Report Overview

Specialty Adhesive Market Size, Highlights

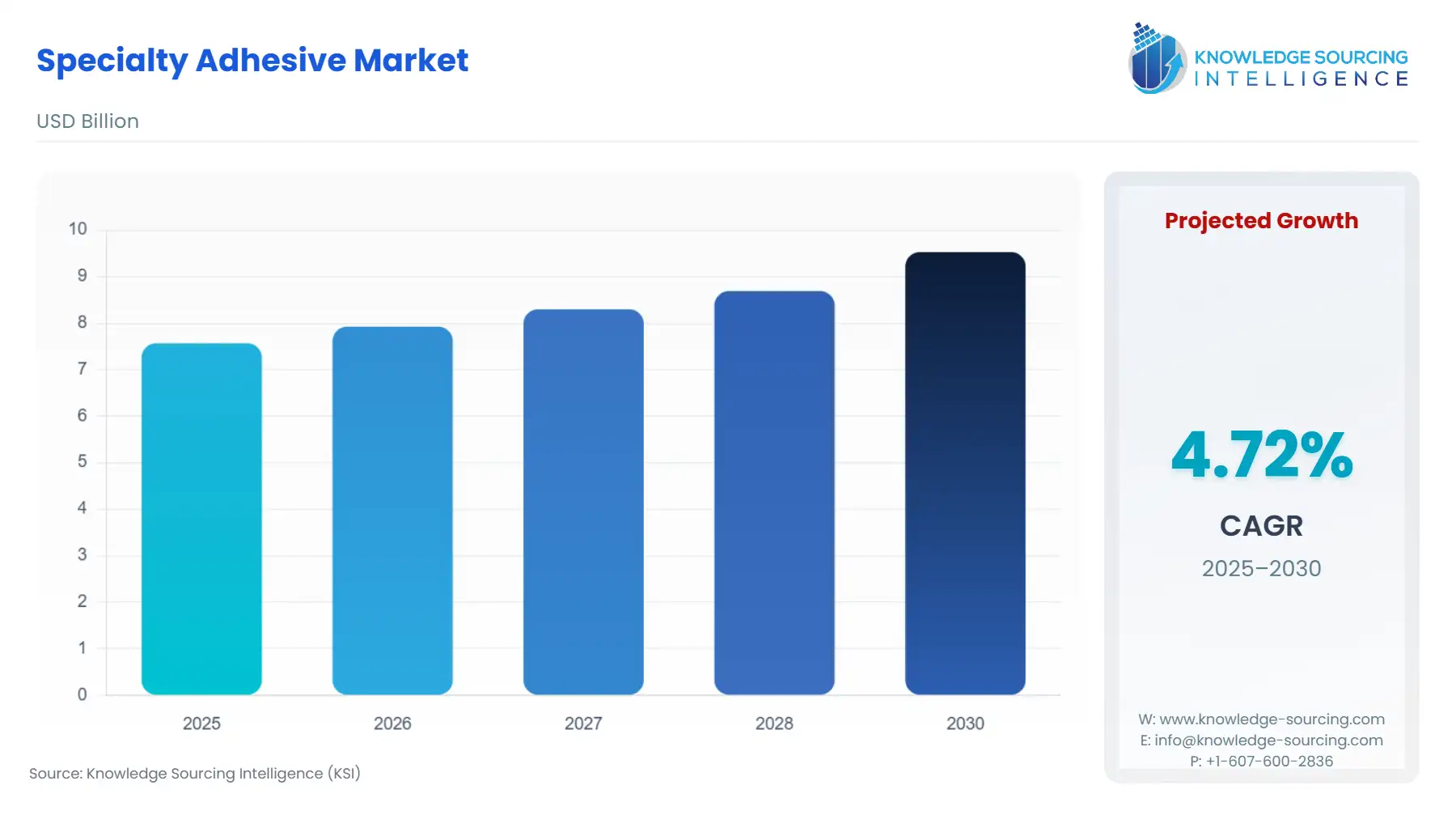

Specialty Adhesive Market Size

The specialty adhesive market is expected to grow at a CAGR of 4.72%, reaching a market size of US$9.529 billion in 2030 from US$7.568 billion in 2025

Specialty adhesives are specialized and customized high-performance bonding agents designed for special, critical applications. Specialized solutions exhibit bonding mechanisms that are beyond ordinary use, as they have been tested with proven super-strength plus durability as well as withstanding heat and chemical exposure and dry environments, unlike general-purpose glue. They are of great help in applications like those found in the automotive, electronic, or construction industries, where reliability and performance matter. They exist in several types, including epoxy, polyurethane, and silicone, and each has a special property that makes it suitable for more specialized applications.

Specialty adhesives have now become even more environmentally friendly, a trend towards more sustainable solutions, and the market is booming owing to the need for high-performance bonding solutions in many industries. Much of what automotive, electronics, construction, and aerospace sectors now rely on advanced adhesives is found in improved strength, durability, and tolerance against extreme conditions of use. Strong, durable, and weather-resistant are the characteristics that these adhesive applications may exhibit, attributes achieved from great technological innovations that address sustainable service applications, and are now paying attention to further emerging eco-friendly alternatives. The major contributors to such innovations are 3M Henkel and H.B. Fuller. A significant growth future is characterized because it is an era of new industrialization continually being set by tighter regulatory standards.

Specialty Adhesive Market Growth Drivers:

- Increasing demand from end-user industries is bolstering the market growth.

