Report Overview

Smart Homes Market Size, Highlights

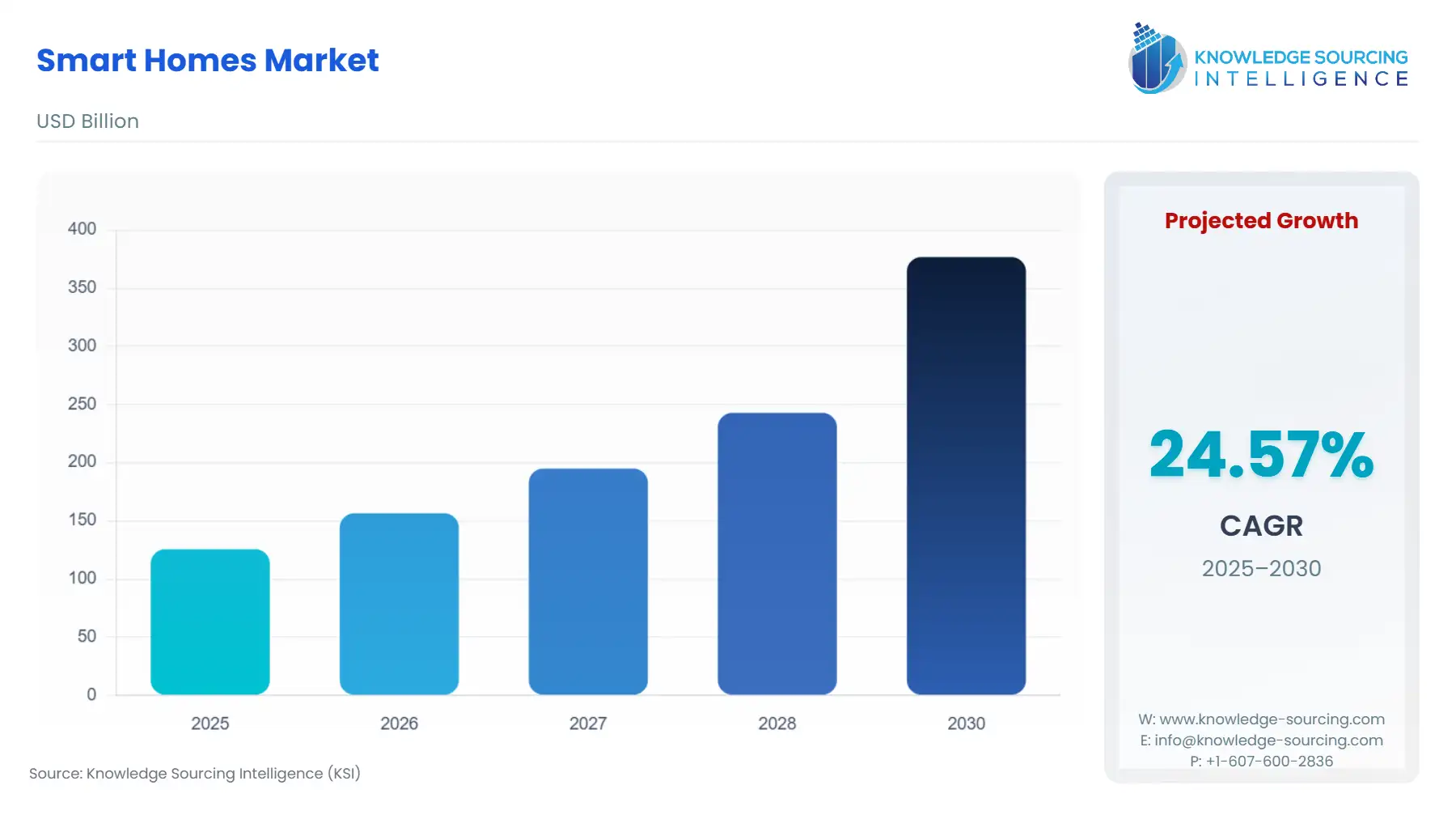

Smart Homes Market Size:

The Global Smart Homes Market is expected to grow from US$125.625 billion in 2025 to US$376.828 billion in 2030, at a CAGR of 24.57%.

