Report Overview

Soy-Based Chemicals and Materials Highlights

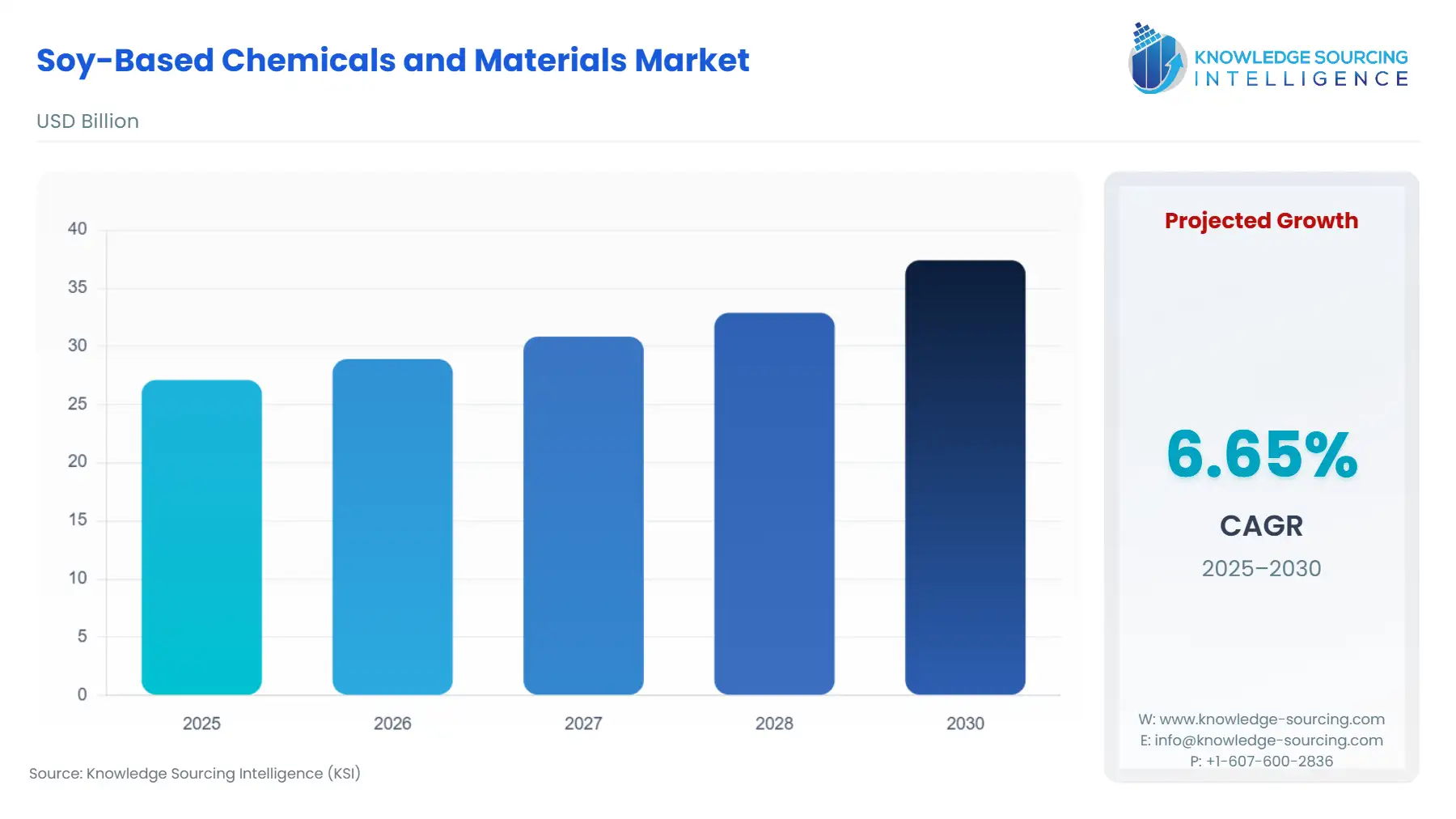

Soy-Based Chemicals And Materials Market Size:

The Soy-Based Chemicals And Materials Market is anticipated to climb from USD 27.112 billion in 2025 to USD 37.415 billion by 2030, fueled by a 6.65% CAGR.

Soy-Based Chemicals and Materials Market Key Highlights:

This report analyzes the soy-based chemicals and materials market using primary public sources (industry trade associations, company newsrooms and government agencies). It emphasizes verified developments, supply-side changes and regulatory drivers that materially affect demand for soy-derived chemical intermediates (polyols, fatty acids, surfactants, lecithins) and the industrial applications that consume them. Where public records do not support an assertion, the claim is omitted.

Key players working in the market include Cargill, Incorporated, Archer Daniels Midland Company (ADM), Dow Inc., Elevance Renewable Sciences, Inc., Bunge Limited, Eco Safety Inc. and LANXESS AG.