The demand for specialty adhesives is surging across various end-use industries like automotive, electronics, construction, and aerospace. According to the Semiconductor Industry Association (SIA) report, The semiconductor fab capacity in the United States is going to grow by 203 percent by the year 2032, having seen a decade of slow growth. The CHIPS and Science Act will also increase the U.S. share of global chip-making from 10 percent in 2022 to 14 percent in 2032, reversing decades of decline. Had there been no Act in National Governments, this share would have fallen to 8 percent. The U.S. still holds the number one in chip designing, EDA, and semiconductor manufacturing equipment.

In the automotive industry, for example, they contribute to weight reduction in vehicles, leading to better fuel economy, while maintaining stringent structural integrity. In electronics, specialty adhesives minimize the size of components while ensuring reliable thermal and electrical insulation. The building industry benefits from increased bond strength and longevity between different materials.

Safety and performance standards are achieved within the aerospace manufacturing domain since specialty adhesives can withstand extreme temperatures and pressures. These adhesives also reduce material usage by streamlining manufacturing to do away with traditional mechanical fasteners and simplify the assembly process. Specialty adhesives are becoming integral as industries evolve towards lighter, stronger, and at the same time more sustainable solutions to improve product quality and manufacturing efficiency.

- Technological advancements is propelling the market expansion.

New advancements in technology have made changes in the form of adhesive formulation as it now promises products with ever-increasing performance and durability. Innovations now make adhesives that bond stronger and resist heat, chemicals, and wear under tough conditions. This leads to true answerability for the increased usage of solutions by diverse industries, such as automotive, electronics, and aerospace, among many others.

Sustainability created a whole new dimension in developing adhesives that are indeed eco-friendly, nonpolluting, and responsible for the environment since all these can be beneficial in terms of producing low-emission products and showing concern in government-initiated worldwide projects to go green. From waters to bio-based adhesives, engineered to comply with certain strict environmental regulations without affecting performance, these cutting-edge technologies continue to address evolving modern industrial requirements while ensuring that they are on board with sustainability initiatives.

Specialty Adhesive Market Major Challenges:

- High costs of raw material& lack of knowledge about specialty adhesives

Major hurdles in the growth trajectory of the specialty adhesives market include the high costs of raw materials, as most specialty adhesives tend to be produced through petroleum-dependent inputs. This creates market volatility in price changes and affects the profit margins for manufacturers while increasing the price tag of the products for consumers. There are strict environmental regulations in different areas of the world, leading industries to reformulate the adhesives to lower emissions and toxic components, which in turn increases research and development costs.

Limited knowledge of small and medium sectors about the merits of specialty adhesives serves as a barrier to their penetration. Added to this challenge is the availability of alternative modes of bonding - welding, mechanical fasteners, and old-fashioned adhesives - that compete with specialty adhesives, particularly in price-sensitive applications. Technical complexity is another challenge: many sticky substances require special application techniques and equipment and hence, are beyond the reach of industries with limited resources or expertise. It is essential to address these impediments to open up the specialty adhesives market completely.

Specialty Adhesive Market Geographical Outlook:

- Asia-pacific will be the fastest-growing region during the forecast period

By geography, the specialty adhesive market is segmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific. Asia-Pacific will be the fastest-growing region in the specialty adhesive market due to the pace of industrialization and urbanization in major countries such as China, India, and Japan.

The booming construction industry in the region, primarily driven by infrastructure development and urban housing projects, contributes significantly to the growth of specialty adhesives, especially in flooring, roofing, and insulation applications. The increase in the automobile sector is extreme and particularly upgrading in the Asia-Pacific region where India and China soon become the manufacturing hubs of the world. In the automobile industry, specialty adhesives are applied as very important to reducing the weight of the vehicle leading to an increase in fuel economy while also ensuring the structural integrity of the vehicle.

The other reason for making that growth possible is Electronics, as the region has been the largest producer of electronics in the globe. Specialty adhesives are implementing component bonding, thermal management, and protective coatings in advanced electronics. According to the Indian Brand Equity Foundation, The electronics manufacturing business in India is going to be worth USD 520 billion by 2025; it is foreseen that the demand will rise to USD 400 billion for electronic products during the same period. The market for electronics systems is expected to grow 2.3x to reach US$ 160 billion by FY25 with extremely rapid growth rates in IT/OA (54%), and industrial electronics (38%), followed closely by automotive electronics (10%). The electronics exports increased from US$ 23.57 billion to US$ 29.11 billion in FY24. With government initiatives like 'Digital India' and 'Make in India' along with an encouraging FDI policy, India will achieve an electronics manufacturing of US$ 300 billion and an export target of US$ 120 billion by 2025-26.,

With rising investments in sustainable and high-performance solutions, this region is expected to retain its stronghold in the specialty adhesive market over the coming years.

Specialty Adhesive Market Key Developments:

Specialty Adhesive Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Specialty Adhesive Market Size in 2025 | US$7.568 billion |

| Specialty Adhesive Market Size in 2030 | US$9.529 billion |

| Growth Rate | CAGR of 4.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Specialty Adhesive Market |

|

| Customization Scope | Free report customization with purchase |

The Specialty Adhesive Market is analyzed into the following segments:

- By Type

- Epoxy

- Polyurethane

- Acrylic

- Silicone

- Cyanoacrylate

- By End-User Industry

- Automotive

- Electronics

- Construction

- Aerospace

- Medical

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America