The smart homes sector stands at a pivotal juncture, where interconnected devices redefine residential functionality amid escalating energy constraints and security imperatives. Households increasingly integrate systems for lighting, climate control, and surveillance, not merely as conveniences but as necessities for managing utility bills and personal safety. Federal initiatives, such as the Department of Energy's Grid-Interactive Efficient Buildings program, underscore this shift by funding pilots that demonstrate tangible savings. The sector's trajectory hinges on balancing innovation with accessibility. As single-family dwellings incorporate modular smart features during construction, demand surges among new homeowners seeking future-proof investments.

Smart Homes Market Analysis

- Growth Drivers

Advancements in Internet of Things (IoT) architectures propel demand for smart home systems by enabling seamless device orchestration, which addresses consumer needs for centralized control amid rising energy costs. Studies suggest that connected IoT unit’s usage is gaining traction in residential places for security purpose and to exercise personalized comfort which correlates with heightened residential integration. This proliferation directly amplifies procurement of compatible ecosystems, as households seek platforms that unify disparate gadgets thermostats, locks, and sensors into responsive networks. According to the “Home Appliance Market Report 2024/2025” issued by APPliA Polska (Association of Home Appliance Employers), the smart appliance penetration in household is expected to reach 30% by 2029 in Poland.

Energy efficiency mandates from government bodies catalyse further uptake by mandating features that curtail peak loads, thereby expanding addressable markets in regulated regions. Governing authorities such as U.S Department of Energy are allocating investments in smart buildings and implementing pilot projects to analyse home energy management system. Hence, such investments are spanning diverse housing from single-family to multifamily, underscores how policy-backed pilots create pull effects: utilities partner with developers to embed demand flexibility, drawing in cost-conscious owners who view smart controls as hedges against volatile rates. Consumer-led security imperatives drive segment-specific surges, particularly in access control, as households respond to vulnerability disclosures by favoring fortified integrations.

The interplay between consumer behaviors and technological maturity has become core to residential innovation. Affluent urban dwellers, particularly in North America and Asia-Pacific, lead uptake, drawn to solutions that blend convenience with cost savings. For instance, voice-activated hubs now serve as central nervous systems, coordinating lighting, climate, and security with minimal user intervention. This not only elevates daily comfort but also addresses pressing global imperatives like energy conservation, where smart thermostats alone curb consumption in equipped homes. Meanwhile, in developing markets, initial penetration focuses on basic security features, signaling untapped potential as broadband expands.

- Challenges and Opportunities

Technological fragmentation undermines demand by complicating interoperability, leading consumers to defer purchases until ecosystems cohere. Studies suggest that users identify protocol incompatibilities as a dominant concern, with APIs that propagate vulnerabilities across vendors, eroding trust in multi-device setups. This discord directly suppresses uptake thereby resulting in underutilized investments and stalled market penetration. In market such as US, where smart home administrators handle diverse brands, such hurdles amplify abandonment rates, constraining growth in wireless segments like Bluetooth-reliant sensors.

Privacy and security shortfalls further dampen enthusiasm, as unpatched devices expose households to breaches, prompting selective adoption over comprehensive deployments. FTC (Federal Trade Commission) documented risks in smart speakers and vacuums heighten parental hesitancy thereby limiting the user exposure. This caution further translates to fragmented demand, favoring siloed products over integrated services and inflating support costs for manufacturers navigating disparate regulations. Moreover, the rising installation and labor expenses pose economic headwinds, particularly in competitive landscapes where margins compress. According to the U.S Bureau of Labor Statistics, in June 2025, the employment cost index for installation, maintenance and repair workers experienced 3.8% year-on-year growth.

