Report Overview

South Korea AI-Driven Hypothesis Highlights

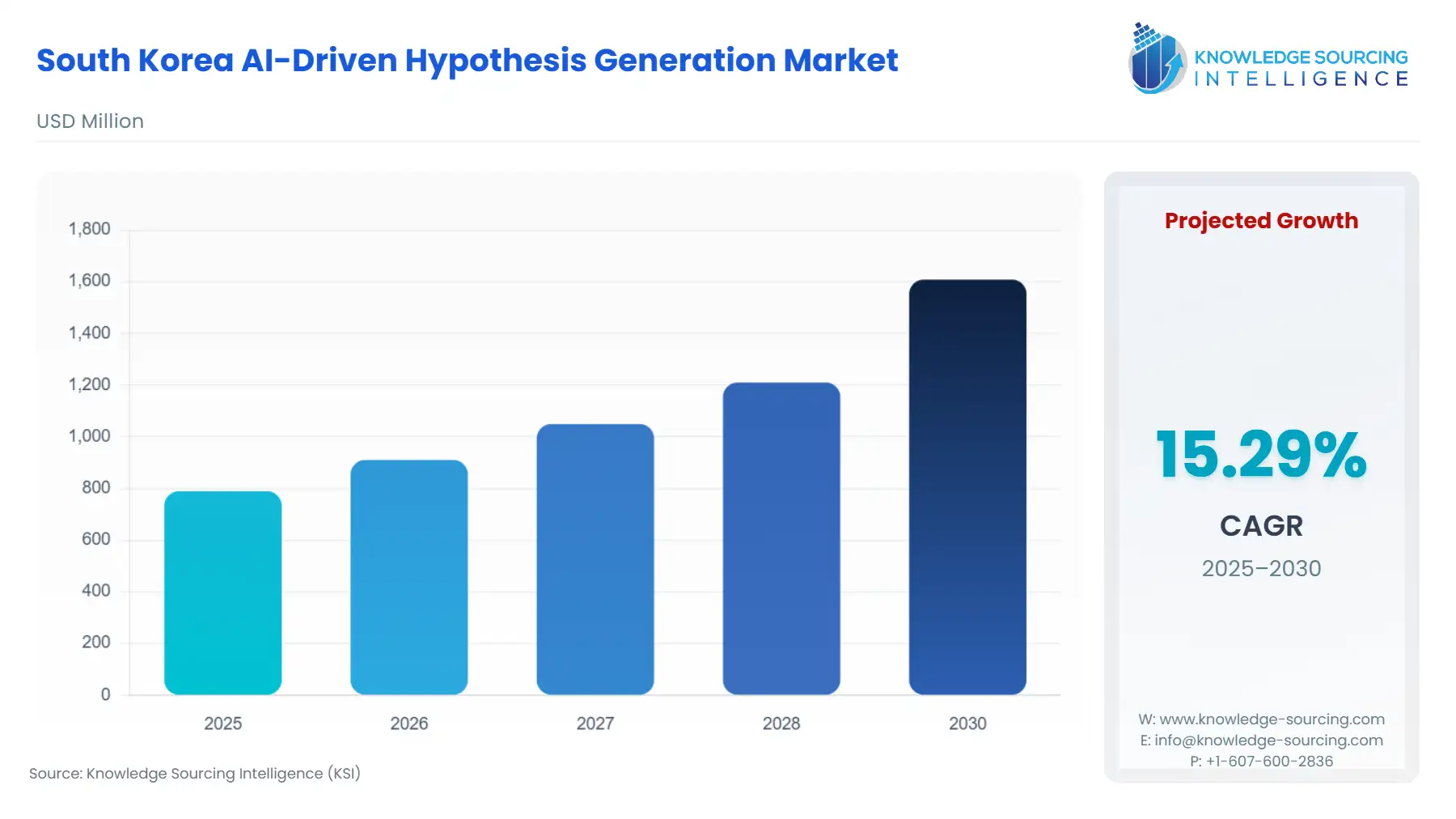

South Korea AI-Driven Hypothesis Generation Market is expected to rise from USD 789.712092 million in 2025 to USD 1608.67278 million by 2030, reflecting a CAGR of 15.29%.

South Korea AI-Driven Hypothesis Generation Market Key Highlights

The South Korea AI-Driven Hypothesis Generation (AI-DHG) market is undergoing a significant strategic pivot, driven by a national mandate to transition the economy from an IT superpower to an "AI superpower." This sector, which focuses on utilizing advanced algorithms like machine learning and natural language processing to predict novel scientific targets and business strategies from complex, large-scale data, is fundamentally an enabler of high-velocity, data-driven research and development. Unlike general AI segments, the demand for AI-DHG is acutely tied to the velocity of intellectual output and the cost-efficiency of discovery processes within specialized fields. The government's strategic vision, coupled with established South Korean technological expertise in data and computing infrastructure, establishes a unique high-growth environment. This market's trajectory is defined less by incremental technological improvements and more by the successful integration of AI tools into critical, high-stakes discovery workflows in key industrial sectors, notably bio-pharmaceuticals and advanced materials science.