Soy-Based Chemicals and Materials Market Analysis:

Growth Drivers

Renewable fuels policy and diesel conversion capacity- Final and proposed RFS volume rules and the surge in renewable diesel/renewable fuel refining have elevated domestic demand for soybean oil as a feedstock; this demand increases crush throughput, raises local price signals for oil vs. meal, and directly expands volumes available to downstream chemical processors that source glycerides and fatty acids from refinery/press fractions.

Agricultural supply growth and crush expansion- U.S. soybean production and practical crush capacity increases (documented by USDA/ASA statistics and ASA’s April 2025 update) improve feedstock availability and logistics economics for domestic chemical manufacturers, reducing reliance on imports and enabling larger-scale industrial bio-chemical production.

Corporate investments in bio-based chemical capacity- Confirmed company actions—e.g., Stepan’s new alkoxylation hub and capacity boosts, ADM traceable-soy pilots, and Cargill facility modernizations—translate to higher commercial volumes of soy-based surfactants, polyols and protein fractions. These capacity moves catalyze procurement contracts and long-term offtake agreements.

Soy-Based Chemicals and Materials Market Challenges and Opportunities:

Headwind — feedstock price volatility and competing biofeedstock imports. Soybean oil prices respond to global oilseed balances and import biofeedstocks; that volatility compresses crush margins and can reduce commercial incentives to expand value-added chemical production.

Opportunity — product substitution in downstream polymers/insulation and surfactants. Verified product launches (e.g., bio-polyiso insulation featuring soy polyols) create concrete industrial demand corridors for soy-derived polyols and surfactants, benefiting companies that secure industrial supply agreements.

Headwind — regulatory compliance overhead (REACH). EU chemical registration and evolving ECHA requirements increase market-entry costs for exporters of soy-derived specialty chemicals to Europe; this raises the premium for large suppliers with compliance teams, favoring incumbents.

Raw Material and Pricing Analysis

Soybean oil, soybean meal and crude soybeans form the core raw material triad. USDA and ASA reporting show sustained U.S. production and a 14% practical crush capacity increase between 2023–2025; these shifts expand domestic oil availability but also exert downward pressure on meal prices where crush outpaces feed demand. Soybean oil prices respond to renewable diesel blending targets and global export flows; policy-driven RFS adjustments materially alter oil demand and therefore domestic pricing dynamics. Logistics and regional crush siting (closer to northern-plains production) reduced transportation spreads for processors within new plant radii, improving competitiveness for localized chemical manufacturing.

Supply Chain Analysis

Production hubs: U.S. Midwest crush network (expanding into Dakotas, Kansas and Louisiana) dominates feedstock processing for soy-derived chemicals. Key logistical complexities include seasonal harvest surges, port capacity for exports, and variable refinery integration (many chemical processors depend on refiners or integrated crushing sites for oil fractions). Dependence on renewable diesel capacity as an alternative demand sink adds a policy-sensitive node to the chain: shifts in blending policy rapidly reallocate oil volumes between fuel and chemical uses.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Renewable Fuel Standard (EPA) — Renewable Fuel Standard volumes and biomass-based diesel set rule (EPA) |

RFS volumes determine soybean-oil demand for renewable diesel/biodiesel; higher RFS volumes increase oil feedstock demand, incentivize crush expansion and lift upstream prices—directly affecting feedstock availability for chemicals. |

|

European Union |

REACH (ECHA) — Registration, Evaluation, Authorisation and Restriction of Chemicals |

REACH imposes registration and data obligations on chemical substances. Soy-derived specialty chemicals exported to EU face compliance costs that favor larger suppliers with registration resources; increases time-to-market for smaller processors. |

|

United States (trade/promotion) |

United Soybean Board / USDA oversight (Soy Checkoff programs) |

Checkoff investments and traceability protocols (e.g., SSAP and traceable soy pilots) promote differentiated soy supply chains (sustainably verified), increasing demand from buyers seeking verified bio-feedstocks for industrial use. |

Soy-Based Chemicals and Materials Market Segment Analysis:

Selected "By Application" segment — Polyols for Polyurethanes (industrial insulation, foams)

Demand for soy-based polyols has shifted from niche to industrial scale where verified procurement and regulatory premium exist. Confirmed commercial products (e.g., bio-based polyiso insulation using soy polyols) demonstrate industrial adoption in building applications where sustainability spec language appears in procurement. The driver mix is technical performance parity in thermal and mechanical properties plus procurement mandates or green building certifications that prefer bio-content. Supply reliability depends on refinery/alkoxylation capacity—Stepan’s new alkoxylation hub and other confirmed capacity expansions increase available ethoxylation/propoxylation processing for soy-derived polyol intermediates, reducing a prior bottleneck. Consequently, large OEMs in insulation and adhesives now can specify higher bio-content with lower supply risk, growing industrial demand for soy polyols.