Opportunities arise from unifying platforms that resolve fragmentation, fostering demand for plug-and-play solutions that streamline onboarding. The growing demand for compatible architectures is potentially unlocking the adoption lifts by easing multi-vendor integrations as seen in EPA's single-provider SHEMS (Smart Home Energy Management System) criteria that consolidate management and yield optimized savings. This approach directly stimulates procurement of middleware hubs, appealing to users seeking hassle-free expansions.

Recurring service innovations present pathways to stabilize revenue while addressing privacy gaps through proactive updates. The ongoing efforts to boost retention in aging devices has laid emphasis in transparent patching which is driving demand for maintenance bundles that embed cybersecurity. Likewise, sustainability alignments offer leverage points, with IoT enabling peak-shifting that aligns with renewable mandates, enhancing appeal in regulated markets. Hence, the benefits from dynamic demand management is spurring uptake of HVAC controls that reduce non-technical losses, and these avenues collectively reposition challenges as demand multipliers, provided stakeholders prioritize standardization and user-centric safeguards.

- Raw Material and Pricing Analysis

Semiconductor shortages disrupt smart home hardware availability, elevating production costs and indirectly curbing device affordability for end-users. According to the World Semiconductor Trade Statistics, in Q1 2025, the global semiconductor supply reached USD 167 billion which showcased a decline of 3.4% in comparison to Q4 2024. This reduction caused by logistics constrains and raw material deficit could directly temper demand, as manufacturers pass escalations to consumers, noting dependencies on Asian fabs that delay lighting and HVAC modules.

In response, firm’s stockpile, but persistent constraints in gallium and germanium critical for sensors sustain premiums, prompting shifts toward diversified sourcing. Rare earth elements constrain scalability in displays and batteries, with China's dominance amplifying geopolitical risks that cascade into pricing instability. Precious metals sourcing introduces supply chain frailties, with gold, palladium, and platinum vital for circuit boards facing mining disruptions that inflate hardware bills.

- Supply Chain Analysis

Global smart homes supply chain centres on Asian hubs, particularly China and Taiwan, for electronics assembly, with majority of semiconductors originating there. Key production nodes include Shenzhen for IoT boards and Dongguan for HVAC components, feeding downstream logistics via sea routes to U.S. and EU ports, and dependencies on these locales expose the chain to disruptions.

Logistical complexities arise from just-in-time models strained by port congestions, amplifying lead times for wireless modules. Recent U.S. reciprocal tariffs, enacted via April 2025 Executive Order, impose heavy duties on Chinese imports, directly hiking costs for access control hardware and eroding demand through retail pass-throughs.

Smart Homes Market Government Regulations & Programs

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Smart Home Energy Management System/ EPA |

Analyze smart home systems that simplifies energy consumption in homes and provides energy saving actions based in usage pattern. The program will support growing transition towards energy management systems for residential applications |

|

European Union |

Smart Readiness Indicator/ Energy Performance of Building Directive |

Rates the level of adaptability of buildings towards smart technologies, and will increase awareness regarding benefits of smart technologies usage in residential buildings. |

Smart Homes Market Segment Analysis

- By Product: Security & Access Control

The security & access control is expected to account for a considerable market share, which is attributable to the rising breach incidences which has amplified the demand for fortified access systems, as households integrate locks and cameras to counter API vulnerabilities. Likewise, urbanization exacerbates entry-point exposures, propelling adoption in single-family gateways. The regulatory nudges, like NIST's update preferences, enforce patching, stimulating service demand for maintenance that sustains high pollutant capture in integrated units. Hence, fragmentation challenges persist, yet unified Zigbee protocols mitigate, unlocking retention lifts. Overall, security drivers transform this segment into a demand anchor, with verifiable savings justifying premiums in retrofit markets.

Likewise, heightened security apprehensions, amplified by urban crime trends, catalyse explosive growth in access control and surveillance, where networked cameras and locks fulfil needs for remote vigilance. As as IoT-enabled alerts integrate with broader home networks, thereby reducing response times to incidents such as thefts and burglary, the attitude towards toward proactive protection rather than reactive measures is estimated to gain traction especially in major economies such as the United States where households are investing in installing connected cameras.