South Korea AI-Driven Hypothesis Generation Market Analysis

Growth Drivers

- National AI Strategy and Investment: The National AI Strategy (2020-2030), championed by the Ministry of Science and ICT (MSIT), is the primary propellant for market expansion. This plan mandates significant public investment, including a KRW 1.7 trillion budget increase in 2020 alone for data, network, and AI (DNA) infrastructure, directly reducing the capital expenditure barrier for companies adopting AI-DHG platforms. Furthermore, the Bank of Korea projects that AI-driven productivity gains could substantially offset the nation's economic slowdown due to an ageing population, creating an existential imperative for corporations to invest in efficiency tools. This structural shift in economic planning translates directly into increased enterprise demand for AI-DHG solutions that can streamline R&D and generate new revenue streams through novel intellectual property.

Challenges and Opportunities

- Data Constraints and Regulatory Landscape: A significant challenge is the localized constraint on high-quality, large-scale, and annotated domain-specific data, despite stringent personal data protection regulations enforced by the Personal Information Protection Commission (PIPC). The strict application of the Personal Information Protection Act (PIPA) imposes process-heavy reporting obligations, which can slow the necessary data-sharing agreements essential for training sophisticated hypothesis generation models. Conversely, a major opportunity stems from the government's establishment of the National Growth Fund, valued at KRW 100 trillion ($72 billion) via private-public joint financing. This fund is explicitly designed to absorb losses before private investment, effectively de-risking private capital's foray into advanced industries like AI-driven drug discovery, substantially stimulating corporate demand for high-value AI-DHG services.

Supply Chain Analysis

The AI-DHG market's supply chain is intellectual and logistical, centered not on physical components but on three critical, non-fungible assets: data, compute, and talent. Key production hubs are concentrated around the Seoul Metropolitan Area, home to major tech conglomerates and specialized AI laboratories like those of Kakao Brain, which drive core algorithm development. Logistical complexity arises from the international dependency on advanced computing infrastructure, specifically high-end GPUs, which are necessary for training large-scale, multimodal AI models. This reliance exposes the domestic AI-DHG supply to global semiconductor shortages and geopolitical risk. The most critical dependency is on highly skilled data scientists and AI ethicists, whose scarcity and high operational cost in South Korea represent a continuous constraint on domestic capacity growth, regardless of computational availability.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| South Korea | AI Framework Act (Passed Dec 2024) | Establishes a pan-government AI Master Plan, creating a clear, centralized roadmap that encourages and legitimizes private-sector investment in AI-DHG solutions by defining long-term national priorities and allocating public resources. |

| South Korea | Ministry of Food and Drug Safety (MFDS) Guidance on AI-SaMD | Clarified that AI software for research and educational purposes only (e.g., hypothesis generation) is generally not classified as a medical device, accelerating its adoption and bypassing stringent clinical trial requirements for pre-market approval. |

| South Korea | Personal Information Protection Act (PIPA) / PIPC | Mandates strict rules for pseudonymization and data review committees for health data, creating a high barrier to entry and increasing compliance costs, but ensuring the long-term integrity and trustworthiness of the proprietary clinical datasets that power AI-DHG in healthcare. |

In-Depth Segment Analysis

By Application Area: Drug Discovery & Life Sciences

The Drug Discovery & Life Sciences segment is the core demand epicenter for AI-DHG solutions, primarily due to the unsustainable cost and time associated with traditional R&D pipelines. AI-DHG platforms directly address this by generating novel target hypotheses and predicting molecular properties in a fraction of the time, dramatically reducing the failure rate in the pre-clinical phase. This necessity is further solidified by official government policy that identifies the bio-health industry as a national strategic priority, explicitly calling for the convergence of AI and biology. Companies like Insilico Medicine Korea, utilizing generative AI models, are actively advancing drug candidates from target identification to Phase II clinical trials in record time, illustrating the direct utility of these tools. This verifiable success provides a compelling return-on-investment case that propels pharmaceutical and biotech enterprises to commit substantial budget towards AI-DHG subscriptions and custom platform development as a non-negotiable component of modern drug development strategy. The high-value, patent-protected nature of the output (novel molecular entities and targets) justifies the premium cost of these specialized platforms, cementing this segment's leading position.