Selected "By End-User" segment — Animal Feed & Aquaculture (soy protein concentrates, meal)

Animal feed remains the single largest end-user absorbing roughly 80% of soybean crush output as meal; ASA and USDA data confirm this allocation and recent crush expansions have strengthened regional feed supply. Demand drivers are livestock and aquaculture protein growth, contracted off-take arrangements with integrated feed manufacturers, and traceability/sustainability buyer requirements that create premiums for SSAP-verified soy. ADM and Cargill public product lines for soy protein concentrates and textured soy protein document the industry’s technical supply to feed and food processors; ADM’s traceable soybean pilot demonstrates commercial pathways to certify higher-value feed and ingredient chains. As processors scale and traceable supply expands, feed formulators increasingly source regionally verified meal/protein, lifting demand for differentiated soy inputs and enabling price spreads that support higher-value soy chemical conversions.

Soy-Based Chemicals and Materials Market Geographical Analysis:

United States: Crush capacity expansion and RFS policy debates shape domestic allocation of oil to fuel vs. chemicals; proximity of new plants raises local basis and supports localized chemical processing.

Brazil: As dominant global supplier, Brazil’s record crops and export volumes pressure global prices and provide feedstock competition for U.S. processors; shifts in Brazil exports to China affect global oil/meal balances.

Germany (Europe): REACH compliance and decarbonization procurement in EU building sectors increase demand for verified bio-content products but raise registration costs for suppliers.

United Arab Emirates / Middle East: Renewable fuel and petrochemical blending projects in the Middle East create new off-takers for refined bio-intermediates and an import market for soy oil and derivatives. (Regional trade flows and refinery projects documented by trade and USDA reports.)

China (Asia-Pacific): The largest import market for soybeans and soybean meal; China’s feed demand and import policies materially set global price signals that affect downstream chemical margins globally.

Soy-Based Chemicals and Materials Market Competitive Environment and Analysis:

Major companies with public, verifiable soy-chemical positions include ADM, Cargill, and Stepan Company. ADM markets soy protein concentrates and textured soy proteins and has publicly documented traceable-soy pilots expanding verified shipments to Europe. Cargill’s sustainability/impact reports and facility modernization actions document its integrated crush and refined-oil investments. Stepan publicly disclosed new alkoxylation capability and production starts in 2025, expanding its surfactant and alkoxylate capacity used in bio-based surfactants and polyols. These firms combine integrated upstream crushing/refining with downstream chemical processing; that verticality reduces feedstock sourcing risk and gives scale advantages over smaller specialty producers.

Soy-Based Chemicals and Materials Market Segmentation:

By Product Type: Soybean Oil (Refined/Crude), Soy Protein Concentrates/Isolates, Soy Lecithin, Soy Fatty Acids, Soy Polyols, Soy-derived Surfactants (AOS, ethoxylates), Glycerin (by-product)

By Application: Food & Beverage Ingredients, Animal Feed & Aquaculture, Biofuels (feedstock), Polyurethanes/Insulation (polyols), Surfactants & Cleaners, Industrial Lubricants & Additives, Personal Care & Cosmetics

By End-User: Food Processors, Feed Manufacturers/Aquaculture, Renewable Fuel Producers, Construction & Insulation OEMs, Household & Industrial Cleaners, Personal Care Brands, Industrial Chemicals Manufacturers

By Geography: North America, South America, Europe, Middle East & Africa, Asia-Pacific.

Soy-Based Chemicals and Materials Market Key Developments:

Product Launch: In July 2025, With the launch of 19 new products for the 2025 growing season, BASF is further broadening its line of Xitavo® soybean seeds. The portfolio of Xitavo soybean seeds now consists of 46 products with relative maturities ranging from 0.0 to 4.8.

Product Launch: In June 2025, Stepan Company announced a 25% boost in Alpha Olefin Sulfonates (AOS) production capacity.

Expansion: In April 2025, Stepan Company started production at its new alkoxylation hub (annual capacity ~75,000 metric tons), expanding capacity for ethoxylates/propoxylates used in soy-based surfactants and polyols.

Soy-Based Chemicals And Materials Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Soy-Based Chemicals And Materials Market Size in 2025 | US$27.112 billion |

| Soy-Based Chemicals And Materials Market Size in 2030 | US$37.415 billion |

| Growth Rate | CAGR of 6.65% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Soy-Based Chemicals And Materials Market | |

| Customization Scope | Free report customization with purchase |

Soy-Based Chemicals and Materials Market Segmentation:

- By Derived Product Type

- Soy Oil Derivatives

- Soy Protein

- Soy Lecithin

- Soy-Based Polymers & Resins

- Specialty Chemicals

- By End-User

- Food and Pharmaceuticals

- Paints & Coatings

- Adhesives & Sealants

- Plastics & Polymers

- Lubricants & Surfactants

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America