Report Overview

Acrylic Pressure Sensitive Adhesives Highlights

Acrylic Pressure Sensitive Adhesives (PSA) Market Size:

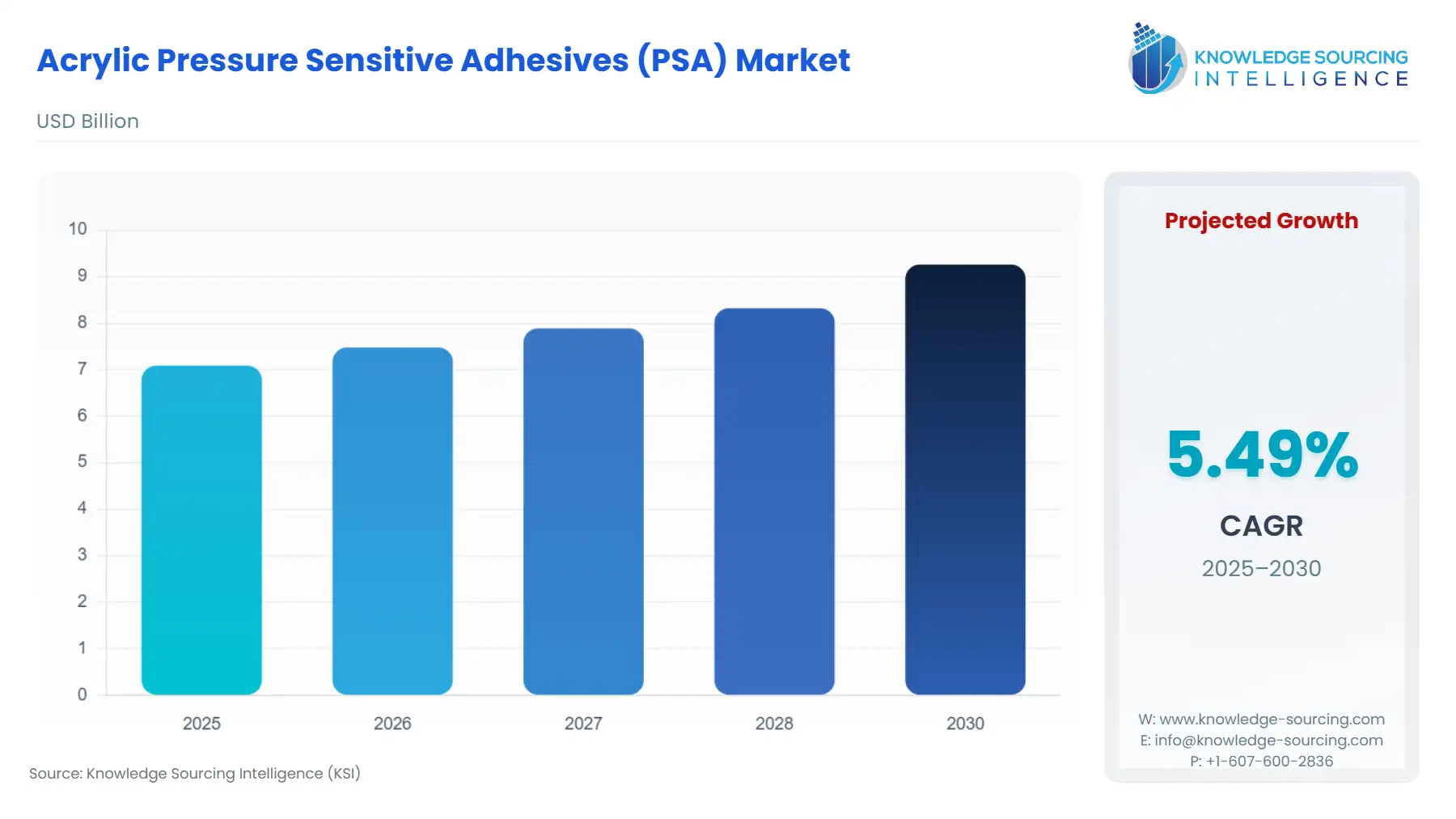

Acrylic Pressure Sensitive Adhesives (PSA) Market, at a 5.49% CAGR, is anticipated to reach USD 9.261 billion in 2030 from USD 7.088 billion in 2025.

