Report Overview

Soldering Applications Antimony Market Highlights

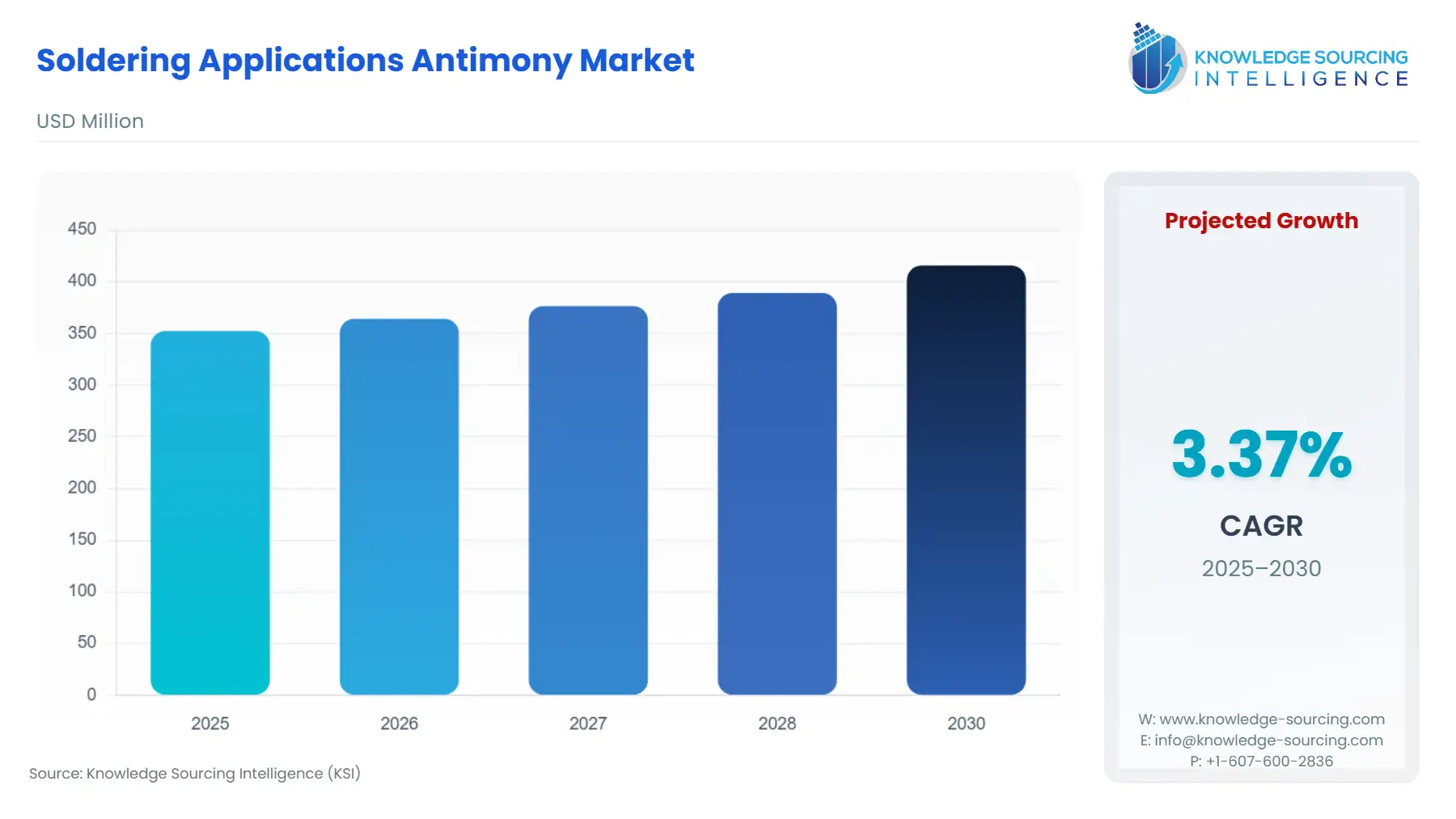

Soldering Applications Antimony Market Size:

The Soldering Applications Antimony Market is expected to grow at a CAGR of 3.37%, rising from USD 352.378 million in 2025 to USD 415.806 million by 2030.