- By Housing Type: Single-Family

Based on housing type, the single-family is poised for a constant expansion as the energy autonomy imperatives is driving the single-family demand, and owners leverage smart controls for outage resilience in solar-equipped homes. Likewise, the demographic shifts toward remote work heighten convenience needs, funnelling investments into HVAC and lighting that adapt to occupancy. Hence, the constant progression in single-family frequency provides new growth prospects, for instance, according to the Office for National Statistics, in 2024, the total frequency of household in the United Kingdom was 28.6 million form which nearly 66.9% comprised of one family with or without children.

Smart Homes Market Geographical Analysis

The smart homes market analyze growth factor across following regions

- North America: Technological innovations in the regional economies namely the United States followed by establishment of smart energy management programs such as “ENERGY Star Smart Home ENERGY Management System” by governing authorities is driving the development of smart homes in such nations. Likewise, the growing single-family house sales has also positively impacted the demand for smart technologies. According to US Census Bureau’s data, in August 2025, the sale of new single-family houses at a seasonally-adjusted rate reached 800,000 which showcased a significant 20.5% growth over previous month’s sales.

- Europe: Transition towards smart energy is gaining progression in the European region, with major regional economies namely Germany, France, the United Kingdom along with Nordic nations showcasing investments in green technology for residential applications. Likewise, futuristic initiatives such as “London Net Zero Neighbourhood Programme” which aims to reduce energy bills for household and reduce carbon emission is further projected to bolster the smart technology usage in homes.

- Asia Pacific: Urban development in the region especially in regional economies namely China, India, Japan, and South Korea has provided new growth prospects for smart homes development. Likewise, the “Smart City” initiatives undertaken by governments has established a blueprint for usage of smart technologies in residential application. The June 2025, data provided by the Ministry of Housing and Urban Affairs states that from the total number of 8,067 smart city projects undertaken, completed projects constituted for 94% while the remaining share comprised of projects still undergoing.

- South America & MEA: The initiatives to bolster residential establishments in major cities followed by investments to integrate AI in various residential application has positively impacted the market growth in South America and MEA.

Smart Homes Market Competitive Environment and Analysis

The landscape features entrenched players leveraging ecosystems for dominance, with Google, Amazon, and Honeywell commanding shares through integrated offerings.

- Google LLC positions as a connectivity leader, embedding Gemini AI across Nest devices for predictive automations. The company has shown active participation in exercising product advancements which meets the current technological trends. For instance, its October 2025 "Next Era of Google Home" launch integrates voice AI for energy optimization and modifying Google Assistant on smart displays, speakers and other smart devices.

- Amazon Web Services, Inc. dominates voice interfaces via Alexa, with Echo devices already surpassing the half-billion million units benchmark. The January 2025 Echo Spot introduction adds customizable displays for alarm-integrated clock that integrates style with functionality and is ideally designed to enhance bedside table experience.

Smart Homes Market Developments

- October 2025: Google launched Gemini for Home, integrating AI across Nest ecosystem for advanced automations, including predictive energy management in thermostats and cameras. The product integrates voice commands with energy optimization.

- September 2024: ABB Ltd. India announced the launch of wireless home automation solutions “Abb-Free Home” which offers enhanced interoperability that not only increase user’s overall comfort, and security but also allows them to control third part devices, white good appliances and EV chargers.

Smart Homes Market Segmentation:

- By Product

- Security & Access Control

- Lightening Control

- HVAC Control

- Energy Management System

- Others

- By Connectivity

- Wired

- Wireless

- By Service Type

- Installation

- Maintenance

- Renovation & Customization

- By Housing Type

- Single-Family

- Multi-Family

- By Geography

- North America

- USA

- Canada

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- United Kingdom

- France

- Others

- Middle East and Africa

- Israel

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- China

- South Korea

- Japan

- India

- Others

- North America