Acrylic Pressure Sensitive Adhesives (PSA) are highly versatile and widely utilized in various industries due to their exceptional bonding properties and ease of application. They have numerous applications, including packaging, automotive, construction, healthcare, and electronics. As a result, the global market for acrylic PSA is predicted to grow considerably in the coming years.

This adhesive type is increasingly in demand in various industrial sectors because of its bonding properties, convenience, and flexibility. This growth is being driven by factors such as the growing demand for lightweight and fuel-efficient automobiles, the expanding use of electronics in various applications, and the increasing adoption of PSA in the healthcare industry. Furthermore, regional trends are also shaping the market, with different countries exhibiting varying degrees of demand and growth potential.

Acrylic Pressure Sensitive Adhesives (PSA) Market Growth Drivers:

• Growth in End-Use Industries

The demand for acrylic PSA is being driven by the expansion of end-use industries, including automotive, construction, packaging, and electronics. These adhesives are utilized in a range of applications, such as bonding of different materials, tapes, and labels, among others. As these industries grow, the demand for acrylic PSA is projected to increase, which will fuel market expansion. The versatility of acrylic PSA, coupled with its ease of application and excellent bonding properties, has made it a popular choice in various industries.

This adhesive is widely used in the healthcare industry, as it can be used in medical devices, transdermal patches, and wound dressings, among other applications. Additionally, it is employed in the construction sector for sealing and bonding purposes. In the electronics industry, acrylic PSA is used to assemble components and bond substrates, among other applications. The increased demand from these industries is expected to drive the growth of the global acrylic PSA market in the coming years.

• Increasing Demand for Sustainable Products

The growth of the acrylic PSA market is being propelled by the rising need for sustainable products. These adhesives are environmentally friendly and do not contain any harmful chemicals, making them a preferred choice among consumers who are mindful of their impact on the environment. The demand for sustainable products is anticipated to increase as consumers become increasingly conscious of the environmental impact of various products, which will further boost the growth of the acrylic PSA market. The market is expected to witness a surge in demand for sustainable products as individuals and organizations increasingly prioritize environmental sustainability. The growth of the acrylic PSA market is thus directly linked to the growing consumer demand for sustainable products.

Acrylic Pressure Sensitive Adhesives (PSA) Market Geographical Outlook:

- Asia-Pacific to show higher growth

In the forecast period, the acrylic PSA market is expected to experience the highest growth in the Asia-Pacific region. The growing demand for acrylic PSA in the automotive, construction, and electronics industries is driving the market's growth in the region. China, India, and Japan are the key countries propelling the market's expansion in the region. These countries have a significant population and a growing middle class, which has fueled demand for a wide range of products and services, including acrylic PSA. As these countries continue to develop, the need for automotive, construction, and electronics industries will increase, which will result in the demand for acrylic PSA increasing, driving the growth of the market in the Asia-Pacific region.

North America is a significant market for acrylic PSA due to the growth of various end-use industries, such as automotive, construction, and packaging. The increasing demand for acrylic PSA in these industries is driving the growth of the market in the region. Additionally, the rising demand for sustainable products is another key factor contributing to the growth of the market. Consumers in North America are increasingly aware of the environmental impact of their purchases and are choosing eco-friendly products, including acrylic PSA. As a result, manufacturers are responding to this trend by offering sustainable adhesive products, which are driving the growth of the market in the region. Leading companies such as 3M, Henkel, and Avery Dennison are actively involved in the acrylic PSA market in North America and are developing innovative products to meet the growing demand.

Acrylic Pressure Sensitive Adhesives (PSA) Market Segmentation:

- ACRYLIC PRESSURE-SENSITIVE ADHESIVES (PSA) MARKET BY PRODUCT

- Solvent-based

- Water-based

- Hot melt

- Radiation

- ACRYLIC PRESSURE-SENSITIVE ADHESIVES (PSA) MARKET BY APPLICATION

- Tapes

- Labels

- Graphics

- Others

- ACRYLIC PRESSURE-SENSITIVE ADHESIVES (PSA) MARKET BY END-USER

- Healthcare

- Packaging

- Food & Beverage

- Automotive

- Building & Construction

- Electronics

- Others

- ACRYLIC PRESSURE-SENSITIVE ADHESIVES (PSA) MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America