By Software Type: AI-Powered Literature Mining Tools

The AI-Powered Literature Mining Tools (AI-LMTs) segment is driven by the sheer exponential growth of biomedical and materials science literature, which has exceeded human capacity to synthesize. AI-LMTs use Natural Language Processing (NLP) to parse millions of publications, patents, and clinical trial results, identifying non-obvious correlations and unstated links between genes, diseases, and chemical compounds. This capability directly increases the efficiency of researchers, who now face an intellectual bottleneck in formulating original hypotheses. For academic and early-stage industrial research, these tools reduce the duplicated effort of manual review and accelerate the identification of critical gaps in existing knowledge. The adoption curve for AI-LMTs is significantly flatter compared to complex predictive modeling platforms, as they require less domain-specific training data and can be deployed in a cloud-based, subscription model. This accessibility makes them a foundational entry point for small and medium-sized enterprises (SMEs) and academic institutions, whose demand is influenced by the need to efficiently allocate limited research grants and manpower to stay competitive with large conglomerates.

Competitive Environment and Analysis

The South Korean AI-DHG competitive landscape is characterized by a mix of established medical imaging specialists expanding into generalized hypothesis generation and pure-play AI biotech firms with deep pipeline assets. Competition centers on the verifiable clinical validation of predictive models and the successful commercialization of AI-discovered targets. The proximity of domestic AI developers to South Korea's advanced healthcare infrastructure provides a unique advantage in securing high-quality patient data for model training, which is a key differentiator against international competitors.

Vuno

Vuno is strategically positioned as an AI medical solution provider that has demonstrated capacity for generating clinical predictions and hypotheses from medical data. A core offering is VUNO Med-DeepCARS, an AI-driven cardiac arrest prediction solution. Their official newsroom verified Vuno securing an FDA nod for its AI-driven chest X-ray triage solution in November 2024. This regulatory clearance is critical, as it provides a validated, real-world proof point for the accuracy and reliability of their underlying AI algorithms—the same intellectual capital that feeds into broader hypothesis generation for disease diagnostics and prognosis.

Lunit

Lunit focuses on AI-powered solutions for cancer diagnostics and therapeutics, a field where rapid, accurate hypothesis generation for imaging biomarkers is paramount. Lunit's strategic positioning was dramatically strengthened by the acquisition of Volpara Health Technologies, which was finalized in May 2024. This major transaction provides Lunit with immediate access to over 2,000 U.S. medical sites and a repository of over 100 million high-quality mammography images. This acquisition is not merely a market expansion but an essential move to secure the data assets required to train next-generation AI-DHG models for autonomous diagnosis and personalized treatment hypotheses.

Kakao Brain

A subsidiary of the platform giant Kakao, Kakao Brain is positioned as the fundamental AI research and development powerhouse. It focuses on large-scale language and multimodal models. In May 2024, Kakao Brain was merged under Kakao Corp. to centralize AI efforts, followed by the launch of the dedicated Kanana AI division in June. This centralized structure and focus on developing massive-scale models like Kanana Flag and Kanana Essence is key. While not a direct hypothesis generation platform, their technology provides the foundational LLM and multimodal backbone that other industry players (e.g., in finance or manufacturing analytics) will leverage to build their domain-specific AI-DHG interfaces, making Kakao a critical upstream supplier.

Recent Market Developments

- March 2025: VUNO announced that its new AI model demonstrated superior performance in predicting ICU readmission compared to traditional methods. This development is a direct product launch that enhances the company's existing solution portfolio. By proving the efficacy of its predictive modeling in a high-stakes clinical setting, VUNO generates robust internal validation for the use of its core AI engines in broader, non-clinical hypothesis generation applications within the healthcare and life sciences sectors.

- May 2024: Lunit completed the acquisition of Volpara Health Technologies for approximately AUD 292 million (USD 193 million). This M&A activity is a pivotal transaction securing Volpara's mammography solutions and their vast repository of over 100 million high-quality images. The strategic rationale is the immediate integration of a massive, high-quality training dataset and a significant U.S. market presence, fundamentally strengthening Lunit's capacity for developing advanced, autonomous AI-DHG models in oncology.

South Korea AI-Driven Hypothesis Generation Market Segmentation

- BY SOFTWARE TYPE

- AI-Powered Literature Mining Tools

- Graph-Based Hypothesis Generation Platforms

- Domain-Specific Predictive Modeling Tools

- Multimodal AI Platforms

- Others

- BY APPLICATION AREA

- Drug Discovery & Life Sciences

- Healthcare & Diagnostics

- Materials & Chemical Research

- Financial & Business Analytics

- Academic

- BY DEPLOYMENT MODE

- Cloud-Based

- On-Premise