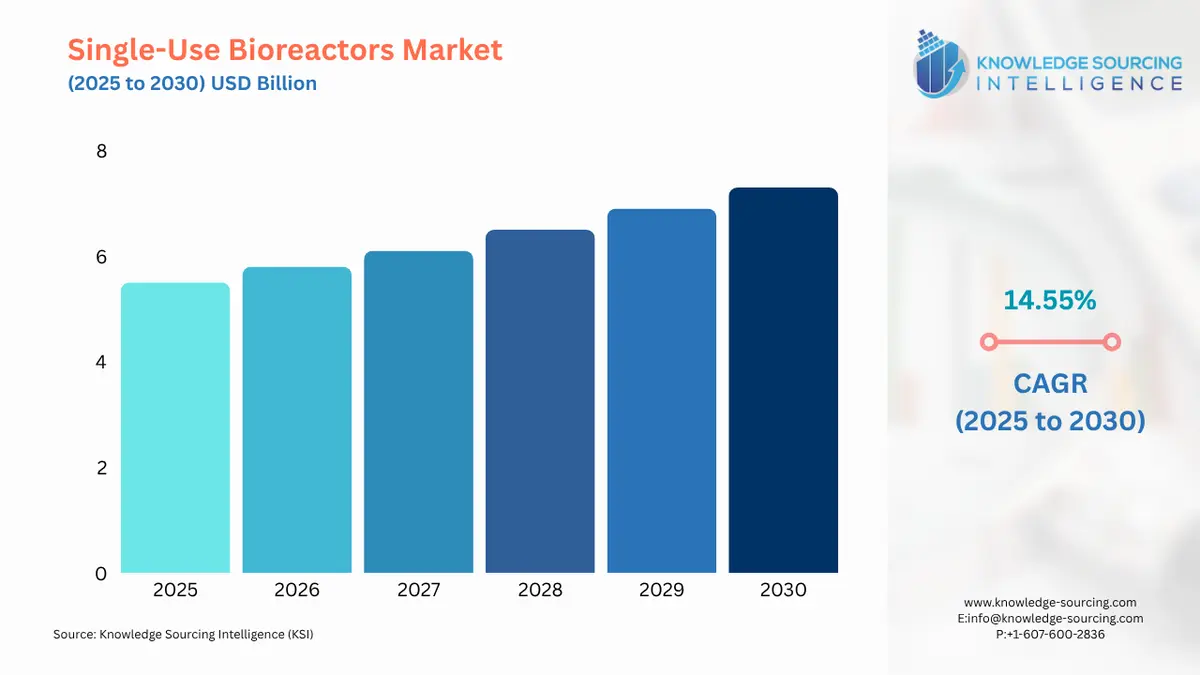

The single-use bioreactors market is expected to grow at a CAGR of 14.55%, reaching a market size of US$7.258 billion in 2030 from US$5.462 billion in 2025.

A solitary-use bioreactor or single-use bioreactor is a bioreactor with an expendable pack rather than a culture vessel. Regularly, this alludes to a bioreactor in which the fixing in touch with the cell culture will be plastic, and this coating is encased inside a more long-lasting construction, so it is high in demand and more eco-friendly. The expanding pattern toward multi-drug offices demands the creation of various drugs utilizing a similar office, which further raises the demand for single-use bioreactors because of their adaptability in the development of different drugs without compromising the quality of drugs. Increasing research activities and developments in the field of biopharmaceutics are giving potential to the market growth of single-use bioreactors.

The flexibility showcased by single-use bioreactors in producing multiple drugs without compromising quality is driving their market value in the medical and biopharmaceutical fields. The reduction in automation complexity offered by single-use bioreactors is also expected to increase the demand for them among large companies and industries.

The policies offered by the governments of several countries in support of research and development in the pharmaceutical and biotechnological fields are also positively influencing the global single-use bioreactors market growth. The efficiency offered by single-use bioreactors by reducing the costly and time-consuming cleaning process is expected to bolster their demand during the forecast period.

What are the Single-Use Bioreactors Market drivers?