The soldering applications antimony market is expanding as industries convert to modern, durable lead-free solder products. Antimony has a key role in improving the strength, heat resistance and reliability of solders by virtue of the metallic alloys used in the electronic, automotive and aerospace industries. With pressure on the use of lead increasing manufacturers are turning to antimony-based solders in order to comply with environmental needs without loss of performance.

The constant innovations being made to the solder alloys and soldering processes improve efficiency, reduce defects, and enhance joint integrity. The increased worldwide demand for smaller and high-performance electronic components will lead to an ever-widening acceptance of the antimony-based solders, which will result in a healthy growth of the soldering applications antimony market, both in existing and new areas in the industries.

Soldering Applications Antimony Market Overview & Scope:

The soldering applications antimony market is segmented by:

- Product type: The market is segmented into antimony metal, antimony oxide, antimony alloys and others. Antimony alloys account for the major portion of the market as they enhance the strength of solder, heat resistance and integrity of the bond. This enhances their applications in complex electronics and automobile assemblies.

- Solder Type: The market includes lead solder, lead-free solder, high temperature solder and others. Lead-free solder is witnessing a rapid growth as countries around the world are enforcing stringent laws to drive industries towards ecological alternatives, in which antimony is the metal used to provide mechanical strength and melting performance to these compositions.

- End-User Industry: The market is analysed as electronics and electricals, automotive, aerospace and defence, construction and others. The electronics and electricals market leads the segment as soldering is one of the most critical processes with regard to circuit boards, connectors and semiconductor packaging, wherein reliability and thermal endurance are important.

- Region: Geographically, the market is expanding at varying rates depending on the location.

________________________________________

Top Trends Shaping the Soldering Applications Antimony Market:

Shift Toward Lead-Free Soldering

Manufacturers are moving to most solder products that are lead-free to conform to stricter international environmental regulations. Antimony is rapidly becoming the favourite element to use as an additive to increase strength, heat resistance and joint reliability, which enables the manufacturer to comply with RoHS and other sustainability regulations while maintaining the performance of the product.

Rise of Miniaturised Electronics

As the devices become smaller and more complex, the manufacturers need to find solder products that have more thermal stability, heat conductivity accuracy. Antimony solder products are the obvious choice to make for use in micro soldering applications, due to their greater thermal and mechanical strength and conductivity, ensuring reliable interconnections in high-density circuit boards and high-technology electronic components.

________________________________________

Soldering Applications Antimony Market Growth Drivers vs. Challenges:

Drivers:

- Expanding Electronics Manufacturing: The growing electronics manufacturing in the world, and especially in the Asian Pacific areas, is manifesting itself in greater demand for solder products, which are more effective and durable. Antimony imparts to solder products strength and thermal stability, which is becoming mandatory for semiconductors, connectors and circuit board assembly.

- Rising Adoption in EVs and Aerospace: Solder products are required which can withstand extreme temperatures and mechanical strain in electric vehicles and aerospace systems. Antimony’s chemical properties produce excellent high temperature stability, corrosion protection and life, contributing to a reliable product performance under adverse conditions.

Challenges:

- Supply Chain Instability: Fluctuations in antimony availability and pricing disrupt supply consistency, affecting production planning and increasing overall manufacturing costs.

________________________________________

Soldering Applications Antimony Market Regional Analysis:

- North America: North America is a major market for antimony in soldering applications because it has a strong electronics manufacturing base and increasing demand from the automotive and aerospace industries. The United States leads this effort with advances in the lead-free soldering materials market and the high-reliability alloy formulations. The growing regulatory push for the elimination of metallic substances with toxic characteristics has motivated many manufacturers to adopt antimony-based alternatives that will mean compliance with environmental regulations. Further, the interest in electric vehicles and defence electronics by the regional producers keeps increasing the market for antimony soldering materials. Additionally, joint research and investments in refining technologies will add to the region's ability to compete in the ever-evolving antimony market.

________________________________________

Soldering Applications Antimony Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 352.378 million |

| Total Market Size in 2031 | USD 415.806 million |

| Growth Rate | 3.37% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Solder Type, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Soldering Applications Antimony Market Segmentation:

- By Product Type

- Antimony Metal

- Antimony Oxide

- Antimony Alloys

- Others

- By Solder Type

- Lead-Based Solder

- Lead-Free Solder

- High-Temperature Solder

- Others

- By End-User Industry

- Electronics and Electricals

- Automotive

- Aerospace and Defence

- Construction

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America