- Rise in biopharmaceutical research and development is expected to drive the single-use bioreactors market

The interest in biopharmaceuticals is expanding worldwide because of the growing geriatric population percentage, as this population is more susceptible to a wide scope of infections. Looking at the increasing opportunities, worldwide organizations, and major companies are investing more in biopharmaceutical research and development programs. When compared to other assembling ventures, the biopharmaceutical industry contributes many times more in terms of research and development. According to the reports of the FIP (International Pharmaceutical Federation) in 2018, the world’s biopharmaceutical organizations had collectively invested about 102 billion USD in research and development programs.

Single-use bioreactors are vital to the biopharmaceutical component-producing work processes. They make up an enormous amount of small and mid-scale biopharmaceutical manufacturing, especially in clinical testing and innovative work. Because of their benefits over traditional biomanufacturing strategies, their popularity has expanded in biopharmaceutical research and development. The increasing research and development programs are considered a positive sign for the single-use bioreactor market’s growth.

- The flexibility offered by single-use bioreactors would significantly increase the demand for single-use bioreactors

The flexibility offered by single-use bioreactors is another major factor positively driving the single-use bioreactor market’s growth. The efficiency showcased by these bioreactors in manufacturing different types of drugs and assisting different biopharmaceutical processes is increasing the application of single-use bioreactors in various fields. The large investments of major companies in developing single-use bioreactors compared to conventional ones are significantly boosting the global single-use bioreactor market growth.

Single-use bioreactors are increasingly popular due to their adaptability to various scales, reduced turnaround time, cost-effectiveness, and minimization of cross-contamination risks. They are suitable for a wide range of applications, from laboratory-scale research to large-scale industrial production. The setup and cleaning processes are faster than traditional stainless-steel bioreactors, allowing for more efficient production cycles.

Additionally, single-use bioreactors eliminate the need for significant infrastructure and cleaning validation costs, making them an economical choice. This is particularly important in the production of biopharmaceuticals and other sensitive products, where maintaining product purity is crucial.

Geographical outlook of the Single-Use Bioreactors Market:

- The North American region is predicted to hold a significant market share in the future

North America is the market leader. Geographically, the North American region is estimated to hold the lion's share of the single-use bioreactor market. The presence of well-established medical and pharmaceutical infrastructure in the North American countries and the presence of major players are some of the prominent reasons behind the region's large market share in the single-use bioreactor market.

North America, particularly the United States, is a global leader in the biopharmaceutical industry, with numerous biotech and pharmaceutical companies using bioreactors for production. The demand for single-use bioreactors, offering flexibility and cost-efficiency, is on the rise due to their advantages such as reduced contamination risk, faster turnaround times, and lower capital investment. The growth of biotechnology startups in the region has also driven the adoption of single-use bioreactors, making them an attractive choice for bioprocess development and manufacturing.

Strategic collaborations between key players in the biopharmaceutical industry and single-use bioreactor manufacturers contribute to market growth. Regulatory agencies in North America have recognized the advantages of single-use bioreactors and provided support for their use in biopharmaceutical manufacturing. Technological advancements in single-use bioreactor technology, such as sensor integration, control systems, and disposable materials, contribute to their broader acceptance. The North American region's strong presence in the global biopharmaceutical market contributes to its competitiveness in the single-use bioreactors marketplace.

Key developments in the Single-Use Bioreactors Market:

Single-Use Bioreactors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2025 | US$5.462 billion |

| Market Size Value in 2030 | US$7.258 billion |

| Growth Rate | CAGR of 14.55% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

The Single-Use Bioreactors Market is analyzed into the following segments:

- By Product Type

- Single-Use Bioreactor Systems

- Media Bags

- Filtration Assemblies

- Other Products

- By Cell Type

- Mammalian cell

- Bacteria

- Yeast

- Other Cell Types

- By Molecule Type

- Monoclonal Antibodies

- Vaccines

- Stem Cells

- Gene-modified Cells

- Other Molecule Types

- By End-User

- Pharmaceutical and Biopharmaceutical industries

- Contract Research Organisations

- Other End-Users

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America